SEC ‘Crypto Mom’ Hester Peirce: US will lose out in crypto innovations if regulations remain in limbo

The US is gold standard for global financial regulations. But if US does not get its act together over crypto, other nations will emerge as leaders in this growing space.

While China spearheads the development of a sovereign digital currency and other countries push for greater cryptocurrency guidelines, the United States could lose its competitive edge if it continues to drag its feet with regulations, according to “Crypto Mom” Hester Peirce.

“I believe that if we don’t do something in the U.S., that [crypto] development will move outside of the U.S.,” said Peirce, a commissioner at the Securities and Exchange Commission (SEC), in an interview with Forkast.News. “Asia is a place where a lot of activity is happening and a lot of governments in this region have found ways to move forward with this technology, and I think that’s something that we really need to learn from.”

See related article: Chris Giancarlo: digital dollar technology is coming ‘fast and furious.’ Can US seize the CBDC momentum?

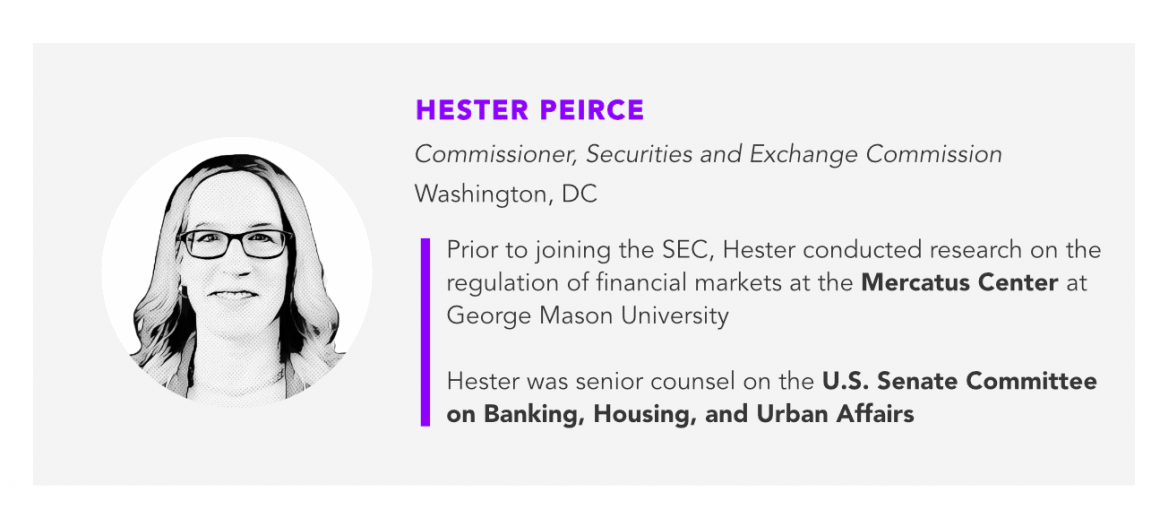

Peirce became known as “Crypto Mom” in the blockchain community for her 2018 dissent on the SEC’s rejection of a bitcoin exchange-traded fund application, and for proposing a 3-year safe harbor for crypto startups to have token sales. The 3-year period would give those companies time to achieve a level of decentralization to potentially pass the Howey Test — the U.S. Supreme Court’s assessment to determine whether certain transactions qualify as securities.

As one of five SEC commissioners, Peirce has been nominated for a second term, pending confirmation by the Senate.

Watch Forkast.News Editor-in-Chief Angie Lau’s interview with Peirce to learn more about her hopes for her second term, and how the U.S. needs to stay on top of crypto innovation.

Highlights

- On changing perceptions about cryptocurrency: “People are moving beyond some of the tired, old stories that crypto is just for illegal activity and recognizing that there’s real institutional interest in it. There’s retail interest in it. And there’s interest in trying to develop things that really will improve people’s lives.”

- Why U.S. regulators need to catch up with cryptocurrency: “If we don’t do something in the U.S., that development will move outside of the U.S., and Asia is a place where a lot of activity is happening, and a lot of governments in this region have found ways to move forward with this technology.”

- On future cross-government regulations on cryptocurrency: “I’m hopeful that we across the government will come together and give people an easier way to navigate cross-governmental regulatory barriers. And that’s a bigger undertaking because it’s not something that we normally do. But I’m thinking that that might be really a way to show that we’re serious about this.”

