In Conversation with Joseph Lubin, Founder of ConsenSys: Blockchain is a Paradigm Shift for the Planet

What is the next big thing? As far as Joseph Lubin, Founder of Consensys, is concerned, we are already experiencing it as you read this. Lubin shares how blockchain is already a killer app, being used globally as a new database technology. He notes cryptocurrency is already enabling cross-border transactions that help facilitate trade and raise money. But how does Lubin respond to questions about governance? In this exclusive one-on-one interview at the OECD Global Blockchain Policy Forum in Paris, Forkast.News Editor-in-Chief Angie Lau talks with Lubin about the challenges that blockchain faces still, including scalability – a solution that Lubin hints we could be seeing soon from Ethereum.

Key Highlights

- ”Technologists are drawn to the technology because they notice deficiencies in how legacy systems are constructed. And they’re very focused on building better systems for consumers, building better systems for economic, social and political systems around the planet.”

- “Even with all the complications around ICOs which raise billions of dollars for small projects and essentially democratizing the raising of money and democratizing access to investing in projects, even with all of that we’ve seen different forms… there’s still lots of utility tokens that are being sold. You just have to do it with care, with legal advice.”

- ”The SEC is “in a complicated situation where they need to apply securities law that has worked really well for the United States for decades. And they need to still foster innovation. They need to enable capital formation. And they don’t want to kill blockchain for America. But it’s a fine balance that they need to maintain.”

Listen to the podcast version

Full Transcript

Angie Lau: Welcome to

this special edition here in Paris — I’m Forkast.News Editor-in-Chief Angie

Lau. And we are here on the second day of the OECD Global Blockchain Policy

Forum, where thought leaders and government leaders and policymakers and

regulators from the highest levels are all converging here to discuss the

innovation called blockchain technology.

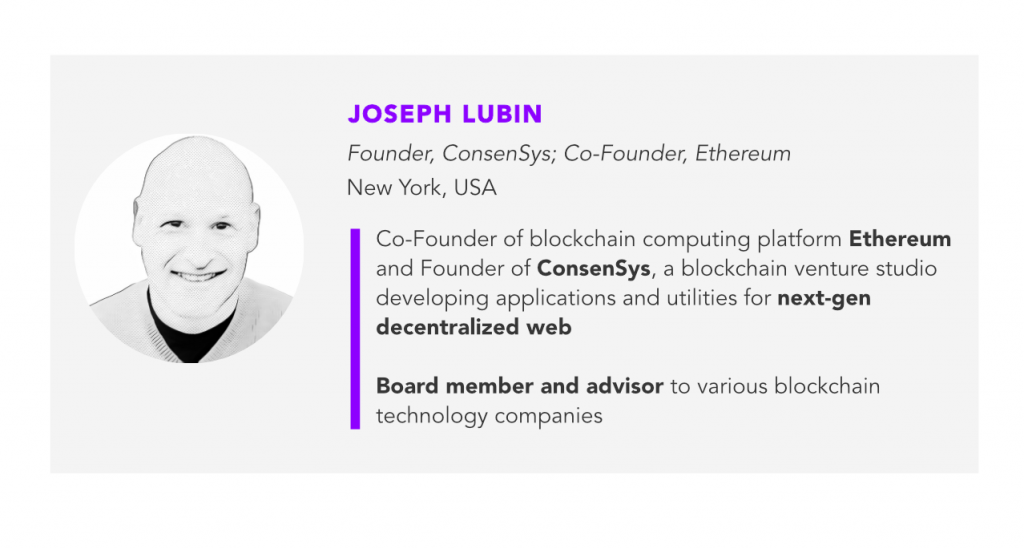

This is a conversation we were not even having more than 11 years ago. It’s 2019, and here we are today. And it is the core of the conversations. And Joe Lubin was onstage. He is Co-Founder of Ethereum and Founder of ConsenSys. And he is what some in the industry would call an O.G., certainly a pioneer in this space. Joe, welcome and thank you so much for joining us on Forkast.News.

