In Conversation with Charles Hoskinson (Full Interview)

Key Highlights

- Open-sourced platforms face bottlenecks

- In a truly decentralized community where there is no direction or leading voice, it can be difficult to gain consensus and make progress; establishing governance for a more disciplined and coordinated team can quicken decision-making and maintain quality

- Creating a bridge between centralized and open-source blockchain is a critical next step

- In Ethiopia, Cardano is training up a team of Haskell developers to work on supply chain pilot for coffee farming

- Cardano hopes to expand the model to many different government services like voting services, property registration, and business registration

- Cardano is both a cryptocurrency and a decentralized computing platform

- Cardano is often criticized for building its smart contract platform on Haskell, a programming language used mainly in academia in which programmers are difficult to find

- Hoskinson says Haskell is more precise and helps secure open-sourced blockchain to internet-based platforms

- Hoskinson says using open-source is a prerequisite to get governments and universities to adopt a system

- Blockchain allows the producer and the consumer to find each other, and interact as if Uber or Airbnb existed, but without these middlemen

Listen to the full podcast version of this interview

Full Transcript

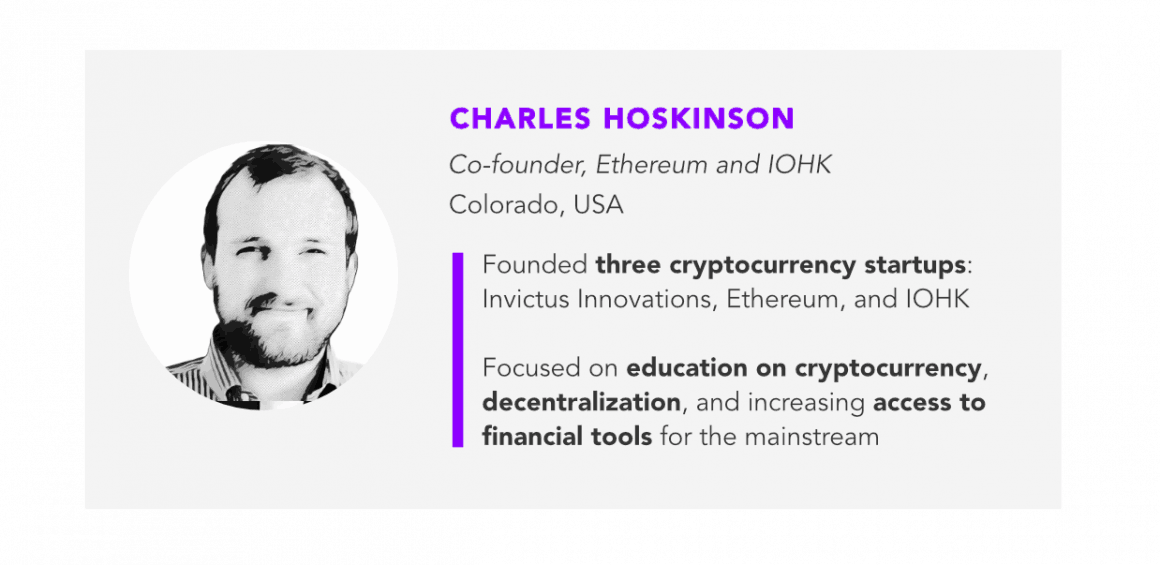

Founder of IOHK which gave us Cardano: He is a Colorado-based entrepreneur, he is a mathematician, and IOHK gave us Cardano, which is a platform that aims to be better, smarter, and faster than everybody else. How? 00:28

So, when I look at Cardano, I look at it kind of like a DARPA project. So, back in 2015, we said where would we like the space to go over the next five years and what’s required for us to reach scale, so let’s get to millions, to billions of users. What’s required for us to be interoperable with both legacy financial systems like credit cards and debit cards and banks and regulation, but as well as the new cryptocurrency space where we have thousands of blockchains and how do we become sustainable, meaning that we actually have a model to pay for things, not just at the ICO or you’re one or you’re two, but you’re five, you’re ten, you’re fifteen.

And we also have a governance model where we can actually decide where to take these protocols, because with their decentralized infrastructure, you don’t have a foundation or a committee, or some leader to say ‘well let’s update it this way or adopt this thing.’ If it’s truly decentralized, you need to have a completely different way of having people coordinate or work together.

