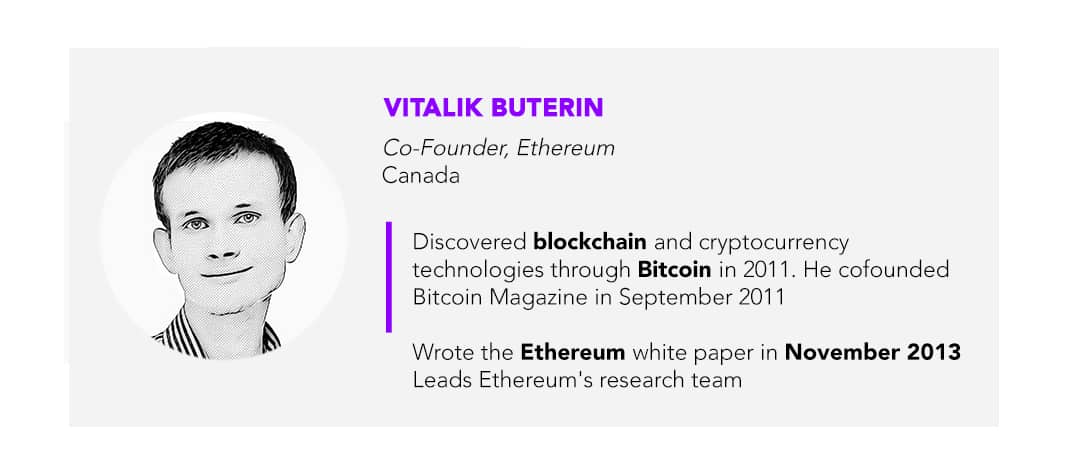

In Conversation with Vitalik Buterin, Co-Founder of Ethereum: On Eth 2.0, Finance, and China

With Ethereum 2.0’s release just around the corner, co-founder Vitalik Buterin has been busy talking about what to expect from the new system and its use of proof-of-stake validation.

Ethereum 2.0 is meant to address a number of issues that the current system has. It is billed as improving scaling, security, and other issues in order to create an environment that bolsters decentralized applications (DApps) as well as smart contracts. Forkast.News Editor-in-Chief Angie Lau sits down with Buterin to find out more about how Ethereum 2.0 will change the industry.

Key Highlights

- So the main thing that Eth 2.0 makes better is obviously scalability. And scalability is important because of the things that it enables, which basically means more of everything. So the applications that we’ve generally seen on the blockchain so far generally have to do with finance and there’s good reasons for that. Because they like existing centralized financial systems are relatively terrible.

- So in governance is definitely something that we have to keep doing and keep, especially as we’re taking the blockchain through this kind of very unprecedented live transition. That’s– it’s basically like upgrading an airplane in mid-flight in some ways, yeah.

- I think in Asia is definitely a kind of a major hub of investment in blockchain projects of all kinds. And there’s a lot of people, a lot of money that people in many places rapidly getting more money in. So I think from an investment standpoint, it’s very significant and going to be even more significant. And also over the last couple of years, I think the blockchain development here has been accelerating.

- I think that some of the incentive blockchain based financial applications are very good at creating a system where, I mean, more people can participate, but also very importantly, not just participate as users or consumers and investors, but also participate as producers. And that’s kind of an inherent property of the ecosystem. And the inverse is that it’s kind of chaotic, as we have seen with things like ICOs, for example

Listen to the podcast version

According to Buterin, a lot of progress happened in the last few months, and they’re “basically hurtling full speed ahead to having a public test network, which is the last major milestone,” he said at The Hong Kong Jockey Club University of Chicago Academic Complex | The University of Chicago Francis and Rose Yuen Campus in Hong Kong.

Buterin, who had recently come back from the DevCon 5 event held in Osaka, Japan, has been on an Asia tour talking about the new fork to Ethereum, and what it would mean for blockchain, businesses, finance industries, and more.

