WATCH: Can Taiwan Be Silicon Valley Without the Price Tag? Jason Hsu, Taiwan Congressman, is Optimistic

Taiwan faces an existential threat. It is a nation that is dependent on exports, but like other developed nations, recognizes that in order to survive, it needs to champion high-technology industries as labor-intensive industries leave for nations with cheaper workforces like Vietnam or China. Could blockchain and cryptocurrency be part of the answer?

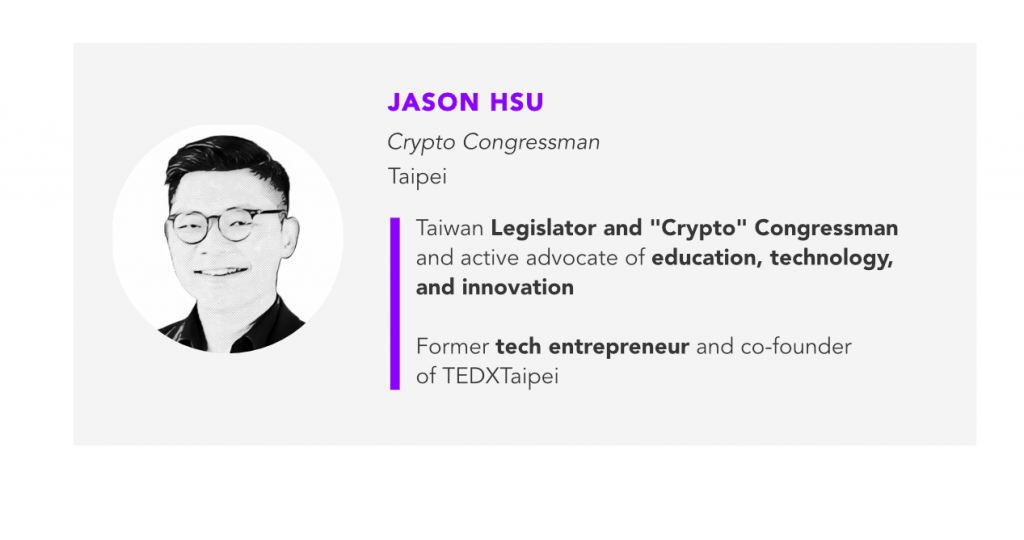

Jason Hsu is known in Taiwan as the Crypto Congressman (yes, check his business card, it is officially his title). He sees blockchain and cryptocurrency as an opportunity for this small island nation to become a technology force that can drive innovation — incubate projects in Taiwan, and position the 23-million person nation globally.

Hsu believes China gave Taiwan that opportunity the day it banned ICOs on September 4, 2017. Question is, how will Taiwan position itself to seize it? Editor-in-Chief Angie Lau sits down in this candid conversation with Congressman Jason Hsu in Taipei.

Listen to the podcast version

Full Transcript

I’m Editor-in-Chief of Forkast.News, Angie Lau. I am sitting next to Congressman Jason Hsu, aka the Crypto Congressman. You actually had to get approval from the Speaker of the House in Taiwan to put that on your business card.

Exactly, so this is no chill in it, this is a real deal, and I do need to get approval from the speaker to print that as my mandate, to promote cryptocurrency and Blockchain from Taiwan to the world.

Now, Taiwan has a very interesting economy. It is a very export-driven, export-dependent, but in the past couple of years, it has winged. Where do you see crypto and Blockchain filling in the vacuum of innovation and growth for Taiwan?

Yeah, I think we are at the point in history where we are going through some transformative change, especially for an economy like Taiwan, which is export-driven. Now it is all about digital economy, it is about intellectual property and for Blockchain and crypto, really it is an opportunity for Taiwan to reposition herself and particularly in the area of the digital assets and the FinTech and with ways that we can empower young people to start up their own project. In this place, we used to raise a ton of money for the hardware businesses, and this is the time for young people to really demonstrate their talents and then create something on Blockchain that can promote to the world and then raise money from the world.

It is almost as if Taiwan in the past couple of years and really decades have taken the role of creating the hardware, that drives the innovation. So the mobile phone, with HTC and then you have semi-conductor industry and yet these are two pieces of hardware that the value has been created somewhere else and it’s left Taiwan. Why has that happened? And how can you fix it?

Yeah, I think we sort of missed the boom of the Internet and obviously, I think there has to do with the market size and the ability to scale. But I think I got into this space on September 4, 2017 when China banned ICO. And I remember it vividly that they got out of calls from my friends in China wanting to move their companies to Taiwan, and I realized this is a golden opportunity for Taiwan to attract global projects. And with the nature of the decentralized ledger technology you can actually operate anywhere in the world and you can have an impact anywhere in the world.

What has happened since then, September 4th?

Yeah, so first of all, I asked our government to take a light-touch approach on this industry. And then I moved to create progressive legislations and also set up industry association, and as well self-regulatory body to work with the government to come up with regulations and compliance. I think in this industry, regulations and compliance are very key in order for the industry to really head to the right path and right track. I think what I want Taiwan to become is to become a regulatory innovative space that is very rare in the world. How do we lead from the standpoint of regulation, that is that we have to create space for innovation to take roots here.

You need space, you also need liquidity, and recently, financial supervisory committee FSC, which is the regulatory body here in Taiwan came out with guidance for STOs. It got a lot of criticism on the market because it capped the ability for any project to 1 million dollars US. As an entrepreneur, you know that’s not enough.