So, that was very aspirational, a high level goal, so what we did was we put together one of the largest teams of scientists and engineers in the space, worked with many different universities, from people at Cambridge to Oxford to people at the University of Edinburgh, Tokyo Institute of Technology, University of Athens, we wrote more than forty papers, academic papers, twenty of which had gone through peer review at major venues like CCS and Crypto, and then we took those papers and extracted from them formal specifications, which then allowed us to actually implement the protocol with high assurance that it’s built correctly, so it’s a very unique project, it was kind of a high-risk high-return project, very aspirational, and for three and a half years we did lots of science, and last year and this year, we’ve been now rolling out a lot of those innovations, and all throughout 2019 we will be achieving great decentralization and smart contracts and 2020 we will achieve the scale that we think can get us to millions to billions of users.

Alright, well that is no small feat. What is the first real case that you can point to that says “ah, this is the first step, this is the genesis of how we get there?” 2:28

So I think what needs to happen is you need to create first a bridge between the permission blockchain space and the permission-less space. So, right now, we kind of have this bifurcation, so you look at projects like IBM Hyperledger Fabric, or like the Cadina, or RThree’s quarter project, and we saw, that’s for enterprises, that’s for governments, and those are for things like supply chains, voting systems, and property registration, and they’re federated or centralized, and while they use some of the DNA of blockchain technology, they’re definitely different because of the people who control those ledgers are kind of pre-decided and they don’t change too much, but then when you look at open systems like Bitcoin, and Ethereum, and Cardano, those systems, they have dynamic quorums, so they have people come and go, they have people who are running this thing a month ago can be completely different from the people today, and they’re meant to be as open as possible and no one is really in control of the destiny of that system.

Is there a bifurcation, or can there be a layering effect? 3:50

What we view as a company is that you can actually look at these rather like a spectrum, and you can link these two ecosystems together. One can serve as a big adoption curve for the other. Let’s give a very specific example: We have an Africa strategy for IOHK’s enterprise arm and by the end of this year we hope to be in 25 countries by the end of next year, all 52. But in Addis Ababa, right now we are training up a whole cohort of Haskell developers and that we are going to roll them over into a supply chain pilot for coffee farming.

Now, that’s going to be an enterprise blockchain solution. But, if we can get farmers into that setup, we now have digital wallets, we have digital identities, we have a way of actually talking to them, and we’ve now functionally banked them so we can then now connect that ledger to the Cardano system and then Cardano can be used for lending, remittances, for insurance, and you know, if you look at the numbers and scale of these things, just coffee farmers alone in Ethiopia, that’s a million and a half people.

If we create a national ID system for the country, that’s 106 million people, and then you start looking throughout many different government services like voting services, property registration, business registration, cumulatively, this is hundreds of millions to billions that you can get digital identities to wallets and addresses to and then suddenly, they can now use cryptocurrencies and you can use it at a very low cost way, very easy way for things that they want to do like lending.

It’s an incredible use case. But when you break it down to even just your choice of using Haskell as a programming language, famously very difficult to find these programmers, right? And so, how do we get to that kind of plethora of applications and ideas and projects when, you know, few people, few talents exist for this language? 4:52

Well, yes and no. So, we do get a little bit of criticism from time to time about using Haskell for the base layer of the system. But it’s like saying, well this surgical equipment is super difficult to use. Well yeah, of course…

When you break it down to even just your choice of using Haskell as a programming language, famously very difficult to find these programmers, right? And so, how do we get to that kind of plethora of applications and ideas and projects when, you know, few people, few talents exist for this language? 4:52

Well, yes and no. So, we do get a little bit of criticism from time to time about using Haskell for the base layer of the system. But it’s like saying, well this surgical equipment is super difficult to use. Well yeah, of course…

Haskell is basically built for high-assurance code. It’s built by very smart people, academics and high assurance engineers. So people in the financial industry like Standard Chartered and Barclays, people in Wall Street like DML, Digital Asset Holdings. And basically what it allows you to do is get a very high assurance that the code you implemented is correct. If you look at the history of the cryptocurrency space over the last ten years, we’re riddled with exchange failures due to poor code. We’re riddled with multi-sig failures where people are able to steal hundreds of millions of dollars. The Dow hack was the most famous hack in our industry — just because we had an intent of what we wanted to do, but the reality was the code didn’t match that intent.

So you need a programming language that gives you a much higher degree of certainty and a larger toolbox, and is much more precise. It’s like a scalpel that can allow you to very carefully implement things, so you know that it’s going to work correctly. Now that’s your base layer.

Then, when people build on top of that platform, you have to think about the whole ecosystem. The problem right now with smart contracts is some people are running around believing that we are just going to throw away the entire Internet, start over. Get rid of Amazon web services, get rid of Azure, and these platforms and do something entirely new. That’s very unrealistic and unreasonable. You’re still going to have the server-client model, you’re still going to have Android apps and iOS apps, and you’re still going to have Amazon. So what we need to do is say, the blockchain is a service layer and what it’s doing is it’s making your app better. It’s reducing the level of trust that you have, it’s guaranteeing that you still have access to it.