About Proof-of-Stake

Bitcoin and Ethereum currently use “proof-of-work” algorithms to determine consensus. This means that in order to add a new “block” to the blockchain, so-called miners compete to solve a complex computational puzzle. The first miner to solve the puzzle will then be able to bundle all open transactions onto the blockchain, and are then rewarded with cryptocurrency.

See related article: In Conversation with Joseph Lubin, Founder of ConsenSys: Blockchain is a Paradigm Shift for the Planet

While proof-of-work systems are what make blockchain systems decentralized and secure from malicious actors, it results in a large amount of spent resources, work, and time as the blockchain scales in size.

According to Bitcoin specialist Alex de Vries at PwC, “the Bitcoin network consumes at least 2.55 GW of electricity currently, and that could reach a consumption of 7.67 GW in the future, making it comparable with countries such as Ireland (3.1 GW) and Austria (8.2 GW).”

Proof-of-stake systems are meant to address this issue by replacing miners with validators who have staked an investment in the ecosystem with their cryptocurrency. An algorithm chooses which of the validators will create the next block based on the size of their stake. In order for a malicious actor to manipulate the blockchain, they would have to own more than 51 percent of all the cryptocurrency on the network.

Should this happen though, any other validator can “challenge” the new block being created, and if the malicious actor is discovered, they lose their stake and ability to participate in the future. In this sense, proof-of-stake is claimed as being more secure and flexible in terms of scaling, while still allowing for a decentralized and trustless system of operation without being resource intensive.

Full Transcript

Angie Lau: Welcome to Forkast News, in conversation with Vitalik Buterin. He’s co-founder of Ethereum. And welcome to this conversation Vitalik, I’m Editor-in-Chief, Angie Lau. You’re here in Hong Kong. You are a world traveler. And really, your home is wherever you are. And a lot of people are asking about what’s the status of Ethereum. So you were just in Shenzhen, what are the conversations that you’re having in China?

Vitalik Buterin: I mean, the conversations that I’ve been having and everywhere I’ve been having on this Asia tour for the last month or so have been very positive. And a lot of things, I mean, in the same direction, I think. I think the big things that have been happening recently is just that, first of all, there is all of this progress with some of the scaling technologies that we’ve been having for the last couple of months.

And scaling is a problem we’ve been talking about for five years, building things for many years, and a lot of the work is finally starting to come to fruition. So, for example, there is this platform called Optimistic roll-up. It’s kind of a scaling solution on Ethereum that’s much simpler than things like Plasma or the Lightning Network or some of the other fancier things, but it gives you like over a thousand transactions a second and that’s running now. So on the technical side, there is a lot of things like that that are kind of really starting to come out like right now. On the business side, I think public chains are being perceived as much more legitimate than before, including in enterprise and everywhere.

This is something that I have heard in China. Something I’ve heard in Korea, like [at] Devcon even just looking at the kinds of applications that people are building, looking at things like Santander Bank launching bonds on the public Ethereum chain, and Ikea using some Ethereum blockchain based token to pay for things. So I think public chains in general have been going through this kind of re-awakening like very recently.

And I think part of that is just people see the promise of blockchain, and people are excited about it. And at the beginning, I think people were more conservative and they said, oh, we need these kind of semi centralized permission chains. But then I think more recently I’m seeing a lot of those projects not come to pass. And people have been realizing that, like, wait, maybe using the existing public chains like actually is the conservative thing. And, you know, and it’s been an interesting shift around that.

Angie Lau: And that shift is something that you’re supporting on the technical side. A lot of people say that scalability and stability need to be really established before more Dapps and developers really come on board and create applications for people like you and me and everybody else out there who are like, “OK, this is a practical use of that”. But on the back end of it, how is is Ethereum, Eth 2.0, establishing itself? And there’s a lot of concern about the forking. Is that a concern that you have?

