In Conversation with Mance Harmon (Full Interview)

Key Highlights

- Hashgraph is an alternative to blockchain

- Hashgraph optimizes both security and performance

- In lieu of being open-source, Hashgraph aims to bring stability to its platform

- Hedera Hashgraph’s cryptocurrency is called HBAR

- Fundraised $100M at a $6B valuation

- Hedera Hashgraph has proposed a new regulatory language

- Hedera Hashgraph will devote capital from the fundraise to grow enterprise sales and double down on regulatory

- The governing body for Hedera Hashgraph was designed to be distributed and representative of all constituencies from a global perspective

- Hedera Hashgraph is focused on enterprise solutions of distributed ledger technology (DLT) adoption

- Several large brands, including Nomura, Deutsche Telekom, Swisscom, and DLA Piper are already users of Hedera

- The market of players will consolidate over time to a handful of large players

Hedera Hashgraph will continue to start with enterprise applications in an effort to become the leader in that space within distributed ledger technology

With a great deal of focus on blockchain, one would imagine that cryptocurrencies cannot be built without this platform. The question that we need to begin asking ourselves, however, is what if there is an alternative?

Hedera Hashgraph’s CEO and co-founder Mance Harmon explains how developers have a choice when selecting DLT in that Hashgraph is the only platform that can both maximize level of security as well as performance. Because Hashgraph does not use proof-of-work for distributed consensus, cryptocurrencies that choose Hashgraph over blockchain have an edge- tens of thousands of transactions can be processed per second, which Harmon argues, will soon compete with major credit cards in transaction speeds.

Hashgraph is also unique in that although its platform is open for review, it isn’t open source. Harmon argues that an open-source platform encourages instability, because like Bitcoin, anyone could easily veer off and build their own applications using the public network. Though in theory this does not seem all that bad given its democratic nature, large or even mid-sized businesses would have no incentive to adopt the platform due to the instability open-source may cause. In short, open-source prevents mainstream adoption.

Harmon believes that Hashgraph and HBAR can coexist with other cryptocurrencies and platforms, but he foresees a far more centralized future in the cryptospace. Though a multitude of crypto-currencies currently exist, he believes that as the market matures, there will only be a handful of platforms, similar to that of the major credit card companies of today. Time can only tell whether or not Hashgraph will be one of those platforms.

Listen to the full podcast version of this interview

Full Transcript

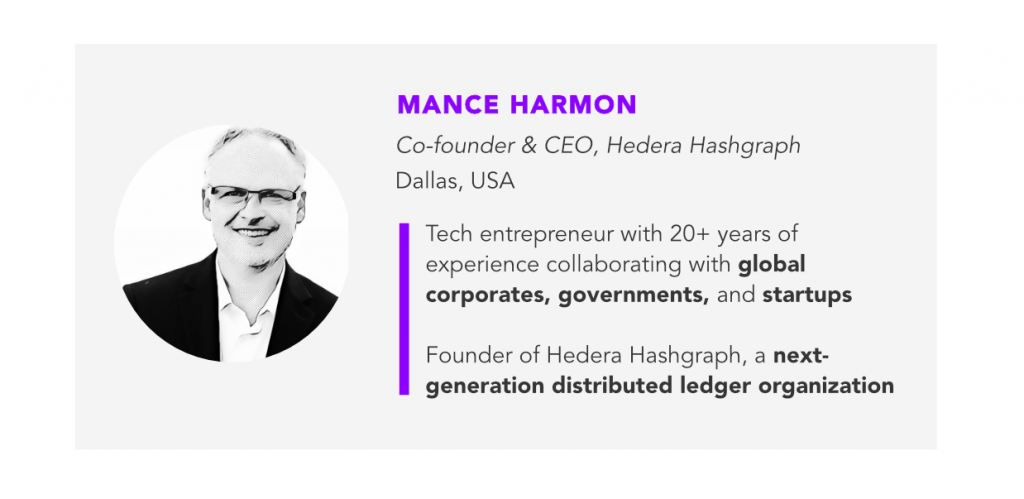

In conversation with Mance Harmon, Co-Founder and CEO of Hadera Hashgraph, and also a course director for cyber security at US Air Force Academy. He’s also a Program Director for the Missile Defense Agency. Twenty years of strategic thinking as a technology executive in this space — really seeing the evolution of technology as it applies today. And here we are in the Pioneer days would you say, of blockchain, but now Hashgraph, which is not blockchain. Explain.

