ConsenSys founder Joseph Lubin says Ethereum can be a trust layer for the planet

Ethereum has amassed a nearly unbeatable network effect, but regulatory compliance is still a major hurdle.

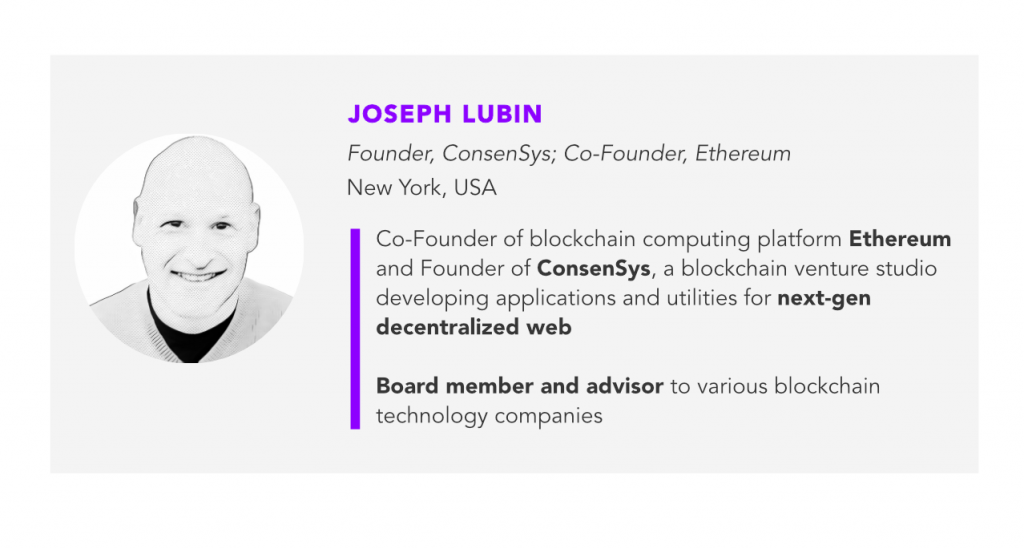

Governments around the world have started to catch up with regulation for new blockchain-related projects, but the underlying technology still attracts entrepreneurial activity. Forkast.News Senior Editor Sam Reynolds sits down with ConsenSys Founder Joseph Lubin on the sidelines of Hong Kong FinTech Week to find out more about how the Ethereum blockchain infrastructure is dealing with regulation.

Against the backdrop of Hong Kong Securities Futures Commission CEO Ashley Alder announcing new regulatory framework for virtual asset trading platforms, projects related to blockchain have seen an increasing amount of engagement in the industry from governments around the world in 2019. This includes Chinese President Xi Jinping recently promoting the development of blockchain technology in the country.

While blockchain and cryptocurrency companies adapt to the new regulations, Lubin says “the technology shouldn’t matter that much as long as you’re doing all the right things according to securities law, you should be able to sell your securities to appropriate buyers.”

Add to that Ethereum 2.0’s looming launch, ConsenSys has been working on various projects including a space program in which “any person can participate and contribute.” The project aims to create a collaborative platform to organize efforts such as space sustainability in a decentralized and democratic way, according to the ConsenSys Space site.

See related article: Forkast.Focus | HKFinTechWeek: SFC Aims to Regulate Digital Asset Trading Platforms

Full Transcript

Sam Reynolds: Hey, guys, we are back at Hong Kong FinTech Week and we’re talking with Joseph Lubin from ConsenSys. So Ethereum is a big topic these days, of course, in blockchain. But we’ve heard that Ethereum’s toolkit isn’t yet where it should be, given the capital being spent on Ethereum. You say that’s dumb. Why?

Joseph Lubin: What do you mean by toolkit? The developer toolchain? You’ve heard that?

Sam Reynolds: We’ve heard it. We have it on tape. But there is that argument that perhaps, you know, given the value of Ethereum and what’s being spent on that, perhaps there could be a bit more.

