Switzerland is a blockchain haven, but government lags behind, says Trust Square CEO

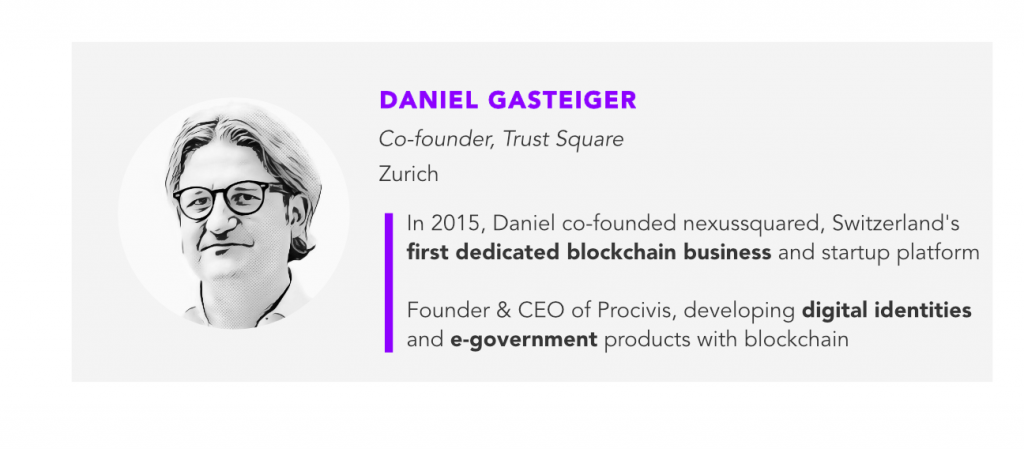

Although Switzerland’s Crypto Valley may seek to become a global blockchain hub, its government is too slow to adopt the technology even as Facebook’s Libra incorporates in the country, according to Trust Square cofounder Daniel Gasteiger.

Switzerland’s Crypto Valley may seek to become a global blockchain hub, but the country’s government is too slow to adopt the technology even as Facebook’s Libra incorporates in the country, according to Trust Square co-founder Daniel Gasteiger.

“Adoption of technology in the government context here is very slow. I think this the same for the financial center, the traditional financial center,” said Gasteiger. Trust Square connects entrepreneurs, early-stage ventures, businesses, investors and academics and offers working spaces for blockchain related enterprises.

The top 50 blockchain-related companies in the country are valued over US$40 billion in 2019, according to a report released by Crypto Valley Venture Capital in October. Switzerland’s Crypto Valley, based in Zug, has more than 800 companies using blockchain and cryptocurrency and employs over 4,000 people based on the report.

Key Highlights

- “Blockchain is a decentralized technology. There is no central power that actually determines or stands for the trusts so intermediaries are not needed anymore. The intermediaries [in Switzerland] are the parliament and the ministers, but we have much more power as individuals. We are very much complementary to this trend with the technology.”

- “We are working with governments, and it’s still a difficult sell to go to a government and explain to them the blockchain and then try to convince them to use it for their digital identity, for instance, like what we are building. But in the long run, I believe what we’re doing with blockchain in the context of digital democracies, digital societies; e-voting is a big, big topic for me.”

- “Everything is totally autonomously managed. It’s the same with self-driving cars, ultimately the cars will own themselves. They will basically go, they will do everything basically fully autonomously because of the whole environment they are running on, which is blockchain and cryptocurrencies and so forth. It’s autonomous futures, what we believe we’ll see happening thanks to blockchain, thanks to decentralized autonomous organizations.”

“While we have this great support and this great vision also from the highest political level, I’m also conscious of the fact that that’s my perception from my company that I founded, that we are very far behind when it comes to e-government, for instance,” said Gasteiger.

See related article: Creating a Decentralized Silicon Valley in Switzerland

In November, the Swiss Federal Council agreed on improving the legislative framework for blockchain in the country, in a move to increase “legal certainty, removing barriers for applications based on distributed ledger technology and reducing the risk of abuse.

