India remains in a ‘gray zone’ over crypto. Are lawmakers crippling innovation?

Will India ban crypto? Regulatory uncertainty is causing nation to miss out on economic benefits. Smart regulations, says Ripple, may provide a way forward.

Following reports that Indian regulators may be working on banning cryptocurrencies, industry leaders say that the government should provide clarity for businesses and banks to avoid “crippling” technological innovation.

“India is under-living its potential, [by] not enabling these new technologies to come in to solve decade-old problems,” said Navin Gupta, managing director of South Asia and EMEA at Ripple, in an interview with Forkast.News. “Within the regulatory framework itself, if there could be innovation that could be available to India and we are not providing them the tools, or the policymakers are not providing them the tools, then in some way we are crippling innovation.”

See related article: Five reasons why India is crying out for a crypto revolution

India has had a tortured relationship with cryptocurrency. In March, the Supreme Court reversed the Reserve Bank of India’s earlier ban on crypto banking. But crypto industry leaders say there is still insufficient clarity from regulators on how the digital assets could or could not be used in business.

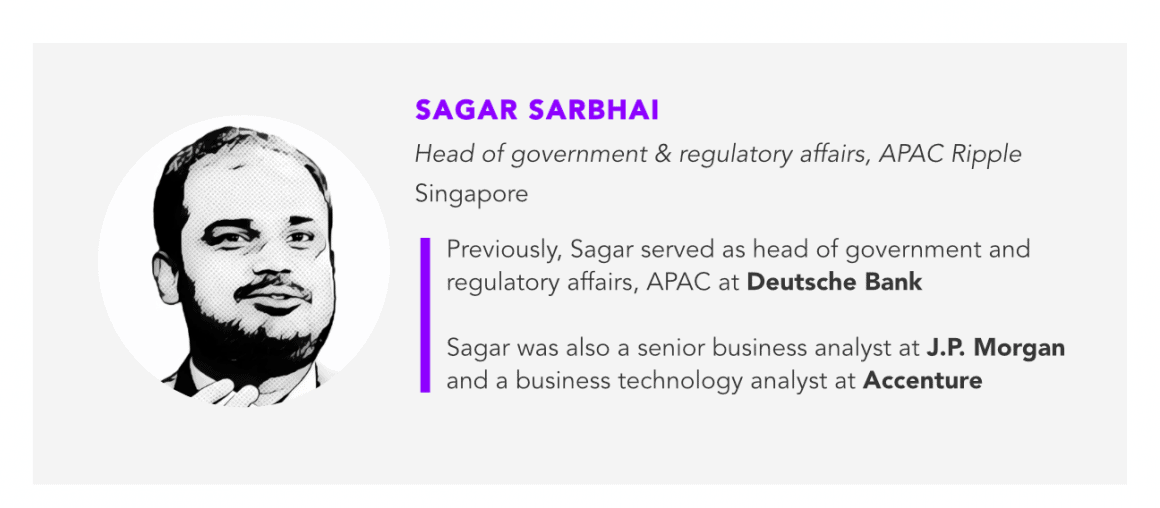

“Instead of saying ‘blockchain good, crypto bad,’ [regulators should] look at this picture more holistically and understand the positive use cases of digital assets and cryptocurrencies,” said Sagar Sarbhai, head of government & regulatory affairs for Asia Pacific at Ripple. “[Regulators should use] that to encourage more financial inclusion and lower barriers to commerce, push more digital payments, which has been a consistent theme in India, in Prime Minister Modi’s regime.”

Ripple, the global blockchain payment platform company, recently released a white paper proposing a framework for India to regulate digital assets.

To learn more, watch Forkast.News Editor-in-Chief Angie Lau’s video interview of Gupta and Sarbhai, on why they believe regulators need to understand the potential benefits of cryptocurrencies.

Highlights

- On India’s regulation of digital assets: “The digital assets regulations in India are still in a grey zone. There is no framework in place that will give that comfort level to banks and institutional investors to enter the space and provide services. I think that is where we believe there is scope for more clarity coming from the government and the regulators.”

- Could digital assets replace fiat currency? “We don’t believe digital assets or cryptocurrencies would replace fiat currency. Cryptocurrency will never become legal tender.”

- How a central bank digital currency could work in India: “For a country like India, a retail CBDC may not be that feasible because there are many other policy angles related to that. But potentially a wholesale CBDC where the central bank issues tokens to the regulated banks, that could be a possible use case as a complement or a substitute to the already existing system within India.”

