Explaining Blockchain to Unwilling Enterprises: Accenture’s David Treat

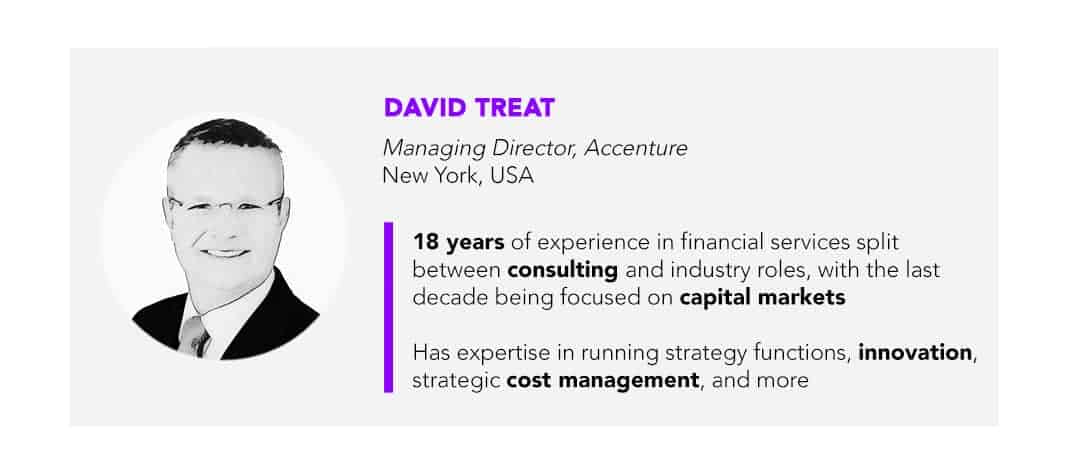

As the Managing Director, Global Blockchain Lead at consulting firm Accenture, David Treat spends his days engaging with enterprise leaders across various industries about blockchain, from understanding the topic until implementation. Forkast.News spoke with Treat on the sidelines of OECD Global Blockchain Policy Forum to find out how these conversations play out, and how Treat manages to open their minds about this technology.

Key Highlights

- So what’s really what’s really going on is that for the first time ever, we have the ability through technology to have uniqueness in the digital world. And if you think about the concept of uniqueness, uniqueness means you can prove there’s only one of them. So I can prove it exists once and only once. And then also embedded in that is tamper evidence. So I know it exists once and only once, and I know no one’s messed with it. And I can be confident that you and I see the same thing.

- We’ve lost any degree of privacy or control in our data, it is out there and it’s everywhere now. And you don’t have any ability to track it. Tomorrow, we’re going to have the ability to own our own data, to be able to to to very deliberately share it with a service provider or an authority element by element.

- I’ve been very pleasantly surprised that the degree of engagement, I’m spending a ton of time in [Washington D.C.] and spending a ton of time with regulators around the world. They are reaching out for information. They are using language about being proactive, about how they need to modernize regulation. They’re engaging in the discussion. They’re hiring technical experts in ways that, I just hadn’t seen to this extent previously. So I’m very bullish on how the regulatory the global regulatory environment is engaging.

Listen to the podcast version

According to Treat, the trick is to not use the word “blockchain” during the first hour. Instead, he starts with data: the implications of it, the infrastructure, how the world’s business logic is shaped around it today. Only after he is successful in drawing them in does he introduce the concept of blockchain.

He does so by breaking down blockchain into its basics: it is a technology that users can trust. Given its ability to record its provenance without being liable to the dangers of being replicated unknowingly, blockchain has emerged to be the unique technology component that is able to be trusted by enterprises. This, according to Treat, is the winning route into blockchain discussion.

“They can trust that no one else has changed its state in some sort of way that the community didn’t agree with, and that it’s auditable and you have that full provenance,” said Treat about blockchain.

From there, Treat shifts into another winning keyword: transparency, which is an area that businesses in general struggle with today given the mistrust users have with enterprises.

“If we do this right, [blockchain] is going to be transparent to the end-users,” he will explain to his conversation partners.

