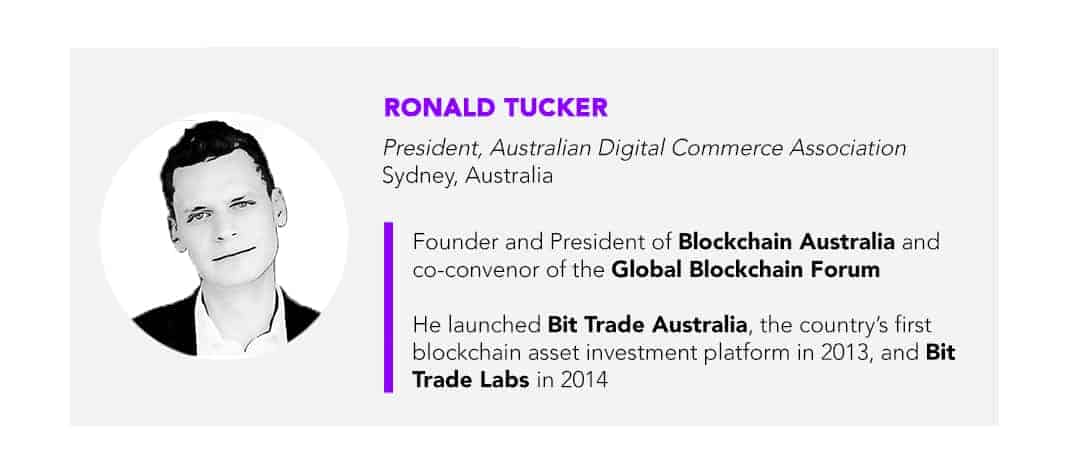

WATCH: Balancing Innovation and Regulation in Blockchain: Ronald Tucker

Ron Tucker, Founder and Chair of the Australian Digital Commerce Association, describes his long-running involvement in the industry and the reasoning behind his faith in the technology. As the head of a crypto exchange, Tucker has been involved in navigating and advising the regulatory steps that institutions such as FATF are taking. Contrary to concern about these new policies stymying the growth of the industry, Tucker asserts that the regulation is necessary in providing a safe environment for cryptocurrency to grow.

Ron Tucker, Founder and Chair of the Australian Digital Commerce Association, describes his long-running involvement in the industry and the reasoning behind his faith in the technology. As the head of a crypto exchange, Tucker has been involved in navigating and advising the regulatory steps that institutions such as FATF are taking. Contrary to concern about these new policies stymying the growth of the industry, Tucker asserts that the regulation is necessary in providing a safe environment for cryptocurrency to grow.

Key Highlights

- “These 20 largest exchanges and any crypto exchange operating with the set of best practices and having their own commercial interests in mind, they will be applying the best anti-money laundering and counter-terrorism financing measures in place”

- “I saw a great revolution at hand, and it was something that I wanted to make sure that certainly Australians had an ability to participate in this new economy as it arose”

- “There is a lot of work that now needs to be done by the global crypto exchanges to come together and make sure they have the protocols and technology in place to meet those new requirements.”

- “It is a matter of getting all of the stakeholders to the table first.”

- “For as quickly and effectively and cost-efficiently as we can innovate, we do need that time and we need to be brought together.”

- “Poorly run businesses produce poor results. Financial crime impacts all of us, especially their bottom line. So getting that right approach is critical, but again, we feel it should be, if not industry-led, heavily industry informed. We need to work together consultatively with regulators to get those settings correct.”

- “I think any central bank or even corporate board is remiss, if not borderline negligent, not to be fully up to speed on this new technology and how it is going to impact the current whether it is their organizations or financial stability of a nation.”

Listen to the podcast version

As such, Tucker formed an industry body in Australia to represent and advocate for the interests of his peers in engaging with regulators. The importance of such a group cannot be emphasized enough – Tucker talks about the difficulties of getting everybody to the negotiating table, as well as the advantages of having continuing dialogue within the community that shares common interests.

See related article: Top Takeaways from OECD Global Blockchain Policymakers — What is Coming in 2020

The future of cryptocurrency is bright, says Tucker. Read Satoshi’s white paper in 2013, he’d known that he was bearing witness to a technological revolution. He has only been proved right thus far, Tucker believes, and cryptocurrency truly stands to be the next world-changing development, akin to Netflix or Uber. Tucker talks about the potential involvement of central banks in this technological future, and how best to position oneself in light of these developments.

Full Transcript

Angie Lau: Welcome to Forkast.News, we are here at the Asia Blockchain Summit 2019 in Taipei. Sitting across from me is Ron Tucker. He is Founder and Chair of the Australian Digital Commerce Association. This is an organization that really helps trigger, set the tone and the pace of regulatory guidance and conversation with not only Australia but around the world. Very recently in Osaka for the V20, which was a parallel summit aligned with G20, and this conversation that world leaders were having on that stage on cryptocurrency.