- On the need for government to consult businesses: “Public-private partnership has been a key theme in policy-making in India, and it should continue to remain so. So we urge policymakers to consult the private sector and all stakeholders involved before taking any action.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the emerging technologies that shape our world: AI, IoT, blockchain, cryptography, cryptocurrency, all of it (you can even include DLT) at the intersection of business, politics and economy. I’m your Editor-in-Chief, Forkast.News Angie Lau, and your host. Welcome to the show.

I’d like to welcome right now, we’ve got two very timely guests: Navin Gupta and Sagar Sarbhai. They’re with Ripple Asia, and between the two of them, they’ve got the regulatory and the policy guidance really in check across the region, from Southeast Asia to Singapore to India. But right now, we’d like to focus on India. It’s a very timely issue here, because at this moment, at this juncture, it really does seem that India is at a crossroads.

Navin, Sagar, we both know that India for the past decade — we’ve been talking endlessly about its economic potential and potential that has yet to be realized. Politically, we’ve seen just the passion of its people to really strive for the kind of political and economic potential that everyone believes in. A country of 1.35 billion people; where are we today when it comes to blockchain and digital assets?

I want to start with you, Sagar, because we’ve got word now that policymakers are potentially looking into filling the void that the Supreme Court of India has left wide open, essentially tearing down the RBI ban on banking for cryptocurrency or digital asset firms. Bring us up to speed as to what you’re seeing, where India is right now, and how it needs to think through all of this.

Sagar Sarbhai: Firstly, thank you so much for having us both here. It’s a pleasure to be speaking with you. Let me take you and your audience back in time to 2013 where all this started. So in early 2013, RBI and the Ministry of Finance in India were still trying to figure out what cryptocurrency, digital assets, blockchain was all about. I think back in the day, there was still that very negative perception about cryptocurrency and digital assets globally, and that triggered a lot of warnings coming in from the RBI.

They said, “look, we see risks and major concerns with cryptocurrencies and digital assets, so you are advised to take precautions.” These were warnings which kept coming out from 2013 to 2017. RBI, Ministry of Finance, senior ministers in the government [all] came out with these warnings. And then in 2018, RBI circulated a circular to all their regulated institutions telling them that they were not allowed to offer services to cryptocurrency/digital assets service providers, and that effectively led to a quasi-ban on trading of cryptocurrency and digital assets. Over the next two years, legal battles ensued in the Supreme Court. And then earlier this year, the Supreme Court actually came out with a judgment saying that the ban was indeed unconstitutional and lifting the ban.

That was a huge positive for the industry. But that being said, the digital assets regulations in India are still in a grey zone. There is no framework in place that will give that comfort level to banks and institutional investors to enter the space and provide services. I think that is where we believe there is scope for more clarity coming from the government and the regulators. And we are hoping that in this year or by early next year, there will be some sort of guidance coming in.

That being said, last fortnight there was a report in the media which said that the government had actually moved a note to potentially looking at a permanent ban on trading of cryptocurrencies. Now, while that may or may not be true, the good news is that at least this topic is now being broadly discussed in the policy circles in India. For a long, long time, the topic of digital assets was in a policy vacuum. So it’s good news that now people are talking about it, people are discussing it, it’s all over mainstream media. That, to me, is good news, because we believe that to take any step, any action, the most important thing for the regulator to do is to consult the public and the stakeholders.

And in India, there has been a wealth of precedents in the recent political policy and national energy policy history where Indian policymakers have taken a very forward-thinking approach of consulting the stakeholders in public, be it your data privacy bill, or the bankruptcy code, or the most recent net neutrality discussion that happened in India. In all these discussions, policymakers took the view of consulting stakeholders. And I think we really now want and urge policymakers in India to take a similarly thoughtful approach when it comes to digital assets and cryptocurrencies.

Lau: So there is a framework. As you said, there’s a policy framework, there’s precedence, there’s a history where when it comes to other emerging technologies or other initiatives or innovations, policymakers in the past have consulted with the private sector and the public sector alike, so the chance of this happening for cryptocurrency and DLT and blockchain stand a very, very good chance. But Navin, you’ve spent a lot of time in Mumbai. What’s the buzz? What’s the energy right now? Is there concern that the policymakers get it? What are the conversations that you’re having?

Navin Gupta: So I think from my point of view, what I can see is firstly that there’s a lot of confusion within the government to say who owns this? Is it the RBI that owns it? Does the Ministry of Finance own it? Who’s the owner who will make the decision, or who’s the one who will get everybody together for the decision to be made? So that’s one.