Like, let’s say an online game. What if the online game vendor goes out of business. Well, the game ends. What if you could guarantee the game would continue, even if the company went out of business? So these kind of things.

So you create more complex applications, and they have more dynamism to them and the blockchain is just providing services to them instead of trying to replace the traditional server model, client model. If that’s the case, then you could still use all your tools and all the things that you do for the normal server-client model. That’d be JavaScript or Java or C#, or however you write those applications. But then for that very particular very precise code, if you get it wrong, people lose money, people lose their privacy and they get hurt – that needs better tools and that needs very specific tools and every 10, 15 years, the industry goes through this one.

Steve Jobs launched iPhone. He didn’t say how do we stay interoperable with Windows, and how do we keep everything that Bill did? He built a completely new app model, understanding that there was going to be a little bit of a learning curve. But after they got through it, you could get a significantly better user experience.

Is that the goal of Cardano? Is that the goal of IOHK? 7:56

It’s basically to balance the needs with what we have in the past with what we need to do today. And to introduce smart contracts in a very pragmatic, reasonable way instead of trying to reinvent the Internet, throwing everything away. We’re trying to say let’s add some additional services to your standard server client model, so that you can reduce the amount of trust, increase your amount of privacy, and also to decentralize it so that you always have access to these types of infrastructures, if necessary.

There’s two messages that I’m hearing from you: incremental change with Haskell and really kind of formulating and using the code that really is the understructure of the JP Morgan’s and the Standard Chartered’s and all that, and the systemic change which you are doing at a country-wide level. Is one isolated from the other or do both have to work in concert with each other? 8:21

You have to look at trends to get a good strategy of how to get to market and get adoption and scale. So, one of the magic miracles of companies like Tesla is at the end of the day, they live and die by the quality of batteries — how fast they can charge, their energy density, the cost of the batteries, the weight of the batteries. So are they doing the research?

No. The research comes from your device and my device. All these big multinational companies, they want to give you an iPad that has the 24-hour battery life. They want to give you a cellphone that charges in 30 minutes. That same technology can then be backported into what Tesla is doing.

So similarly, if you look at where Africa is at, where Southeast Asia is at, where Latin America is at, you have these huge international mandates for fair trade, for sustainable farming, for tracking and traceability of products. And if they want to be global citizens, actually make money in the marketplace, they have to actually start adhering to these new standards.

We have to move from a paper-based, analog, person-to-person, oral economy to a digital economy. So, whether there’s blockchain or not, there’s IOHK or not, there’s many many billions of dollars and huge international pressure, for carbon reduction. All these things to get these countries back into a new framework that is understandable, so then what we can do is interject ourselves in the conversation, and say the money is there, the need is there, the demand is there, blockchain is actually a really good solution for your guys. And once we have that, then we can take these incremental things that we’ve done and wire them into these revolutionary things that we’ve done and both systems will work together and bring lots of users into the space.

The revolutionary comes from open-source. But increasingly, we’re seeing from the corporate world including JP Morgan, really applying blockchain technology internally within their own systems and it’s privatized. Is that a good direction for the industry? 10:17

I think overall, software is moving in the open-source direction. The last grand holdout was Microsoft. They had a CEO who said open source software is cancer. That was Steve Ballmer — and Bill Gates — they both thought that. Now they have Satya Nadella, and they’re using Linux, they have opensource.net. So the fact that a company that can be that hostile to that ethos is now moving so far in the other direction that they’re taking some of their core infrastructure and giving it to Apple…

And Azure is actually working a lot with…

Open-source software, yeah. And they have a blockchain as a service project. So as a consequence the trend is moving towards open-source. Now with that said, there are certainly plenty of people in our space who are patenting things. Hashgraph is patenting things, Algorand is, DML, Digital Asset Holding, excuse me, probably has some patents in their portfolio and a lot of cases they do this to get acquired or to work with larger companies because they can get a license deal.

But in our view, that violates the fundamental ethos of decentralization and being useful to everybody. So, we as a company don’t pursue patents, don’t pursue intellectual property. All software we write is under MIT license, and there are many other people in the space that also follow that ethos. In fact, the majority of the people are open-source. And at the end of the day, when we talk with governments and universities, usually this is a prerequisite for adopting a system. They don’t want to get locked into a particular standard, and be forced forever to license from one particular company. They’d much rather have an open-source foundation and know that if regimes change, facts and circumstances change, they have the freedom to fork and go in a different direction without my consent or some other person’s consent.