Vitalik Buterin: So I guess from a technical point of view, we’ve had a big workshop in Toronto about one and a half months ago where we got all of the different teams building Eth 2.0 implementations to talk to each other and kind of speak the same protocol. And we’re coming very close to having public test networks, which is basically the last step before launching a public main network. So things are really full steam ahead and moving forward quite quickly now. So, of course, the way that Eth 2.0 will be rolled out is that it starts off being separated Eth 2.0 chain, and then there’s a link between the two chains and then eventually the kind of existing Ethereum chain gets kind of fully merged into the Eth 2.0 chain.

But it’s definitely this multi-stage process. And the reason we did this is to be more safe and conservative. Like you don’t want to move the entire existing ecosystem onto the fancy new thing before you’ve proved the fancy new thing can work. And the fancy new thing here includes proof of stake. So it’s not just a technology change, it’s also an economics change. And that’s not really something that you can test in the lab. And so, we need to have some way of like actually having it run in real life while at the same time not having applications like all depend on it from day one. So like having…

Angie Lau: You don’t want it stressing out the system like crypto kitties.

Vitalik Buterin: Yeah, exactly. Having the two of the established thing and the experimental thing kind of run at the same time with bridges between them. But it’s still running at the same time. That basically is the safest way to watch the whole thing.

Angie Lau: And so back to your point about public chains and a truly decentralized, truly public gaining more credibility. How much is governance a part of that and how much are they involved in any kind of leading? A lot of people trust what you’ve built and what the community has built. But governance is still a very critical issue.

Vitalik Buterin: Yes. So in governance is definitely something that we have to keep doing and keep, especially as we’re taking the blockchain through this kind of very unprecedented live transition. That’s– it’s basically like upgrading an airplane in mid-flight in some ways, yeah.

Angie Lau: Not necessarily the safest exercise, but that’s how quickly this industry is moving.

Vitalik Buterin: Yeah, exactly. And so it’s something that needs to be done, you know, because the space, the technology and the space is still very far from being at the level it needs to be to fully support the industry. And, we’re trying to take it there. So it’s definitely something that requires kind of broad consent and collaboration across the Ethereum ecosystem.

And I feel like we’ve been very actively engaging with the community. We have developer communities, and application developer communities that we’ve been interacting with very closely for that. And it is a process that I think is happening very publicly and very transparently. And I think obviously there are people that are to be unhappy with the direction.

But I think people who think that proof of stake and sharding are good are good ideas in principle, are happy with how we’ve been doing things. And people that don’t think that proof of stake and sharding are good ideas in principle, like most of them are not even kind of part of the Ethereum ecosystem now because we’ve been talking about proof of stake and sharding for years. It’s not like some new thing that we’re springing on people without expectation. And so a lot of those people, for example, who’ve moved over to Ethereum Classic are like, oh, when that fork happened in that chain…

Angie Lau: And that’s the Democratic… You can vote with your feet.

Vitalik Buterin: Exactly. It’s the Democratic way. Yeah.

Angie Lau: At the end of the day, you know, people are still taking a look at what blockchain enterprise solutions applications are. You know, and very famously, Gartner recently published its hype cycle, that blockchain is sliding into the trough of disillusionment.

Vitalik Buterin: Sliding into the trough or coming out of the trough? I feel like it’s on the right side of the trough of disillusionment. I feel like the bottom was more like at the beginning of this year and the bottom is over already.

Angie Lau: What do you see in terms of applications? What’s on the horizon that you’re excited about most with Eth 2.0? The things that it solves that makes it better.

Vitalik Buterin: Yeah. So the main thing that Eth 2.0 makes better is obviously scalability. And scalability is important because of the things that it enables, which basically means more of everything. So the applications that we’ve generally seen on the blockchain so far generally have to do with finance and there’s good reasons for that. Because they like existing centralized financial systems are relatively terrible.

And like there’s definitely kind of specific cases where they can be very efficient, especially if you look at international markets, if you’re trying to do anything kind of unconventional, like as soon as you kind of get outside the box a little, they start breaking down quickly. And like that’s more obvious in finance than it is in kind of centralized services almost anywhere else.

