WATCH: How Cryptocurrencies are Becoming an Asset Class: Marc P. Bernegger, Crypto Finance

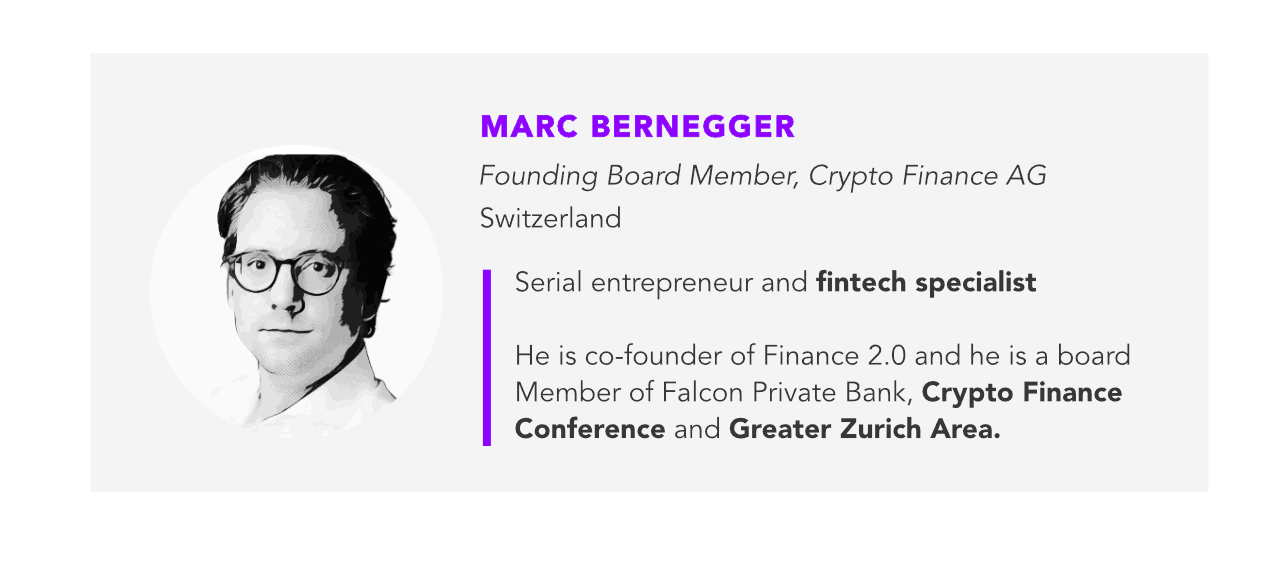

Cryptocurrencies have become a new target for investors shying away from politically volatile alternatives. As an on-going trade war between the United States and China and the U.K.’s exit from the European Union threatens the stability of conventional markets, more and more traditional investment entities have started experimenting with decentralized assets. Forkast.News’ Editor-in-Chief Angie Lau talks to Mark Bernegger, Founding Member of Crypto Finance AG to learn how the investment space is adapting to cryptocurrencies.

Key Highlights

- [Asia has a] far more tech-savvy environment [than Switzerland], I would say also future forward looking environment. So ultimately, I think in the long run, crypto assets in Asia, that’s the ultimate match.

- Definitely that we see far more adaption from the old world, really old traditional world moving into this space. I mean, as I said in the beginning, I think we’re not yet at the crucial tipping point. It’s still a niche industry. It’s still not everywhere perceived as a serious industry. So that needs some more time.

- The question is, is the existing system able to work through this crisis or is there potentially a new way to somehow get to the next step and and implement perhaps new technology based possibilities which somehow make the whole system more decentralized, which I think would be a huge added value for the whole financial world.

- That’s something you will see in the next crisis to traditional assets not controlled by traditional gatekeepers like central banks or traditional financial intermediaries. So some of the natural ingredients and key elements of crypto assets as a decentralized new asset class may make them quite appealing to diversify your existing portfolio.

Listen to the podcast version

“In a slowdown, since the global economy is so interconnected, there are only a limited number of assets that are isolated,” said Ampleforth CEO Evan Kuo, in an interview with Markets Insider.

Asset management platforms like Crypto Finance are designed to help investors manage their investments in cryptocurrencies and similar digital assets. They operate much like their traditional investment management counterparts, but with the added value of using blockchain’s distributed and immutability features.