Yeah, I was a tech entrepreneur and obviously I was very vocally critical of these guidelines. I felt that it is very conservative, and I think it projected a lot of concern that we are still trying to protect the establishment, but I think right now, what I’m gathering is, there are 60 days of a common period, so I’m collecting everyone’s feedback and next week, I’m hosting a hearing, a public hearing for the industry to come and provide feedback to the FSC, so hopefully over time they will modify the guidelines.

Is there an opportunity within those 60 days that the FSC can bump that cap up to 4,5, 6 million?

I think the cap is probably difficult to move, but I want them to change one thing to begin with, that is to open the investment to global investors and open for retail investors. Right now, it is only in restricted to Taiwan investors with professional assets, which is up to 1 million US dollars, and it is only restricted to single platform trading, all of this does not really register well with the nature of this industry. So these are things that we wanted to push first, and the cap if regular regulators have worry, have concerned, we can keep that to begin with, but first of all we want global participation.

The political climate is interesting in Taiwan. You are up for re-election next year. How much of this Crypto Congressman, the tech-driven, the entrepreneur side of you that really resonates with your electorate?

Certainly, I’m gaining a lot of traction from the community, from my constituency, people who believe that tech is really important for this country, and I think what I want to do is to really rally and mobilize the young generation and to really own today and tomorrow.

Is the talent there here in Taiwan to be able to contribute tech talent to blockchain projects?

Absolutely, I think if you compare the engineering talent and the cost to hire an engineer, a qualifying engineer here versus silicon valley, I think we hire as qualified if not better engineers here with a cheaper cost and also build the same quality of the products and services.

What about adaptability of cryptocurrency, the legality of cryptocurrency?

Yeah, I think that has always been an issue I think anywhere you go in the world, and there has been a lot of calling for the jurisdictional collaborations.

How does Taiwan feel about it?

I think we want to be ahead of it. We want to take a leadership position in defining the regulation in the space. For example, I proposed and amended the Anti-Money Laundering law and to regulate the virtual assets, and we actually had a FATF on June 22nd, came up with the rulings to regulate all the virtual asset service providers. Taiwan can actually hold this space by bringing the best practices and also come up with the set of definitions and rules that are friendly and progressive for everyone to follow.

How progressive can Taiwan be if it is still very much in its nature, very conservative, very risk-averse?

Well, I think one day, if you elect a crypto president, then you will see we will go full throttle for this. But I think it is all about future generations, it is not about trying to claim the entitlement and it’s trying to provide opportunities for younger generations.

Let me ask you this, how easy is it for a blockchain project in Taiwan to get a bank account?

Good question, I am happy to say that after the FSC announcements, banks are now more proactive, opening bank accounts. So I would use this opportunity to share with the audience that if you wanna open a bank account in Taiwan doing crypto and Blockchain business, our doors are open. And I also created a law in our company Act, you are able to register cryptocurrency service businesses in Taiwan, under the Ministry of Economic Affairs.

What does that mean?

It means that you now have a legitimacy, and you are now properly and officially recognized by the government as a legit business.

As a legitimate business in Taiwan. Are Blockchain projects taking advantage of that right now, are you attracting projects to Taiwan?

I think right now the issues are still on the user case, I think we are seeing the lack of participation from the ministry in enterprises and I think what I want to see is more participation from banks, from big enterprises like Foxconn and it was really harnessing Taiwan’s strength on manufacturing, on smart cities, on IOT, on AI, and medical, all these kind of things. If we can convince or show and demonstrate people that Blockchain is really changing our lives and people can feel the impact, and I think that is when we really make the change.

Do you think that Taiwan could also act as proof of concept in real life in those enterprise solutions in people’s daily lives as kind of an incubator for a lot of these projects?

Exactly, I think right now we are rolling out with our national digital ID project, which we will combine the social security data, healthcare data and other sorts of data sets, onto a Blockchain protocol, which would allow the government to use it, and for opportunities for business and other things.

But it will still be centralized with the government, it is not truly decentralized.

Good question, I think we are trying to understand this issue on whether or not we can build it on a truly decentralize the protocol.

What value do you think there will be on building with truly decentralized protocol?

Well, I think obviously the announce of Libra has raised eyebrows, particularly on how it is being governed and whether the governance mechanism is fair and I think in this day and age, I think we need to build it a project or have some sort of proof from the government level, on a national level that this Blockchain thing can work. If the government can take actions to address this for example, issuing national digital currency, Taiwan’s foreign reserve has one of the worlds largest foreign reserve. If we can take a portion of that and issue digital currency on trade finance to use it, implement it on the trade and supply chain finance, and I think that would be very, very helpful.

Ultimately, in your view, how do you rank Taiwan globally when it comes to the regulatory environment for Blockchain and crypto? Where do you want it to go?

I think as of today, we are flexible, I think our government is flexible, and we are open for soliciting feedback from everyone, particularly on the global community. We know that we cannot stand alone in this world, and so I would say I would like to see more projects being implemented here and show it to the world that this can work, and using Taiwan as a lap and using Taiwan a regulatory sandbox, and that you experiment here, and you scale up globally.

Sounds like a promise, we will see what happens. Thank you so much for sharing your vision and your thoughts about where Blockchain can be for Taiwan.

Yeah, thank you so much.

Alright, thanks Jason.

Read Related Articles

Innovation vs Conservatism: Taiwan’s Big Blockchain Conundrum

WATCH: The Status of Blockchain in Asia, From “China Internet Report” Author, Edith Yeung