Angie Lau: I mean, look at Hong Kong. This is a financial services hub. There’s a lot of multinationals that are here. At the same time, there’s a lot of discontent on the street. What’s your perception of how blockchain can evolve into a society that possibly could return the power of the economy back to the individual, which is the promise of blockchain.

Vitalik Buterin: Yeah. So I think that some of the incentive blockchain based financial applications are very good at creating a system where, I mean, more people can participate, but also very importantly, not just participate as users or consumers and investors, but also participate as producers. And that’s kind of an inherent property of the ecosystem. And the inverse is that it’s kind of chaotic, as we have seen with things like ICOs, for example, but there’s a lot of experimentation happening in and creating newer and more participatory ways of starting projects, of creating new financial assets of different types.

Angie Lau: Give me an example that excites you the most. Like right now in the real world, you take a look at that project and you’re like, “Wow, that’s that’s really going to be impactful.”

Vitalik Buterin: I mean, smart contract insurance is one example. Like there’s already pilots in places like Sri Lanka, for example, where what they basically do as they create smart contracts that talk to oracles like data sources on the Internet. And they just say, like if a hurricane happens, automatically make a payout over here. If there is no rain, automatically make a payout over there. And it’s something that you can just make in 50 lines of code and it works pretty well and it seems to be starting to provide value to people.

Angie Lau: Well, before I let you go, because you are in demand, we’re here at the beautiful University of Chicago Booth. There’s a crowd waiting to hear from you. Google just said it broke the quantum computing conundrum. And that really kind of makes a lot of people take a look at blockchain and speculate it threatens the stability of blockchain. Your thoughts?

Vitalik Buterin: So there’s a lot of misconceptions about quantum computing in general and the Google quantum thing specifically. So I guess, first of all, like what the Google Quantum announcement proved is that like there exists quantum processes that we create that we can create that are kind of more computationally complex than we can simulate on computers. Right. So the equivalence of this would be like hydrogen bombs as proof of concept for nuclear fusion energy.

So it proves that the ability to make a big boom exists. What it does not prove is the ability to harness that big boom to create things that are useful. And for creating things that are useful, like just as like with nuclear fusion, I mean, we’ve had the bombs for 70 years, but making nuclear reactors that kind of calmly and peacefully give us free, really cheap power, it still hasn’t happened yet. With quantum computers, there is also a lot of structural reasons why we’re still potentially over a decade away from kind of harnessing the quantum to do specific computations that we want.

So that’s the first thing. So the world is not going to break tomorrow. I mean, the second thing is that even when we create quantum computers that we can direct to create specific computations, it’s not true that quantum computers and break all cryptography. They can they break some cryptographic algorithms, but for every cryptographic algorithm that quantum computers can break, we know that we have a replacement and sometimes the replacement is 5 times or 10 times less efficient. But we have a replacement that quantum computers cannot break. So we have an upgrade path and we know what the upgrade path is.

Angie Lau: There you go. And before we leave, this is Hong Kong. We’re in the steps of China. This is Asia. How are you feeling about the investor space here? The blockchain technology investment space here, the VC space in China.

Vitalik Buterin: There’s a lot of people that are interested in both cryptocurrencies and blockchain technology more generally. And I think in Asia is definitely a kind of a major hub of investment in blockchain projects of all kinds. And there’s a lot of people, a lot of money that people in many places rapidly getting more money in. So I think from an investment standpoint, it’s very significant and going to be even more significant.

And also over the last couple of years, I think the blockchain development here has been accelerating. So I think in about five years ago, there was kind of very little it was just miners and exchanges. But now, I mean, even here in Hong Kong, there’s projects like Enuma, for example, that’s doing layer two scaling on top of Ethereum. There’s projects doing things with hardware, there’s projects doing things around security, centralized exchanges. So there’s there’s more and more things happening.

Angie Lau: Vitalik, thank you so much. Thanks for joining us on Forkast news.

Vitalik Buterin: Thank you.