Facebook also incorporated its Libra Association in Switzerland, and has applied for a payments license in the country, according to a statement by the Swiss Financial Market Supervisory Authority (FINMA).

“The choice of Switzerland as the home for the newly established Libra Association, which when fully developed will have a diverse group of member organizations spanning technology, fnancial services, social impact organizations and venture capital, among others, harnesses Switzerland’s role as a nucleus for international organizations,” said the Libra Association.

Regulators including FINMA have been careful to scrutinize Libra’s risks. “The highest international anti-money laundering standards would need to be ensured throughout the entire ecosystem of the project. Such an ecosystem must be immune against elevated money laundering risks,” said FINMA.

See related article: Gibraltar is pioneering creation of blockchain ecosystems

In August, FINMA approved the first banking licenses to blockchain firms SEBA Crypto and Sygnum under strict money laundering guidance.

Gasteiger said that the move will change traditional financial industry perceptions. “This is now really becoming a professional business. This is not some decentralized exchange thing anymore that nobody really understands. This is now proper business — that has a huge impact,” he said.

Nonetheless, Gasteiger said that developments in the sector may occur more quickly in Asia. “I think it’s not going to be here that we will see these applications develop the fastest. China and Asia, that’s where the music plays. That’s where I see startups that are live. That’s not something we’ve seen happening here so much. But obviously it’s also going to catch up,” he said.

Listen to the Podcast

Full Transcript

Angie Lau: Welcome to this special edition in Switzerland. It’s a country that is seemingly almost working in unison at almost every level; from the government to industry groups to even the startup hubs, they are working on the promise of DLT. I’m here at one of the most prestigious addresses in Zurich right now. It’s across the street from the National Bank of Switzerland, [in a location] which is the European equivalent of Wall Street, you’ve heard of that, or even Bond Street in London.

Founder and CEO of Trust Square Danny Gasteiger joins us right now. You got interested in blockchain as a banker. Tell us about the story of your transition from one of the top banks in Switzerland to where we are right now at Trust Square.

Daniel Gasteiger: Well, it all started in 2014 when I first started reading about blockchain. Obviously, at the time it was all about Bitcoin, and at the time Ethereum was coming to Switzerland, they incorporated the foundation here. So it was kind of starting to become what is now known as a Crypto Valley, so I got interested.

It was also the time of my career that I started to think, OK, now I’m turning 40, so I would like to do something else for the second part of my career. So I started looking around for topics and I started getting more into this topic of blockchain. As a banker, it obviously would have been natural for me to get into this cryptocurrency trading and all the speculation and hype about it.

Then went basically to a study trip to Silicon Valley and read a lot of books there. I basically met a few people that were at the time already thought leaders in the topic. And I discovered that blockchain is much more than just a cryptocurrency topic. It’s about decentralization, it’s about what Switzerland is all about, giving power to the individual in every aspect, not just the financial context. And so really with that, I started deciding to pursue my second half of my career in that space and become an entrepreneur.

Lau: And the entrepreneurial path brought you to blockchain. Wanting to nurture and foster that talent, you created and founded Trust Square, along with other founders. Tell us about Trust Square. What is this as a resource to the industry?

Gasteiger: Trust Square was meant to be, and is actually now, a hub in the center of Zurich, in the middle of the financial center that brings together the startups and the academic side of things. So when we started, our focus was really to combine all the startups that were scattered all over into this hub, and then combine them together with our university that we have here – in Zurich we have the University of Zurich, we have ETH, which is a technical university – and really foster that ecosystem with these two partners.

Personally, what we have done with my own startup a partnership with the University of Zurich is to develop an e-voting solution with the professor of IT there. Others have been working together with their academic partners like this. So this was the original goal. The third pillar was to educate. We have a big main meeting room upstairs where we do host a lot of meet ups. We do a lot of academic meet ups again with the University of Basel, where we educate, where we explain.

