China’s blockchain talent is driving an investment boom

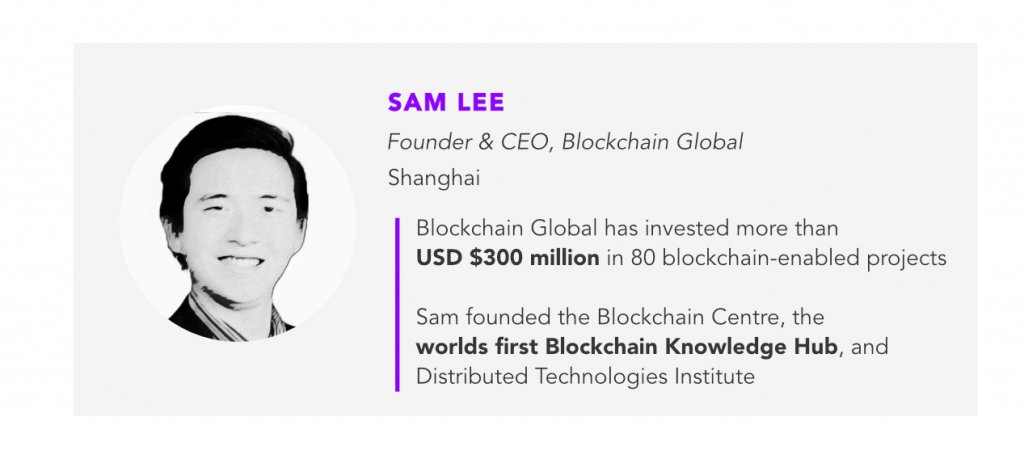

Investment in Chinese blockchain projects reached USD$367.7 million in the first half of 2019. Blockchain Global CEO Sam Lee says Baidu, Alibaba and Tencent have fueled a breadth of tech talent.

China’s blockchain talent pool is increasingly attracting investment from firms such as Blockchain Global, especially in the wake of endorsement from Chinese President Xi Jinping.

“The breadth of talent in China is what really attracted us,” said Sam Lee, Blockchain Global founder and CEO. “We want to leverage the talent pool that has been created through tech giants [Baidu, Alibaba, Tencent] in China and then leverage them into the blockchain space and export it overseas.”

Key Highlights

- “This realization that blockchain is real, by getting your coffee or getting a bag of chips from a vending machine is what we have exported from China. And it is going to be even more crazy with the ability to use facial recognition. So that is, I think, where the rest of the world can benefit, because what we’re talking about is the next level of incentivization and the next level of gamification.”

- “The opportunity for us to export Chinese blockchain capability is that we could build things faster, cheaper and quicker than anyone else in the world through the existing payment and technology expertise that China has. Apply that into blockchain, layer on some smart contracts and some blockchain sexiness, and you have an explosion of allowing any country in outside of China to build a solution similar to WeChat that is secured and custody and transparent on the blockchain.”

- “Through the blockchain, we’re able to more easily prove to regulators that the tokens are backed by real value because of the transparency and the limiting of supply or the management of a treasury to ensure that we’re able to create a WeChat-like payment solution in any country in the world.”

Blockchain Global is an investment firm headquartered in Hong Kong that has invested over USD$300 million in blockchain-related companies and projects around the world.

According to data tracker 01Caijing, investment in blockchain projects in China reached 2.6 billion yuan (USD$367.7 million) through 71 deals in the first half of 2019. Most of the investments occurred in Beijing, Shanghai and China’s southern Guangdong Province.

“China, having been the epicenter of the bitcoin mining boom, the exchange boom and subsequently the ICO boom, has gathered a lot of talent and capitalized a lot of opportunities in technology,” Lee said.

Get more exclusive insights in the Forkast.Insights China Blockchain Report

Blockchain Global, which has worked with the International Organization for Standardization, sees China’s relative lack of regulatory infrastructure for the blockchain industry as an opportunity.