Regardless of the volatility seen in cryptocurrency in the past few years, some investors prefer to take the risk, as it isn’t tied to other politicized markets.

See related article: Is the World Ready for a Federated Currency?

Kuo, whose company runs a digital ledger protocol, said that “There’s been almost 10 years of data to suggest that [bitcoin] has almost no risk exposure to precious metals, commodities, equities, currencies, and so on.”

However, a lack of regulation and global precedent also results in risks to early adopters, which is why Bernegger says that their unique selling point is that they have been approved by the Swiss Financial Market Supervisory Authority FINMA.

Full Transcript

Angie Lau: Welcome to the special edition in Switzerland. I’m Forkast News, Editor-in-Chief, Angie Lau. So what’s happening in the world of crypto and finance for institutional-grade clients? Well, it is a question that everyone seems to be asking, and it’s a question that a two and a half year old Zurich based firm called Crypto Finance seems to be answering. Now, this is the first asset manager authorized and licensed by FINMA and they’re expanding. With me right now is Mark Bernegger. He’s a member of the board here at Crypto Finance. Welcome.

Marc P. Bernegger: Hi. Nice to be here.

Angie Lau: It’s great to be here in Zurich. It’s beautiful weather, but it’s also very interesting what’s happening in terms of the blockchain and crypto space. And you saw this two and a half years ago. This is when Crypto Finance was founded. What did this firm see happening that others did not?

Marc P. Bernegger: Yea, I’ve been in the whole crypto space since 2012 and since then, quite a few things happened. And as you know, the Crypto Finance group, we were literally the first serious player in this game focusing on qualified and institutional investors. And quite a few things happened in the last two and a half years. But I think we’re still a little bit before the real tipping point in this space. But you have far more interest from serious parties all over the world, but especially here in Switzerland. And they really want to move into this space.

Angie Lau: What’s the value proposition in Crypto Finance? What you offering institutional players that they’re not getting, and that they want?

Marc P. Bernegger: Yeah, I mean, as I just mentioned, I mean, back in October 2018, we were the first fully regulated asset manager here in Switzerland offering crypto asset management. That’s definitely already one quite unique value proposition. Additionally, we also do storage for institutional clients and also brokerage services for hedge funds, other banks, other funds. So we are a little bit bridging the two worlds, the crazy crypto asset world and the traditional more boring traditional finance group.

Angie Lau: Well, I mean, when you talk about institutional grade clients, you’re talking about a liquidity pool that, you know, demands security, demands auditing, demands regulation. But it didn’t really exist previously. What is it that gives people, the institutional clients peace of mind if they’re going to be working with you?

Marc P. Bernegger: I mean, besides the regulation, which already shows that at least from a banking regulatory perspective, FINMA here in Switzerland, that we fulfill all the criteria to get this license, I think it’s mainly the team. I mean, we have roughly 40 people with sometimes more than 15 years experience in traditional banking. So from trading, asset management, private banking, investment banking, all kinds of areas from the traditional herd. Additionally, I mean, we have quite a strong shareholder base from also very well known and respected people here in the whole business world. And I mean, among others, also, the board gives some [seriousness] to the company.

Angie Lau: Who is on your board?

Marc P. Bernegger: Besides me, we have the founding chairman Tobias Reichmuth from the renewable energy space. We have Raymond J. Baer, honorary chairman from Bank Julius Baer, Philipp Cottier, also in the hedge fund space since ages. So a little bit a broad diversified space. Additionally, we have a professor, traditional lawyer. So we cover literally every space, every facet in this space.

Angie Lau: But one thing about the criticism surrounding cryptocurrency for a while now that the regulators try to address, and has really been becoming very specific about KYC and AML, how do you address those concerns?

Marc P. Bernegger: We have, if you become a client here, you have the same onboarding rules, like if you would open a Swiss bank account, well nowadays that’s quite messy, I would say, or it’s quite time-consuming. So, yes, ultimately sometimes we even get inquiries from people already having bank accounts and we have to reject them because we have more or strict rules than others. So I think in this regard, sometimes I have the feeling we are even too compliant. But that’s how it is nowadays, right?

Angie Lau: Why is it being compliant is how it is these days?