We have event series like Women in Blockchain where women can come and learn to start code with blockchain. A lot of things are happening. Education, together with academics and the startups were the focus at the beginning of Trust Square. Now we now have 40 startups here, more than 40 actually. We have, I think by far the biggest hub at such a scale in the world with 3,500 square meters. That’s how it all started and developed.

Lau: You get a lot of visitors from around the world. Governments come, industry groups come, blockchain startups come to check it out. Why are they interested in coming here? What are they interested in learning from you and from the ecosystem in Switzerland?

Gasteiger: International delegations that visit us obviously are interested in how it happened that Switzerland became one of the leaders in the blockchain space, by having a lot of startups here, I think we have more than 800 companies working with blockchain one way or another, startups, companies that have not formed their own expertise in house.

How that happened, it’s obviously the same story like in the 1980s and 90s with the Internet, and Silicon Valley. We have here a very favorable regulation since the beginning, in 2014. That’s another reason why I actually was interested. In 2014, the Federal Council issued their first assessment on the risks of cryptocurrencies. At the time, they called it virtual currencies and basically said there’s no risks involved by having this technology evolve here.

That was very, very early when it comes to official government statements about what are now cryptocurrency issues. From then onwards, the canton of Zug started to embrace the technology and they started accepting bitcoins for payments in 2016 if I remember correctly, they did their first trials with digital identity in 2017, and so locally in Zug, it was a very, very open situation for startups to come there and really be present.

Then over the years, FINMA, the national regulator was kind of open, so the first ICO rules that came out in 2017 were supportive. That brought this whole ICO rush to Switzerland, and a lot of startups came here because of that, because of the favorable regulatory environment.

Lau: We saw, though, the downfall of ICOs. It left a poor taste in a lot of people’s mouths. The perception is still lingering as it pertains to the potential of blockchain in cryptocurrency. How have you as a participant in the industry here in Switzerland, and how has Switzerland itself tried to, or has it been successful in pushing that perception aside?

Gasteiger: As I said, the FINMA guidelines from the beginning were clear. It’s always better to have some clear rules than no rules. The reason why ICOs have a bad connotation these days or a bad reputation, is because in some countries across the globe, there were no rules and things just happened. And there was a lot of obvious speculation and a lot of criminal behavior.

But with the rules that we had here, we were very early on regulating something that was a Wild West. It was a crazy time when it comes to how much money could be raised in two days with a white paper, but it was at least regulated. We also had some issues here, but it was much less than elsewhere where it has been banned because of all these issues and stories. So it was kind of an evolution on how these things were experienced.

Lau: So early regulation, clarity and a framework that blockchain companies could really play in: that’s number one. Number two: talent, education, academia — this relationship is very critical to growth in innovative technology like blockchain. What’s happening in the academic world that supports this technology?

Gasteiger: For instance, a good example is ETH, the technical university here in Zurich. Don’t quote me, but it’s been said that they have issued the most research papers on blockchain in the whole world since they started working with it. It’s a hidden gem in that sense that ETH I guess is one of the leading universities globally when it comes to doing the research of this technology.

There’s a lot of people that were originally also called developers of bitcoin coming from the ETH school. Then the second example I would like to mention is the University of Zurich. They’ve just founded what is called the Blockchain Institute. There’s 22 professors from all over universities, from all fields of research, legal and societal topics, obviously finance and obviously technology coming together and basically incorporating this topic in a consistent way into the university.

I think I’ve not heard of anything like this anywhere else in the world. It’s really that real focus on how people can come together and work on this and foster the education around it as well.

Lau: One of the critical things as well is this almost political culture that exists here in Switzerland. Describe it for people who don’t necessarily understand how it works here and why this bottoms up approach to being a citizen here in Switzerland is very complementary to even the decentralization philosophy of Blockchain.