Correct. So, Hashgraph is an alternative to blockchain. It solves the same category of problems that blockchain solves. But it does so in a far more efficient and secure way, so the performance of Hashgraph is fantastic. Better by orders-and-orders of magnitude than blockchain. And the security of Hashgraph actually achieves the theoretical limit of what can be achieved in the whole category of distributed consensus.

And that’s really the value of Hashgraph. The value of Hashgraph is that it both maximizes the level of security while maximizing performance, and that’s unique in the industry. Everything else in the industry, there’s been this trade-off between performance and security. Public DLTs, better security, worst performance. Permission DLTs, better performance, worse security. Hashgraph maximizes both.

And for those who are watching from the mainstream side, the global audience who’s groaning, right now because they’re thinking I just learned about blockchain now I have to learn about a completely different thing, Hashgraph. Isn’t that something that we see in social media language, but you’re talking about something that is really an evolution as part of this technology evolution that we’re seeing.

Yeah, well, the whole category was sort of created by blockchain. Ten years ago, Bitcoin was introduced to the world. And that is just a next evolution of database technology.

Databases have been around for decades. The assumption has always been, there’s one company running all the databases for the company. Google would never assume or presume to give Apple or Tencent, or you name it, a copy of their database and let them run it for them.

What was demonstrated with Bitcoin is that for the first time, we could have copies of the database being given away to different parties that maybe are mutually competitive, maybe they’re unknown to each other. But you could do so and do it securely in a way that wasn’t previously possible. And so it’s really an evolution of database technology. But if you think about the current performance of Bitcoin for example, and think of it in terms of a database…

In terms of the consensus cycle?

Exactly. It can only process about seven transactions per second globally. That’s a pretty slow database. There’s not that many things you can do with the database that can only process seven transactions per second.

What Hashgraph makes possible for the first time in a public network, like Bitcoin, is the ability to process tens of thousands of transactions per second. With our beta release coming this summer, and after we’re fully optimized, we’re expecting 100,000 transactions per second. So, that’s a game changer.

It’s a game changer internally in the industry. But when you’re asking Visa, Master Card, and American Express, and they make transactions of north of million per second, how does that equate in terms of practicality and utility?

Yeah, it’s interesting you would think that that’s the case. It turns out that their systems on average collectively are processing somewhere between 50 and 60,000 transactions per second. And so it’s actually possible now, with public DLT in Hashgraph, to build a system that processes as many if not more transactions per second as the large credit card networks can process. And it clears or finalizes those transactions in the same amount of time, within a few seconds.

Where with Bitcoin, if I go in and want to pay for a coffee from Starbucks with Bitcoin, the merchant that’s receiving my coin can’t be sure that that coin isn’t going to disappear for an hour. It takes about an hour for them to know that that coin is going to be there permanently. Well, that’s a problem as well. And with Hashgraph, we can provide that certainty within just a few seconds.

So, the Hashgraph, this public DLT that we’re building, absolutely could process the same volume of transactions that the current credit card networks can process.

But Hashgraph in of itself is patented…

Hashgraph is an algorithm, correct. The IP for Hashgraph is privately owned. But it’s … we’re using the patent in order to solve a fundamental problem with existing networks. And the entire community of public distributed ledger technology platforms are all open source, they’re not proprietary, everything is open source. While that’s been good for innovation, it’s also created chaos in a certain way that has prevented mainstream adoption by big enterprise or even medium-sized businesses.

And it’s because everyone knows that these networks like Bitcoin are going to ultimately split into competing networks with competing cryptocurrencies and that represents risk to any business manager considering building an application on one of these public networks. So we’re using the IP of Hashgraph to bring stability to a platform that no other open-source platform can achieve.