The regimes not only include industries, but it also includes nation-states, it also includes complete economic ecosystems in which we currently exist. Do you feel that if we do get to a point of mass adoption in which you’re working towards, that that’s going to be upended, that society, the fabric, and the economy that exists today is really going to shift dramatically because of blockchain? 12:25

I think the Internet is what is changing society. We think of it as an old technology, but we’re just now running an experimentation. If you look at human society, it’s many many thousands of years, right? The Internet has only been around for a little bit.

This concept of having instantaneous access to information, it fundamentally changes the structure of society. We used to build cities around libraries and palaces because that was where all the knowledge was and where all the smart people were. So now, all of the sudden, we now have a situation where somebody in the Namibian Desert can be just as well-informed as someone in Cambridge, Massachusetts at Harvard. There’s never been a time in human history where we’ve had that.

What is the social consequence for all this? People have an overwhelming amount of information and now they see counter-narratives to what the governments are saying, the religions are saying, the media is saying. And in some cases you have the fake news phenomenon, or conspiracy theories or siloing. Another case is you have people saying ‘wait a minute, these systems we’ve inherited from our fathers, from our grandfathers and their fathers, maybe aren’t well-suited for society today.”

Back in the 19th and 20th century, there’s a very famous picture when one of the monarchs in England died — all these kings of Europe showed up for his funeral, because he was related to most of the European royal families. And within just ten years of that picture being taken, almost all those kings had been deposed or de-powered as a consequence of World War I. So you have this social system of kings ruling Europe for a very long time, and then suddenly an inflection point is reached where almost all of them are removed and new governments are put in.

And I think the Internet is causing this globally speaking. It’s making us think less about our particular country and more about the world. It’s making us think more about collective global problems like global warming or systemic poverty or equal treatment of people and things that are happening in Nuba Mountains or Saudi wives are suddenly problems in New York or suddenly are problems in London, and that’s the first time in human history.

Knowledge though is one thing, access to a greater world in understanding it is one thing, being able to participate in it and do something about it is completely different, and that’s where really blockchain changes the equation for a lot of people. 14:23

Right, because it gives you an economic voice. I was in Mongolia — I was in the outskirts of Mongolia — and I saw this camel herder come by. And we talked to him, and he has bitcoin. It just blew my mind. When I first entered the space, I signed up for a meetup group. There were two people who registered, myself and another person. The other didn’t show up, so I had a great conversation with myself about my love of bitcoin. And then just eight years later, I’m in Mongolia and a camel herder has bitcoin. So it really tells you that things change pretty quickly.

And what does that mean? It means he has an economic voice. It’s that person can now for the first time ever buy things and participate in a global economy and when that gets extended to voting, it gets extended to property rights, it gets extended to securitization in financial markets, that means that everybody in the world is now on the same playing field and this smallest person now has the same access that Bill Gates has.

So then what happens to central banks, what happens to banks? 15:22

They have to — instead of being middlemen of necessity, they have to become middlemen of value. There’s all these entities in society that provides a service, and we don’t really like them, but they’re there and we need them to get something done. It’s like the eBays, the Airbnbs, the Ubers. They’re there. They provide a lot of utility. They bring two sides of a market together, a producer and a consumer. But then what happens is that they get a monopoly, and as a consequence of that, they start to de-platform people, or screwing people on fees. They really sculpt a market in a way that really becomes unfair.

So, what our technology is doing is getting rid of these middle men of necessity. It’s allowing the producer and the consumer now to find each other and interact with each other as if Uber existed or Airbnb existed, or the other middleman existed, but instead of having that middleman taking value away from them, we no longer need them.

It’s almost an interesting analogy to blockchain platforms themselves that is there a winning platform or can many platforms exist because they serve different functions in the same way, is there a winning economic system or can there be multiple economic systems that work in concert with each other? 16:15

There’s never been a time in human history where we’ve ever universally agreed on everything. We’ve never had one god, or one language, or one government. People are diverse because facts and circumstances and resources and situations are diverse. Weather is diverse. I live in Colorado and we are going through a polar vortex right now and it’s pretty brutal. But it’s nice and warm out here. So given that the world is a very diverse place, reflections of that diversity will manifest themselves in political and economic systems. So we are going to have many blockchains and many different ways of handling money, some more decentralized some more centralized.

The point is: consumer choice and the freedom of movement is increasing. Instead of being locked into a system and forced to live in that system and endure the consequences of that system — like if you’re in Venezuela — you now have a way of insulating yourself a bit or voting with your digital fee and moving into a different system. So, in the not too distant future — instead of just having one currency, and say, if I live in America, I’m dollars, if I live in Europe, I’m euros — you can now actually have portfolio-based wealth with some gold, some silver, some stocks, some different currencies, and you can spend any one of them at any point of sale.