So, Ron, welcome. Tell us what the conversation was at V20 as you aligned with industry leaders in parallel to what global leaders were talking about in the cryptocurrency space?

Ronald Tucker: Sure. This was an exercise to bring together representatives from the 20 largest crypto exchanges in the world to be able to have an informed conversation amongst ourselves, but also with the Financial Action Task Force, which, as you may be aware, recently put through a set of guidelines globally to help regulate cryptocurrency internationally.

Angie Lau: So the rule is the FATF rule, which is housed in the OECD headquarters in Paris, was essentially that all cryptocurrency exchanges must provide I.D. of participants exchanging at least one one thousand dollars in assets. So basically that removes the anonymity factor of cryptocurrency. Is that a good or a bad thing?

Ronald Tucker: I think nobody wants to see financial crime. Not only is it bad for societies and certainly a headache for regulators, but it’s bad for the bottom line of business. So you’ll find that these 20 largest exchanges and any crypto exchange operating with a set of best practices have their own commercial interests in mind, they’ll be applying the best anti-money laundering and counter-terrorism financing measures in place.

So yes, I would say it’s a good thing. Otherwise, what we put forward to FATF is the need to continue to consult with them to make sure we get the right settings that are workable for industry and we get the right technologies in place to help them do their jobs and do it better.

Angie Lau: You’ve been in this space since 2013, in the early days?

Ronald Tucker: Yes. It was February 2013 working in an incubator space in Sydney, Australia, and somebody had come in with the Satoshi White Paper, dropped it on my desk, and I didn’t sleep for three days. What I saw when I read it was, was this the Uber moment to banking? Was this the, you know, Netflix to Blockbuster of banks, central banking, even? I saw Great Revolution at hand. And it was something that I wanted to make sure that certainly Australians had an ability to participate in this new economy as it arose.

Angie Lau: Fast forward to short six years later and you have international collaboration on guidance of this currency, this cryptocurrency dreamt up by somebody called Satoshi putting a out white paper in 2008.

Ronald Tucker: Well, after launching the crypto exchange in February 2013, it was about a year later, May 2014, when the Australian Tax Office called in. At that point, the seven heads of the crypto exchanges that had emerged.

Angie Lau: Of which you were one.

Ronald Tucker: Of which I was one. And that day, understanding the nature of the impact that a taxation like that could have on our industry. And at the time we said, look, this is an existential threat to our businesses. A full 10 percent tax on the entire supply of bitcoin could send it underground. It’ll send businesses overseas.

But you mentioned Satoshi for the course of the day, having that conversation, we realised there was a need to form a proper industry body on behalf of Australian businesses to engage with regulators. And it was a gentleman by the name of Dr. Craig Rate, who joined us about halfway through the day when we realized just how important it was to have that representation to explain how it was going to impact us. So that was step one, the trade association. Two years later, we linked up with the Singaporean Cryptocurrency and Blockchain Association access, the US Chamber of Digital Commerce and our UK Counterpart Association.

We signed an MOU which formed the Global Blockchain Forum, and that was with an eye on if bitcoin or cryptocurrencies emerge is truly a global de facto currency. What types of things are we going to need to think about in terms of regulation, policy alignment, interoperability? So that was step one. As of last year, we’ve gone to 15 countries’ trade associations.

So when the FATF guidelines came through February 22nd of this year, we naturally called out to those other trade associations to activate and to come together and engage with FATF on this situation, and that’s what we did last week successfully at the G20.

Angie Lau: All right. What was the guidance that the V20 group came up with?

Ronald Tucker: So the guidances have come down to say essentially crypto is something that should not be regulated through SRO models, self- regulatory models, and said it should belong in the hands of financial crimes regulators of the national jurisdictions. There was the cap of a thousand dollars known as the Travelers’ Rule in the US. The U.S. has the most mature regulatory framework in the world for the traditional financial services sector. So what’s being applied now is that to our crypto sector.

So a thousand dollars, anything above that is going to require full KYC and the exchanges need to know who the senders are and where they’re sending to more importantly. So there is a lot of work that now needs to be done by the global crypto exchanges to come together and make sure they have the protocols and technology in place to meet those new requirements.

Angie Lau: How expensive is it for exchanges to meet those requirements?

Ronald Tucker: Well, fortunately, this is arguably one of the most innovative and agile industries in the world. So I would say not that expensive, but it’s a matter of getting all of the stakeholders to the table first.

Angie Lau: If it wasn’t that expensive, why was that not implemented before the regulators came down and said these should be your best practices?