We’re running the project just like it’s open source in the sense that our source code, the actual code itself, will be published and fully transparent. Anybody that wants to look at it, will be able to do so. And review it and see exactly what we’ve written, every line of code.

But to code with it and to develop products. They have to pay you.

No, no. So the public network doesn’t require a license. So we have transparency, but no license is required to use the network. It’s just like Ethereum. Developers will build applications or DAAPs, distributed applications, that use the services of the network. And when they do so, they pay for those services using the cryptocurrency of the platform at the time that they use the services. It’s micro-payments at the time, the services are used. We’re exactly the same.

So, the developer community can build applications on top of us. And as long as they are paying for the services using the cryptocurrency, like the other platforms do, they don’t even have to tell us who they are. They can do it in total anonymity and they just use platforms.

And the cryptocurrency is called HBAR?

Correct. It’s called HBAR and that’s the major difference. So we’re solving a fundamental problem in that, we’re bringing stability to the DLT market that doesn’t otherwise exist. And also concurrently solving performance and security.

But it does sound very suspiciously like the same as everybody else, except … so if you’re going to conduct yourself like open-source and public to a community, why not just make everything open-source?

The fact that it’s not open-source means that we can prevent the community from leaving and creating a competitive network. And that’s the fundamental problem if you … you’ve got all of these platforms have a governing body.

If it’s the case that the governing body can’t enforce the rules or regulations that they pass. Then that’s weak governance and in fact it’s no governance at all. There are suggestions by the governing body, but if there is a group of the population, that becomes disgruntled then there’s nothing to prevent them from just leaving, forking…

Diluting value…

Absolutely. Creating chaos and preventing the trust in the network needed for mainstream adoption, because of the chaos that would result. So our governing body actually has a tool that makes it possible to bring stability. And that is our IP and the fact that it’s not open source. They can actually pass rules or regulations.

And determine what the product road map is going to be and set rates that are going to be paid to those that participate in the network and fees for the use of the network and all of those things. And they have the authority to enforce them, and so, it’s strong governance in a market that doesn’t have strong governance otherwise.

Well, it’s very exciting in the space. You raised 100 million dollars on a 6 billion dollar valuation. What are you doing with 100 million dollars? How are you thinking about capital deployment?

Oh, so we’re very conservative. Number one, when the money came in – and some of it came in and cryptocurrency – much of it came in and fiat. The moment it came in, we converted it to fiat.

US dollars?

Absolutely. And all of that went into the bank. And because we sort of expected crypto-winter, we knew that was going to happen. And so from the beginning, we converted everything into fiat. We now have that.

We put together a budget to give you some sense of how we approach this. We put together a budget that allows us to scale the company, but with some really draconian assumptions. Specifically, if there was no revenue, zero revenue with very modest assumptions, we have enough runway to go for many years. And so we know we’re going to get through crypto-winter, number one. And then number two, we’re actually going to market by creating a line of business solutions for businesses that have real problems and need real solutions.

Maybe they don’t even care that if cryptocurrency or blockchain or Hashgraph is under the hood, all they know is that there’s a problem that they want solved. And they’re willing to write a check to have somebody solve that.

We are going to market by helping them along with global system integrators to solve those problems. And so, we’re staffing up. We’re staffing up the team that does that the team that does the business development for Enterprise Software Sales. We also are giving a lot of emphasis to the regulatory concerns and our legal team. One of the very first people that I hired when we started this company 18 months ago now, was my general counsel, Natalie Furman. She’s fantastic. And, we knew from the very beginning that we wanted to approach this market in a different way than most do. And so we’ve given a lot of emphasis to making sure that we’re engaging with the regulators, from day one and…

All of them? Which one, in the US?

Well we started in the US for sure. We’ve had many conversations with the appropriate government organizations in the United States they are…

Are they frustrating conversations?

Not at all, not at all the … I think the regulators absolutely want to do the right thing. And they’re looking for help and understanding what the right thing is. And so we have an approach, we have a strategy, we have a model for how companies like us should go to market in a regulatory compliant way, we’ve proposed the model to the regulators.

What’s that model?