So, when you go to Starbucks, you’ll be able to just tap your phone, you pay them in gold. They got paid in dollars. They have no idea that you’ve paid them in gold, because that infrastructure is all there and nobody even knows that composition. You could be from Ukraine. You could be from South Korea. It doesn’t really matter. So, what does it mean? It means that the impact that central banks have upon your lifestyle and your quality of life diminishes, and if they’re going to be relevant, then they actually have to become middlemen of value. They add something to your life, they add something to the transaction, they add something to the economy. And if not, they become obsolete like the horse and buggy makers and the horse whip makers and the others that got pushed out by the cars, and society moves on and changes.

At the end of the day, we all are born, we all die, we need food, shelter, we need air, we need water. That essentially is what we are talking about. The technology changes our relationship with all of those things. At Cardano, you’re moving towards shaping that part of the future. What’s the roadmap for 2019? Everybody is waiting, excited, and anticipating what’s the roadmap for you? 18:23

The centralization and smart contracts are the two big lineups for 2019 and they’re going to consume a huge amount of time. We’ll probably get some degree of interoperability wired into our protocol during 2019 to be finished in 2020. And 2020 is all about scalability and governance. It’s basically getting us to the next level in terms of performance so we get to those millions and billions of users, giving us a governing system so that no custodians need to be around.

The system can kind of pay for its own needs and decide its own future, in which case I could disappear like Satoshi into the wind and the system will persist and service and grow and thrive. That’s the ultimate accomplishment I think for a protocol. That’s what we’re mostly focused on. And it’s just really exciting to say that we kept our principles and we endured Crypto-Winter. But we’re coming up the other side much stronger and better for it, I think.

So products, what products can we see? 19:42

So we’d like to see first a lot of infrastructure. So we have a partnership with Tangem. It’s a beautiful little hardware wallet that costs less than a dollar to make, and will only sell for only a few dollars. Tap it on your phone and you can use it just like a ledger device. We’ll probably try to get some ATM infrastructure and debit card infrastructure. Things like that will just make the acceptance of and payment of data and storage of data a lot easier. So that’s kind of one layer.

Then another collection of products towards verticals. So things I’m very interested in, digital identity, lending, and insurance. So we’d love to have some microfinance and microinsurance products on our platform and experiment with different things there.

And of course, inevitably people are going to go for high value applications, so we’ll probably see things like gaming and gambling on the platform that third parties create and other things along those verticals. And there will probably be a lot of hoarding and application, because at the end of the day, if you look at all the depths employed on EOs and ethereum, you know, they’re not really loyal to the platform nor should they be. It’d be crazy if you say, ‘Hey we’re Netflix, but we’re so loyal to Amazon, we are going to build our entire business model around Amazon.’

At the end of the day, it’s a service provider for their commercial vision. And if the fees get too high or the platform is not stable enough for them, maybe they go to Microsoft or maybe they go to RackSpace or a different vendor. Well similarly, if you’re running Golem or MakerDAO, or these other things, the theorem is not really working for your needs, then you’re going to go somewhere else. So we’re going to try to convince some people that it’s a good idea to port from ethereum and other applications.

How integral is Cardano, IOHK for Asia and how much does Asia support the Cardano vision? Japan and Korea, two of your main markets here. 21:13

We have a huge fan base in Japan, it’s pretty overwhelming. Some fans got together about two years ago and they got a bunch of people in panda costumes to run around Osaka. It was a surreal moment. I got a message from somebody saying why is there an army of panda men walking through Osaka with Cardano banners? I said I have no idea what you’re talking about. So when you see these things, you say ‘ok wow!”

But levity aside, what’s really exciting is we’re building kind of concepts right now, like how would you do supply-chain management for agriculture? If that works for coffee, it works for rice. If that works for rice, it works for any other agricultural good. Just, it has to be retuned. So plenty of places that we are going to try to innovate in Vietnam, and Cambodia, Malaysia, Indonesia.

In fact, Emurgo, one of our commercial partners, has already gotten a lot of infrastructure in these different areas, and they’re just waiting to basically be able to flip a switch and run along a pilot. And similarly, there’s a lot of rural places in rural Japan that have huge problems, you know it’s getting systematically older. The young people move to the larger cities, you have ghost towns all throughout large chunks of Japan, and so the government is trying to figure out, well, how do we solve these types of problems. So it would be cool to be in that conversation, see if we can revitalize some local economies and give them some new ways of doing things.