Apart from transparency, end-users will also be equipped with the ability to own their data, which was a concept that was non-existent prior to blockchain. Being able to own while simultaneously share said data, with the autonomy to pull back at their discretion, is a conversation that intrigues enterprises.

“What I think we’re going to do is build up a degree of relationship redefinition between individuals and the service providers and authorities that they work with,” said Treat of transparency.

Despite challenges and highly “philosophical” discussions on blockchain application, Treat was able to point out a number of instances in which blockchain played out to be beneficial. The Risk Institute in the US, for example, was quick to realise the benefits of this technology and formed a consortium with 33 of North America’s largest insurance companies. The platform has gone live this summer and as a result, users will experience a simpler process and receive expedited payments.

Looking forward, Treat is “incredibly optimistic” on regulators’ involvement in the future of blockchain implementation as he noted that the quality of conversations and engagement within central banks and regulators is “fantastic”.

Full Transcript

Angie Lau: Welcome to this special edition here in Paris, I’m Forkast.News Editor-in-Chief Angie Lau. So we are here at OECD Global Blockchain Policy Forum, where thought leaders from across industries and certainly at the highest level of governments are really situated here. I just had the pleasure of sitting on a panel with David Treat.

David Treat: It was my pleasure.

Angie Lau: Thank you so much. He is the managing director of Global Blockchain Lead at Accenture. And really, your job at Accenture is to engage with enterprise leaders from across all industries about blockchain. So let’s get started. David, welcome. First of all, understanding blockchain is a difficult task unto itself. How do you start those conversations?

David Treat: It usually features not using the word blockchain for about the first hour. And literally just talking about the world that we’ve been living in. So since databases have been invented we’ve been living in this world where we’ve just had this orthodoxy that “I couldn’t possibly trust your data and you couldn’t possibly trust mine.”

So we’re going to message data back and forth with each other and our ops teams are going to reconcile. And when you walk around the operations team of any industry’s floor, you hear stuff like, did you get it? How much was it? Eight, 10, 20. It’s this constant reconciliation of data. And so we help executives think through the world they’re living in and then introduce the notion of, well, what if that could be different? And what if actually through technology, you could be confident when you’re working with a counterparty that, you know, you see what they see. And if I know that I see what you see, I don’t have to message to you. We don’t have to reconcile. We’re not going have a trade break and misunderstandings about data. We’re not gonna have data quality issues.

And so, you know, kind of step them through the implications of the data, infrastructure, data, world business logic of today, get them grounded in the possibilities of then how could it be different and then start to introduce the blockchain concepts.

Angie Lau: I mean, first and foremost, blocking is that technology is trust-less, which is that in terms of language, very intriguing today.

David Treat: Another inadequate term we’ll get back to.

Angie Lau: Trust-less in that you’ve heard it. But in that trust is baked in. I don’t need to know you, David, to know that as we engage on this platform. I trust this process, this transaction.

David Treat: And I don’t use that word when I talk to clients and we talk about that component of what this technology is about. I find that that masks what’s really going on. So what’s really going on is that for the first time ever, we have the ability through technology to have uniqueness in the digital world. And if you think about the concept of uniqueness, uniqueness means you can prove there’s only one of them.

There’s only one of it, in the digital world we’ve been living in because of copy and paste, we’ve never had just one. You have no idea. I share a piece of information with you. You could copy paste a zillion times and share it with your friends and family. And it’s gone. It’s everywhere. Now, suddenly, through the technology, we have uniqueness. So I can prove it exists once and only once. And then also embedded in that is tamper evidence. So I know it exists once and only once, and I know no one’s messed with it. And I can be confident that you and I see the same thing.

To me, that’s what’s probably meant in most instances where someone uses the word trust, meaning they can trust that there is only one of it. They can trust that no one else has changed its state in some sort of way that the community didn’t agree with. And that it’s auditable and you have that full provenance. And so I find that it’s much more helpful to talk about the core capabilities at that and at a more precise level to help people really understand what’s going on.