Gasteiger: Switzerland is a decentralized country in the political sense. We have what is called direct democracy. So that means that each and every single Swiss person can raise any topic and have it voted on as a referendum by basically all the Swiss people. So you need to collect 100,000 signatures if you want to raise any topic to the Swiss population. And then we have to have a referendum on it and vote and basically decide yes or no. That’s a core element of the strength of this country.

Then we have 26 cantons, or states. They’re very small; Switzerland as a country is small, but the states are sometimes much smaller, obviously in comparison to other countries. And they are very autonomous as well. So the autonomous levels are top down to the national level. It’s very weak in that sense. There’s obviously the national security army and these things, but then the rest is pretty much decided on the canton level.

The big things are decided on the community level or the city level. Individuals have this power, so basically, if the parliament decides a law, we can again raise the referendum against that law and 50,000 signatures can actually turn the law down that the parliament has voted in. And so that’s a very powerful thing. And when I learned about blockchain, obviously it’s very much the same thing.

Blockchain is a decentralized technology. There is no central power that actually determines or stands for the trusts so intermediaries are not needed anymore. The intermediaries here obviously are the parliament and the ministers, but we have much more power as individuals. We are very much complementary to this trend with the technology.

And I guess that’s another reason why Switzerland is embracing this technology so much. We had the president here for our first year anniversary. He’s a big fan. He’s a big spokesperson for the blockchain movement. We also had the National Bank’s president here. So we have a very small country. We get to get together easily, much more easily.

Lau: So you just name-dropped two of the most important people who just showed up at your first anniversary. But it really reflects the unison approach of blockchain in Switzerland. So you have the president from a top government level, alongside the banking industry, which is the strongest, most powerful industry in Switzerland, sitting [and talking about] blockchain.

This really feels like the underpinnings of the ecosystem that is unique to Switzerland here. Why do you think those relationships, number one, are there? And number two, how do those relationships help blockchain?

Gasteiger: It gives you credibility, of course. If you read the average press article about blockchain, it’s still about Bitcoin hype, the price of Bitcoin … it seems to be the biggest issue journalists have these days. It’s actually anything but that. That’s what helps when we have people, as I say, like the National Bank president coming here, talking about the potential impact of Libra on the world economy.

These things are giving us credibility because there’s obviously … these things are being taken seriously, and it’s a much more focused approach to explain this topic as well from that level. Then giving us as a startup community that has also had, as we said earlier, these issues around the hype with ICOs, it gives us still the trust to actually do something in a strategic, in a sustainable way. With their presence at these events, for instance, obviously that gives both parties a good working relationship for the future.

Lau: Give us a sense of the innovation that we can expect to see out of Switzerland. You’re in a position to be able to answer that authoritatively because you are a startup hub. You’re also CEO of Procivis, another startup, tell us what kind of innovations we’re going to see out of Switzerland in the coming year.

Gasteiger: The breaking news in the last few weeks was that the first two startup banks in Switzerland got a full banking license. That I think will now change the perception from the traditional financial industry much more as well. Ultimately, there are now two banks, proper banks that have a full license that can take on money from clients and they can basically give loans to clients, that can institutionally trade cryptocurrencies, that can have a storage offering.

So all of this is now really becoming a professional business. This is not some decentralized exchange thing anymore that nobody really understands. This is now proper business. That has a huge impact. That was the very latest of the announcements we had. We had Libra coming to Geneva, incorporating the foundation there. That’s another big news from the summer.

As a banker, I should be in that field but I’m not because I have seen the technology to be an enabler for much more fair and much more democratic society going forward. And that’s what Procivis is all about. We are building solutions with blockchain where it makes sense; sometimes blockchain doesn’t make sense, and sometimes it’s too early.