I mean, at the end of the day, it really depends on that device that lives in those people’s hands. You walk around the streets of Hong Kong, and nobody knows where they’re going, they’re just staring at their phones and walking into walls and walking into people. But really, this has changed the dynamic for people not only in Asia but around the world. And a lot of blockchain projects and products are taking a look at handheld devices as a way to engage with the consumer. HTC has come out with Exodus, as you know. There is word that Samsung might be interested in supporting Cardano. Can you talk about that a little bit? 22:41

We have nothing to comment on at the moment on the Samsung-Cardano relationship.

There is a relationship though? 23:26

Nothing to say about that, there is no official relationship. We are not in any discussions or negotiations with Samsung. We are very curious, though of how a person can get onto the S10. Samsung, for years has been building up a trusted computer platform within their phone called Samsung Knox, and mostly at the moment it’s used for enterprise-users to do things like digital identity management.

Well, if you could manage a digital identity in a trusted hardware module, you could also manage a public-private key pair for cryptocurrency in that same setup. So basically Samsung is extending those capabilities to cover that area, but it’s unclear how cryptocurrencies get onto the enclave. They’re not the only company that’s been exploring this. In fact, Stephen Sprague company’s Rivetz has been playing around with for well more than three or four years and they have a great stack of really sophisticated software to get into SIM cards and get into TPMs on many consumer devices. And they’ve been trying to actually work out a partnership on several large phone companies so that they can pre-deploy this software.

So Samsung is just one of many and we’ll see over a trend over the next three to five years probably universal coverage because these TPMs exist already built into the phones, so it’s repurposing them to now be able to store digital keys for cryptocurrency.

So basically I will be able to use whichever phone that I am using and it will serve as my crypto-wallet? 24:43

Yeah, because it’s just like when Bluetooth and NFC and other things came to the phone, these are fundamental capabilities and trusted computing has been built into the phones. If anything, it’s just for digital rights management, so you know you can store…

In the same way I would have credit cards on my phone, I have my wallet… 25:01

Yeah, so that’s coming in and Samsung doesn’t have a monopoly there, it’s going to be pretty ubiquitous I think over the next three to five years. So we’ll see what we can do to get onto the S10. That’d be great. But at the moment, it’s not publicly known how to do that. And they’ll probably make an announcement at some point because it is new to them. And you know the regulatory environment area is one that has ends and flows, they embrace, and they take a step back, so they have to be very careful and systematic with the way they do things. But they’ve been building a payments infrastructure for quite some time with Samsung Pay so, and Apple has…

But that is mass adoption, I mean just take a look at north of us right here in China, they have single-handedly transformed peer-to-peer on social networks in WeChat and really kind of taking over the FinTech space. 25:38

Right. So there is a lot of requirements about how do you bind an identity with these transactions — how much meta-data do you need to flow with these transactions? Do you need to pre-register to be able to accept payments? This is the hard part of it. It’s not the actual technology of moving value between Alice to Bob or one trusted enclave to another. It’s how do you fit this into a regulatory model that China is ok with, the United States is ok with, Korea is ok with. Because they’re all snowflakes, they’re all very different, they have their own needs.

But see, that goes back to the fundamental problem of when you allow a global community to be able to peer-to-peer with each other, what’s the need for borders, what’s the need for capital controls, what’s the need for central banks? 26:22

I agree with you completely. There really is not a lot of need for these guys, or at least in their current instantiation. But remember it takes time for governments to catch up with the emergence of technology. It wasn’t too long ago when we had laws in the United States that if you had a car, you’d have to have a person traveling in front of it with flags to alert people. And you couldn’t even sell things online until 1992 with the 1992 repeal of the NSFAUP. You know, so it’s preposterous to think e-commerce would be banned on a public network, but that wasn’t too long ago.

So it takes time for regulation to catch up with technology. But the trends are pretty clear that we’re becoming more global and things regardless if governments want to or not are trying to become more free. There are regressions. Like Russia recently passed a law you can’t criticize Putin and want to build their own internet and China obviously has their issues. But you don’t look at the particulars, you always look at the trends. And you look at the global environment day-by-day, month-by-month, year-by-year.

Things are moving towards more travel, more communication, more commercial flow on a global basis, and reduction of things like capital controls and restriction of the flow of information and value.

In terms of the technological trends that we’re moving from Proof-of-Work to Proof-of-Stake, how important is that evolution and is there a co-layering or a bifurcation: one or the other? 27:46

Right. Consensus protocols in a way are almost like religions more so than science. I mean, at the end of the day, you have a collection of things you want to do. You want to go from one state of the ledger to another state. So you have a basket of pending changes that you want to make, and I want to move value from Alice to Bob. I want to run this code. I want to verify that this proof is correct., so somebody has got to do that work. So first thing is who is going to do it? And the second thing is what is the most efficient way of doing it?

