WATCH: From Myanmar to South Korea: Breaking Down Blockchain’s Future in Asia with Paul Ulrich, GSMA

Key Highlights

- “For the blockchain technology itself, there’s universal acceptance. I haven’t come across one government either in person or having read about any that are at all negative about the underlying technology. They are ambivalent about a key application, which is financial cryptocurrencies, because of certain things that have happened over the last two or three years. But the technology itself, they see the efficiency and productivity gains that can be achieved in the private sector and public sector, and they want to take part in that.”

- “From a regulatory standpoint, I think the [developing country] that has been the most active has been India and that’s exciting because of their size and their influence in the sub-continent, especially for the countries around them. It was the first country anywhere in the world to mandate the use of blockchain for a key regulatory aspect, which is to block unwanted calls, which are a concern for multiple countries, from the US and UK to India… And that went very well.”

- “Pakistan… is a very quick and straightforward example of a country that’s seen as relatively not developed compared to say Japan or Korea but actually implementing something blockchain-based in a much more rapid pace. Because I haven’t seen, say, a remittance system or international transfer system yet from either Japan or Korea.”

- “I’m a big fan of stablecoins: currencies that are tied to fiat. Example: the recent initiative by Facebook, that didn’t get much press, which is quite interesting. There are two lines in its 20-page white paper, and 100 pages of documentation basically saying it wants to create a self-sovereign ID system, which would be on an ID system based on blockchain, where the users themselves have control of their data – what is released selectively, decentralized, and secure. And that’s kind of the holy grail for IDs… A self-sovereign ID is a kind of platform, is a kind of system. How do you get a platform adopted? One way is to be a big platform already and tack it on to what you already have. And that’s what Facebook is able to do.”

- “I think the application, the proof of concepts that were across all industries are now moving into production level systems, so all the major platforms, the Googles, the Facebooks, Amazon, Tencent, Alibaba, SAP in Germany, those are the big ones worldwide. They all have blockchain as a service offering. It’s standard with whatever their cloud platform is. Telecom operators, mobile operators… we know we have to compete with those guys with cloud services and so forth, so we should have a similar kind of blockchain as a service, and we have certain advantages, as in 5G. As it’s evolving in taking hold now in a number of countries, you’re gonna have mobile edge computing very soon, and the telco operator’s best position is at the edge of the network… whereas the global internet players, they have these big cloud services, but they don’t have the ties that we do in the local governments.”

- “What operators refer to as zero-touch interaction… has a number of uses including, most importantly I think, cybersecurity, because for the Internet of Things, one drawback is these devices often don’t have the computing power to have adequate security, and so they’re a vector for hackers, and if you can get into a system that’s centralized, you can get into the whole system. So blockchain, apart from securing the network, edges. Its decentralized nature is also inherently more secure against hackers so it has multiple benefits.”