The second thing is, for the last two years, there also has been negativity in India. Blockchain good, digital asset bad. In that mind, it’s very clear — this needs to be looked at together. Blockchain without digital assets is just a database which may or may not solve the problem that India is looking to solve.

And then the third thing is that we need to give clear signals to foreign investors. So if there are investors who are coming into India expecting that there is no law against trading cryptocurrencies or digital assets, then we owe it to these investors to give them a clear guideline of whether you can do this or not. And clearly, because this issue has been in discussion for quite some time — as you know, India is the fifth largest GDP in the world, it received 79 billion U.S. dollars just in remittances from overseas — so the buzz on the ground is a state of confusion, that’s what I would say.

And hence, it’s very important for India to come out of this fog and essentially say, “Hey, you know what? This is a lead regulator. This is how the consultation process would work, and this is when and how we are going to make a decision. And we want to incorporate everybody’s views and then make the decision that’s best for India.” And that’s what individuals, institutions and investors are looking for. Nothing more.

Lau: Well, as we all know, politics can make messy bedfellows, unfortunately. And authorities recently in India have announced that all foreign investment would be screened, which essentially would mean delays. That’s the kind of message that’s being sent out to foreign investors right now. So, Navin, I’m curious, can you give us an overview of the venture capital market in India? What’s the appetite that you’re feeling for blockchain and the digital assets space, both domestically and foreign inbound?

Gupta: I can definitely speak about the blockchain and the digital asset space. For that, there is no other market like India. Even if we look before 2007, if you look at the ban, the crypto market in India was doing very well — very large amounts of trading used to happen in India. If you look at reports in the last three months, exchanges that are in India are reporting increased volume.

Recently we had Binance and a number of other institutional players making the play for India, [players] who are present globally but now want to invest in India as well. India, like I said, received 79 billion U.S. dollars in remittances. So we are very excited about India, for example, to bring on-demand liquidity into India, which essentially lowers the cost of remittances for everybody. So, as you know, there are about 35 million Indians who live overseas and they send a huge amount of money into India. On an average they pay 7% of the principal value; that gets taken away every time they remit money to India.

We want to make it easier, faster, better and cheaper for them, and that would not be possible without using digital assets. And we are waiting for this regulatory clarity to then introduce the solution into India. I think there are many more like us. For us and all the others, investment is not an issue, but the key issue is without the clear regulatory signals, we can’t move ahead.

Lau: And that’s something that Ripple Asia, that Sagar, you helped lead the policy paper [for], hoping to really lay out piece by piece what policymakers and legislators really need to consider. But I wanted to focus on digital asset space because this is a really exciting space for India. It allows the middle class and upper income citizens to really participate in part of the economy that they might not have, especially if you take a look at securitized tokens, perhaps if you take a look at the real estate market, for example.

It’s been said that land rights are at the center of all scandals in India, and even if a fraction of that were true, this is a huge market that can actually be cleaned up and given access to a lot of people, especially with a population of 1.35 billion, middle class to be able to participate in a meaningful and transparent way. Where are policy makers there? Where are industry giants here when it comes to thinking about the digitization of traditional assets?

Sarbhai: So as we mentioned earlier, for a long, long time, the narrative in India has been blockchain good, crypto bad. And the idea behind this paper was to define and highlight why the two go together, why the two go hand-in-hand. So really, what we wanted to do was lay out solid use cases of digital assets with blockchain. So prime examples being micro-payments or cross-border payments; how digital assets would be used potentially as a bridge currency between two fiats to make cross-border payments very efficient.

You mentioned securitization. That was one more use case which we wanted to highlight. So that was the first line of thinking. The second line of thinking was, there has been a lot of discussion around what a good regulatory framework should look like. We have talked about the high level principles — let’s say, the framework should be technology-agnostic, it should be principles-based and not rules-driven, and it should be risk proportionate. So the industry has been talking about those kinds of very high level concepts for a long, long time. But we wanted to give a very detailed blueprint to the regulators.

We wanted to talk about what other countries have done around taxonomy, for example, because, again, as we mentioned, there has been a lot of confusion in India around who will own this space, whether it would be the securities regulators — Securities and Exchange Board of India (SEBI) — or whether it be the central bank — RBI — or possibly a new agency. So we wanted to lay out our recommendations, taking cues from some of the more forward-thinking regulators like the UK’s FCA and the Monetary Authority of Singapore and the kind of steps they have taken.