“We were successful in bringing a lot of that kind of regulatory framework to many, many markets. And we saw when we could put talent from China with regulation from Australia, that was a very dynamic coupling of activity and value.”

The government bans speculative trading of cryptocurrencies like Bitcoin, but it has created supportive policies for startups and related projects to use the underlying blockchain technology.

See related article: Hong Kong Exchange chief says city is a springboard for tech, blockchain opportunities

“The opportunity for us to export Chinese blockchain capability is that we could build things faster, cheaper and quicker than anyone else in the world,” said Lee. China’s existing mobile payment systems such as Alibaba’s Alipay or Tencent’s WeChat Pay have potential blockchain use cases as well.

“Layer on some smart contracts and some blockchain sexiness, and you have an explosion of allowing any country outside of China to build a solution similar to WeChat that is secured and transparent on the blockchain.”

Forkast.News Editor-in-Chief Angie Lau sat down with Blockchain Global founder and CEO Sam Lee to learn about how the company is tapping into and incubating blockchain talent and enterprise in China.

Listen to the Podcast

Full Transcript

Angie Lau: In China, there is opportunity in undefined spaces, and that explains a lot about the young, vibrant energy that surrounds the blockchain industry in China. Developers with vision is one thing, but without the support of investors and resources around them, it remains only that.

We’re here in Shanghai, one of the tech hubs in China, and we are sitting in one of the blockchain centers around the world that CEO of Blockchain Global, Sam Lee, helped build. In fact, this is just one of many. Blockchain Global has invested more than US$300 million into dozens of blockchain-enabled companies and projects around the world. So who better to help us understand China and the blockchain industry than Sam. Grew up in Australia, but you saw the opportunity here in China two years ago, and here we sit today.

Sam Lee: Absolutely, thank you for having me.

Angie Lau: It’s great to have you here with us. Help us understand what you saw in China, what you saw with blockchain two years ago that said you need to be here.

Sam Lee: Well, we first start with wherever there is talent. And China having been the epicenter of the bitcoin mining boom, the exchange boom and subsequently the ICO boom has gathered a lot of talent and capitalized a lot of opportunities in technology. Now, these talent and technology, however, lack the regulatory clout in order for that rubber to hit the road.

As an Australian company that has successfully worked with regulators, especially in Australia since 2014, creating tax laws, accounting standards, as well as blockchain standards for Standards Australia ISO standards. We were successful in bringing a lot of that kind of regulatory framework to many, many markets. And we saw when we could put talent from China with regulation from Australia, that was a very dynamic coupling of activity and value.

Angie Lau: I want to understand that, you come from experience from the Australian regulatory space, right? And so you’re applying that regulatory framework to talent pool here in China. Well China’s regulations have also evolved since 2014. They’ve shut down the mining, they’ve shut down the ICOs, they are shutting down the Crypto exchanges. So in the context of that, how is Chinese policy shifting and shaping blockchain innovation in China?

Sam Lee: So the capability of building on the blockchain is not something that you can build overnight. And because of all the wealth and capital that came into funding a lot of exciting blockchain opportunities in China, we have a real expertise. That was what attracted us to China in the first place. We have actually got over 240 regulated exchanges registered with AUSTRAC, which is the Australian government anti-money laundering body.

That means that Australian regulated exchanges actually take up over 80 percent market share of all regulated exchanges globally. What that meant was there was a significant arbitrage for us to take Chinese talent in building blockchain enabled exchanges and subsequently deploying it into an Australian regulated framework. And with that, there was a real ability to capture and create jobs in China from a technology front and in Australia from a legal and regulatory front.

Angie Lau: Yeah, we’ve been talking to so many young people. We’ve been talking to so many people in the blockchain industry here in China. And the one thing that is hard for an outsider to understand is really what motivates, what drives, what’s in their heart, what’s on their mind, what do they see about the blockchain industry that excites them? And that’s something that you see every day.