Listen to the podcast version

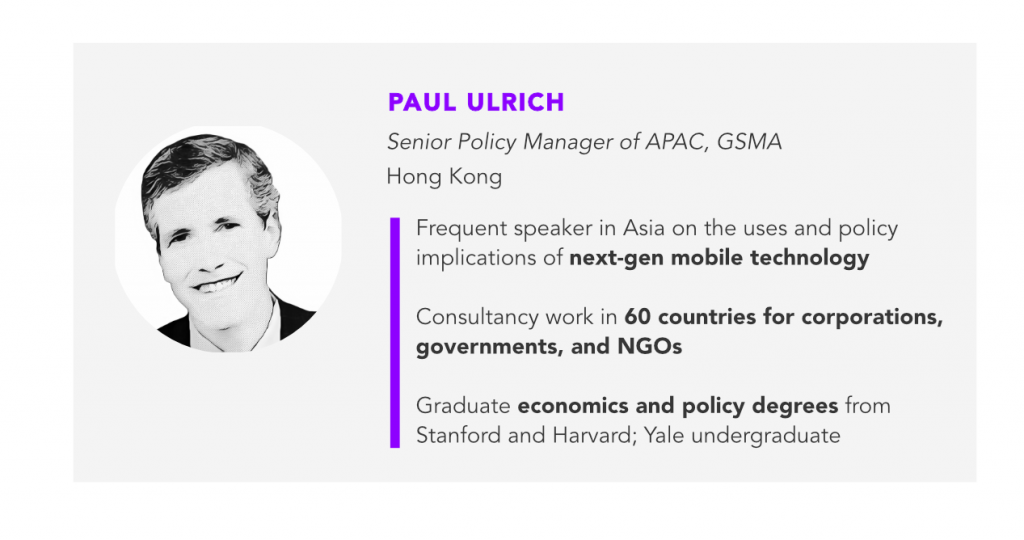

GSMA Senior Policy Manager Paul Ulrich sits down with our Editor-in-Chief Angie Lau to share his expert opinion on governmental and regulatory telecommunications companies’ attitudes towards cryptocurrencies. As the intermediary between governments and other parties, Ulrich is familiar with the inner workings of international bureaucracies. He balances the potential benefits of blockchain and cryptocurrency adoption with the risks they pose, in context with individual countries’ circumstances.

In China, for example, Ulrich postulates that despite its considerable talent pool and market, the government is taking too big a role, with no need for an intercept to be lawful, for a blockchain company to feel secure in establishing a stake there. The “Galapagization” of China is comparable to that of Japan in the early 2000s, and will result in a stifling of the blockchain industry there – lest its national bank makes good, quick, on its supposed intentions to create a cryptocurrency themselves.

In contrast, other developing nations in Asia stand to gain much from embracing the burgeoning industry. Ulrich takes Myanmar, India, Pakistan, and South Korea, among other countries, as case studies, citing examples from all three of blockchain involvement and its potential rewards. For example, the susceptibility of centralized systems to hacking can be lessened by the implementation of blockchain. In Korea, such an integrated Internet of Things system has been rolled out. Ulrich posits that it is telecom operators who should, and are, making waves with this experimentation, as they bear the burden of having to compete with “global internet players.” Stablecoins, Ulrich suggests, are one way to do so.

Full Transcript

Welcome, I’m Angie Lau, Editor-in-Chief and Founder of Forkast.News. We are here in Shanghai, we are at the GSMA Mobile World Congress in Shanghai, where tens of thousands, from mobile carriers to operators and everybody in between, are here talking about how emerging technology is changing the industry but also talking about blockchain. I’m here with Paul Ulrich. He is with GSMA. He’s a senior policy manager whose job it is to talk to governments, and regulators on behalf of members – I believe you said for mobile operators, and carriers and everybody in between. You are probably one of a few in the company, in the organization, talking about blockchain.

This is the first year that Blockchain Summit was part of the verticals here, at Mobile World Congress in Shanghai. You’re one of, certainly a growing number within the organization. Why is blockchain so interesting to your members?

Well, it’s getting traction in virtually every major industry in the C-suites. People are talking about it, governments are talking about it… when I go around the region I often offer to give an introductory presentation on blockchain and there’s always a lot of interest, from government top people to their staff, so they want to learn.

What is the color of that interest/concern? Is it, “what is this thing that is blockchain?” Give us a degree of the emotion and psychology of this interest.

For the blockchain technology itself, there’s universal acceptance. I haven’t come across one government either in person or having read about any that are at all negative about the underlying technology. They are ambivalent about a key application, which is financial cryptocurrencies, because of certain things that have happened over the last two or three years. But the technology itself, they see the efficiency and productivity gains that can be achieved in the private sector and public sector, and they want to take part in that.

In Asia Pacific, there is a very interesting dynamic with a lot of emerging frontier nations. I mean, there’s only one developed nation here in the Asia-Pacific, and that’s Japan. There is an opportunity though with emerging technologies like blockchain for a lot of these nations to leapfrog and join a global economy in a way they potentially never had the opportunity to do so. What are the most exciting nations right now to see the promise of blockchain technology transform their economies?

