WEF seeks greater financial inclusion to help poor, Covid-ravaged communities

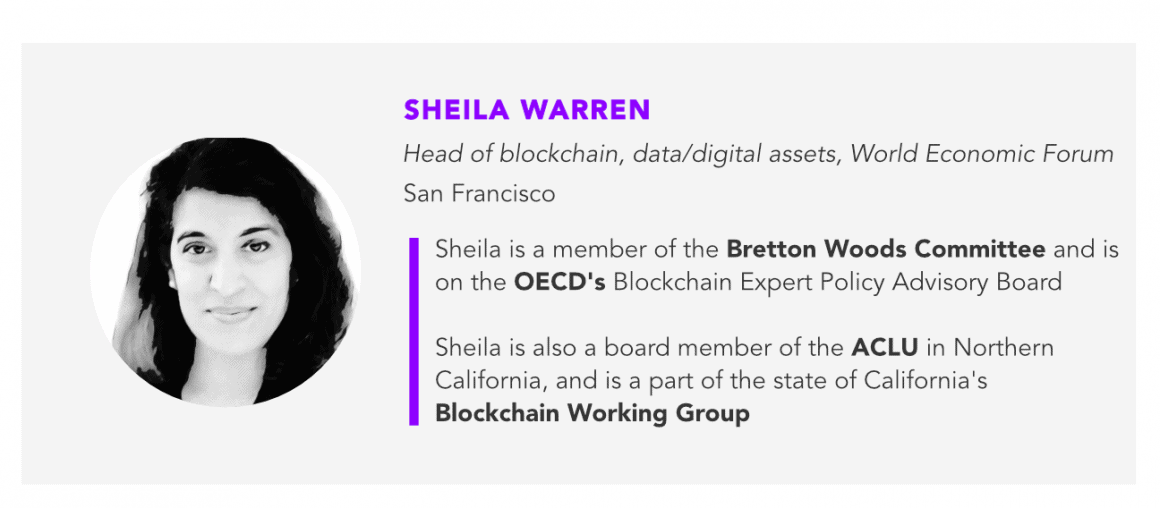

Sheila Warren, World Economic Forum’s head of blockchain policy, also discusses the growing importance of digital currencies and how America is falling behind.

As the global economy flounders from the coronavirus pandemic, the impact on the world’s poor has been even more devastating. But greater adoption of digital currencies could increase financial inclusion among the unbanked and help lift impoverished communities, according to Sheila Warren of the World Economic Forum (WEF).

“We’re facing a reckoning of the systems that we deliberately built to be somewhat exclusive. We don’t have truly inclusive financial systems in the world and the global economy, and now we’re seeing the consequences of that,” said Warren, the WEF’s head of Blockchain, Digital Currency and Data Policy, in an interview with Forkast.News.

“We’re seeing that this virus is ravaging impoverished populations,” Warren added. “In the United States, it’s ravaging people of color… those below the poverty line are being hardest hit, homeless populations are being hardest hit, and the most vulnerable of our society are not distinct from us.”

At its annual meeting in Davos this past January, the WEF launched a global consortium for digital currency governance to help create a governance framework for cryptocurrencies as well as stablecoins like Facebook’s Libra.

See related article: As China’s DCEP approaches launch, Facebook’s Libra pivots

Watch Forkast.News Editor-in-Chief Angie Lau’s interview with Warren, a featured speaker at Asia Blockchain Summit this week, to learn more about how the need for greater financial inclusion, the push for more stablecoins and central bank digital currencies (CBDCs) in the world economy, and the private sector’s role in adoption and innovations.

Highlights

- On the need for financial inclusion: “Financial inclusion is a core component to safeguarding the entire world population, and I think we’re seeing advances. We’ve already seen acknowledgement of the problems of inclusion and how e-money, your digital payments, or things like this could start to bridge some of those gaps.”

- Crypto adoption comes first: “Once you have broader scale [crypto] adoption, you can then invest the resources that are often needed to serve those who are most in need. I think that’s just the financial reality around this. You have to kind of hit a certain level of scale, and then you can be more inclusive.”

- Cutting through the crypto hype: “A lot of our work has really been cutting through hype in the technology space, but also just bringing a very practical orientation to the work, to say, ‘it’s not a competition.’ It’s not CBDC, or crypto, or stablecoin — all of these things have a place.”

- Privacy concerns of central bank digital currencies: “Competing concerns around privacy really aren’t driven by concern about the United States, it’s driven by other jurisdictions, including China, and what it would mean to basically see a global digital currency that was led by a society that didn’t necessarily embed privacy considerations into its issuance.”