So, we view it as sort of a bridge that crosses a chasm from the point where the money you’re raising is clearly in a security instrument, to the point … once you’ve crossed the bridge there now are tokens in the market that clearly, are not securities and the trick is understanding what activities need to occur when you’re crossing the bridge. And so we are now on the bridge…

And the fiduciary responsibilities that you have to the people who are investing in you in the first place.

Absolutely, that’s part of it. And so you have all those concerns. But there does come this, I won’t say a moment in time, because there is no magic bright red line prior to which everything is a security post everything is a utility token or a currency or not a security, it’s more like a process and you can see evidence of the conversion over time based on the activities that are being performed by the company in the reception by the community and the use of the platform for what it’s intended purpose is…

So really defining a new regulatory language?

We’ve actually proposed a new language. That’s right. We proposed a new language, and the reception has been good. It’s a clear dialogue and nothing negative has been said. And I view that as a really strong positive.

Sometimes negative can be also helpful because you know how you’re being challenged. The dangerous one, they don’t tell you, and they say, “No.”

Well, we clearly ask questions that … So let me say it this way: they want to help.

I think they literally want to help. And they’re not there to penalize or punish organizations that clearly are not wanting to commit fraud. And so when they understand that it’s a legitimate organization that is legitimately seeking a cooperation between the company and the government to achieve the well-being and good for the consumers, they receive that well.

Liquidity and market. When you’re talking about regulators liquidity is great marketplace is access, right? And then, governments that depend on the good will of people to support the politics or the direction, whether you’re talking about the US or even China. You’re going to Shanghai?

We are, we’re going to Shanghai. On this particular trip, we started in Tokyo, had great meetings there across the spectrum of different kinds of potential partners or customers or government bodies. Same thing is true here, while we’re here in Hong Kong…

Is it different here? Is it different in Asia?

You know, it’s interesting. And when we’re talking about the regulators, the way in which they’re viewing the market and how they’re trying to make decisions about what is a security and what is not a security, those are different. The litmus test of what is or is not is different based on the historical law that is in place in a given jurisdiction. Those influence the way the regulators view the world and we’ve seen that. So we understand that that’s different. When it comes to the partners or the companies, they all want the same thing, and that’s easy, right? When we come to enterprise software sales and trying to solve real world use cases, using this new category of technology that’s the same process, no matter where we go.

China though, is in a very interesting space, I think that with the US trade wars and you take a look at the underlying economy that really props up the strength of the political structure there, the feeling, the sentiment of blockchain and certainly cryptocurrency in forms of capital control is certainly not as robust or trusting of this new technology. Are you feeling that?

Well, it’s directly impacted us. So, our governing body was specifically designed to be the most distributed or representative of all constituencies in the market on a global basis.

And what that looks like ultimately is a council of 39 global blue-chip organizations that are representative of 18 sectors of the market and geo-distributed and term-limited. So, they’re not members of the council forever, they can serve up to…

Like the United Nations of Hashgraph.

Right, that’s right. Of Hashgraph. And we have representation from many markets today. And we did talk to some potential council members in China. But it’s not possible at this moment in time for those organizations … or at least there’s enough concern about regulatory, the regulatory situation with the Chinese government and their participation in the governance of a cryptocurrency at all has prevented us from having the kind of relationships there that maybe we’re going to have everywhere else. So, there’s been a direct impact. I don’t expect it to last forever.

It’s of course a black box. It remains to be seen what actually evolves over time. But I’m hopeful that as the market matures and the new category matures in lots of different ways that regulators will become more amenable to participation on the part of Chinese firms and something that’s global, like this.

I had a similar conversation the other day with some Hong Kong legislators. And really taking the view of Hong Kong potentially, and it was the first time I really heard it. That it is, of course, part of China, one country, two systems. It is the famous adage. But potentially the scene in Hong Kong as it pertains to technology, and start up and blockchain is this a testing ground for potentially the future of policy in China?

