How Hedera Hashgraph Will Spend $100M (Part III)

Key Highlights

- Fundraised $100M at a $6B valuation

- Hedera Hashgraph has proposed a new regulatory language

Listen to the full podcast version of this interview

Transcript of Part III

Well, it’s very exciting in the space. You raised 100 million dollars on a 6 billion dollar valuation. What are you doing with 100 million dollars? How are you thinking about capital deployment?

Oh, so we’re very conservative. Number one, when the money came in – and some of it came in and cryptocurrency – much of it came in and fiat. The moment it came in, we converted it to fiat.

US dollars?

Absolutely. And all of that went into the bank. And because we sort of expected crypto-winter, we knew that was going to happen. And so from the beginning, we converted everything into fiat. We now have that.

We put together a budget to give you some sense of how we approach this. We put together a budget that allows us to scale the company, but with some really draconian assumptions. Specifically, if there was no revenue, zero revenue with very modest assumptions, we have enough runway to go for many years. And so we know we’re going to get through crypto-winter, number one. And then number two, we’re actually going to market by creating a line of business solutions for businesses that have real problems and need real solutions.

Maybe they don’t even care that if cryptocurrency or blockchain or Hashgraph is under the hood, all they know is that there’s a problem that they want solved. And they’re willing to write a check to have somebody solve that.

We are going to market by helping them along with global system integrators to solve those problems. And so, we’re staffing up. We’re staffing up the team that does that the team that does the business development for Enterprise Software Sales. We also are giving a lot of emphasis to the regulatory concerns and our legal team. One of the very first people that I hired when we started this company 18 months ago now, was my general counsel, Natalie Furman. She’s fantastic. And, we knew from the very beginning that we wanted to approach this market in a different way than most do. And so we’ve given a lot of emphasis to making sure that we’re engaging with the regulators, from day one and…

All of them? Which one, in the US?

Well we started in the US for sure. We’ve had many conversations with the appropriate government organizations in the United States they are…

Are they frustrating conversations?

Not at all, not at all the … I think the regulators absolutely want to do the right thing. And they’re looking for help and understanding what the right thing is. And so we have an approach, we have a strategy, we have a model for how companies like us should go to market in a regulatory compliant way, we’ve proposed the model to the regulators.

What’s that model?

So, we view it as sort of a bridge that crosses a chasm from the point where the money you’re raising is clearly in a security instrument, to the point … once you’ve crossed the bridge there now are tokens in the market that clearly, are not securities and the trick is understanding what activities need to occur when you’re crossing the bridge. And so we are now on the bridge…

And the fiduciary responsibilities that you have to the people who are investing in you in the first place.

Absolutely, that’s part of it. And so you have all those concerns. But there does come this, I won’t say a moment in time, because there is no magic bright red line prior to which everything is a security post everything is a utility token or a currency or not a security, it’s more like a process and you can see evidence of the conversion over time based on the activities that are being performed by the company in the reception by the community and the use of the platform for what it’s intended purpose is…

So really defining a new regulatory language?

We’ve actually proposed a new language. That’s right. We proposed a new language, and the reception has been good. It’s a clear dialogue and nothing negative has been said. And I view that as a really strong positive.

Sometimes negative can be also helpful because you know how you’re being challenged. The dangerous one, they don’t tell you, and they say, “No.”

Well, we clearly ask questions that … So let me say it this way: they want to help.

I think they literally want to help. And they’re not there to penalize or punish organizations that clearly are not wanting to commit fraud. And so when they understand that it’s a legitimate organization that is legitimately seeking a cooperation between the company and the government to achieve the well-being and good for the consumers, they receive that well.

Keep Watching

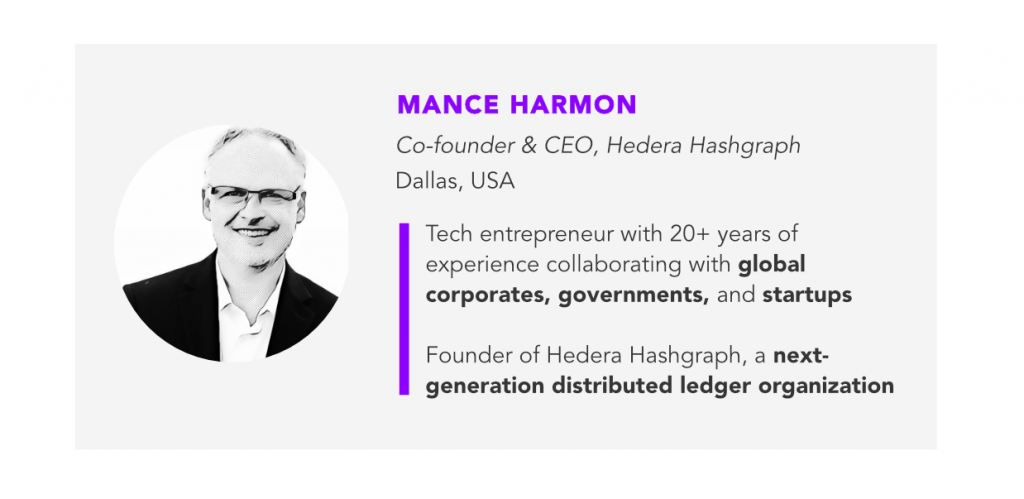

Part I: Mance Harmon on Why Hashgraph is a Better Alternative to Blockchain

Part II: The Advantages of Not Being Open Source

Part III: How Hedera Hashgraph Will Spend $100M

Part IV: How the U.S.-China Trade War Impacted Hashgraph

Part V: When Will We See Real-World Solutions?

Part VI: Can Hashgraph Co-Exist With Other Blockchain Players?

Full Interview: In Conversation with Mance Harmon