- Her hopes for the future: “Crypto is an opportunity for us to be introspective and to say, hey, are we handling innovation right? Or do we need to really make some wholesale changes in the way we use it as a regulator? Think about innovation. And so that’s a theme that I hope to carry forward and think about in the next term, if I’m confirmed.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the emerging technology, blockchain, cryptocurrency, DLT at the intersection of business, politics and economy. I’m Forkast.News Editor-in-Chief Angie Lau. It is my great pleasure right now to introduce to you and speak with Hester Peirce. She has been nominated for a second term. She’s one of five commissioners at the Securities and Exchange Commission and she’s one of the upcoming speakers at the Asia Blockchain Summit coming up in July. And I’m thrilled to welcome you to the show, Hester.

We’ve been tracking you, the entire industry has been really watching almost the advocacy that you’re doing internally at the commission and giving voice to what many in the industry had regarded for a long time as being voiceless, at least amongst lead regulators like yourself. So the first question is, you’ve been nominated for a second term. Congratulations. It’s a five-year term. Any word on U.S. Senate confirmation yet?

Hester Peirce: Thanks, Angie for having me, and I appreciate the chance to be with you today. In terms of the nomination, I’ve been nominated along with another commissioner, and the two of us will probably go through the confirmation process together. And so we would appear in front of the Senate when the Senate is ready for us. And then after that, if it goes forward, then then there could be a confirmation. The timing is a little difficult to predict; it’s really up to the Senate to figure out the timing of moving forward.

Lau: Being one of the five commissioners, obviously your voice is important. But of course, it also is reflective of what the entire commission and one of the many opinions that are voiced when it comes to policy and legislation, advisory and regulations. Since you started, which was about two years ago, to where you are now, what would you say has been perhaps the evolution of understanding or even regard for cryptocurrency and and DLT and financial instruments as such amongst your commissioners at the FCC?

Peirce: Well, I think it’s a really important point that you bring up that I’m one of five. And so that’s one of the beauties of the commission structure in the U.S. It brings together people of different views. And so I have to tell you that the views I represent are my own views and not necessarily those of the commission or my fellow commissioners. And I think in this space, that’s been pretty evident that sometimes I take one view and my colleagues take another.

But that said, I continue to be optimistic because I think my colleagues are following the space and they do see that there are developments happening in the space and that there are positive things coming out of it. And so even today, I had a conversation with a colleague that gave me some hope that we will see progress on some of these fronts. It may not happen as fast as I’d like, but I do think that we’ll make progress.

People are moving beyond some of the tired, old stories that crypto is just for illegal activity and recognizing that there’s real institutional interest in it. There’s retail interest in it. And there’s interest in trying to develop things that really will improve people’s lives.

Lau: You know that is a stark difference from when bitcoin or cryptocurrency was introduced even a decade ago. In his recent book, John Bolton, “The Room Where It Happened,” allegations of a statement made by Donald Trump saying to go after bitcoin. That sentiment, at that political level, where do you think the administration is right now? At least when it comes to thinking about blockchain and cryptocurrency and the DLT and DeFi, all of these things that technology has really innovated for us?

Peirce: Well, again, I mean, I can’t speak for my own agency, let alone the administration. We’re an independent agency. And so that does affect how we move forward. But what I will say is that a number of my colleagues across the government have been very interested in this space, whether it’s… Brian Quintez at the CFTC or Brian Brooks at the OCC, Chris Giancarlo, who used to be at the CFTC — there’s really a lot of interest. And so I think people are seeing the positive aspects and looking for a road forward in a way that provides the legal protections we need to provide. But at the same time, it offers people some opportunities that they’re looking for.

Lau: You mentioned your conversation with one of your fellow commissioners about progress made recently. You proposed a three-year safe harbor, prospects for cryptocurrency projects. Where are we on that? I mean, we know that the statistics are still fairly low. I think it’s below 5% before it’s passed by the House and the Senate. But where are we on that when it comes to potentially seeing establishment of a three-year safe harbor?

Peirce: Well, I think there’s still work to be done. I’m hoping to come out with a new iteration of the safe harbor at some point. And I’m taking in the commentary that we received and trying to figure out how we can improve it to address some of the concerns that people have expressed in protection of token buyers is, of course, something that’s at the top of people’s minds. And so are there ways that we can strengthen the safe harbor to address those concerns?

I think, as I’ve said all along, having this kind of thing ready to go for when people feel the moment is right, is helpful. And so I think even moving the ball along in this direction is helpful. Now, that said, I continue to believe that if we don’t do something in the U.S., that development will move outside of the U.S., and Asia is a place where a lot of activity is happening and a lot of governments in this region have found ways to move forward with this technology. And I think that’s something that we really need to learn from.