So taxonomy being one, then we talked about some short-term low-hanging fruit. So one example we gave was how can… so India has a free trade zone … in the state of Gujarat, so we suggested that maybe you can look at Abu Dhabi global markets in the UAE, which is a similar free trade zone, where they actually introduced a very thoughtful framework for digital assets outside of the UAE central bank region. So we kind of proposed that you can take a cue from that and maybe in the short term allow digital currency trading to be done within that free trade zone.

Then there were other measures such as allowing crypto-based use cases to be included in the Reserve Bank of India’s regulatory sandbox. That, again, would be a low hanging fruit. And then the paper talks about more mid- to long-term solutions like what are the specific legislation and regulations that need to be amended or included to have a conducive framework for digital assets, key among them being empowering the securities regulator SEBI to regulate and license digital asset exchanges and custodians.

Lau: But how does that policy, and Navin maybe I’ll ask you this as a follow-up, how did these inform your conversations? For example, you know, real estate; let’s just talk about some real use, real world possible applications there. You’ve got the stakeholders, the institutional bodies like the Real Estate Regulatory Authority, insurance regulators… are these bodies actually thinking about it? Are they having conversations with you about it? How are they thinking about this holistically?

Gupta: Right, and I’ll even take a much simpler use case than real estate. So let’s look at the yoga market globally.

Lau: The yoga market.

Gupta: That’s right.

Lau: Namaste.

Gupta: Yeah, absolutely. Yoga is to India what pizza is to Italy. I mean, of course, yoga came from India, and there is a great respect for a lot of people in India who can teach yoga. And we know we’re all digital now, right? So it’s fairly easy for us. The yoga market globally is about 100 billion U.S. dollars plus.

So let’s assume Angie wanted to learn yoga, and she says, “Hey, you know what? There are 100 trial teachers in India, let me pick up a person who already has a website, has got certain certifications in yoga.” And you wanted to take a trial class. Everything is possible over Zoom, everything is possible digitally, the only problem is that Angie cannot transfer 100 Hong Kong Dollars from her account in Hong Kong to the yoga teacher in India. That’s the biggest issue that today stands in the way for millions of yoga teachers in India to essentially be commercially available to people all over the world who want to learn. And this was the main idea behind Yoga sales, that it should be available to anybody who wants to learn.

So the medium is there, but the payment system or the cross-border system, that essentially stops them because the friction is so high. So to my mind, in some way, India is under-living its potential, this not enabling these new technologies to come in to solve decade-old problems. And these can be done legally. These can be done in a very regulated manner in which then crypto onboards onto an exchange, full AML and KYC can be performed. And similarly, when somebody sells it, full AML and KYC can be performed.

So within the regulatory framework itself, if there could be innovation that could be available to India and we are not providing them the tools, or the policymakers are not providing them the tools, then in some way we are crippling innovation. And yoga is just one example, but there are tons of others which India could provide to the world, but we are not able to. And we have had these discussions. So then we have this discussion at the individual level, one to one, and I give the same yoga example to anybody at the policy. They totally agree. But somewhere there is a disconnect in terms of everybody getting together and making it a priority to say, this needs to be solved and the right decision needs to be taken.

Lau: I mean, yoga on one hand and then DeFi as a potential on the other hand. India could truly be an innovation leader in this aspect, and yet, I guess at the end of the day, we’re still really just waiting for regulatory guidance and policy guidance from Indian lawmakers.

Gupta: Absolutely. And also, if you look at just the nature of India itself, India is a land driven by entrepreneurs. I mean, if you look at the internet industry in 1999… The top outsourcing companies in India essentially rose from India, and these were all entrepreneurs who essentially brought the new industry to life for the greater good of the country.

India has got so much entrepreneurial spirit and all they need is clear regulatory policies for then a lot of these entrepreneurs to then build their business models on top of it. I wouldn’t be surprised if there are thousands of companies, entrepreneurs who today are in the gig economy who are building business models. They’re waiting for the political ladder to be there, then to be able to offer goods and services to people around the world.

Lau: I mean, if we were to do a back-of-the-envelope calculation, what would you say is the pent up demand of entrepreneurs waiting to unleash their entrepreneurialism, from goods and services to digital assets and everything in between, if the policymakers were clear and specific about blockchain and cryptocurrency?

