WATCH: In Conversation with Emma Cui: Incubating Blockchain Startups Around the World

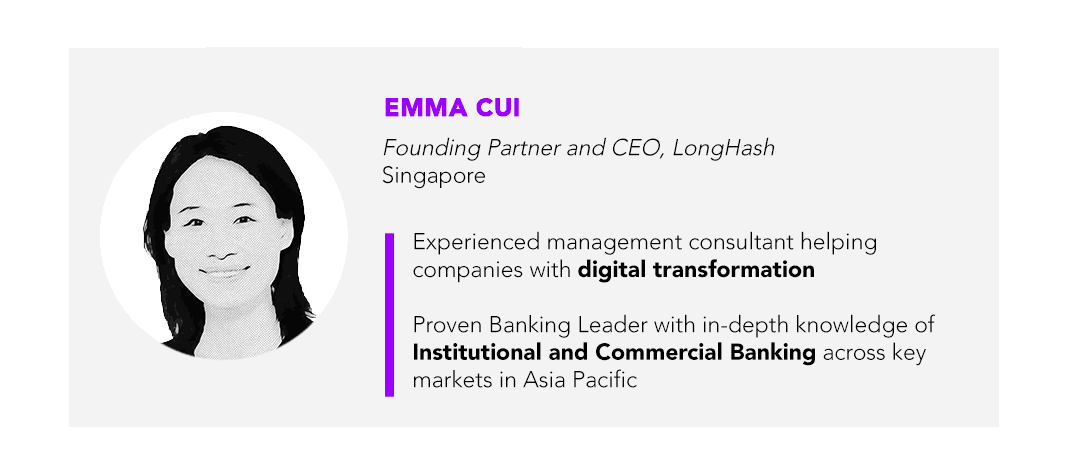

Blockchain-related startups have dealt with a fair share of challenges and skepticism, especially throughout a tumultuous year where volatility in cryptocurrencies has shaken people’s confidence in the industry. However, investment in blockchain projects has seen continued growth, and incubators like LongHash have sought to harness that potential. Forkast.News Editor-in-Chief Angie Lau sits down with Emma Cui, Founding Partner and CEO of LongHash to find out more.

Key Highlights

- As industry players and as an incubator who’s more or less in this neutral position, we do a lot of workshops. We do a lot of dialogues with the relevant regulators to facilitate discussion. And we also invest in technology that’s going to help them in terms of regulating, and understanding the industry.

- Our competitive advantage is really the Asia presence, our connections to Asia investors, our, I guess, familiarity of the regulatory landscape in Asia. So I think that’s where we’re playing. So even if it’s projects coming from Europe or coming from the U.S., they see so much interest in Asia when they come here. And that’s where our home base is.

- For industry standards among the incumbents, an open mindset will have to happen because so far most of the disruption happens more from a bottom-up way. And you can see payments is one of the most disrupted areas because that’s where startups have a chance.

Listen to the podcast version

As startups continue to emerge around the world, numerous incubators in Asia, backed by venture capital organizations have also seized the potential for innovation and profit in the nascent industry.

According to research group Diar, in 2018 “blockchain and crypto companies have raised nearly 3.9Bn through traditional VC – 280% more when compared to last year. The number of deals also nearly doubled from last year. And investors are not only writing more checks, they are also writing much larger checks.”

Although blockchain-related companies were uncommon in the past decade, in recent years there has been a surge in expectations regarding the technology and its potential use cases, despite turbulent cryptocurrency-related stigma.

An assessment from Deloitte’s 2019 Global Blockchain Survey reports that a number of industries have started acknowledging that blockchain is real, “and that it can serve as a pragmatic solution to business problems across industries and use cases. This is not some far-flung vision held by long-standing believers in the technology. Even leaders wary of tech-based solutions have come to see the larger, transformational importance of the technology.”

See related article: Balancing Innovation and Regulation in Blockchain: Ronald Tucker

Full Transcript

Angie Lau: Welcome to Forkast News, In Conversation With. I’m Editor-in-Chief Angie Lau and I’m sitting across from Emma Cui, she is with LongHash Incubator, coming from the very traditional markets of ANZ and McKinsey. And now all of the sudden you’re now in the crypto and blockchain space. So, how’s it going so far?

Emma Cui: Great, thanks for having me.