Because if you just throw around the word trust, you know, I don’t know whether I’m trusting the operator of the system to do it right. Which we’ve done forever. You know, I trust that when I log on to my bank and I look at my balance, that it’s the right balance. How many of us balance a checkbook anymore? Like we were done with that 20 years ago. So it’s you know, the word trust is one of those inadequate terms. And it’s much, much better to talk about the precise aspects of what the technology actually does.

Angie Lau: It is still critical to doing business. It is what legacy businesses, like auditors, like lawyers, actually derive value for themselves and for their families because they reinforce that that interaction between businesses. And so if we talk about blockchain, you know, really kind of disrupting even that process. Where does that leave all of us?

David Treat: I think it leaves well, two things. Shortly, the notion of blockchain, if we do this right, is going to be transparent to the end-users. We shouldn’t be inflicting database structures on conversations with end-users. It’s a system of record. It’s not a system of engagement. You’re still going to log onto an app. You’re still going to, you know, get on your laptop and go look at the presentation layer. You don’t know what’s behind that presentation layer as an end-user. And you shouldn’t.

It should just be easy, simple to use and transparent. So there’s one aspect and I’m not answering your direct question, but there’s one aspect where I think it becomes transparent to the end-users. On the other side, what I think we’re going to do is build up a degree of, there’s going to be a redefinition of the relationship between individuals and the service providers and authorities that they work with. So today we talked about this on the panel right. Today, the winning digital business is the one that accumulates the most data and they get it from anywhere that they possibly can.

We’ve lost any degree of privacy or control in our data, it is out there and it’s everywhere now. And you don’t have any ability to track it. Tomorrow, we’re going to have the ability to own our own data, to be able to to to very deliberately share it with a service provider or an authority element by element. I want to share my, you know, age and age and height with you and, you know, weight and home address with someone else.

I’m not showing you my whole driver’s license, etc. I can be much more focused about what I want to share, but most importantly, I can share that data with it encoded with the intent of why I want you to have it, the approval that I want you to have it, the rights I’m giving you to use it and your obligations back to me as to what you owe me around it. And then later I can actually revoke it.

And so from an end-user perspective, I think we’re entering into a period where the winning digital business is the one that develops that. The winning digital business is the one that creates the most compelling personalization, you know, personalized relationship with a customer where you’re negotiating that exchange that they want you to have the data to get a service and they know you then. And the rules are encoded as to how you can use it.

And you can’t just simply sell it to someone else, because if you move that piece of data, it doesn’t have my cryptographic signature that says I gave it to you. If that’s only so it shows up in someone else’s data store, that auditor should find that and say that that’s not right. And so we’re gonna see the reclamation of privacy control and it’s going to take time to get there. But that is absolutely the direction of travel, of regulations, of our social dialogue and of the technical capabilities where we can now have that ability.

Angie Lau: So you work in a very high-level Ethereum Alliance. You’re a part of that. So, you know your technology.

David Treat: I’m on the board of the Linux Hyperledger project, as well as the Enterprise Ethereum Alliance and a few other of the bodies. At Accenture, we’re not a product company, we fiercely defend that, we’re always focused on being a services company and providing value to our clients, stitching together the best of the tech platforms and capabilities that are out there. So it’s always been very important for us to be part of the core dialogue as to how the technology is evolving both at a technical and a functional and business level.

Angie Lau: But you chose Ethereum and you chose Hyperledger. These are two concepts that are very specific. So you chose one protocol and you chose Hyperledger, which is really taking a look at private enterprise and launching solutions there. And some would say as the innovation and technology is changing, it’s certainly many, many, many blockchain protocols with unique characteristics. There’s very specific that maybe should talk to one another. And then from a private Hyperledger type concept to a public language of decentralization and truly not owned by any one entity, but certainly the system itself is self-policed, self-enforced, self-governed. Where do you stand on that?

I want us to use totally different language. So let’s take the “three selfs” you just used. It is wildly misunderstood. So there are actual operators of the blockchain ecosystem. There are a defined set of companies that have chosen to make the investments to build their mining capabilities and run the network. And in those operators exist. And it’s and it’s not the, you know, tens of thousands, hundreds of thousands of end-users.

