The Federal Reserve Bank of New York has joined hands with the Bank for International Settlements (BIS) to launch an innovation hub in New York— dubbed the New York Innovation Center (NYIC) — to explore and build financial technology products for the central bank community.

Fast facts

- The NYIC will focus on five areas — supervisory and regulatory technology, financial market infrastructures, future of money, open finance and climate risk.

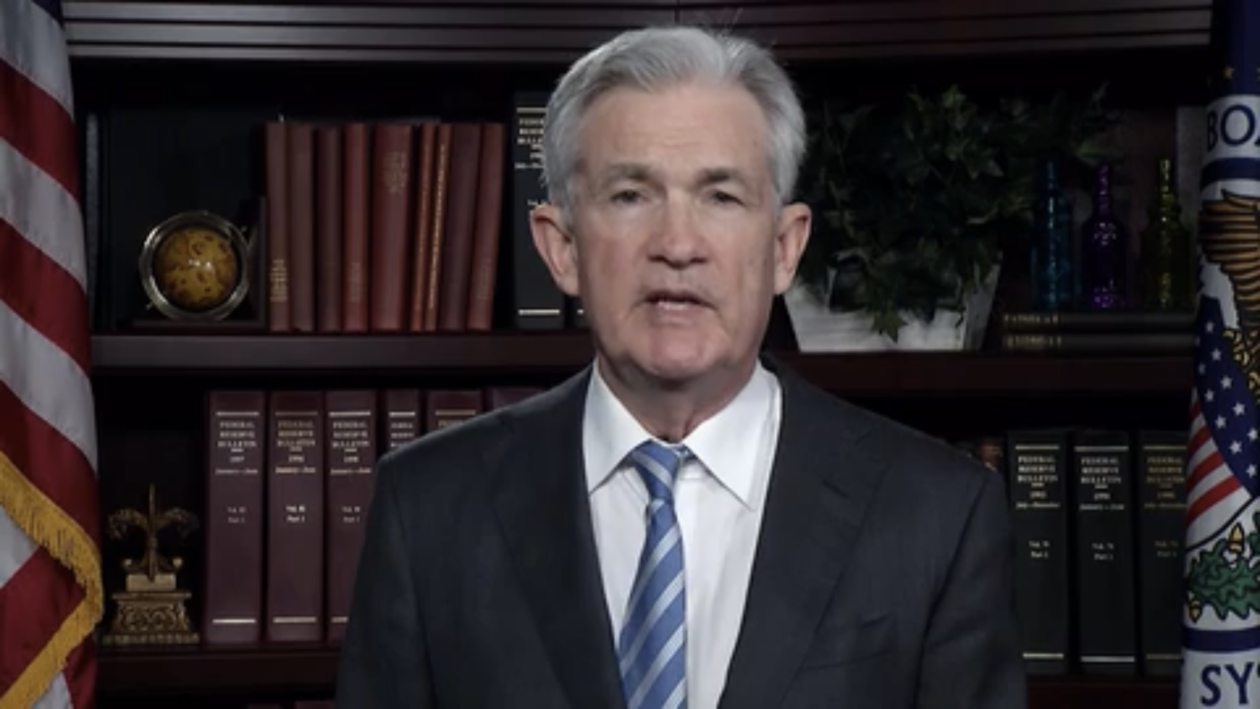

- Notably, Jerome Powell, chair of the U.S. Federal Reserve, said Monday at the center’s virtual launch event that the new partnership with the BIS will “support our analysis of digital currencies — including central bank digital currencies.”

- Powell, who has been renominated for the U.S. central bank’s top job by President Joe Biden and is widely considered crypto-skeptical, said the new center will also work to help improve the current payment system with a particular focus on making cross-border payments faster and less expensive.

- “The NYIC represents a unique opportunity to drive innovation in collaboration with the central bank community,” said Per von Zelowitz, who joined the New York Fed in July.

- On top of the new venture in New York, the BIS has established a number of innovation hubs in Hong Kong, Singapore, Switzerland, London and Stockholm. On a wholesale level, the central banks of China, Hong Kong, United Arab Emirates and Thailand, together with the BIS Innovation Hub in Hong Kong, have been collaborating on a multiple CBDC (mCBDC) bridge project to develop an international settlement platform to facilitate easier cross-border payments.

- In September, the BIS Innovation Hub announced it is also working with central banks of Australia, Malaysia, Singapore and South Africa to collaborate on testing the use of central bank digital currencies for international settlements.