We are working with governments, and it’s still a difficult sell to go to a government and explain to them the blockchain and then try to convince them to use it for their digital identity, for instance, like what we are building. But in the long run, I believe what we’re doing with blockchain in the context of digital democracies, digital societies; e-voting is a big, big topic for me.

Again, coming from Switzerland, we vote every three months on topics that have been raised by the citizens. That’s a big thing, and I believe that’s gonna be one of the killer apps on blockchain, will be e-voting. That’s why we heavily research that. That’s why we heavily invest together with the University of Zurich or others, academic partners, in this topic.

Lau: Describe the energy of the blockchain community here and the people and the students that are coming in to this industry as we speak.

Gasteiger: We have a lot of international people here. So, yes, that’s what I always liked. That’s also, in my job at the at the bank, I was always in the international division in investment banking, because that’s what I like. That’s represented here. We have Bitmain here, a Chinese company, one of the biggest ones in the world. We have a lot of American startups that came to Switzerland for the regulatory security that they’re building.

We have a lot of really forward thinkers even here in the office, think tanks that they’re thinking 20 years ahead of what is the impact of blockchain on us as a society when it comes to autonomous self-managing vehicles like this satellite that we have back there, or a house that maintains itself and owns itself? So all these style ideas that you have heard about. So that’s kind of a mix of things that we have here, and so it’s a very dynamic, a very enthusiastic environment to be in.

Lau: To have a think tank, to actually commit brain cells to thinking about how societies are going to be formed differently because of blockchain. You mentioned one topic, our houses. What will our houses look like with technology? Blockchain merging with AI and quantum computing and 5G, 6G, whatever G it’s going to be in the future?

Gasteiger: It’s gonna be autonomous, and the thinking is that we will have a building like this, a co-working space, a hub where basically there’s no management team anymore that runs around because everything can be done automatically. You can book your meeting room, the meeting room is basically then automatically ordering the cleaning lady after you pay by cryptocurrencies, of course.

Everything is totally autonomously managed. It’s the same with self-driving cars, ultimately the cars will own themselves. They will basically go, they will do everything basically fully autonomously because of the whole environment they are running on, which is blockchain and cryptocurrencies and so forth. It’s autonomous futures, what we believe we’ll see happening thanks to blockchain, thanks to decentralized autonomous organizations.

Lau: In the meantime, back in this century, in this decade, in this year, it is still very much driven by the ideas and the hard work of the people. At the end of the day, Switzerland is still a very small country, but some would say it hits above its weight class.

Do you think that, though, when it comes to adoption and enterprise, that that’s going to happen outside of Switzerland because this country has 8 million people, and you take a look at China, it’s 1.4 billion people. Where are we going to start seeing enterprise adoption on a mass scale?

Gasteiger: I think it’s not going to be in Switzerland. While we have this great support and this great vision also from the highest political level, I’m also conscious of the fact that that’s my perception as my company that I founded, we are very far behind when it comes to e-government, for instance.

Adoption of technology in the government context here is very slow. I think this the same for the financial center, the traditional financial center. The banks – while my former employer basically has been dabbling in blockchain already very early on in 2015 as well, they opened the first blockchain lab in London – there’s not much real things happening, you cannot see much of these banks having developed.

The big topic of the month is tokenization. There’s no tokenized funds or something like this yet. Of course not, because it’s also very early. I think it’s not going to be here that we will see these applications develop the fastest. You mentioned China and Asia, that’s where the music plays. I’m going to Seoul again, I’ve been there now three times.

That’s where I see startups that are live. One of my favorite examples that I always mention is there’s this tokenized art startup that you can actually go and buy a piece of a Banksy and look at the piece in a basement, in a cave that you can access thanks to your piece that you get a QR code for, and really cool stuff, and it’s happening there, trading these pieces of this Banksy in a digital way. That’s not something we’ve seen here so much happening. But obviously it’s also going to catch up.

Lau: Well, thanks for a glimpse of the future right here in Switzerland.

Gasteiger: Thank you for coming by.