Gupta: I think the easiest way for me to think about it would be, there are about 20 to 25 million developers in the world. Roughly. Coders, people who provide code. And I can think of each individual person almost as an entrepreneur in himself or herself, because each coder can essentially say, “Hey, you know what? Here is an idea.” They code, set up a website, and their goods can get sold, or the information can be available to 7 billion people around the world, including India.

Now, the majority of these coders are in India, almost 9 to 10 million coders out of this 20, 25 million population not in India. So there is a huge potential. To my mind, the sky’s the limit. So if you look at even the gig economy figures, people who outsource and do coding, do presentation, do logo designing, there is a very significant number who come from India, who essentially say, “Hey, Angie, you need a logo design. It is two hours of my work and yes, for 200 Hong Kong Dollars, I’m happy to do it for you on my part time on a Sunday.”

So there is, of course, clearly a very large formal economy, but there is a very large, you can call it a gig economy. And if I look at, going forward, maybe the formal economy will not grow so big, or it cannot grow so fast, but it will be the gig economy that takes off and provides employment to people. And for that, the cross-border payments absolutely need to be sorted out.

Lau: I mean, between the both of you we are all more than familiar with India’s journey to essentially clean up its finances, with Narendra Modi trying to legislate India out of the black market scenario. Some years ago, as we all know, he tried to cut the use of physical cash in India, so wouldn’t CBDC or cryptocurrency actually be a vehicle in which India could be more transparent, tie with more smart contracts to be able to have more clarity into how people are using their money?

Sarbhai: So I think, first of all, it’s very important for everyone in the industry and the policy makers to understand the nuances between a CBDC versus a cryptocurrency. And I haven’t actually used the word digital assets because digital assets are basically a new form of technology which are not backed by anything. So if you look at the native neutral digital assets like bitcoin or XRP, they’re not backed by anything. They are backed by mathematics. But a stablecoin or a CBDC is actually backed by a basket of asset classes or fiat currencies. So that’s the difference.

Now, to answer your question, we don’t believe digital assets or cryptocurrencies would replace fiat currency. So I know that in early 2008, 2009, when bitcoin first came into being, the narrative was “down with banks, down with central banks, and bitcoin would become the reserve currency.” That hasn’t happened, and we don’t see that happening. So cryptocurrency will never become legal tender. And I think the regulators/policy-makers in India are cognizant of that.

Now when it comes to CBDCs, there are two types of CBDCs at a very high level. There is the retail CBDC and then there’s a wholesale CBDC. Now in a lot of countries, so Sweden, for example, there has been a big push for digital payments so that almost 80 to 90% of payments are non-cash. So for a country like Sweden, it does make sense for the central bank to introduce a retail CBDC where the central bank would issue digital tokens to the entire population.

For a country like India, a retail CBDC may not be that feasible because there are many other policy angles related to that. But potentially a wholesale CBDC where the central bank issues tokens to the regulated banks, that could be a possible use case as a complement or a substitute to the already existing system within India.

So yes, as you mentioned, Prime Minister Narendra Modi has been a big advocate for a push towards digital payments, and in the post-Covid world, there will be a bigger push organically, and I think a combination of CBDC and digital assets would potentially boost that push towards digital payments where digital assets will be the bridge between fiat currencies and potentially replacing them.

Lau: So Sagar, you work a lot with the Monetary Authority in Singapore, you’re familiar with the U.K. space, and Navin, you the same; if you take a look at this international landscape, who’s best positioned right now? The policymakers and the nations that are leading the way, and where does India rank in your mind?

Sarbhai: So let’s again, let’s travel back into time and look at the adoption flow of the process. It has been a classic innovation cycle that we have seen playing out. In the early days of crypto, forward-thinking regulators, countries like Japan, for example, were the first movers in this space. They came out with frameworks; as early as 2013, 2014, Japan took the lead globally. And you could argue that was triggered by two potentially big hacks — they were really forced into coming up with frameworks but that actually acted as a trigger for innovation.

And today Japan, along with a couple of other countries in APAC, are the leaders in this space. Then came the phase of fear and uncertainty, where after the 2017 boom in crypto, a lot of policymakers and regulators got a little nervous about the risks linked with crypto. So countries like India and China introduced blanket bans because they were still trying to figure out how to regulate the space.

Now what we are seeing is the maturity phase of the innovation life cycle. So a lot of countries over the past 12 months, including Singapore, Thailand, UAE, Mexico, have all come out with very well thought-out frameworks to regulate this space. And unlike in the past, APAC — Asia-Pacific — has taken the lead globally. If you look at Southeast Asia, for example, every country — Singapore, Malaysia, Indonesia, Thailand — all these countries have introduced frameworks to regulate this new industry and they’re already reaping the benefits of that.