Angie Lau: We were just discussing before sitting down here this incredible space that we’re sharing here in Taipei. Asia Blockchain Summit, 2019. And a lot of interesting dialogue as to the potential of blockchain. And over at LongHash, Emma, you’re really seeing the value of blockchain projects, talent pool. You’ve got incubators in Hong Kong, in Tokyo, in…

Emma Cui: That’s right. Zug, Berlin, Hong Kong, Shanghai. So we have six offices across the globe.

Angie Lau: What are you seeing in those cities that is different than potentially cities in North America or in most of Europe?

Emma Cui: That’s an interesting question. The reason why we set up a multiple geographic network, is because we feel blockchain technology is a decentralized technology. There’s so much culture in this technology space such that everyone is used to open space, open source. Everyone’s used to collaborating no matter your geographical location or your culture or your religion. So that’s why we see of having a global presence where, say, for example, our Berlin office is very connected to the local developer community, which are known for some of the best projects in the space, such as Parity, such as Lisk, such as Iota I think is also based out of Berlin.

So that makes sure we keep a tab in terms of what’s happening. The developer world and then the Singapore office is where the east meets west. There’s lots of investors projects, governments coming through and ideas get exchanged. And that’s where we can bridge the gap, right? Bringing projects to meet investors, finding strategic partners. And then we’ll have a place in, say, Shanghai, where a lot of the big money are from and Tokyo, where a lot of enterprises are looking to adapt blockchain. So we’re really trying to leverage the strengths of each of these offices and trying to give a holistic offering to the projects we’re helping.

Angie Lau: You and I share the same DNA. We both come from traditional markets, you come from ANZ, and you also are ex-McKinsey. So really, you kind of saw the traditional markets, you saw how that functioned. And then you got into crypto and you got into blockchain. What was the impetus for you?

Emma Cui: The impetus. That’s a really good question. I got into blockchain, about two and a half years ago initially I came across ethereum and I was like, oh, wow, smart contract, imagining a world running on smart contracts. So I started digging deeper into that. And it was not so much in terms of the ICOs, the investment. It’s really because I was a corporate banker and I knew the pains of customers when it comes to trade financing. The whole industry hasn’t evolved for like 100 years, were still very documentations heavy, lots of fraud. And then I was a syndication loan banker for for a while. I also see, when you do a club deal, there’s so much back and forth exchanging information, documentations. And I just find it mind boggling.

And when I come across blockchain, I was like, wow, a lot of those business logic can be programmed into smart contracts. Imagine how efficient that would be? How much cost that would cut. So that’s kind of what drove me to blockchain from a technological potential perspective. But what’s more important, I think it’s the philosophy, because for the first time there is the technology that embodies–I think the Internet did that in the early 90s, 80s, 90s, when Tim Berners-Lee created this idea of world wide web that’s decentralized, that allows everyone to have easy access to information. And I think blockchain does the same because it has this notion of democratizing access to data, democratizing access to capital, and also potentially allows consumers, people, average people like you and me to kind of take back control of our data. So there’s a lot of promise in that.

Angie Lau: A lot of critics as well. We heard it onstage today with Nouriel Roubini really slamming the entire integrity of not only crypto, but the practical use of blockchain technology. Is he right?

Emma Cui: I think he’s neither right or wrong. In a way that is true. When the technology was first embraced by curious people, and those are not exactly mainstream people. And you look at some of the early adopters of cryptocurrencies, there’s the dark-web, there’s the Silk Road. And there’s also a lot of cyberpunks who were curious about this technology. And that’s not exactly coming from, you know, your Ivy League schools, multinational companies and stuff like that. So there is a lot of experimentation. And I think there are people who are taking advantage of the early stage of the industry.

And the same thing goes for the security industry. If we look back in the history of the securities industry, there were penny stocks before the whole security industry was becoming well developed to well-regulated and having global standards. There’s people who are taking advantage of that. But you cannot say the tool is bad. I think that’s why, to achieve mainstream adoption, you need a lot of infrastructure to fall in place. You need transparency. Then you need regulatory understanding of what they’re dealing with and come up with appropriate rules and regulations. You also need a general people who are using it to understand what this is for.

Angie Lau: So the question that regulators are asking right now is what is this for, and how do we safeguard regular retail investors and users, and really, how do we safeguard the mainstream? At the same time, for those of you who are innovating, who are investing in these blockchain projects, how are you dealing with almost that adversarial relationship? Some would say evolving into more collaboration. That’s certainly where it started. So how do you balance it?

Emma Cui: So for us, we actually have quite a bit of conversations. I’m based in Singapore, we’re very lucky to have very progressive regulators, although some people might say they’re still not as progressive as I would like them to be. But you know, they are regulators, at the end of the day they always tend to, of course, be on the side of caution. But I think, comparatively speaking, Singapore’s regulators are always having constant dialogue.