- Where the U.S. stands on CBCDs: “As a general matter, the United States, I would not call us a cutting-edge country when it comes to digital currencies.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into blockchain, cryptocurrency, and the emerging technologies that shape our world. It’s what we cover right here on Forkast.News, at the intersection of business, politics and economy.

I’m Forkast.News Editor-in-Chief and your host, Angie Lau. I’d like to welcome to the show right now, Sheila Warren. She is head of Blockchain, Data, [and Digital Assets,] and a member of the Executive Committee at the World Economic Forum. Sheila, it’s great to speak with you. I know you’re dialing in from Northern California. It’s great that technology allows us to connect around the world.

Sheila Warren: I couldn’t agree more, Angie, thanks so much for having me. It’s great to be here.

Lau: We’re both sheltering in place right now. Quarantines; shelter in place; people working from home; this is the new normal. I really want to talk about just what the new normal truly is. Covid — first half of the year, it’s almost over, but it’s not only informing the rest of this year, but I would argue the rest of this decade. It’s a new normal, it’s a new type of thinking, and as firms and protocols and projects still try to really continue the incredible work of innovation in this space, what must we be thinking about? What are the things that you’re viewing from your perspective that we should not be ignoring here?

Warren: Great question. I think that Covid-19, this pandemic, has brought a couple things to light, things we always knew that were somewhat buried, and what I find really interesting is that we’re seeing this simultaneously understanding of our interconnectedness. The reality is that viruses don’t respect national boundaries or sectoral boundaries or protocol choices. We’re all in this together, and yet the response has necessitated some geographic [actions]… shutting down the borders, and things like that.

It’s pulled us into almost this isolationist moment at the very time that we have to acknowledge how connected we really are. And I think that our technology in particular is going to have to accommodate that balance between those different needs: the recognition that we need to be thinking more communally and collectively about how we act, how we operate in the world, but also have safeguards in place that can be focused on citizen protection. These are both very important pushes and we’re going to see, I think, that tension and friction becoming more and more a highlight as we move forward.

Lau: To your point, there’s so many issues. We’ve got the exponential burst of data collection, especially as governments track their citizens and populace to combat Covid-19, who knows what that’s going to do or how it will define our personal rights in the future? From that all the way up to the fact that right now, with financial inclusion being a critical issue, if you couldn’t say that before, it is enormously important right now as millions truly are slipping back below the poverty line. This is a stark contrast to even what we’ve seen as a little bit of an improvement when it comes to financial inclusion.

But now, with the global economy sputtering as a result of Covid-19, that is certainly weighing on people a whole lot more. So I want to start there with financial inclusion. You come from Wall Street. You come from the social entrepreneurial side. Philanthropy has been in your background since before you joined WEF, and certainly from this purview. What are the realities right now, and what are the needs that we need to think about as a global community to really react to what the economic realities are, for unfortunately millions of people around the world?

Warren: I think we’re facing a reckoning of what the systems that we deliberately built to be somewhat exclusive. We don’t have truly inclusive financial systems in the world and the global economy, and now we’re seeing the consequences of that. We’re seeing that this virus is ravaging impoverished populations. In the United States, it’s ravaging people of color. Those below the poverty line are being hardest hit, homeless populations are being hardest hit, and the most vulnerable of our society are not distinct from us. And to cover my point about collective action, we are only as healthy as the least healthy among us as a society with something like this virus.

So I do think that financial inclusion is a core component to safeguarding the entire world population, and I think we’re seeing advances. We’ve already seen acknowledgement of the problems of inclusion and how e-money, your digital payments, or things like this could start to bridge some of those gaps. We were always taking a very tech-heavy approach, and what I’m hoping that we’ll see is a recognition that we have to rethink some of the existing systems.

It’s not just that we can move our existing systems digital and then think that we’ve made these major strides. Yes, we might make things faster, or we might accommodate some needs of a certain part of the population, but we’re only going to enhance the digital divide, enhance the distinction and stratification of wealth in our society, if we don’t look at the fundamentals of how these systems are set up and commit to doing better by more people.

So my hope is that this situation that we’re in right now, the need for economic recovery, for a reset, as you call it at the forum for a great reset in how we imagine our financial system, my hope is that in doing that, we will be able to be more creative and more inclusive in how we build technical solutions and focus on the entire suite of problems, not just the ones that are easiest to solve.

Lau: A white paper that WEF published a few years ago, “Blockchain for Enterprise,” followed that up this year with guidance for central banks and CBDC. Is this what we’re talking about when we’re talking about, in your word, a reset?