Marc P. Bernegger: I think, as you also know, I mean, this whole cryptocurrency space, it’s a little bit like in the Internet space. I founded my first Internet company in 1999, it’s always in the beginning you have some. Let’s call them shady creatures. Some people you don’t really know what they’re really doing. And that’s why it’s even more relevant that you have a fully compliant, fully regulated, serious set up to avoid to attract any of these shady creatures.

Angie Lau: And as we bring light to the industry, you know, and casting more light and transparency into the market, help me understand and help the audience understand how finance is shifting into this space. I mean, obviously, we’ve talked about, you know, portfolios and we always talk about the fundamental principle of diversification. Cryptocurrency is becoming an alternative asset class. How should people be thinking about it from an institutional and professional point of view? And has cryptocurrency reached that maturation point?

Marc P. Bernegger: Yeah, I would say I mean, it’s a good point. I also look at the whole cryptocurrency space as a new emerging asset class. We have a few of the most traditional and conservative families as clients at Crypto Finance group, and they don’t approach us because they want to speculate. They really look at cryptocurrencies, crypto assets as a new way to diversify their existing portfolio. They take perhaps at the beginning just one, two percent of their commodity or gold exposure and put it into these new crypto assets as a new diversification asset class non-correlated. That’s something you will see in the next crisis to traditional assets not controlled by traditional gatekeepers like central banks or traditional financial intermediaries. So some of the natural ingredients and key elements of crypto assets as a decentralized new asset class may make them quite appealing to diversify your existing portfolio.

Angie Lau: And help us understand the mindset that is evolving amongst some of the oldest European families in this region as they think about cryptocurrency. Was this something that they thought about last year or two years ago? Three years ago?

Marc P. Bernegger: Yeah, it’s quite mixed. I mean, interestingly, when you talk to families, even here in Europe, I mean, it’s not that long time ago where you had hyperinflation. Also here in Europe before the First World War, for example. So if you have inheritance from some family relations somehow involved in these happenings, you look at this whole existing system a little bit differently. When you go to South America, it’s perhaps the same as we speak. So that’s why I think especially when you have a broader long term perspective, some of the status quo elements we all think are given are perhaps a little bit. You know, you look at it from a different perspective.

Angie Lau: I mean, does it surprise you? You’ve been in the space since 2012. Bitcoin was born in 2008. This is a very, very young asset class. Does it surprise you even how this adoption is starting? Even amongst the most traditional families?

Marc P. Bernegger: Yeah, I think like with most technologies, you see some exponential curve, right? I mean, you have in the beginning only the geeks and nerds and the early adopters looking into it. I mean, the very early days, you had a lot of libertarian elements in it. There’s still existing, but perhaps a little bit more in the background. And then you reach certain tipping points and some elements when you read it in the press. That’s not always the most relevant indication, but at least every taxi driver heard about Bitcoin. But I think it’s far more relevant that it’s now really going into these these traditional circles where you have very conservative, smart people looking into it. As I said, not from a speculative perspective, but really more from a U.S. class perspective. And I think that’s happening as we speak.

Angie Lau: Bitcoin and cryptocurrency and this whole DLT world is really about decentralization. Do you think? And so therefore, this crypto finance team really could have been born anywhere. What what is the benefit? What is the environment in Switzerland that that allowed this firm and other firms like it in this entire ecosystem to really grow and develop? What is it about Switzerland?

Marc P. Bernegger: I think in general, I mean, we have by nature a decentralized system. I mean, our whole political system is somehow decentralized from day one, direct democracy. You have communities voting about small elements and then the state voting about bigger issues. And ultimately, it’s always the people who vote, so I think this element, this mindset is already in the DNA of all people here, and that perhaps laid the foundation of having some of the early Bitcoin core developers, who through the Ethereum foundation in these early crypto projects being based here in Switzerland, meaning crypto valley in and around Zug and Zurich. And I think that was the beginning. Nowadays, I mean, we have the endorsement of the government. I mean, already two years ago, a Swiss federal councilor announced the crypto nations, Switzerland, say it’s a group to finance conference. So it’s from the round to the top. People somehow have a connection to this new decentralized world. And I think that’s besides some regulatory advantages, a liberal mindset in general. One of the key elements that in Switzerland, we have a very crypto friendly environment.