So there is a whole science to how to sort this out and at some point, the science ends and then the philosophy tradeoffs begin. Well is it ok to just have 21 people in control? Or do you want more knowing that if you add more, you’re probably going to slow the system down a little bit.

And then second, you have to think about other factors like, are you going to preserve everything forever? Bitcoin tends to save everything. But that’s not a sustainable model if you’re talking about global scale systems because eventually you’ll have blockchains that are in the exabytes – that’s either Google or the NSA that has it, you have to pick which one you want to get it from. So you need to have some notion that it’s sometimes ok to throw things away. And who gets to decide that? So these are the difficult questions that we’re running into and they’re much more philosophical than technological and we have solutions and answers for all of them. What Proof-of-Work does really well is it aggregates a lot of computational capability.

Now, if you do it smart, meaning you’re ASIC-resistant, this is general purpose computational capabilities or CPUs and GPUs. So these are things that can be used for machine learning and to folding proteins and solving complex problems so they’re socially useful. If you’re stupid, you have ASIC that can only do one thing, like compute some hash and that’s not really useful to anybody.

So the next generation of Proof-of-Work is moving into the direction of being useful in some way — either solving classes of complex problems, verifying a decentralized database so you can have a decentralized dropbox or whatever that may be.

Now in terms of Proof-of-Stake, this is all about efficiency. It’s saying do everything that Proof-of-Work can do for just running a system, and let’s do that with the least power consumption possible. Like for example with Cardano, one of our fan members came up with a way of getting Cardano to work on a rock pi board and it uses around six watts of power.

What is a rock pi board? 30:11

So it’s like a raspberry pie, it’s like an open-source piece of hardware. I’ll show you a picture of it in a bit, and basically this device can be purchased by anybody for less than 100 dollars. It’s an open-source design. It runs commodity hardware the same kinds of things that’s in your tablet, but just cheaper. And suddenly now I can run a global scale financial system with just a few hundred or a few thousand of these devices. And so less power consumption in a single home in the United States compared to a system that requires more power than the country of Ecuador.

So if it’s like apples to apples where you’re just looking at power consumption and nothing else, Proof-of-Stake is just unbelievably better in every respect. It’s more decentralized. Our system is about 100 times more decentralized once it gets fully decentralized, whereas bitcoin is fifty times anything else, transaction throughput is about thirty times faster than bitcoin and about twelve times faster latency. So transactions sell a lot faster in our system.

But setting that aside, what Proof-of-Work really does is it gives you lots of computation. And if you do it smart, then you’re actually talking about different systems now. One’s a world computer that you could tap into and use it as a marketplace to go and do stuff for you. And the other one is a kind of special purpose computer just to make sure that your financial system is working, to prove transactions. And I think both of them will coexist if that’s the case. If they’re just replicating the same thing, then there’s no reason to use Proof-of-Work because of Proof-of-Stake is so much better.

It really boils down to why those fans, fan members, ran around Japan in panda suits. Were they fans of the technology or are they fans of the potential for Cardano, the potential of this really philosophical vision of where we should be going? 31:36

I think a lot of them are fans of the philosophical component of Cardano. That we have an obligation to make the world a better place. And right now, whether we like it or not, whether we want to participate in it or not, we are re-writing the DNA of the world governance system. So all the systems, how we vote, how we own property, how we pay taxes, how we move money around, what is money, what is wealth, how to pay people, they’re just being re-written.

And this happens every few decades to few hundred years. Sometimes as a consequence of a global conflict, sometimes as a result of a plague, you know like when the Black Death came, people said well if the Pope can die, then maybe the Catholic Church isn’t so all-knowing and all-powerful, right?

So, maybe we should change society a little bit. And it led to the reformation. So when these major events happen, the DNA of the world and how it’s running gets changed. What we realized is we have a chance – a small window of time – to build a very fair system for the people who have the least. People who can’t get credit, people who can’t build up wealth. When a monsoon comes, they lose everything and they starve to death. Suddenly, they can have a financial system equivalent in capabilities to the system that Bill Gates has.

First time in human history this has ever been the case. And this system is not owned by someone. There is no cult of personality. There’s no great Steve Jobs coming to the stage holding something. This is just as much theirs, as it is mine, as it is yours. And if we get it right, it’s something that is going to be around for the next century or two, if not longer.

2008 gave us bitcoin. We stared into the abyss as a global system taking a look at capital markets in where we all have to bet on our children’s future to pay off debts of yesterday. Do you think that we learned the lessons of 2008 that gave us bitcoin? Do you think that event is yet to come? 33:17

No we haven’t. If you look at every metric from bank centralization to regulatory policy. Look at national debts. You look at how we handled the bailouts — the fact that there were no consequences for the people that caused these things, globally speaking. I don’t think the world economy on the legacy side learned a lesson. They just doubled down, they kicked the can down the road and the next crisis will even be worse. This is why bitcoin exists. If you cannot in an existing system get a recovery from a mistake, then the only option you have is to build a parallel system that is better, and that’s what we’re doing.