Joseph Lubin: Pleasure

to be here.

Angie Lau: When we think about blockchain, it really for a lot of people, is this complex network of ledgers and technology and language that seems very confusing. But at the onset of it, when you first saw blockchain or heard about what was blockchain about, that piqued your interest?

Joseph Lubin: So first, technologically, blockchain is just a new kind of database. It’s a new kind of database that enables different actors using the system to trust, to be certain that what they think is happening on the system is actually happening on the system, and makes it very difficult if it’s sufficiently decentralized, for minorities, sets of actors to improperly manipulate the database.

Angie Lau: And so we’re talking about, essentially, trust being baked into the system.

Joseph Lubin: It’s

a radical innovation in the trust architecture for the planet. It brings us

from subjective centralized trust systems to automated and objective trust

systems.

Angie Lau: The way that currently in our legacy in

traditional social construct to achieve trust is like this. I meet you, we

talk, we see if we’re aligned in our interests. We kind of figure it out that

way and/or our networks talk to our other networks and we figure out whether or

not we can trust each other to do business.

Joseph Lubin: Or

subjective governance systems or subjective judicial systems. And so those

things work reasonably well in many places. They work less well in some other places.

Where they work well, they can be augmented and work much better. We have a

project called Open Law that enables us to build legally enforceable

blockchain-based agreements, and that will probably save people and

organizations enormous amounts of money in legal fees, essentially because the

agreements will be available in templates and you’ll be able to customize them.

We’re already using that in our business and you will likely have fewer

disputes and reduced the costs of legal fees by orders of magnitude.

Angie Lau: We’re really talking about efficiencies here

as we create efficiencies through blockchain technology. So one of the

conversations in the thread of many of the conversations that’s happening here,

in OECD is the role of regulators, the role of policymakers, and certainly the

role of governments as they take a look at this emerging technology in its pure

disruptive state and try to figure out where the guideposts are, where to put

the lanes, and how to create an environment in which innovation can thrive.

Is this, in your mind, a fundamentally adversarial

relationship or do you feel like this is more collaborative in nature as we sit

today?

Joseph Lubin: I

think it’s important to realize that the people, the technologists that created

and continue to build out the technology are makers and creators rather than

breakers. They’re drawn to the technology because they notice deficiencies in

how legacy systems are constructed. And they’re very focused on building better

systems for consumers, building better systems for economic, social and

political systems around the planet. And so I think the creators, the

technologists, are ultimately heavily aligned with the regulators that are

trying to keep the consumer safe and make sure our systems are working well.

So there is this innovation, this disruption, and it’s going

to be a massive change in how we architect systems on the planet, and so it’s

hard to understand how new ways of doing things will fit in certain rules. And

it’s hard right now to understand how they will enable the evolution of the

laws and regulations that we operate under. And so that’s going to be a

discussion probably years and possibly decades that different jurisdictions

have to have about how this technology maps into how they want their societies

to operate.

Angie Lau: Because technology is changing the rules.

Joseph Lubin: Sure,

always has.

Angie Lau: And it’s changing the rules of business as

well.

Joseph Lubin: Yeah,

absolutely.

Angie Lau: How is it changing the business logic of the

startup companies that you’ve invested in at ConsenSys? You’ve invested tens of

millions across projects that affect almost every industry. In terms of the

potential of the technology as you see it, how is it changing the business logic

fundamentally?

Joseph Lubin: Yes.

So the first thing to understand is that there is a new trust infrastructure

for the planet. It’s a baby trust system. It’s incipient, but it’s going to be

the foundational trust system for the planet. So automated objective trust,

once you have that sort of platform and you need a maximally decentralized

protocol architecture to get the trust characteristic…

Once you have that in place, you can have groups

collaborate, coordinate much better because they’re you’re trusting that no

minority set of actors can improperly manipulate the system. Once you have this

trust platform, you can have digital scarcity upon digital scarcity. You can

build digital money, cryptocurrencies, you can build other forms of digital

assets, whether they’re fungible like stocks and bonds or non-fungible, like

playing cards or some representation of bottles of wine or jewelry or real

estate.