Lau: For the commissioners, including yourself, which nations are most of interest to you? What are the innovations in this space, especially in this region, in Asia? Have you been monitoring?

Peirce: Well, I think Singapore has been very active. I think there’s interest in Japan and in developing a regulatory framework. There’s interest. China is obviously taking steps in it to move forward as well. So I think we’re seeing a lot across the region. And then I think even then, some of the less developed countries there, they’re looking for ways to integrate some of this technology.

Maybe they’re at an advantage in a way, because they don’t have the same sort of scale. And I say that not in a critical way, but it’s easy for a regulatory regime that’s been in place for a long time to get stale as with respect to technology. And so if you have a less developed regime, then you’re able to sort of build it from the ground up. And then integrate that technology. Or at least make it technology neutral, which is really where we should all be trying to get.

Lau: That comparison is really astute. At the end of the day, you’ve got a very established system in the United States. A lot of checks and balances across government and agency. SEC is an independent yet government agency. And so the web is very intricate, but designed to obviously support a mature nation. Less can be said about the evolution of systems in the modern era from China, that went from empirical China to communism, to now a market economy with socialism ties. So you’re right about that.

But still there are developments that are being made at such a fast pace that we’re observing, being based here in Asia, that we’re just not seeing in the US. So, for example, as you know, DCEP, the digital currency electronic payment project, a pilot in China is already being integrated across four cities. The population is already used to digital payments of some kind. No, it’s been a cashless society practically for the past couple of years.

And so where does that put the United States? Are you worried about just the stark difference between adoption, on one hand ready to go in China and in other spots in Asia, versus the still-figuring-it-out and talking-about-it stage in the United States?

Peirce: I absolutely do worry about that. I think we in the U.S. have something to offer that still helps us have an advantage in many ways in that a lot of people want to go to the U.S. to build things and to raise capital. And so we have that. We have that advantage. But we can’t just ride on the laurels of that. We have to also look at what’s happening elsewhere. And it is interesting to see some of the developments that are happening in terms of sort of moving to this cashless society.

I don’t know that that’ll be the way it goes in the U.S., but I think that there is certainly going to be progress on that front. And I think it can be helpful for lots of people. So we need to keep that in mind, too. It’s not just the innovators who are trying to get stuff done. It’s the people who will actually be able to use it. And so we want to make sure that we’re offering as many opportunities and many options for investors, consumers and others in society to be able to do what’s most convenient for them.

Lau: Yeah. Do you think, amongst the intergovernmental agencies, SEC is one, CFTC, OCC, as you said there are more and more Hester Peirces, for lack of a better description, of people who are understanding the space at a different level and also seeing the perspective from an industry point of view and being a lot more open rather than closed door, with the old narrative of this all just being an excuse to launder money.

Do you feel that with this kind of emergence, even on the intergovernmental side, that it’s also being reflected on the industry side? Back in the day with the ICOs, it was to ignore U.S. regulations and now we’re seeing absolutely this evolution of companies and projects and protocols, understanding that they have to work within the confines and work with the SEC. How has that evolution been for you as you track just what’s been happening in the space?

Peirce: Well, I think as you get more institutional interest in the space, people are going to say, look, we can’t. We’ve got to work within the regulatory framework. And so that can be very helpful. But I think one missing piece is, at least on the FCC side, is that we really have to show people progress. We have to show them not only that it’s important to comply with the regulatory framework, and that’s why we’ve brought a number of these enforcement actions. We have to uphold the law as it’s written. But we also have to say that we understand that there are some changes that we have to make.

Until you really show that with offering people — hey, here’s an accommodation we made — people get discouraged. And so that’s what I worry about, is that. People have been waiting for a while to see some kind of change. Their money’s running out. I mean, that’s an issue, too, right? You can’t just keep flying forever without bringing a project to fruition. And so people are waiting. And so until we actually say, no, we’re serious about this, I’m worried that there’ll be a problem.

Now, the counter to that is that we have given some no action relief, and there are some players in this space who have gotten that. And we’re offering products that are based on a cryptocurrency. So there are some things happening, but I think we need to have more progress to really have even more people come to us and say, OK, now here’s what I want to build. Here’s where I think the regulation is going to stand in the way. What can you do about this?

So I’m hopeful that not only will we at the SEC give people more hope, but that we’ll actually make those accommodations. But I’m hopeful that we across the government will come together and give people an easier way to navigate cross-governmental regulatory barriers. And that’s a bigger undertaking because it’s not something that we normally do. But I’m thinking that that might be really a way to show that we’re serious about this.

