Diginex’s Richard Byworth: Crypto borrowing and lending to increase 10-fold

In this edition of Forkast Forecasts, Diginex’s CEO offers his views on CBDC initiatives, crypto custody, and more growth in borrowing, lending of digital assets in the upcoming year.

Welcome to Forkast Forecasts 2021. In this series, leaders, innovators and visionaries in blockchain-related fields tell Forkast.News what they see as the most noteworthy developments for this industry in 2020 and their predictions for the year ahead.

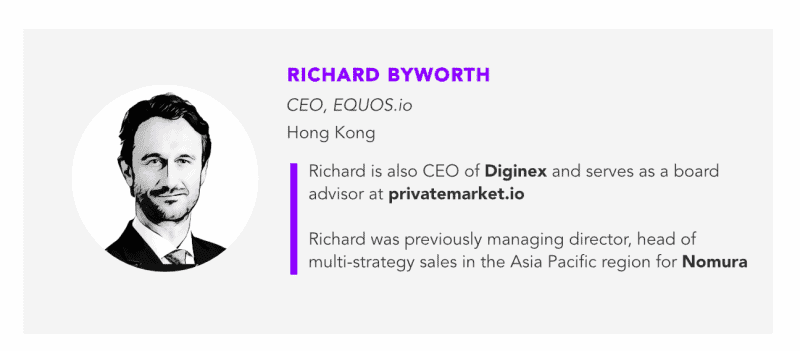

Richard Byworth

Richard Byworth is the chief executive officer at Diginex, a digital assets financial services and blockchain solutions company. Diginex made news in October by becoming the first Nasdaq-listed company with a cryptocurrency exchange.

The company offers cryptocurrency exchanges and over-the-counter trading operations with its EQUOS and Access platforms, and custody services through its Digivault solution.

Byworth was previously managing director at Japanese investment bank Nomura, where he led Asia Pacific derivative and equity linked product sales globally. He is a Hong Kong regional ambassador for the Global Blockchain Business Council, and has spoken on blockchain for business and finance at the World Economic Forum in Davos and the United Nations in Geneva.

See related article: How global fragmentation is holding back blockchain’s progress

Biggest developments in 2020

- Diginex’s Nasdaq listing in October: “That’s been an amazing experience for everyone. Being in front of a lot of investors and talking about the very differentiated approach that Diginex has to the full digital asset ecosystem, I think that the performance of the stock is going to continue into next year, along with the overall performance of the industry.”

See related article: Will Diginex’s backdoor Nasdaq listing start a crypto industry trend?

- Experimentation in decentralized finance (DeFi): “We’ve seen some obviously very non-credible projects, but we’ve also seen some advancement in the industry and the technology, and this is great that we’re starting to see use cases play out, even though there’s a lot of risk being taken and people have lost funds. But that’s at least a good way that Ethereum is moving into being more of a utilizable network on a protocol level.”

See related article: Why DeFi is here to stay and its takeover in finance inevitable

- Bitcoin’s maturation: “The logical progression of bitcoin adoption with central bank stimulus, both fiscal and monetary, has been something that is obviously very good for the industry. [The higher] the bitcoin price goes, the more security we see to the network and the more overall adoption.”

See related article: How Fed-led inflation of USD could be good for bitcoin and digital assets

- China spearheading central bank digital currency (CBDC) initiatives: “China’s going ahead and launching that so fast, will actually really inspire a lot of people to move into the space a lot quicker.”

See related article: Hong Kong may be first global ‘sandbox’ for China’s DCEP digital yuan

Predictions for 2021

- Further advancement of CBDCs:

- Japan: “We’re going to see Japan as a rival economy to China in the trading space, really move forward and want to effectively compete and make sure that they’re not being left behind. We have seen signs of consultations happening with many of our partners in Japan, with the Bank of Japan directly around this. And it seems that that’s being expedited at the moment.“

- U.S.: “I think that the Federal Reserve is biding their time. I don’t think that they’re being rushed into it. But obviously they want to keep an eye on what’s going to be happening with China and the way that current dollar hegemony over the global economy, how that may or may not be affected by China’s digital yuan.”

See related article: 2021 may be the year of China’s DCEP and other digital currencies

- Custody services for institutions: “Third party custodianship is going to become a real requirement for institutions moving into the bitcoin space, but broadly into digital assets. These institutions can’t keep custody on their own bitcoin. They can’t sit there with [cryptocurrency wallets like] Ledger and Trezor. They can’t sit on exchanges with their balances. So they need to have third party regulated clean custodians.”

See related article: More traditional investors are eyeing cryptocurrency to diversify their portfolios

- Bitcoin exchange traded funds (ETFs): “There are a lot of credible players that have obviously been trying to push forward with bitcoin ETFs for the longest time. The current products out there are a little bit limited in their offering. Having a proper ETF in the space will be much better for investors that are looking for an equity way to access this asset class.”

See related article: Power over Bitcoin is held by a few. Is it at risk of a 51% attack?

- Crypto borrowing and lending to increase 10-fold: “We’ve seen borrowing and lending balances increased by 10 times this year, gone from US$1 billion of assets to about US$10 billion of assets being lent out in the space. I think with the growth of bitcoin, other cryptocurrencies going into [2021], we’re likely to see those balances increased by another 10-fold. This is what you really need for a developing asset class — you need to be able to borrow these assets so that you can short them or you can provide them for positions, for financing, whatever it might be. That’s how we see the industry evolve and grow.”

See related article: What are the SEC and OCC’s thoughts on digital asset regulations?