Sam Lee: Yeah, well, blockchain is the buzzword. And there’s so many adults that don’t understand anything about it. And it’s, I guess, really funny. Just like the dot com bubble, we’ve all been through it, where, you have these young people saying, “I now know more than you and I’m going to teach you”. So it’s actually a great way for intergenerational education. As well as a give and take between the son or daughter and their parents or grandparents. And what we find is children in China, they’re not familiar with the concept of physical cash.

It’s all digital to them, even if you have a 6 year old, that person has got a smartphone with a WeChat wallet, and that can translate into a blockchain enabled wallet that people can then use to pay for food out of a vending machine or pay for a couple of rounds on an arcade machine. So that is an exciting interaction that kind of leaps across very well.

And because China’s already gone digital into how they interact with things on a value basis, blockchain enabled tokens is something that they get very, very quickly. And we’re here to take advantage of that and provide the necessary education through the blockchain center as a not for profit to drive this kind of dialogue, but in primary school and secondary school programs.

Angie Lau: So what do the kids want to know about blockchain and what do they want to understand when they come to learn?

Sam Lee: The easiest way for us to explain blockchain is we see this as a technology that allows everyone to issue a token of value, that has a consensus of value based on whatever of the friends and family are willing to pay for it. So this is how we see trust being built in the future. It’s not just amongst governments issuing currencies or a gold certificate that everybody trades off that has value for 5000 years. We’re talking about peer to peer interaction between value I create and you create.

Angie Lau: Why did you come to China? What was the opportunity that you saw?

Sam Lee: The breadth of talent in China is what really attracted us. Because although regulation in the blockchain space has not really been the strong point of the Chinese ecosystem, and we completely understand about the central government has, of course, 1.4 billion people to kind of juggle. So that is fine for things to happen slowly. But what we want is to leverage the talent pool that has been created through these tech giants in China and then leverage them into the blockchain space and export it overseas.

Angie Lau: And so what are you exporting? What kind of ideas are you exporting from the talent pool here in China?

Sam Lee: The opportunity for us to export Chinese blockchain capability is that we could build things faster, cheaper and quicker than anyone else in the world through the existing payment and technology expertise that China has. Apply that into blockchain, layer on some smart contracts and some blockchain sexiness, and you have an explosion of allowing any country in [and] outside of China to build a solution similar to WeChat that is secured and custody, and transparent on the blockchain.

Angie Lau: And so really what you’re leveraging is this enormous speed in which China has adopted fintech, has a talent pool of developers and coders that support that, and then build kind of the back engine to whatever product that can be exported and used in any other country. That’s what it sounds like.

Sam Lee: Yeah, absolutely. We want to have the rest of the world experience China’s payment technology. But regulation in these parts of the world struggle to understand that payment technology really requires regulatory approval to to digitize value. And I understand that a lot of regulators are here to protect end consumers, but that is also stifling innovation.

So through the blockchain, we’re able to more easily prove to regulators that the tokens are backed by real value because of the transparency and the limiting of supply or the management of a treasury to ensure that we’re able to create a WeChat-like payment solution in any country in the world.

Angie Lau: Is it easy for you to find projects that you want to invest in in China?

Sam Lee: Well, in terms of investing in China, we definitely have made numerous investments on the equity side. And we feel that at the right time, creating a byproduct that involves a tokenized unit overseas makes perfect sense. Just like how many Chinese companies have a three tier corporate structure that allows them to list in the US, we see the same [idea] applying to having a Chinese company having a three tier structure to create a token overseas as well.

Angie Lau: What do you think of [China’s] central bank backed digital currency that is about to be launched in either probably next year or sooner?

Sam Lee: I’m so excited that governments around the world are leveraging Blockchain technology to more efficiently manage the digital value and this process is going to save governments potentially billions of dollars and also increase the velocity of trust and the transfer of value. If we increase the velocity of value, that means everybody can actually have more value in their pockets at the same time.

Angie Lau: Tell me about the one thing that excites you the most in based here in Shanghai, setting up here and thinking about blockchain innovation. What are the projects that excite you the most?