Joseph Lubin: And so the foundational constructs of our society are moving into natively digital form. So we’ve been living analog lives for millennia. And for the last 60, 70 years, we’ve had some quasi digital representations of things that are naturally analog, like money, like identity. You know, I’ve got identity cards that index into some ledger that some government maintains.

So money assets, legal enforceable blockchain-based

agreements, securities, other kinds of financial instruments, they’re all now

just starting to get rendered in natively digital form. And that’s going to

squeeze all the delays and all the frictions out of our economy. Basically

every time we do a transaction touching on analog things like identity, like

money, like securities, the delays in clearing and settlement are pretty

enormous: in many cases, days, weeks, and months in some cases, like when

you’re selling a house or something like that.

And if you

can compact all of those transactions into the clearing and settlement into the

instance of the transaction, you can remove lots of the delays and frictions

from society. And so what we invest in is the development of the

infrastructure. We have this new trust foundation.

We have this decentralized finance or open finance revolution happening mostly on Ethereum right now, where we’re building the financial plumbing, the decentralized financial plumbing, lending, payments, other sorts of instruments, essentially in trustless form so that this financial plumbing layer will enable us to build out different verticals of the emerging decentralized economy.

Angie Lau: You’re one of the founders of Ethereum, it’s

based in Switzerland–

Joseph Lubin: It’s

based on planet Earth.

Angie Lau: It’s based on planet Earth. But a nod to the

environment that exists there. But, at the end of the day, technologists and

developers aren’t necessarily tied to any specific policy or any specific rules

and regulations. It’s almost like–

Joseph Lubin: Of

course they are. Technologists and developers have their own very strong set of

rules and procedures.

Angie Lau: Of course, but politically driven, trading,

agenda…

Joseph Lubin: Not

necessarily controlled by government, although it does operate within the

context of different governments. But yeah, there’s a lot of rigor in the

technology space, the space of developers.

Angie Lau: Well, the criticism has been about

governance. Where does governance come into play for protocols and technology?

Joseph Lubin: It

depends which one. Bitcoin would claim that it really has no governance and

that’s its strength. And that has led, in my opinion, to fairly slow

innovation. But Bitcoin is a currency. And so maybe slow innovation in a

currency makes a lot of sense. Ethereum has a crypto fuel, which some people

consider a cryptocurrency called Ether, which powers transactions on the

system, enables people to pay for storage of data.

But it isn’t a cryptocurrency. Ethereum is a platform for

decentralized applications, it’s a software platform. So it really needs to be

agile. It needs to evolve. And so it needs people figuring out what the next

important thing to do is and implementing that as quickly as possible.

Angie Lau: There’s no doubt that the price of ether is

fundamentally what drives the initiatives and the innovation that you’re

actually investing in at ConsenSys, that you’re investing in the projects.

Joseph Lubin: The price of ether is important for the security of the network. And it’s absolutely important to draw talent into our ecosystem. So that is true. You were talking about governance. I assume you mean of the Ethereum platform and other platforms?

Angie Lau: Yes.

Ethereum has really quite decentralized governance. It’s

an open source system. So anybody can inspect the code, anybody can fork the

code. Anybody can even fork the running system. If people disagree with how the

system is operating, with some of the principles of the system with respect to

immutability, for instance, if somebody has a different definition of how

immutable a system should be, they can fork the running protocol and

essentially two systems, nearly identical, go off in their own different

directions or they can fork the code base.

Joseph Lubin: And

so we always relied on that characteristic to keep the core team honest. So if

you know that people can just take your system and do something that they think

is better with it, then you’re going to try to form more ConsenSys in the

community around what it should be.

Angie Lau: That does get really murky and in the weeds

for a lot of people.

Joseph Lubin: Yeah

it’s complicated. There are many different classes of actors in the Ethereum

ecosystem and in blockchain ecosystems. We have the core developers, we have

companies with lots of developers, independent developers. Nobody pays them,

but they contribute anyway. We have exchanges, we have the miners or the

validators of the transactions, we have government regulators.