Well, from a regulatory standpoint, I think the one that has been the most active has been India and that’s exciting because of their size and their influence in the sub-continent, especially for the countries around them. It was the first country anywhere in the world to mandate the use of blockchain for a key regulatory aspect, which is to block unwanted calls, which are a concern for multiple countries, from the US and UK to India.

And that went very well. It took only nine months to get a working system going, involving 8 operators and fixed line carriers in India and the regulator, to step back and not have to manage that function, but have oversight of it, and blockchain allows that. And because they’re a regulator and can tell the industry what to do, it was an efficient way of getting a system that basically a few operators were hesitant about; they didn’t see the immediate return on investment, but the regulator published a 100-page explanation on the Internet, laying out how they could make more revenue, information from the operators themselves because they would have disaggregated information about consumers who could opt in or opt out of different types of wanted or unwanted calls and that information, that data is very useful. So they explain that you’re actually going to do better from this. And they all came on board, and it went so well that now the regulator is thinking of using it for mobile number portability. So it was orders of magnitude of improvement in the time to handle blocking unwanted calls and it could have the same effect in terms of mobile number portability, which is supposed to take no more than a day, but can go on for weeks as the operator who’s losing a customer tries to win them back… But with blockchain you wouldn’t have that.

Well, and if you just do a couple of steps more in terms of mental creativity of the changing business logic of applying blockchain, we could talk about digital identification. This is still a country of more than a billion people… just the magnitude of being able to individually identify each and every citizen in India – it’s still an impossible task at the moment.

Well, India is actually very advanced in that respect too. Their regulator was the one who put in place a few years ago this Aadhaar system. It’s the largest national digital ID system in the world: covers, probably 95% to 98% of the population, and it’s been very effective. And this is kind of a technical thing, but in blockchain there is something called the zero knowledge proof where you only release information that’s needed, you don’t release everything. So for example, proving someone is 18 or older, to vote or to go to a bar or whatever, they don’t have to provide the birthday, they just say yes or no. And the Aadhaar system actually uses that kind of yes-no information. So it was well-designed and the current chairman of the regulatory… he had put that in place starting in 2009 and he’s very interested in what technology can do. So he’s been very innovative.

Talk about the other countries as well. Myanmar is interesting. This is a hermit kingdom where when the embargo lifted, most people didn’t have cell phones. Today everyone does. The cost of a SIM card has been reduced to just mere dollars. What is the potential of a country like Myanmar to… after decades of not participating in a global economy, what is the potential of not only mobile but also marrying it with emerging technology like blockchain?

Myanmar probably of any country in history or in the world had the fastest rate of adoption not only of mobile phones, but of smartphones. They went from virtually single-digit penetration of mobile telephony to almost universal coverage, with maybe 70% smartphones. So that shows what telecom liberalization could do and how leap-frogging can occur. We are not engaging right now with the government for a political reason what I’m sure you’re familiar with what has happened in recent years, and the UN and and so forth. That’s an example, but we do work with our member operators there. So blockchain could have all the applications there as elsewhere. Another country at that level or maybe slightly more advanced is Pakistan, and Alibaba recently, about a year ago, bought a 50% share of the micro finance subsidiary of Telenor and within a few months, they set up a blockchain based remittance system with Malaysia, and these countries like Pakistan rely hugely on remittances coming into the country especially. So that’s a very quick and straightforward example of a country that’s seen as relatively not developed compared to say Japan or Korea but actually implementing something blockchain-based in a much more rapid pace. Because I haven’t seen, say, a remittance system or international transfer system yet from either Japan or Korea.

Forkast.News was just recently doing a reporting trip in Vietnam, as well. And what’s really interesting is that this is a population median age of 30, one of the youngest in the region. What’s exciting about that is also the comfort level of technology. A lot of the young people have grown up with the internet, they know how to use it. The developer talent pool is pretty strong there. How does blockchain help a country like Vietnam? And certainly for policy makers, how do they encourage that ecosystem to thrive, potentially also assisting in the GDP of Vietnam.