Joseph Lubin: Sure, there could always be a bit more, but the Truffle Suite is an outstanding developer tool. I believe it’s been downloaded significantly north of 2 million times and might be a bigger number. I believe they have something like 80 thousand unique users that they verified. So it’s beloved. There are other developer tool suites. There are formal verification methods. There are different languages. There are security audit teams. We’ve got a product called MythX, which is a set of tools for static, dynamic, ongoing analysis. So the rails, that blockchain, that Ethereum blockchain provides for directly accessing value, tokens, money or other kinds of digital assets are live. And that’s never been true before in the history of computing. So it’s still not an incredibly mature technology, but it’s maturing rapidly. And the tooling is, I think, incredibly impressive considering that the theorems ecosystem is 5 years old and no other blockchain ecosystem is close in terms of the amount of tooling and developer activity.

Sam Reynolds: That’s definitely true, right? Ethereum’s only five years old, yet it still has the ecosystem that is massive. But we see now the emergence of new Blockchain technology coming down the road. Things like Neo or things like Tron. So how do you guys compete with these new blockchains?

Joseph Lubin: So there are good competitors and there are good marketing projects. So Tron is an excellent marketing project. There are other excellent marketing projects and some of those marketing projects aren’t necessarily intellectually honest and not technologically strong or rigorous, but they’re pretty high quality technology projects, projects like Polkadot and Dfinity and Tezos and NEAR, Algorand, Avalanche. All of those are quite impressive technologically. An analyst named, Matteo Leibowitz, describes something called the distribution quadrilemma, and he was basically talking about how difficult it will be to become a layer one based trust layer. There are two of them in existence right now. Two of them that are sufficiently decentralized to be a base trust layer for applications for the planet: Ethereum and Bitcoin. In order to become a base trust layer, you need to issue a token broadly and equitably. You need to garner enough revenue so that you can build your project and continue to build it out, maintain it. You need to have a vibrant, large and growing community.

And this is something that bitcoin in Ethereum didn’t have to deal with; you need to be regulatory compliant. And so any project hoping to aspire to being a massively decentralized based trust layer, an actual layer one, everything else is can be a layer 2 system. They would have to accomplish those four pillars. The problem is the regulatory peace, in order to grow, keep growing a community, you generally have to promise that the token that you’re selling them will appreciate. Usually by the action of the developers or promoters of the system, by definition that’s a security. And so securities law is then implicated and now you can’t sell a utility token as it’s not a utility token, it’s a tokenized security. You can’t sell it broadly and equitably. And so it’s going to be very, very difficult. Not impossible, but very, very difficult for even a technically very strong project to challenge the early head start and the massive network effect that the Ethereum project has.

Sam Reynolds: For sure, and looking at regulations, you know, the blockchain once had this aura of a libertarian wild west. Now it’s moving towards enterprise, is moving towards being part of a, you know, enterprise workflow or government workflow. And I definitely think that with some of these tokens, there is a pathway to bring that into the fold with regulations. At the same time, with some, there are no pathways possible to bring that into what can be legally sold to anyone. So, you know, can you talk about, perhaps, that process of trying to make things compliant and trying to work with regulators and not against regulators to make sure you can fundraise legally for projects.

Joseph Lubin: So we’re big fans of the maximally decentralized, public, permission-less space. We think it will be very important to have a base trust layer for the planet and a global settlement layer for the planet that essentially all nation states can trust that can’t be improperly manipulated. At the same time, minimally viable, decentralization brings a tremendous amount of value to a whole bunch of companies that want to cooperate with one another and, you know, some of their business processes. We should be able to sell tokens for networks like that, whether they’re utility tokens or tokenized securities even. And in many jurisdictions around the world, including the United States, things are not so fuzzy anymore.

We at ConsenSys have a very strong legal team, maybe the best in the world for our industry. And we’re very comfortable that we can sell utility tokens. We wouldn’t sell them in massive quantities to speculators. We would sell them in situations where we might require proof of use before they could be traded between different counter-parties. And the securities law has been operating well in the United States for a long time and and in other regions of the world. And the technology shouldn’t matter that much as long as you’re doing all the right things according to securities law, you should be able to sell your securities to appropriate buyers.

Sam Reynolds: Okay, so we’re here at Hong Kong FinTech Week. What’s your favorite trend so far on the show floor?

Joseph Lubin: I got here recently and only did my panel and my talks, so I haven’t had time to walk around.

Sam Reynolds: Okay, fair enough. Well, great. Thanks for your time.