And so it’s a complex discussion but it’s still moving forward incredibly rapidly, even with this. In the computer world, Eric Raymond wrote a book called The Cathedral and the Bazaar. The cathedral is a sort of top-down, highly organized way of running software projects in the bazaar represents open source projects where people show up and they do what’s necessary at the right time. And that’s the way the Ethereum ecosystem works and it’s been working very well.

Angie Lau: At the end of the day, we are still looking

for that one mass adoption, that killer app, people still talking about what is

that proof of concept that will draw businesses and enterprises. And I think a

recent study at the World Economic Forum showed that 57 percent of businesses

that were surveyed are interested in applying blockchain innovation.

The one thing that holds a lot of people back is how do

we actually use it and ensure that it actually works for us. We talk about

efficiencies. We talk about creating and unleashing all of these fantastic

things as a result. But is it actually working? And what’s your assessment?

What’s working?

Joseph Lubin: It’s

working remarkably well. Instead of a killer app, let’s call the killer a

paradigm shift for the planet. We’re introducing a new trust infrastructure and

introducing a new open financial system for the planet. And so the first killer

app is blockchain. It’s being used everywhere, it’s a new database technology.

The second killer app was cryptocurrency. It’s making the lives of many people

in many countries much better. It’s enabling cross-border transactions. So it’s

a pretty sizable, thriving economy. Another killer app was the ability to raise

money. Mostly it happened on the Ethereum platform.

We’re working out the regulatory aspects of all of that, but even with all the complications around ICOs which raise billions of dollars for small projects and essentially democratizing the raising of money and democratizing access to investing in projects, even with all of that we’ve seen different forms. Essentially tokenized securities and there are still lots of utility tokens that are being sold. You just have to do it with care, with legal advice. And that market is still pretty enormous in terms of killer apps for consumers. We’re starting to see games really kick in.

So, I mean, on the Ethereum ecosystem and other ecosystems, games are probably going to be a pretty big breakthrough application. We have applications in the music space. We have applications in journalism. And so we really need to fix the main issues, which are scalability, privacy, confidentiality, and usability. And once those get handled, essentially this new decentralized worldwide web will be made use of by lots of people.

Angie Lau: Scalability is huge. Where are we in terms of

the runway, the roadmap, if you will, of scalability?

Joseph Lubin: The

Ethereum ecosystem is doing a really good job on that. We knew we were building

a sort of prototype system. We knew that we wouldn’t have much scalability with

Ethereum one, but we had to put it out there to prove that something like that

could be built because most didn’t believe that we could build it. And we also

needed to enable people to build decentralized applications and figure out what

it means to build a company around a decentralized application and to build all

this infrastructure.

So even the decentralized finance stuff, which is enormously

popular right now, it doesn’t need enormous scalability. You need small, smart

contracts. And it’s not a huge number of transactions per second to build out

all that infrastructure and to explore the solution space for decentralized

finance. With respect to actual transaction throughput per second, we have

layer 2 technologies that anchor into layer 1 so that if anything bad happens

on layer 2, you can pull your assets back to the safety of layer 1. They are

two technologies are enabling us to do tens of thousands of transactions per

second for different applications.

So whether it’s state channels type technology that enables point to point transactions off the blockchain that gets settled whenever necessary on the blockchain, or whether it’s blockchain systems themselves that have less rigorous consensus mechanisms so they can run at hundreds or thousands of transactions per second.

They anchor into Ethereum and they get essentially the full

trust characteristic. So that’s one thing that’s going on and that’s bringing

hundreds of thousands of decentralized transactions per second right now to

Ethereum. Games are bringing their own throughput. But Ethereum itself, the

base layer, is moving towards Ethereum 2.0.