About a year ago, I met a Hong Kong-based blockchain company, and something like 90% of their staff and developers were all in Vietnam. They have, as you said, highly trained people, young people, and their cost structure is much lower than Hong Kong for a number of reasons. So that’s a great source of jobs, and transfer of technology. And Vietnam, like many countries and specific cities, wants to become the blockchain city or the blockchain country, so they’re welcoming these kinds of companies with all sorts of incentives for blockchain. Some are more ambivalent, as I said, about crypto-currency. Korea last year… They were going to ban it, and then they saw that a lot of investment was going to Singapore and they reversed their decision. So that’s more problematic.

You bring up a great point because you can’t have blockchain industry hoping for it to thrive and then suck out the very incentivization called crypto-currency from it, so that that innovation goes elsewhere. We’re seeing it right now from the US side. There’s a lot of brain drain when it comes to this technology and it’s coming to Asia; we are seeing it. So how do you tell or talk to a government like Vietnam, that says a crypto-currency is illegal?

Well, I’m a big fan of stablecoins: currencies that are tied to fiat. Example: the recent initiative by Facebook, that didn’t get much press, which is quite interesting. There are two lines in its 20-page white paper, and 100 pages of documentation basically saying it wants to create a self-sovereign ID system, which would be on an ID system based on blockchain, where the users themselves have control of their data – what is released selectively, decentralized, and secure. And that’s kind of the holy grail for IDs. Other companies or other foundations like in Europe, you have sovereign uPorts. It must be a handful of these that have been working on it.

They don’t have the scale of Facebook. So while they’ve been underway for several years, we haven’t seen widespread adoption and a self-sovereign ID is a kind of platform, is a kind of system. How do you get a platform adopted? One way is to be a big platform already and tack it on to what you already have. And that’s what Facebook is able to do.

How would a country like China think about the Libra project and the impact that has on the global economy?

Unfortunately, China, while they have great technical talent and a very innovative ecosystem, is increasingly becoming its own Galapagos, as it were. And you might think back to Japan in the 1980s and ’90s; they were way out in front in technology, but I think this term of ‘Galapagization’ started with Japan. Sort of a sui generis system, and now their network equipment providers are maybe 1% of the global market, 2% tiny Fujitsu or NEC. So they have their own system, and it didn’t evolve or keep in step and harmonize when the Apple smartphone came out 10-12 years ago. So there may be your risk for China, in that. On the crypto-currency side, I don’t think they allow it at all and they’re clamping down on the crypto-mining. At one point there were three-quarters of the world’s cryptominers there, so I’m sure it’s environmentally unsustainable. So with good reason, they’ve been clamping down on that. But I’ve heard that… I think this was in the press a while ago that the People’s Bank of China wanted to come out with its own digital currency, so, they have not allowed the two big players or the three (Tencent, Alibaba, or even Baidu) to have any kind of crypto-currency because they want do it and make sure they get everything right themselves first.

It’s very interesting to see what’s happening in China. These conversations thrive and exist. I was just talking to China Telecom. They’re coming up with a blockchain SIM card. So really they’re looking at the adoption of blockchain technology internally, here within domestic orders, very encouragingly, very warmly. But the thing is, how do these policies also suck the oxygen, suck the innovation out of potentially what could be 10x or 100x. For example, it is now illegal to be a node in China unless you get permission from the government first, and this actually kind of dams down on the innovation.

Right. And that is scaring people away. At least one company I know of, a blockchain firm that has global operations, they’re staying away from mainland China for that reason. It’s not only getting permission to have a node, but also, the Chinese government, if they want, can get access to all the data. And that’s fine, but in the West, you need a court order or a warrant of probable cause. You need to show what we call in the telecom industry ‘lawful intercept’ so, if there’s probable cause and something wrong is going on, we encourage the law enforcement to take a look, but if not, then that could be construed as invasion of privacy or commercial secrets or whatever.