Warren: I think it’s part of it, I do think that focusing on financial tools, whether that’s money, e-money, payments, digital currency, that’s one kind of example, wealth creation, intergenerational wealth transfer, the ability to basically build an asset base and pass that down to your family, these are things that are only available to really a pretty small segment of the population. And without that, every generation is just starting over again. If you have to begin at the beginning, then it’s a huge mistake.

As a society we’re missing the opportunity to build those legacy systems of wealth or heritage that can be extraordinarily important to a society to pull the society together. So I think that’s part of it, I think we see a suite of options here. I think central bank digital currency, CBDC, we see a role for CBDCs regardless of what happens with other kinds of digital currencies or even cryptocurrency itself. I think we see a role for stablecoin, other extrinsically-backed coin and we see a role for pure crypto, for intrinsic crypto, that’s intrinsically backed to have its own value. All those things serve different needs. What we’re doing right now is exploring digital currency governance more broadly and trying to explore some of these friction areas that I’d mentioned.

So, for example, the tension between your privacy and security is a very known one. But the tension in financial inclusion and certain kinds of technical solutions is not as widely acknowledged. You have to have access to certain kinds of infrastructure, certain kinds of hardware, to use certain kinds of technology really effectively. So what does it mean for the parts of the population that don’t have that kind of access, if we’re focusing on certain ways or modes of building that are, by their very nature, exclusive, yet again?

Lau: You’re totally right, it presumes that you have access to technology, and while that is the case for the majority of people, the whole point of financial inclusion is that there is a huge swath of underserved and that includes access to technology, and we’re seeing that. So what is the work that needs to be done? Not only from a software point of view. We talk about architecture and infrastructure, but that also needs to be supported by the access points in the real world — actual computers, or mobile phones. Which projects do you think are a lot more thoughtful about that? Or is anybody thoughtful about that right now?

Warren: We are seeing some opening up of the hardware options. So rather than your mobile device or certain kinds of hardware wallets, maybe you look at the cards, and there’s this experimentation happening now with crypto cards and things like that — maybe it’s easier, it’s more flexible — I think we’re also seeing more interest from more “pure” crypto people in what I call these on ramps and off ramps.

So the idea that, for some people, cash is going to be a superior medium of exchange for a variety of reasons, any number of reasons. And if so, what is your on-ramp and off-ramp into banking? Now, I don’t think that the goal of a single coin issuance, for example, should be to provide an inroad to the traditional banking system. I don’t think that’s necessarily the end in and of itself, but I do think that an accommodation of that is going to lead to broader scale adoption, which is important.

Once you have broader scale adoption, you can then invest the resources that are often needed to serve those who are most in need. I think that’s just the financial reality around this. You have to kind of hit a certain, generally speaking, level of scale, and then you can be more inclusive. But that only really works if from the very beginning in your design you were contemplating that path. You can’t all of a sudden shoehorn in impoverished populations into whatever solution you built, not for them. You have to be thinking ahead about what that would look like, even if it’s not something you can roll out in your very first beta, for example, which is logical.

Lau: Yeah, beta right now is whoever’s got the biggest audience or users. Like Libra, for example, is one. In your view, what role does the private sector have to play to establish these new routes, these on ramps?

Warren: I think a lot. I think the president has a huge role to play here, and I think the role is not just in adoption, it’s in pushing innovation. The private sector has thought, in many cases, even more than the crypto sector in some cases, about who’s included and who’s excluded. Because certainly the goal of the private sector in some cases is to capture the market, and they’ve done a lot of market analysis in some of these populations, and they’ve made decisions in some cases, and certain populations just could not be captured with the product and services they were offering.

Now they have potential to have a new suite of services, but some of that thinking is very rich — very rich knowledge there. So what we’re trying to do is connect the private sector to the public sector with civil society organizations and those who actually work directly with these populations that we’re talking about here, and members of the populations themselves to get a real sense of what the actual need is and what is realistic and practical in terms of tools and solutions that would actually solve the problems that these populations are facing.

Lau: So you’re working with a lot of private firms and projects and protocols. You’re launching your own fund there. What’s the thesis? What is the end goal?

Warren: So we’re not launching a fund, just to be clear, we’re not funders. But we have a digital currency governance consortium that we have launched, and what that is focusing on is in typical form, fashion. We’re bringing together a variety of stakeholders from very different geographies, focusing on a multitude of use cases and thinking about, again, what are the boundaries on what a stablecoin issue as a regional currency issuance can easily accomplish? What is really, really hard to accomplish, and what are the tradeoffs that you have to consider?

What we want to do is not so much to say, “this is better, this is worse,” or “this is a good coin or bad coin,” it’s not about a rating or a grade. It’s just saying there are some realities here. If your goal is financial inclusion, then maybe you’re not going to be as able to provide the same measure of encryption in certain ways because the ability to access private keys is going to be a little limited because of your technology limitation (random example).