Lau: No action relief. It still feels case by case. Lots of lawyers involved, a lot of outreach between SEC and attorneys, which can be enormously expensive. But if that is entrenched in a three-year safe harbor, that’s a different story. So right now, you’ve got no action relief for the big projects, at least two are capitalized, but less so with Covid. And then at some point, a three year safe harbor. What’s the time-frame here that the industry can expect?

Peirce: Well, again, it’s it’s hard to predict, but I’m hopeful that we can make progress, you know, that we’ll be able to say that something has moved forward in 2020. But Covid has really affected everyone. It’s affected us. Certainly the market. What’s been going on in the markets as a result of Covid in the shutdowns has also affected us and affected our workload. We’re in work-from-home mode. And so those kinds of things do have an effect.

That said, some things we’re trying to be business as usual as much as we can and some things are going forward. So the Fin Hub, which is the group at the SEC that spends most of its time on crypto and other fintech issues, they’re still doing their meetups. They’re just doing it virtually now. So people should still be reaching out to us. Don’t assume that we’re not interested, even though a lot of the public facing stuff you see is related to Covid. That doesn’t mean that we’re not interested in hearing about your projects.

You don’t have to come in with a lawyer, that’s important to know, too. But I understand that as a practical matter, probably if you’re going to try to do something in the U.S., you’re going to need to get legal counsel. But at least coming and talking to us can give you a sense of the potential issues that you might need to get legal advice on what those are.

Lau: And that’s certainly much different than suddenly waking up to this legal action, which we’ve seen over the past couple of years. It also boils down to the Howey test. Is cryptocurrency a security? How is that regarded? The CFTC sees it as the one thing, and the SEC sees it as another. When are we going to get a standard definition of a token cryptocurrency? Are we starting to see the different multi-layers of understanding, how it’s regarded by the commissioners, how it’s regarded by the agencies?

Peirce: Well, I think that there has been some clarity that’s come out based on the enforcement actions. People can read the tea leaves from that, certainly from the guidance that our division of corporations, finance or directors put out. But I’ve gotten the feedback that that’s quite complicated. I think it’s quite complicated. I personally have an issue with some of the ways that we’ve been viewing this. I think the way we’ve been viewing it is, in my mind, a misapplication of the Howey test.

I’ve been pretty open about saying that this is not news because I think it’s really making it impossible for a project to get started without falling into that Howey definition. And so, that’s made me sort of think more broadly the Howey test has been out there for a long time, and it’s been a quite useful framework for us to think about whether an investment contract is, in fact, a security. But it does lead to some really interesting questions about whether things that none of us might have thought are securities actually are securities.

So I think we really need to do a little bit of soul searching to say, well, if we’re if we’re applying this test in this way and the crypto context, have we been misapplying it in other contexts? And is it much broader than we actually thought? There’s a chance that Congress might come in and say, hey, we want you to think about tokens in some other way than through the Howey lens. That’s certainly their prerogative to do that. But because they haven’t done that yet, we are using the framework that has been passed on through the courts.

And that’s how our securities law in the U.S. is made, which does distinguish it from some other places which have much more descriptive definitions of what it is to use securities. So that I think that framework is probably here to stay. The safe harbor would at least offer a way to keep the framework, but then allow token projects to move forward with more certainty.

Lau: I recently spoke to Chris Giancarlo, ex-head of CFTC, one of the names that you shared at the beginning of this conversation of people who are just increasingly in the space, who are coming from agencies and then also working. The Digital Dollar Project has recently made headlines with Jerome Powell, Federal Reserve Chairman, being asked about it very specifically and saying that private should not overtake what a public role is, and this project should be led from a Federal Reserve perspective and that they must understand first and best.

So it seems that they’re still in the understanding phase. But how do you regard that kind of political climate at the moment to talk about the digital dollar? As you said it really has to be motivated by Congress to tell you as an agency how you want to re-define and/or tweak the language, the regulatory language. Do you think that political interest is there? Or is it being distracted right now because of what’s happening across the country and also with Covid?

Peirce: Yeah there’s a lot happening. And certainly the digital dollar debate is really outside of my purview as a securities regulator. But I think that one of the things that crypto dad Chris Giancarlo has been very helpful in thinking about, and this is not just related to crypto, it’s not just related to fintech, but more broadly, when he was chairman of the CFTC, one of the things that I really appreciated was that he had a very optimistic outlook about how technology could really transform our lives.