So the first rule of fintech sandbox, their overall payment service bill, what’s going to coming to action later this year, which will then have clear rules and regulations when it comes to service providers that are dealing with cryptocurrency. So I think this kind of dialogue is very important. And as industry players and as an incubator who’s more or less in this neutral position, we do a lot of workshops. We do a lot of dialogues with the relevant regulators to facilitate discussion. And we also invest in technology that’s going to help them in terms of regulating, and understanding the industry.

For example, one of the projects we invested in was doing KYC AML standards. So what they’re doing is they’re trying to combine the KYC AML standards technology within the traditional banking fiat world with what’s happening in the blockchain world. Now, the blockchain world is an emerging thing, right? There are no standards. Even regulators don’t have clear regulation. So we take this thing to regulators and say, hey, there’s these new tools that are potentially developing and maybe we can work out a way to help you guys understand how best to regulate this. Because the best way to regulate is actually to embrace and understand. So I think things like this is what we’re trying to do to help to shape standards and help to perhaps address some of the impediments along the way.

Angie Lau: So what inspired you to get into LongHash?

Emma Cui: I was already thinking about joining blockchain industry for a while. Even when I was working at McKinsey, you know, working seventy five hours a week, and still kind of trying to keep an eye in terms of what’s happening outside of McKinsey. And through common friends, I met the co-founders of LongHash and I was really kind of enchanted by the vision they have, because if you look at incubator businesses, to put it bluntly, the incubator business is not an easy business to make money in.

But I was really convinced by their vision to the ecosystem, to educate people, to invest and support early stage blockchain startups and to really ensure a flourishing of the ecosystem. So I feel coming from very much institutional background, this is the kind of comfort place I want to be in and also be exposed to what’s happening in this space.

Angie Lau: What are the projects? What’s your investment thesis? And just tell us some of the promises, some of the companies that were incubating.

Emma Cui: Happy to share. So right now we’ve got 10 portfolio companies. They are a mixture of infrastructure building projects and industry specific use cases. So infrastructure, meaning they can be solving for easy onboarding. One of the company called KLS that’s basically taking people’s biometric data, thumbprint or face scan, to turn it into a private key and distribute that private key to the distributed database to enhance the customer onboarding experience and also ensure the ownership of that data.

And another company called Unblock, that’s doing KYC AML combining the fiat world ways to crypto world. And it’s a highly talented team coming from the MIT media lab. They have advisers, professors who used to answer a Senate inquiry when it comes to, you know, dark-web money laundering. So there is a lot of experiences coming to this new space.

And also, we have a project called the Track.AI it’s a Singapore based project. They’re building a marketplace for renewable energy credit. So basically, renewable energy credit is needed by big companies such as Facebook, Apple who have huge data centers in order to remain carbon neutral. They need to buy renewable energy credits or carbon credits to stay carbon footprint neutral. But the traditional market, how it works today, it’s it’s a broker-only market and it’s when a REC is generated, there is no centralized registrar global standard per-se and there’s no reliable way to burn it. So people just make announcements in the newspaper saying I’ve burned it, virtually. But how do you ensure they’re not going to burn it five years later or somebody else is doing that?

Angie Lau: You need authentication, record of proof. You really need a trust-less, the system that blockchain promises. Do you find that the projects innovate faster or slower depending on their jurisdiction of base? For example, I asked you this question because there seems to be a flow of talent coming to Asia from the US. That’s very direct link that some would say to the tightening of the regulatory environment. Just take a look at Facebook Libra and the moratorium that immediately is asked and cast upon this project.

Emma Cui: Yeah, it’s definitely an interesting point, but I feel like the whole blockchain space, all the projects are very fluid in a way that they were organized in a decentralized way and they’re organized in a global way so the core team could be coming from five different [places]. They might have foundations in one location and subsidiaries in different locations, which makes it really hard for regulators, I empathize with that. But because of that, they are able to tap into talent like I mentioned, the US, in Berlin.

Angie Lau: Are you finding that U.S. talent in North American talent is coming to Asia specifically?

Emma Cui: Absolutely, but not necessarily migrating over. I think they see the attraction of Asia. So, for example, there’s a lot of investors and there’s the top three exchanges are all Chinese operated. And there’s just so much interest in this space. And also from a regulation perspective. There is some sort of regulation arbitrage, because different jurisdictions move in different paces.