They are seeing a lot of international players coming in and setting up shops. They are seeing a lot of enterprise use cases of cryptocurrencies being encouraged and figured. They’re seeing a lot of local entrepreneurship being developed. So they will be reaping the rewards of this. So hopefully India will take cues from these countries, and again, to be very honest, India has a lot of innovation in the payment space.

They have been leaders in payments innovation for years now. A lot of initiatives, but not in the cryptocurrency/digital asset space. And again, they have a huge opportunity with the kind of market India has and the kind of forward-thinking regulators India has, there’s a huge opportunity to introduce a framework to regulate this space and potentially then start competing with some of the other countries in Asia Pacific.

Lau: Well, that is a very diplomatic way of saying that they have not yet started where others have already established precedents and regulatory framework. But I’ll say it so you don’t have to. Look, at the end of the day, I want to leave you with this question: we have the Federal Reserve Chairman Jerome Powell, this past week, saying, when challenged about the digital dollar, digital assets, blockchain, and what digital currency might look like, he said that this is something for the government to understand first and best, and something that the private sector should keep out of.

So when you come from the private enterprise side, how do you react to that? When the government says to those in the private sector, “you know, we’ll figure it out. We don’t need you guys.”

Gupta: I can make a comment first. I think there is no difference between the government and the private sector. There is no hard division, because at the end of the day, the government will make the decision which is best for all stakeholders — that means institutions in the country, foreign investors who want to invest in the country, and for the consumer at large.

So in my view, having a public consultation to essentially say, “hey, what are the options out there?” So that every voice gets heard and then eventually the government makes the best decision, that is the best of both worlds. So nobody is taking the right from the government to make the decision, but I think people are asking for the right to be heard to make sure that the best decision gets taken.

That’s how most of the countries evolved, that’s how most of the good policies have evolved around the world, and that’s how democracies work. And clearly, in the case of India, there is already a precedent for it, and all that needs to be done is replicating that precedent in the digital asset space as well.

Lau: So Sagar, if you were to say, three calls to actions, in your view, what are the most important calls to actions for policymakers, lawmakers right now in India?

Sarbhai: Point number one, the most important thing, do not take any action without consulting the stakeholders. Public-private partnership has been a key theme in policy-making in India, and it should continue to remain so. So we urge policymakers to consult the private sector and all stakeholders involved before taking any action. That would be my first call to action.

Second would be to see what other countries, specifically in APAC, have done. Take cues from them, around taxonomy, how to regulate this, which regulatory body will be supervising this new framework, and then take a proactive measure and introduce a framework which is technology-agnostic, principles-based, and risk-proportionate. And make sure that there is a balance between innovation and risk to encourage more entrepreneurs and innovation in India.

And number three would be, again, India has a huge opportunity. So instead of saying “blockchain good, crypto bad,” look at this picture more holistically and understand the positive use cases of digital assets and cryptocurrencies. And then again, use that to encourage more financial inclusion and lower barriers to commerce, push more digital payments, which has been a consistent theme in India, in Prime Minister Modi’s regime. So look at this whole thing holistically. These would be my three calls to action.

Lau: Well, I think one thing that could not be made more abundantly clear is that sometimes the world has different plans for us. And so for all of these central banks who are in the business of trying to manage risk, I think coronavirus has certainly taught us that there’s no amount of managing that could have prepared us for this nearly catastrophic event. But what it also allows for us to see is the opportunities in digital transformation. Certainly cryptocurrency and blockchain are part of that conversation.

And I think to your points indeed, Navin and Sagar, more and more of us are waking up to the fact that these conversations must be made with full transparency, full engagement, and it certainly can’t be on the ivory tower on the hill. We’re all on the same boat these days. But I want to thank you so much, both of you, for really giving us not only a perspective from the ground in India, but all the way to the top and what policymakers must and should be thinking about.

Those are very clear calls to action, and I think a lot of foreign investment money is betting on it, and more than that, 1.35 billion people are betting on it too. Navin, Sagar, thank you so much. That’s Navin Gupta and Sagar Sarbhai from Ripple Asia. I’m your Editor-in-Chief, Forkast.New, Angie Lau, and your host of Word on the Block. Thank you for joining us on this latest episode. Until the next time.