Angie Lau: How important are these conversations that you have with regulators? How important is this collaboration and how direct is it?

Marc P. Bernegger: I think also from a regulatory perspective, I mean, ultimately, I would say that should be the approach of all regulators, they’re technology neutral, so they only have to somehow preserve the ecosystem and avoid any misbehaviors. So as long as you stick to these rules, it doesn’t matter if you have a DLT technology based solution or some more traditional approaches. And I mean, I can remember when we got this asset management license, at Crypto Finance group roughly two years ago, I mean, MAS from Singapore approached us and FINMA to understand how a, back then I think eleven month old company was able to get this license. So I think also regulators all over the world look into this space and somehow want to understand what could be ultimately also the benefit for the whole financial system, adapting these new rules and possibilities.

Angie Lau: Well, that’s that conversation is having at the regulatory level and certainly the international level. You mentioned Singapore. It is positioning itself as very blockchain friendly environment with some, you know, crypto friendly legislation, thinking about it from a monetary authority level. But still, they came to Switzerland to learn a little bit more about the regulatory space. Now you are heading over to Asia. Crypto Finance just announced that it’s expanding into Asia. Do you feel the environment there is ready for product and values? The value proposition that you’re offering up?

Marc P. Bernegger: Yeah, I think so. I mean, otherwise we wouldn’t have decided to move to specifically Hong Kong. I think it’s ultimately the deer desires and the demands are similar. Right. You also have a lot of wealthy people, families in Asia, and they also look into this newly emerging asset class. So from this perspective, I think there’s not a big difference. On the other side, I mean, you have far more tech-savvy environment, I would say also future forward looking environment. So ultimately, I think in the long run, crypto assets in Asia, that’s the ultimate match. So that’s why I think as a player in this field, we have to be present in this region. I mean, we start small, but I think the idea is to definitely have a far bigger presence in the mid to short term perspective and then ultimately fulfill and offer the same solutions we already do here to wealthy clients in Europe.

Angie Lau: It’s a very competitive market. There are certainly other firms who are offering the same slate of products. What differentiates you in that field? Why you and not somebody who is already in Hong Kong, already knows the ecosystem, already knows the families.

Marc P. Bernegger: That’s a good point. I think as it was also 20 years ago in the Internet space, at the moment, every competitor or every player doing something similar is ultimately helping the ecosystem. Right. I mean, the market is still tiny comparatively at least from my perspective, future outlook of this whole ecosystem. So that’s why I wouldn’t say that we’re competing against other players. I mean, ultimately, they are the ones doing similar. Stuff, but I think it’s more about creating this new world together, creating this new and building a serious entry into this new asset class. And we have quite a few quite close collaborators in Asia already. So I think ultimately at this stage it’s more about building up the whole ecosystem together.

Angie Lau: Truly, that DNA of decentralization and working together. You talk about outlook. What is the outlook for this industry in the next two to five years?

Marc P. Bernegger: Yeah. Nobody knows what it is. But I would say I mean, one part is definitely that we see far more adaption from the old world, really old traditional world moving into this space. I mean, as I said in the beginning, I think we’re not yet at the crucial tipping point. It’s still a niche industry. It’s still not everywhere perceived as a serious industry. So that needs some more time. I think we saw other asset classes going through the same cycles. We had this huge hype which burst it, which still is a reason why some of the players look at it as a not mature market yet. Additionally, I think we have a very unique, let’s call it that way situation in global financial markets at the moment. So I think it’s quite obvious that at least in the Western world view, not in a sustainable mood. We can’t continue like we do at the moment. So there is some inimitable change ahead of us. And the question is, is the existing system able to work through this crisis or is there potentially a new way to somehow get to the next step and implement perhaps new technology based possibilities which somehow make the whole system more decentralized, which I think would be a huge added value for the whole financial world.

Angie Lau: Because at the end of the day, it really is about, you know, when we talk about the global economy and social inequality and income gaps, potentially this could be a technology that evens the playing field a little bit more. But thank you for your insights certainly into what’s happening here in Switzerland. But I think at the end of the day, when they say that the serious money is here, that’s when people start paying attention. And certainly we’re paying attention.

Marc P. Bernegger: Yeah. Thank you, thanks a lot.

Angie Lau: Thank you, Mark. It’s good to meet you.