It’s a set of companies that have gotten together. They’re mining pools or infrastructure players, but they’re they’re deliberately providing a service and operating the company. And so that the reason I don’t like the public versus private blocking concept is we’re masking or masking the valuable conversation around separating the user population of whether you’re having public or private users of a system, which is what we should reserve that word for versus the conversation around who’s operating it.

Angie Lau: But what if I want to decide that I’d prefer nobody really control any access points that I want to participate in something that we can all kind of control, that there is not any one access point.

David Treat: As long as you know who’s operating that system and you’re comfortable with it, that’s where we’re going to have these new social contracts and decisions. One of the things that we’re exploring with corporate enterprise and government clients is where are you comfortable? In which context? And what rules? Every corporate enterprise and government agency has care of duty to its end users. They are there to provide consumer protection, system protection, market protection and those aspects then require specific obligations of the operators of those systems to be able to support that. And so what we are focused on building and the protocols that we avail ourselves on are those that we can get into that contractually obligated, SLA based, auditable, regulated services by the operators of the system.

Angie Lau: We’re talking about a brand new operating system, one that looks very different from my parent’s generation, our generation, my child’s generation. And yet, you know, we’re all trying to figure out how not only how to use this emerging operating system, but are we thought about as it’s being architected? What is the social contract, the business logic? And even the governmental and regulatory aspect of this operating system that’s changing by the second.

David Treat: It is changing by the second but there are truisms that we have found in all of the work that we’ve done. I think this is going to get overly philosophical. But I think if I look from the dawn of human existence and all of the social constructs that we’ve created, I think there’s some fundamental things that we’ve always required. I think as humans in any social, economic, financial, governmental context, we’ve always demanded that there is a method of recourse. There is someone to fix it when it goes wrong. We formed legal systems around it. We have the expectations in these systems. I think that’s an example of a truism.

And so what we do is evaluate for the particular business process, that particular business flow: can it meet the requirements and expectations of the users around recourse. And you know, the fallback, and it’s all too frequently talked about is: you’ll default to the legal system for recourse, you know, or you’ll default to a community vote to change the platform. That’s all well and good for certain types of issues. And it’s a great backstop. However, when I have the hundred million dollar transaction or I’m standing in a border and I can’t get my child across the border, or where there’s something that has to be fixed operationally, now that doesn’t work. You need constructs to be able to provide different levels of recourse for different types of business processes.

And so that’s what we do, is we basically look at the look at the user need, the business transformation we’re trying to achieve, and then what platforms and constructs will then match those needs? Do you need someone who can fix something in minutes or seconds, in which case you’re never going to rely on the legal system as your actual form of recourse. You’re going to need someone, an operator of the system who can play that circuit breaker, that choke point or, you know, the auditor. And then the most valuable thing in this whole space is that through the technology and through the possibilities, we’re now reimagining it.

So the notion of an intermediary will wildly change across those ecosystems. And it should and it’s going to evolve in really creative, innovative ways. But there are in most business cases, in every corporate enterprise and government constructs, there are roles that need to be played, and the right question to ask is who do you want to play them and how now that the technology enables something different. And where it’s unhelpful is where we talk in these binary languages of if it’s just centralized or decentralized. There are no intermediaries.

Angie Lau: Let’s use real-world language and real-world applications of what businesses are doing now in the blockchain space. Accenture, the World Economic Forum just came out with a really extensive study. A lot of businesses are very interested in it. Certainly it’s transforming industries as we speak. We’re not necessarily seeing it. You’re seeing it. What are the real-world applications that will shift the reality for regular joes just like me in the next 6 to 12 months.

David Treat: So a few of my favorites. So the RiskStream Collaborative used to be known as the RiskBlock Alliance. Both of those are a mouthful for me to say. The RiskStream Collaborative was formed by the Risk Institute in the US, which was the North America Insurance Industry Policy, Education and Lobbying Forum for the insurance industry. They recognized the value of this technology and what it could potentially do, and they formed a consortium and stood up a brand new entity within its structure where they’ve done it right.