So probably in Q1 of 2020, we’ll release one phase of a

three-phase rollout that will essentially link to, Ethereum 1 and enable us to

evolve Ethereum 1 slowly into Ethereum 2. So that will provide a little more

than a thousand times the throughput of Ethereum 1. And so if you essentially

multiply all the layer 2 stuff that’s going on by a thousand times, you’ve got

pretty good, headroom for the next few years.

Angie Lau: You could say that again. But you’re really

talking about the speed of innovation of this technology. And people are still

kind of stuck at that layer one scenario in terms of understanding. But we’re

catching people up. So when we take a look at, for example, the projects that

you’ve invested in ConsenSys, have you really almost theologically thought

about investing as you kind of shape and shift the architecture of Ethereum

from one to two and potentially three, four and so on and so forth? And how are

you doing that?

Joseph Lubin: Well, we invest in things that we believe work right now and we invest in things that we believe will progress the technology.

Angie Lau: Like what? In terms of the kind of projects?

Joseph Lubin: So

there’s one really big project that we’re investing in and helping token launch

and network launch that I can’t mention right now, it’s a very important

project for immediate scalability in the Ethereum ecosystem.

Angie Lau: Ok. And so you’re investing in that. And

tokenization, you talk about that. So in the backdrop of the conversation that

we had this morning here at OECD with regulators from the S.E.C. and the E.U.

and the like. And what you often talk about the need to acknowledge and work

with regulators and think about compliance. Are you doing that?

Joseph Lubin: Yeah. All over the place. So very much in the United States we had Valerie from the S.E.C. And so we’re very familiar with many people at the S.E.C. We’ve had voluntary conversations on many occasions, and I’m personally impressed with their understanding of the technology. And they’re in a complicated situation where they need to apply securities law that has worked really well for the United States for decades. And they need to still foster innovation.

They need to enable capital formation. And they don’t want

to kill blockchain for America. But it’s a fine balance that they need to

maintain. And I think they’ve done a pretty good job of adding clarity to the

situation. Uncertainty is the most damaging. I think we still need to move

forward with that. But essentially at ConsenSys and even at Ethereum, we

believe we had clarity, decent amount of clarity with the help of our legal

advisors and our own legal staff for doing utility token launches and tokenized

security launches.

So we believed that we understood what we could do all the

way through. And so far that’s panned out. But it’s expensive right now because

you really need to pay for opinions because it isn’t black and white yet.

Angie Lau: It’s not black and white. But you’re guiding

it forward. The next big thing, in your mind, that we can expect from Joe Lubin

and blockchain technology?

Joseph Lubin: More

of the same from Joe Lubin. We do so many things at ConsenSys. We’re rolling

out in our commerce and decentralized finance group, our Codefi group. We’re

rolling out a bunch of products. So those are going to be around payment

systems, around different kinds of financial instruments, around utility token

launches and tokenized security launches and network launches. I hope I didn’t

give too much away because you’ve got a bunch of announcements coming up. So

lots on that front.

And we continue to work at the application layer in

different industries and building out journalism systems and music systems and

advertising technology systems and health systems. And I have the most fun, I

think, when I work with the groups that are at the protocol level. We have

about 100 protocol engineers at ConsenSys and whether it’s building out

Ethereum 1, making it enterprise friendly as we have done a pretty good job of

at this point through the Enterprise Ethereum Alliance. And now we submitted

our code base to the Hyperledger Foundation.

So our Pantheon client, our Ethereum client which is a

Mainnet client and a private permission client, is now part of the Hyperledger

foundation. So it’s going to be exposed to all those people that didn’t have as

much access, permissioned access to Ethereum from their bosses, essentially.

The most fun I have is the Ethereum 2 stuff, I believe, just pushing out the

envelope on what we can do.

Angie Lau: Well, the thing about blockchain technology

in its purest form is really capturing the imagination of a lot of people and a

lot of industries. And there’s no doubt that the technologists are giving

everybody the tool to determine our collective futures. Joe, thanks for being

one of those architects. Thanks for this conversation today.

Joseph Lubin: Thank

you.

Angie Lau: Thanks for joining us.