I’ve heard people say that. That’s part of why we’re here. We would welcome the participation of council members from Hong Kong and you know, that’s sort of the hub, if you will, of the Greater Bay Area, and maybe a representation or entry way into Mainland China. Ultimately who knows? But what we want is representation from all major jurisdictions or geographies. And until we can achieve that in a way that satisfies all constituencies and regulators etc, then we’ll do the best that we can.

What’s the road map for you? Testnet, Mainnet, what do we expect to see?

So, we have finished the first round of the community testing. The Mainnet has been live since August.We’re in the process now of preparing for the second round of community testing. At that point, we will open up a network to up to a 100,000 users in the first round, we allow 5000 users, we’ll continue to harden the platform and we expect the platform to go live this summer, there are already more than 300 companies developing products on our test networks. We would expect them to launch roughly the same time or shortly thereafter, but really that’s just a starting point. You know that, that’s a major milestone, no question, but it’s the starting point. Our focus is enterprise, we are the enterprise grade distributed ledger.

It solves the problems that prevent enterprise adoption of public DLT. And what that means is that we approach the market in the same way that software companies approach enterprise software.

And we’re engaging enterprises and precisely the same way. It’s also the case that our council members are each individually have tens of billions of market cap and the best brands in the market, and they’re all going to be users.

Tell me some of the brands and the blue chip companies.

Yeah, the first five that we announced, and we just announced them a few weeks ago:

- Number one was Nomura. Of course, out of Tokyo, global financial services organization and bank

- Number two, Deutsche Telekom, the largest teleco in Europe

- Number three was Swisscom, blockchain, their blockchain division of Swisscom, another major teleco in Europe

- Number four was DLA Piper. They are one of the top global law firms. And I was very glad that they joined us. Just the fact that a global law firm felt comfortable enough to participate on a governing council like this I think says a lot about our company and the way we’ve approached this. That a global law firm feels comfortable enough to participate in it

- And number five is magazine Luiza, which is maybe unknown to most of the world. But they are the primary, or the leading online retailer in Latin American then, so Central and South America

So those were the first five. The next five will be announced in three or four weeks, something along those lines. And we’ll continue announcing these out through the end of the year until we’ve achieved the full 39. And I think there’s another, one more point that I think is worth making.

These are not marketing agreements with these council members. This is a corporation, it’s a, Hedera Hashgraph is an LLC. And until a few weeks ago, there was one member which was Swirled, the holder of the IP. Now there are six members. And there will be 39 members. And there is a board of managers and I report to that board of managers. They have control if they want to fire me. I have given them permission to do so. I’ve literally given the company away to this governing council.

So it’s like nothing else in the market. It’s an enterprise DLT platform governed by real enterprises that are going to use it, and their leaders in their respective industries and this is how we lead the entire market, to adopt this new category of technology.

Is it incremental change but of seismic proportions?

Well, I think Hashgraph is not incremental, as an algorithm. I think Hashgraph is a fundamental advance in the state of the art. No question.

Can you co-exist with Ethereum and Bitcoin?

We certainly can co-exist. The question is a matter of focus. We’re focused on enterprise. We care about the developer community and we will support and continue to support the startup community and the developer community. But we care about the enterprise. And if we can get enterprise grade first, then the entire world and the rest of the developer community simply benefits from that, right?

And so, in the long term, it remains to be seen what will happen. I think that there will not be 100 different cryptocurrencies or platforms out there. I expect the market to narrow over time in the same way that they are sort of a handful of credit card companies in the world. There will be just a handful of global public DLTs that get used. And we’re clearly focused on a piece of this, and no one else is.

It’s a brave new world and I’m sitting with one of the pioneers in this space. It’s not blockchain, it’s Hashgraph, Hedera Hashgraph, is such a pleasure.

Thank you so much.

Recap

Part I: Mance Harmon on Why Hashgraph is a Better Alternative to Blockchain

Part II: The Advantages of Not Being Open Source

Part III: How Hedera Hashgraph Will Spend $100M

Part IV: How the U.S.-China Trade War Impacted Hashgraph

Part V: When Will We See Real-World Solutions?

Part VI: Can Hashgraph Co-Exist With Other Blockchain Players?

Full Interview: In Conversation with Mance Harmon