In certain countries in the world where they make a request that maybe has political motivations or some other motivation that’s not related to these legal precepts, our operators will push back to the extent that they can and say, “well we need a court order or something to do that.”

When did GSMA start thinking about blockchain or even paying attention to it?

I’ve been with GSMA for less than two years, so I think they were thinking about it before I joined, but we only called a list back in September. We have a monthly call of about 30 of us who are interested in it, so it’s been building momentum and I think you mentioned that this was the first time they had a blockchain Summit in Shanghai. I noticed – I’ve been to the Mobile World Conference in Barcelona twice, it occurs in February – and a year and four months ago, blockchain was relegated to a tiny part of the whole exhibition hall, and then this year it moved to Hall 8, getting closer to the main stage, so I expect by next year, it will be on the main stage in Barcelona. I would be very surprised if it’s not.

It is that quickness of the evolution and adoption. What do you think is driving it? Why do you think people are getting more and more excited about it within the industry?

I think the application, the proof of concepts that were across all industries are now moving into production level systems, so all the major platforms, the Googles, the Facebooks, Amazon, Tencent, Alibaba, SAP in Germany, those are the big ones worldwide. They all have blockchain as a service offering. It’s standard with whatever their cloud platform is. Telecom operators, mobile operators… we know we have to compete with those guys with cloud services and so forth, so we should have a similar kind of blockchain as a service, and we have certain advantages, as in 5G. As it’s evolving in taking hold now in a number of countries, you’re gonna have mobile edge computing very soon, and the telco operator’s best position is at the edge of the network.

So yesterday in the innovation city or four years from now, I saw a very interesting presentation of a startup that has a blockchain solution, and a chip that is developed to handle automatic payments among things at the edge, where the telcos, the mobile operators, are strong and they have control; whereas the global internet players, they have these big cloud services, but they don’t have the ties that we do in the local governments.

Centralization as well. You’re talking about what naturally exists in the telcos, which is decentralization. There are 1,200 members around the world, but all under one umbrella. That umbrella is becoming increasingly powerful. Where do you see telcos, smart phones, blockchain being four years from now, or five years from now?

Well, predictions are hard, especially when they’re about the future, but your smartphone is a kind of Internet of Things device. It’s the end point of the network and blockchain is often combined with artificial intelligence and with IOT or Internet of Things, for example, increasingly at point of sale, which is also kind of an end device, so you’re gonna have AI embedded more and more in your smartphone. Some of it is there already with systems like Siri, voice recognition, where you type an email and it automatically fills in the words correctly for you. I can take notes faster on my smartphone than I can on my laptop. So all that functionality will be at the edge of the network on your smartphone, on your Internet of Things device, and it’ll occur without human intervention; it’s what operators refer to as zero-touch interaction, so it doesn’t require a human or monitors to oversee it. It has a number of uses including, most importantly I think, cyber security, because for the Internet of Things, one drawback is these devices often don’t have the computing power to have adequate security, and so they’re a vector for hackers, and if you can get into a system that’s centralized, you can get into the whole system.

So blockchain, apart from securing the network, edges. Its decentralized nature is also inherently more secure against hackers so it has multiple benefits. And we’re already seeing, for example, in Korea about two months ago, KT, which is the largest fixed line and mobile operator, they announced a 5G-based IOT blockchain-secured system called Gigachain. Basically, what it does is it uses blockchain to mask the IOT device address. Because just like on the web, you have website addresses, every IOT, and anything that connects to the internet has its own address and there are services that can look those up and hackers can buy them. Several $100 a month can buy into those services and access, whether it’s smart city street lights or electric grids, perhaps. Hopefully those are more secure. Or consumer home devices. So they could do all sorts of things. And so blockchain can be used to hide that.

Well, I expect to see you on the main stage. I think blockchain is going to be on the main stage and it will stay there for years to come. An incredible insight into what telcos are thinking and also what policy makers and governments across the Asia-Pacific are thinking. Paul, that was wonderful. Thank you so much for your insights. And thank you everyone for joining us. We will see you later. I’m Angie Lau. Until then.