Former banker Mike Novogratz is ‘petrified’ of China’s new state-issued cryptocurrency, and ConsenSys’ Joseph Lubin agrees

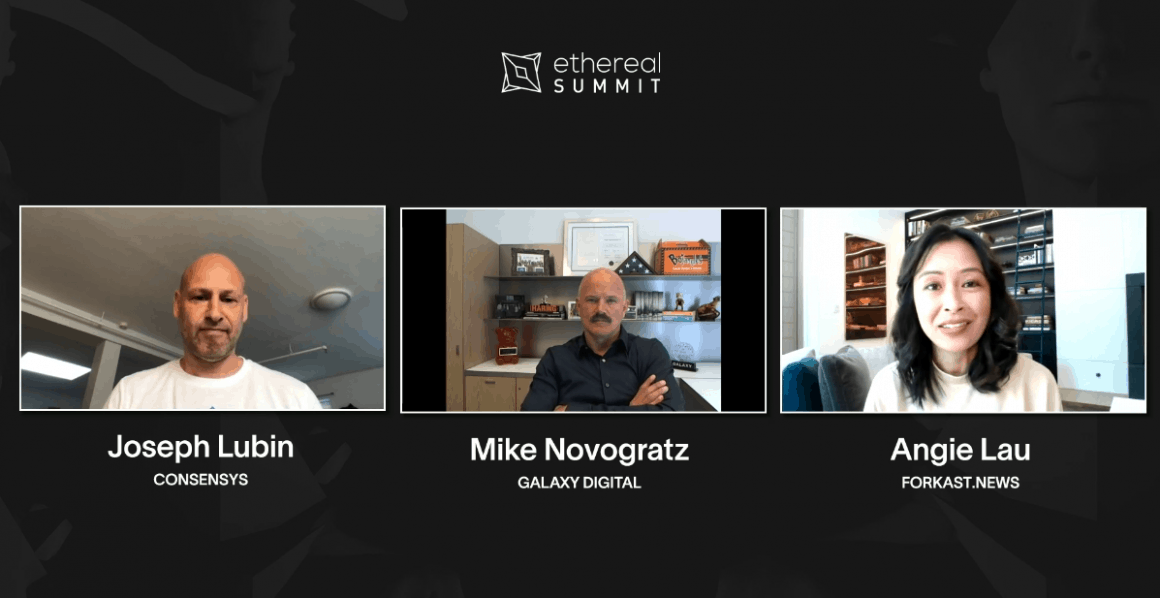

Two titans of blockchain discuss China’s DCEP, Covid-inspired technology and more with Forkast.News Editor-in-Chief Angie Lau, in video highlights from Ethereal Summit 2020.

Billionaire ex-hedge fund manager Mike Novogratz said countries developing central bank digital currencies (CBDCs) could usher in a “dystopian world” with regards to privacy and tracking of users, pointing to China’s potential use of their upcoming new digital currency.

“I am petrified of a centralized cryptocurrency in China where they say ‘we don’t like gay people anymore let’s just freeze their money,'” said Novogratz, founder and CEO of digital assets merchant bank Galaxy Digital at the Ethereal Virtual Summit 2020, a conference organized by blockchain software technology ConsenSys.

In the “Changing Crypto Narratives” panel moderated by Forkast.News Editor-in-Chief Angie Lau and joined by ConsenSys founder Joseph Lubin, Novogratz — who was a Goldman Sachs partner in Asia and then an executive at Fortress — said China could apply large information databases on their citizens to analyze people by their shopping patterns and their search histories.

“China is an extreme example of a culture that is used to sacrificing some privacy for social good. If all of a sudden you’ve got a government with this accelerating technology that now has really scary state operations that can monitor, spot, facially recognize, socially score people’s behavior… it could become a dystopian world with centralized data collection,” Novogratz said, drawing parallels to reports of China’s discrimination against gay individuals as well as the repression of Uighur Muslims.

Reports of China running pilot tests of a digital renminbi, officially named “Digital Currency / Electronic Payment” (DCEP), have stirred concerns over privacy.

China is not unique in pursuing a CBDC. Most of the central banks around the world are working to develop sovereign digital currencies, according to a study by the Bank of International Settlements. But China’s DCEP is the first major one to debut.

Countries’ use of CBDCs could enhance control over how those currencies are used and supervised, leading to a shift in global financial activity. As reported by Forkast.News, the coronavirus pandemic has also led to legislative interest in creating a “digital dollar,” which could lead to a U.S. CBDC.

“Unfortunately, I agree that we’re seeing a pretty serious bifurcation of the planet,” said Lubin, adding that government control has been a consistent theme in China. “[China] will be incredibly good at it — they don’t need a CBDC to get even better. Maybe it’ll make them a little bit better at it, but it’s a pretty scary future that we’re facing potentially.”

Others point out that China’s state-issued digital currency and proposals for a U.S. digital dollar still suffer from the same underlying weaknesses of fiat currency.

“Both of them will bomb,” predicted billionaire investor Tim Draper, in a recent interview with Forkast.News. “The whole point of cryptocurrency is that it’s decentralized. It’s open, it’s global, it’s transparent. It is not subject to political whims.”

See related article: Famed investor Tim Draper predicts both a digital dollar and Chinese DC/EP “will bomb”

Coronavirus accelerates digital development

Novogratz and Lubin agreed that the coronavirus crisis has been a catalyst for government and businesses’ development of digital solutions. Companies have started adopting remote work in greater numbers, schools are migrating to distance learning, and the healthcare industry has shifted toward telemedicine. Blockchain technology could enhance all those transitions.

In healthcare, for instance, blockchain could be used in tandem with telemedicine platforms to provide secure and trusted data systems to connect patients with qualified doctors remotely.

See related article: How healthcare uses blockchain to wage a smarter war against the coronavirus pandemic

The economic disruption caused by Covid could also accelerate blockchain development in other industries.

“It’s not just a biological virus crisis, it’s a global economic crisis,” Lubin said. “But maybe that’s not so bad. Maybe Covid is going to enable the builders of the new financial, social, economic, political infrastructure on decentralized protocols.”

On the heels of the U.S. Federal Reserve’s spending over $6 trillion, investors may seek out more stable assets such as cryptocurrencies.

“We have this fiscal orgy going on and it’s being monetized by central banks,” Novogratz said. “Money is growing on trees, and so you see investors look for hard assets, looking for scarcity value.”

Well known investors such as Paul Tudor Jones have also recently bought bitcoin to counter the potential inflation from central banks’ printing of money.

“[Jones was] the first one that bought crypto as a macro asset. It’s an inflation hedge for him,” Novogratz said. “So we’re seeing an acceleration in adoption of of bitcoin as a scarce asset, and I think we’re just starting.”

However, the panelists agreed that although change is occurring quickly, the infrastructure for cryptocurrencies was not quite ready yet.

“Covid is accelerating this idea that we are going to get a host of state-backed stable coins and other stable coins… so crypto, even as a hedge, as an option to change in the near term until the [innovators like Vitalik Buterin] build out the infrastructure so that the new world can actually operate in a decentralized way, because we’re not there yet,” Novogratz said.

Lubin said he does not expect cryptocurrencies like bitcoin or Eth to be used like cash the same way gold or oil isn’t used for regular day-to-day transactions.

“What we’re really talking about is building the foundational layers of a new kind of economy,” Lubin said. “So those are the pieces, and state issued cryptocurrencies, CBDCs — those will certainly have a big role.”