He always approached it from that perspective of thinking about what technology is going to do to make our lives, the lives of American citizens, the lives of people throughout the world better? And I think that’s something that I’ve taken away from him, and that’s how I like to think about things, too. And so I think we need to have these conversations and these conversations happening in society can then filter into Washington. And I think we’ve already seen that.

There’s really bipartisan interest in this technology, and in trying to figure out ways to allow it to develop in a way that does benefit society. And so it’s kind of a nice moment, right? There are a lot of divisions about a lot of things and this is something that we can come together and we can discuss and we can talk about how it can help make lives of people who have been excluded from the financial system, how maybe you can make their lives better and easier. And so I think this is all part of the life cycle, right? We expect that there should be some debate and discussion, and then we’ll figure out what works and figure out what doesn’t.

Lau: Well, from crypto dad to crypto mom, you’ve been seen in your dissent at the commission to be one of those thoughtful regulators who really think from that perspective, as you’ve just shared. So we’ve got crypto mom, crypto dad; how do you regard your role, especially if that there’s no doubt, at least from a lot of people’s mind, until the confirmation from the U.S. Senate entrenches your second term for five years, what’s what’s your mandate going to be as crypto mom?

Peirce: Well, again, if I am confirmed, which would be an honor, then I would continue trying to do some of that work on some of the things that I’ve been working on. And I think stepping back from the crypto space and thinking more generally of innovation, that’s really what brought me to this space, it’s a great case study for us. And how do we handle this new, totally new way of thinking about the world?

We haven’t been great on innovation on much more micro levels than this really brand new way of thinking about so many things. And so crypto is an opportunity for us to be introspective and to say, hey, are we handling innovation right? Or do we need to really make some wholesale changes in the way we use it as a regulator? Think about innovation. And so that’s a theme that I hope to carry forward and think about in the next term, if I’m confirmed.

I think also just thinking about how we can make our capital markets work for a broader segment of the population. Capital markets can transform people’s lives, and so allowing the financial system to reach more people means that we have to really revisit some regulatory features that are in place now. So we have a standard that says to invest in certain things, you’ve got to be accredited, and to be accredited means that you have to have this level of wealth or income.

So is there something that we can do on that front? To think about that and to think about whether that still works. And maybe some of the unintended consequences of that are that we’ve kept people from participating in the financial system who might have wanted to participate. So those are some of the kinds of things that I hope to think about.

Lau: That is one of the legacy regulations that have indeed prevented a lot of people from participating in wealth generation, to the point where you could almost argue that cryptocurrency and blockchain and all the financial instruments that have evolved was really, this was one of the things that it was responding to. DeFi has just popped up as well. It’s certainly an emerging space for financial services. How do you regard SEC’s role and DeFi? What’s your opinion on that?

Peirce: Well, again, I think it has to be considered on a case-by-case basis. We have to think about the facts and circumstances and in some cases, it really won’t implicate us as much as probably some of our fellow regulators. But there are other instances when it may well be within our wheelhouse. And I guess that’s the message that I have to bring as well, which is that with all of this stuff, you’ve got to think about the regulatory framework if you’re reaching into the U.S. and have to think about that, because there could be consequences if you don’t.

And for people who are involved in this space, please come talk to me and talk to me about where you think the regulations are preventing you from doing what you want to do. Now, some of the DeFi space is one that really asks us to reimagine it entirely. How finance is done and if it moves us away from a world where we as a regulator are dealing with a few specific entities that play a major role in the financial system. Well, that’s the point from the people who are innovating in this space. But it also does make our job more difficult if something does go wrong.

People may come to us and say, hey, something bad happened to me. I want you to stop it from happening to other people and to help me. And we have to grapple with that, too, because part of our job is to protect the integrity of the markets. So thinking about the legal structure in this new world is difficult, and figuring out where exactly we’re implicated as a regulator is difficult. So I don’t have all the answers yet.

Lau: Well, I don’t think any one of us do. But what’s critical here is public discourse, and it is a pleasure to have this conversation with you and share some of your views with the rest of the audience. Very eager to learn as to where 2020 and beyond really takes the world and this industry. Hester Peirce, thank you so much for joining us. It was a real pleasure.

Peirce: Thank you, Angie. I really enjoyed it.

Lau: And thank you, everyone, for joining us on this latest episode of Word on the Block. I’m Angie Lau. Until the next time.

Forkast.News will participate in the Asia Blockchain Summit 2020, which starts this week.