Do you think that system is ready for the next event that’s coming? 34:21

No, I really don’t. I mean 23 trillion of debt in the United States. A lot of derivatives are still toxic, floating around the global economy. It’s unbelievable amounts of dangerous stuff there, and we’re just one major global crisis away to knocking all of these nation-states into a big problem. We have a real-estate bubble in China that they’re trying to hide. You know this trade war is really starting to expose that and their markets are not stable. US markets aren’t stable. None of the markets are stable. They’re just being propped up by massive amounts of new money that’s being printed, and we’re kicking the can down the road for a large collapse. And this is nothing new.

We saw this in the Great Depression. We saw this all throughout the 19th century, and so forth. It just is an invitation to change the way the world economic system works. The other thing is we have a lot of innovation coming that is going to create structural unemployment at very high rates, especially in the service economy. When robotics come and artificial intelligence comes, it’s going to wipe out a good 10, 20 percent of the low-class economies that people make under 30 under 40 thousand dollars. All the truck drivers are inevitably going to lose their jobs, or it’s going to consolidate down to 10, 20 percent.

One of the big misnomers is somehow all the manufacturing jobs in America disappeared. It’s not like we made less in America than we made in 1980. In fact, we make as much or more. The difference is that instead of needing a manufacturing plant with 5000 people, we can run the same operation with 500 people. So we’ve permanently lost 4500 jobs due to an increase in technology. So when these trends occur, and you get 10, 20 percent of your economy now unemployed or unemployable, and you combine it with this huge amount of debt which we eventually have to pay, and the inflation is going to cause the money, it’s a death spiral and it’s something that is going to really hurt a lot of governments.

Is blockchain a partial antidote to that? 36:18

Just think about the insanity of our space where we say, hey, there’s this anonymous money, some guy, hacker on the Internet, nobody knows who he is, and there’s like these computers somewhere, you don’t know where they’re at, mint these coins and would you like to buy that?

I mean 2009, we tried that and people said, “Oh, this is insane.” Now it’s like, yes, I want bitcoin! Everybody wants it, so the very fact bitcoin got adopted on a global scale and it made sense to people tells you that there’s definitely concern at the base level for the health and vibrancy of the world economy. You don’t go and buy gold, and you don’t go and buy land, and you don’t go and diversify outside of national assets, accepting that you don’t get a good return on these things if you’re super happy or super confident in your economic system.

People are worried because politicians aren’t accountable on a global basis, certainly not in the United States. There is no political solution. I can’t fire Nancy Pelosi or Donald Trump – they’re in, and even if they get replaced, the next person to replace them seems to be categorically worse. And people aren’t listening or talking to each other, and so as a consequence of that, people are taking their own lives into their own hands and say look, I’m just going to move into bitcoin and kind of move into cryptocurrencies, I’m going to move into gold.

If we see year-by-year more and more people are doing that and if millions and eventually billions of people leave the legacy system and go into the new system, then the new system becomes the legacy system, and that inflection point will inevitably occur at some point. If it takes a global financial crisis to push us into that, or it’s just an organic movement like the option of the Internet, in either case, I think the merit is on our side. Because at the end of the day, money wants to be free, people want to be free, people want to be in control of their own financial future, and if you tell them know you can’t do that or you have to stay in a system that can turn into Venezuela or Zimbabwe and by the way enjoy 20 percent unemployment rates, they’ll never get better.

There’s going to be a revolution, people just can’t tolerate that. That’s what causes social unrest. So, I like to be productive. I like peace. And I think giving people a class of technology that lets them socially work their way out of this tunnel without violence and without revolution, and without hard times, these are much better alternatives to just riding the legacy system until it burns to the ground and enduring the consequence of that. That’s what leads to food lines, rise to communism, totalitarianism and so forth.

Recap

Part I: Charles Hoskinson, Co-Founder of Ethereum / IOHK, on Why Cardano is a Better Platform

Part II: Launching a Blockchain-Powered Coffee Supply Chain Project in Africa with Cardano

Part III: Of All the Programming Languages in the World, Why Haskell?

Part IV: Revolution or Evolution? The Philosophy of Blockchain with Charles Hoskinson, Co-Founder of Ethereum and IOHK

Part V: From Africa to Asia, What does Global Growth Look Like for Cardano?

Full Interview: In Conversation with Charles Hoskinson