Or maybe if your goal is penetration into areas that really aren’t working with much or don’t really have a lot of access to infrastructure, maybe the tradeoffs there are different. If you’re focusing on banks and interbank settlement payments, maybe your security needs are so high, your regulatory needs, your compliance needs are extraordinarily high, that involves maybe excluding certain parts of the population, saying the solution is never going to work for the “unbanked,” as we call them.

So it’s just surfacing some of these choices that have to be made, and then saying where does this particular coin issuance fall? And what’s the governance model underlying that that can support the priorities that are being focused on by that team or that protocol or that company or that government or whoever is doing the issuance?

So a lot of our work, I think, over the past few years, has really been cutting through hype, number one, in the technology space, but also just bringing a very practical orientation to the work, to say, “it’s not a competition.” It’s not CBDC, or crypto, or stablecoin — all of these things have a place. It’s a different place, and let’s help identify and land what is most appropriate for the problem you’re trying to solve, always going back to that initial idea of the problem in this case.

Lau: The work that you’re doing at a global level is so rich, it’s so deep in detail, and the conversations I think you’ve noted in the past, are like night and day. The beginning of the hype cycle of blockchain and cryptocurrency was like, “Huh? What’s this?” to next year, literally talking about regulatory compliance and advocating for innovations in different vehicles and such.

And now we get to 2020; recently, the Federal Reserve Chairman, Jerome Powell, kind of disregarded the role of the private sector, or at least said that it must be led by the public sector, obviously. So in your work, in the white paper that you just shared about central bank thinking, is this dynamic in keeping with how central banks are functioning or talking about it, or is there a little bit of an outlier attitude right now?

Warren: That’s interesting. Certainly there’s high variance, I would say. I think in general, central banks would prefer to be able to do their own issuances, to have more control over it, for reasons that are probably obvious; certainly, if we’re talking about direct access to a nation’s coffers and national credit, I think there are reasons why that is really important, and that is a very reasonable stance to take.

That being said, I think that the United States in particular has not been, well, this varies, again, branch by branch of the Fed, but we have seen a little bit less enthusiasm about these hybrid or synthetic CBDC models. We have a wholesale CBDC that connects to retail layer — whereas many other countries have really embraced it, whether they’ve done that in implementation, at least in theory, they have embraced that model, relegating the private sectors to their respective spheres of expertise and influence.

My view is that the synthetic model makes a lot of sense, a hybrid model makes a lot of sense, because again, you’re playing to strengths, you’re providing a layer of protection to the central banks, you’re accommodating some of the adoption and scalability that for the price that it can bring, that the banking sector can bring. So in that sense, I think it’s a little bit of an outlier. But again, I think part of that is because not every central bank has a reality where they actually could promote mass adoption.

They just don’t have that reality. They don’t have the ability to do that, and they don’t have the kind of security — I don’t mean cyber security, the faith and credit and security nationally — to feel like they could pull that off, for a variety of reasons, some of which are political. So in that sense, it’s not an outlier. But I do think that as a general matter, the United States, I would not call us a cutting-edge country when it comes to digital currencies as a general matter.

Lau: Well, I wouldn’t count it as among the countries who are in the test pilot phase right now, which is what we’re seeing happening in Asia and specifically China, that is for sure, to say the least. But that’s also increasingly sparking a lot of concern about privacy issues. The ability of individual control, usage of dollars, or even access to a digital currency, these privacy concerns are cropping up. What is the WEF recommendation when it comes to thinking about that? What is the guidance that you have for central banks?

Warren: So there’s two things I think, behind your questions, and one is this concern around dollarization, and that is not a new concern. There is a fear that digital currencies will expand that will accelerate the dollarization of many world economies, and look, every country has to assess for itself if that’s a good or bad thing. There’s soft power considerations, there’s financial stability considerations, or monetary policy stimulus considerations, a lot of different economic considerations that the variance, again, is quite high, and it’s really not for me to tell a government what’s the right thing for them to do. So that’s one piece of it that’s the fear.

In terms of the privacy component, I think that honestly, it comes less from dollarization and more from concerns about different models and different cultural notions of privacy, different political notions of privacy. Certainly — I think we can just name names — China has a different stance on privacy and on a citizen’s right to privacy than the United States. That serves them well sometimes, like the pandemic response, it sometimes is not as forward-thinking as other jurisdictions.