Sam Lee: Well, what excites us the most is the ability for anyone to imagine anything. And for the turnaround time in the development houses in China to be almost weekly. Within a sprint, you’ll get new functionality, new features. And for that to spread blockchain adoption on a global scale is instrumental because this industry moves so quickly, this technology moves so quickly. So you really do need a very proactive force of developers that can make it happen almost overnight as opposed to going through the whole three month, six month waterfall project plans.

Angie Lau: How does China compare them in terms of speed of talent and speed of evolving functionality to European teams, to American teams, to even Australian teams, in your point of view?

Sam Lee: Well, Chinese blockchain talent has been evolving as the new features and functionality that B.A.T. [Baidu, Alibaba, Tencent] the large tech giants in China actually build as well. So if you look at the velocity of capital in China, it’s faster than anywhere else in the world not only because of the population density, but also due to the digitization of value.

And now this kind of experience would increase economic activity in any country that adopts it. And so what we want to drive is these countries having the right framework for us to deploy and copy paste the technology outcomes that Chinese people have benefited from into these western spheres of influence.

Angie Lau: Ok, so if I were to understand this and correct me if I’m wrong, that in a country of 1.4 billion people, the technology has evolved at such a speed that proof of concept is happening all the time. And if the regulatory framework then becomes more consistent outside of China, in Australia, in Europe, in America, that the products that are created here in China could easily be transplanted and used because it’s already been tested by 1.4 billion people.

It’s already been debugged. It’s already been evolved within this incubator. It’s almost like you’re explaining China as like a giant incubator for blockchain innovation that potentially we could see down the road two, three, four years from now.

Sam Lee: Yes. And what is a good example of this technology and action is we’ve got ATMs, vending machines, coffee machines, gaming machines, all accepting tokens. And we’re talking about over 600 tokens available on our custody solution that is enabling all this hardware to actually interact with all these digital tokens that you can’t touch.

This kind of realization that blockchain is real, by getting your coffee or getting a bag of chips from a vending machine is what we have exported from China. And it is going to be even more crazy with the ability to use facial recognition and to issue loyalty and reward points for, for instance, employees who turn up on time or the ability to scan your face 10 times and get a free coffee.

So that is, I think, where the rest of the world can benefit, because what we’re talking about is the next level of incentivisation and the next level of gamification. And it’s already happening in China.

Angie Lau: Cryptocurrency, though, is not legal to use. So how does the token economy fit within that policy framework, that guideline that China has issued?

Sam Lee: Well, what we have created is corporate backed tokens that are pegged to the Chinese yuan. It’s more like a debt instrument. And of course, you could spend this debt instrument in a vending machine inside your workspace.

Angie Lau: So it is not necessarily a decentralized cryptocurrency. It’s more like a stable coin, like an internal token that is tied to the yuan.

Sam Lee: Exactly, so think of it this way. You work for an extra couple of hours overtime. And when you sign out by pressing your thumbprint on the corporate device that registers your sign out, that device is linked to your corporate wallet that gives you 20 more tokens that is spendable inside the corporate ecosystem.

Angie Lau: And so it really is a social experiment as well as a business experiment, because you’re testing out how people engage with the token economy.

Sam Lee: Exactly, and get this, you put rubbish in a rubbish bin. The outside of the bin actually is covered with a panel. It’s kind of like a flexible display screen. So as soon as you put rubbish in the bin, the flexible display screen displays a QR code that you have to quickly scan in five seconds.

Once you scan it, it rewards your wallet with a token that you’re able to then spend at a vending machine right next door. So what we’re doing is talking about picking up loyalty points, picking up these kind of little social engagements for being a good citizen. That is happening already in China, that we believe is driven more effectively on a blockchain.

Angie Lau: That’s amazing. Can’t wait to learn more. That’s for another conversation.

Sam Lee: Yes, and I look forward to that other conversation to happen in Paris or Shanghai or… Oh, actually, we are in Shanghai.

Angie Lau: Truly, truly global. You guys are everywhere. Thank you so much.