Ronald Tucker: Well, we’ve been given a very short window. Unfortunately, it wasn’t until February 22nd of this year that those proposed standards came forward before we really could contend with and get a handle on what it was we were going to have to develop. April 8th, three weeks later, the industry was called together for a consultation at the United Nations with FATF.

We had a group of central banks, financial crimes regulators, the existing FS sector, And then about forty five from the crypto industry, from some of the biggest brands in the world, from Coinbase Bitfinex Kraken altogether. This was our first chance to start. So for as quickly and effectively and cost efficiently as we can innovate, we do need that time and we need to be brought together. So that’s that was a first step.

Angie Lau: Slightly controversial in that there’s a lot of people in this space that say regulated regulatory policy inhibits the innovation, inhibits the growth. And yet you have an entire industry group that says actually, we do need rules.

Ronald Tucker: Yes, absolutely. So striking that balance is difficult. And we always have to be mindful of the very nature and spirit of where our industry has come from, certainly where I came from six, seven years ago. But one thing I’ve also learned is, is that poorly run businesses produce poor results and financial crime impacts all of us, especially their bottom line. So getting that right approach is critical. But again, we feel it should be, if not industry led heavily industry informed. We need to work together consultatively with regulators to get those settings correct.

Angie Lau: What’s the validity of even blockchain or cryptocurrency in this space as it pertains to fintech? You heard from Nouriel Roubini today who pretty much said that the entire industry is, excuse my language B.S. How do you balance those types of opinions versus really the innovation and the technology that you see behind the scenes?

Ronald Tucker: That’s a that’s a great question. Look, I think we have to be mindful, as with all things, this is a community. We’re going to have a myriad of opinions and voices. So, again, all the more reason to come back to striking at the core of what the technology demands, which is collaboration. That’s what blockchain is, it does not work without collaboration and through consensus.

Now, the technology itself will insist and deliver that to us. But in the meantime, we still need to take the people together originally and have those conversations and take on board what’s needed. But ultimately, we’ll leave it to those to a consensus of the group. Again, why we had the V20 together to see where we could go and how we can work together.

Angie Lau: Your view on central banks getting in on the action of providing digital assets?

Ronald Tucker: I’m a big fan. I think it’s important to keep an eye on the horizon. Central banks should be mindful of the innovation and be looking at the very least. I think any central bank or even corporate board is remiss, if not borderline negligent, not to be fully up to speed on this new technology, how it’s going to impact the current, whether it’s their organizations or financial stability of a nation. So just for these, you know, coming into it, the conversations are most important and coming to these types of exercises like the V20,.

Angie Lau: You spent six years in the industry project forward, six years from now. What are we going to be talking about? How will the landscape have changed and how will real people, you and me, use cryptocurrency, if at all?

Ronald Tucker: Well, I would say in six years time, I mean, we are moving at lightning speed. This is moving faster than the development of the Internet and how it affected just about every other industry up until this point. I mean, it’s money. It’s, you know, lowest hanging fruit. So you will see it move quickly. But I expect what we see is it becomes more about the plumbing in the background. That’s where the technology sits.

And the user out in front needs to be less aware about it. They won’t need to worry about it. Think about email back in the earliest of days. 1990 I think it was my mother working at the local university, I’d have to dial it and type in my TCP IP settings and get two or three days to get the email done. It wasn’t until Hotmail came along in ’95 that changed email forever. Just a simple log in, send your email. I think we’ll be much closer to that in six years with crypto. And in terms of I guess more philosophically, where do we go?

You know, when I read that white paper, this is absolute truth will flash in front of me, as I have mentioned Uber, I’ve mentioned Netflix, but oh my God, if you have a mobile phone in your hand and a crypto wallet and a dollar is finally worth a dollar globally, a bitcoin is a bitcoin. We remove the dollar disparity around the world and then all you need is anyone, no matter where they are, has a fair shake at building something for themselves if they have a good idea and are willing to roll up their sleeves. So I see a whole transition in the coming decade to the global economy.

Angie Lau: But doesn’t that mean it’s got to be more decentralized versus central banks centralizing the control over these digital assets?

Ronald Tucker: You know, that’s a great question. The way I’d go with that is, look, you can certainly commercially you need to be on top. You need to continue to innovate, be one step ahead, OK, but change is inevitable. So even if there is to be a transition from the way things were to the way things are going to be, even being prepared to help make that disruption a little less disruptive, easier on yourselves, the better. And that’s the point of governments and central banks as well. They’re here for the people. So, yeah, we can be a part of that and help people forward. We’re grateful for it.

Angie Lau: Ron Tucker, very good to see you, very good to meet you. Thanks so much.

Ronald Tucker: Such a pleasure. Take care.