Some are on the spectrum of being more open and some are on the spectrum of being more strict. And that kind of drives projects in a very fluid way. But I don’t think that’s a permanent thing because the whole regulation is evolving, landscape is evolving day by day. Even if the U.S. has the most, I guess perhaps stringent rules right now. But like it or not, Silicon Valley is still where most of a lot of the tech talents reside. And there’s so much VC money as well. So I think it’s an evolving thing.

Angie Lau: Are you competitive because you’re not in Silicon Valley or should you be in Silicon Valley?

Emma Cui: It’s definitely on the cards. But I think right now at the stations we [have], every office serves a purpose. And I think our competitive advantage is really the Asia presence, our connections to Asia investors, our, I guess, familiarity of the regulatory landscape in Asia. So I think that’s where we’re playing. So even if it’s projects coming from Europe or coming from the U.S., they see so much interest in Asia when they come here. And that’s where our home base is.

Angie Lau: Yeah, Asia is a fascinating home base. That is very true. There’s a lot of needs that companies need. How do you address those needs as an incubator? What are the demands and the needs of a project when they actually do come to you?

Emma Cui: I think that can be broken down into firstly, early stage funding. So not only us, we can potentially connect them to some of the investors that we’re closely connected to. So to offer our strategy for investors, one of them is called Embouchure Capital. They are one of the first blockchain folks, the VC is based out of Shanghai, invested in Ethereum. And since then, they’ve invested in, I think, more than a hundred blockchain projects, some of them including world’s leading projects.

Then the second one is HashKey Capital under the Wanxiang Group. I don’t know if you’ve come across it in Hong Kong, but Wanxiang is one of the largest auto parts manufacturer based out of China. And it has morphed into a conglomerate, a multi-billion conglomerate. So when projects come over, in addition to funding, we can also connect them with the partners we have in this base. Say, for example, the community managers, the marketing outlets, the potential ecosystem partners such as exchanges and wallets.

Angie Lau: Ultimately this entire industry and the success, including the work that you’re doing, including the work that a lot of the projects and the talent that is contributing to those projects depends on one thing and that’s mass adoption. Do you think we’ll ever get there? What do you feel we need to do? You need to do in order for mass adoption to happen?

Emma Cui: There’s three questions. I’ll break it down by one. I think “Would it happen? Mass adoption?” I’m a firm believer in that. I think, compared to two years ago when I first came across this industry. We have progressed so much and you have big companies like Facebook coming out and launching Libra. That’s a testimony by itself. And then the second question is what needs to happen? I think there’s multiple pieces, maybe three areas. Firstly, regulation needs to be more transparent.

Secondly, the technology itself, I think for certain use cases, there is suitable technology. But overall, the customer experience is just terrible even for me. I think who has been, you know, dealing with this whole thing. It’s not user friendly. So if one day my parents can use it like how today they use WeChat Pay, you know, you can give money to a beggar on the street in China through WeChat Pay. That’s where we made it. So there is so much improvement in that space that needs to happen.

And the third thing is, I think for industry standards among the incumbents, an open mindset will have to happen because so far most of the disruption happens more from a bottom up way. And you can see payments is one of the most disrupted areas because that’s where startups have a chance. But when you come to syndicated loans, when you can come to capital markets, you know that that’s that’s just kind of license players activities. Although ICOs kind of disrupted the capital raising, but it’s very much license and Big boy’s game, right? So then for people to kind of really see mass adoption, even the incumbents like I was talking about earlier, they need to look at this as a whole. They need to have had those and kind of especially some of the bigger players.

So, for example, like JP Morgan. People might not think JP Morgan coin is a real cryptocurrency, but JP Morgan has a great advantage because they are one of the largest USD clearing bank out there. So when they launched JP Morgan coin, they set the standards. And I think, like it or not, it helps with mass adoption. And I think the big players out there ought to take this kind of more progressive approach, because you can and you should set the standards, of course, you have on this on the spectrum, like smaller players probably wait to adopt and see because they don’t have that much capital to burn, that much sway in the industry, which is fair enough. And maybe that’s a different strategy they should take.

Angie Lau: Well, I’m going to borrow a phrase, you know, people once upon a time voted with their feet. And I think in this digital age, people have the opportunity to vote with their money and digital assets. And that’s a whole new ballgame. But it’s a game that’s not even in the first inning yet. So, it’s really great to speak with you Emma Cui.

Emma Cui: Thanks for having me. Great to be here.

Angie Lau: It is great to have you here. Thank you.