They created a very egalitarian basis. They brought in 33 of North America’s largest insurance companies. The impressive part was this was an industry-wide effort. The members cover more than 65 percent of the North American insurance market. So this is one of my favorite examples where this is the type of work that we’re really pushing for and working to use our relationships across our client base to drive ecosystem-wide. They focused on the first use case, which was “you and I smash our cars into each other”.

The proof of insurance that both of us have to produce the first notice of loss and involves that you, me, the two insurance companies, the police. Traditionally [that involved] multiple messages and reconciliation and lots of phone calls back and forth. Now, through using the platform that we’ve built, you will be able to tremendously simplify that process and in its full grandeur, it’s just gone live this summer, in its full grandeur it’s a multibillion dollar use case that’s gonna make it the next time you and I get into an accident in North America and when our insurance companies are part of it, we’re going to have a much simpler experience. You’ll get paid faster. And, you know, and at the end of the day, you may not know it’s blockchain. It’s going to be simpler.

Angie Lau: That is actually how this conversation is evolving when we talk about technology that the end user is not even going to notice what efficiencies are being felt if it’s done right. So now in the backdrop of the OECD, in the backdrop of all of these governmental, intergovernmental, trade, finance, you know, enforcement agencies like the S.E.C., are these conversations getting it right? The role of regulators and the role of governments on the innovation of technology.

David Treat: I’ve spent my whole career in financial services. I’ve really actually incredibly enjoyed over the past couple of years playing this global role and getting, you know, getting across industry vantage points and learning other industries. But if I if I focus on that, you know, S.E.C. financial services, you know, the global regulatory bodies that are involved. If you would ask me 10 or 15 years ago, particularly coming out of the financial crisis and the wave of regulation that was started, if you had asked me how I would predict a new wave of innovation would go, I never would have. I’ve been very pleasantly surprised that the degree of engagement, I’m spending a ton of time in [Washington D.C.] and spending a ton of time with regulators around the world.

They are reaching out for information. They are using language about being proactive, about how they need to modernize regulation. They’re engaging in the discussion. They’re hiring technical experts in ways that, I just hadn’t seen to this extent previously. So I’m very bullish on how the regulatory the global regulatory environment is engaging. There’s a somewhat entertaining little competition between the regulators around: “can I create the better innovation sandbox or innovation backdoor into my region?” And in particular, the stance of the smaller jurisdictions which have a very innovation, forward-looking, innovative stance on their ecosystem, willing to spend money and engage. We just did the first-ever central bank to central bank exchange of fiat currency in a DLT form from Canada to Singapore.

So the MAS (Monetary Authority of Singapore) and the Bank of Canada, have had a whole very deliberate plan structure of how they’re going to explore this whole technology space. And project after project is really kind of proving to themselves that it can work. And always balanced, there’s always the part of the organization that will always need to play the safety, security, soundness, risk-focused part of it. That’s what won’t go. That can’t go away. It’s critically important for all of us that we don’t get in trouble again. But the balance in the integration with the innovation side of these organizations is spectacular. So I’m very bullish on it. Where there are a lot of them that are our clients, were engaged with them. So, yeah, I think I think it’s going as well as it could be.

In the OECD, from what I’m learning about, I wasn’t here last year which now I really regret, is that being here this year has been a phenomenal set of content and speakers. And I’m very much looking for next year. The group of central banks and regulators and the quality of the conversation and the intent to really engage productively isfantastic. So I’m incredibly optimistic. I try to keep that wider perspective. Sure. On a daily basis, we will always have frustrations with each other. But it’s going I think it’s going incredibly well.

Angie Lau: Well, I think the first step to trust does boil down to conversations face to face and certainly conversations like this. Thanks for helping us lift the hood. Look around at the engine of this blocking technology that is shaping our lives as we speak. David Treat, it was a pleasure.

David Treat: Nice. Thank you very much. I appreciate it.