So I think that the competing concerns around privacy really aren’t driven by concern about the United States, it’s driven by other jurisdictions, including China, and what it would mean to basically see a global digital currency that was led by a society that didn’t necessarily embed privacy considerations into its issuance. And I do think that that is the direction that we’re moving. No one really knows — well, some people obviously do, I am not one of them — but some people have the details on what’s really happening inside of China with the issuance.

But we all know it’s coming, and I think it’s a question of what the adoption looks like. I think it will be very dramatic and very quick, and what that means for other competing efforts, including, I would say, stablecoins like Libra. So we’re going to have to just see how it all plays out and what the timing winds up looking like, what the adoption looks like, if the epidemic has an effect on that.

It could go both ways: the pandemic could really accelerate adoption, or it could actually decelerate adoption and kind of stagnate adoption. We’ll have to see where things stand at the time that this thing really takes off. We’re only halfway through this crazy year… My crystal ball certainly failed. I don’t know whatever was [discussed at] Davos this year, but it certainly was not pandemics. None of that was anything that I really saw coming at the scale and speed that it happened

Lau: It’s apocalyptic fiction come to life, it’s really what it feels like. But hopefully in 2021, we’ll see a lot of conferences come back, announcing physical dates where people can come and rub shoulders, I don’t know how close, if people feel comfortable doing that in 2021. Much more elbow bumping in Davos, maybe, in 2021. What do you think the conversation is going to be like? Let’s say it does happen. What do you think the conversation is going to be like in this space, in cryptocurrency, DLT, DeFi, all of this, the financial realm of where this is taking us?

Warren: Well, let me tell you what I think it will be, and what I hope it will be. What I hope it will be, is that we’re going to be having much more inclusive conversation. The notion that there are parts of society that are just left behind, that’s just how it is, I’ve actually been in conversations with people that just say this, “well, we just can’t serve those parts of the population. So we’re going to do the best we can, and if we get to 80:20, good enough.”

I don’t think that is a good enough answer. I think that is a partial answer. I think that not every protocol or every issuance has an obligation to meet the needs of everyone, but I think there needs to be connectivity and interoperability among those different offerings. And I hope that we move to a place where we are taking more care and bringing some of the empathy that we have felt in light of this pandemic into these systems and into the design of these systems. So that is my hope.

What do I think is going to happen? I think we’re going to continue to see a lot of an extractive model. We’re going to see an acceleration of all kinds of e-money and digital currency that was already in place, and it’s just going to continue to accelerate, in my view. CBDC issuances, certainly Libra, is going to launch at some point, that’s going be a whole thing. China’s gonna do what China’s gonna do it, we’re all going react to it. How we’re going to react to it, we can’t really plan for it all that well. So we’ll have to deal when the time comes to see where we are.

So all those things are going to happen over the course of the next year, and it’s going to be an extraordinarily active space. Now, along with that, I think is going to come, and this is the other thing I hope for, that we’ve had some role to play in, is a normalization of cryptocurrency. A removal of some of the fear of not just Bitcoin, but different kinds of cryptocurrency and the notion of cryptocurrency being less scary, less criminally-oriented, and all this kind of thing.

Not just for hyper-security, but just more normalized for ordinary kinds of things, whether we’re at a scale of adoption where we’re paying for our coffee, which is always the trope that’s trotted out, I couldn’t say. But I certainly think we’ll have moved along a spectrum to where that doesn’t seem like this crazy idea the way it did two years ago, and people who are focused on that area and building in that area are not going to be dismissed as these crazy people who are just living in a sci-fi world. This stuff is real, it’s really real, it’s coming and it’s coming fast. So that’s where I think we’ll be and faster than I think it would have been before all of this, like we entered virtual land for a few months.

Lau: I think you’re absolutely right. The speed in which people are becoming more familiar and accepting that the world has irrevocably changed forever is here not only from an individual point of view, but all the way up to corporate and global leaders. Certainly, you’re at the center of all of these conversations at the World Economic Forum. So really, Sheila, thank you so much for sharing your perspectives and gazing into your crystal ball. I hope we’re all healthier in 2021, and I hope to elbow bump you in Davos in person as we do this.

Warren: Oh, I do too, Angie.

Lau: But until then, we’re just going to have to telecommute and hang out with each other. You’re going to be showing up in Taipei, July 15th to the 19th for the Asia Blockchain Summit, so I will see you there.

Warren: Right, I’ll be Zooming in. Look forward to it.

Lau: We will Zoom in together. But, Sheila, it’s been an absolute pleasure, and I thank you for joining us on Word on the Block. And everyone else, thank you for joining us on this latest episode. I’m Forkast.News Editor-in-Chief Angie Lau. Until the next time.

Forkast.News will participate in the Asia Blockchain Summit 2020, which starts this week.