Investment in the area of phygital commerce — the blending of the physical and digital worlds in the customer’s experience — has remained strong, despite an unruly end to 2022 for the blockchain industry. The concept of a blended marketplace — where physical and digital commerce combine — has piqued the interest of many Web3 companies, creators and tech giants alike. The adoption of non-fungible tokens within the fashion arena, in particular, has gained huge momentum in recent months. Many fashion conglomerates such as Gucci, Vans and Ralph Lauren have demonstrated their commitment to this new era of commerce, setting up shop in the metaverse and creating their own exclusive NFT collections. E-commerce analysts have taken notice of this trend, with a BigCommerce report praising Balenciaga for blending the physical and virtual worlds.

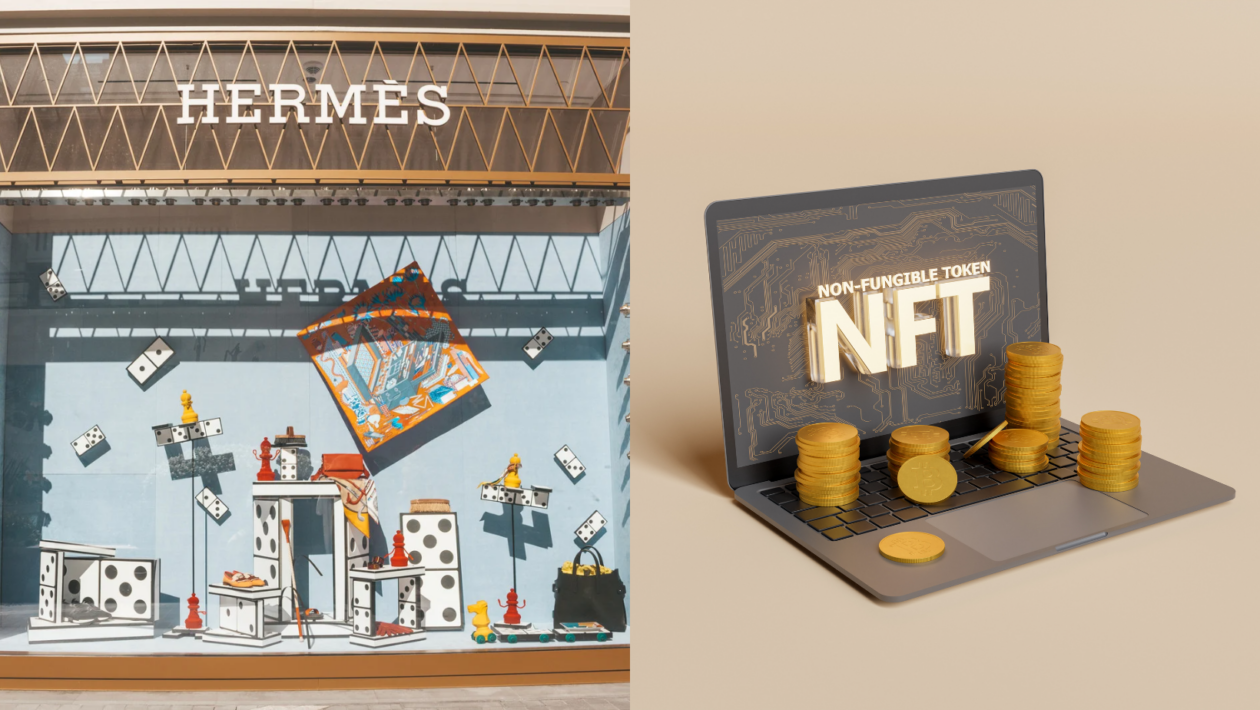

The recent Hermès v. Metabirkins trial has brought the protection of intellectual property rights relating to NFTs into question. While IP protections were relatively simple to enforce in the analog era, the digital world has brought new challenges to the fore — with complications arising, in this case, around the Birkin bag. An NFT artist was selling digital renditions of Hermès’ most famous handbags, named after the actress Jane Birkin. Hermès sued the artist, Mason Rothschild, and a jury found that the NFTs violated the luxury fashion house’s trademark.

What the verdict means for established brands

Fundamentally, NFTs are not a threat to the IP of major brands — that’s why so many are investing in Web3. However, the outcome of this trial has set an important precedent by extending trademark law to cover brands’ own NFT collections.

This landmark legal case clarifies that NFTs are digital versions or extensions of a brand’s physical consumer products and are therefore IP-protected. The ruling further protects brands’ investment in NFTs, and ultimately, this is just one example. Web3 will be very positive for brands on the whole, and the industry is realizing that. Going forward, a line has been drawn between artistic expression and the protection of original creators, paving the way for mainstream investment in the space, and subsequently setting up the continued growth of phygital commerce.

The next step for Web3 is to achieve global adoption within and beyond its current beachhead of the fashion industry to transform the world economy. The verdict of this Hermès trial will see brands act with confidence when expanding their earnings, knowing there is legal precedent for their right to do so. As this trend grows, we will begin to experience a computable economy, built up of computable capital (NFTs), where all physical products and services across the world are available in one interoperable format, known as “programmable commerce.”

Therefore, Web3 leaders have an opportunity, amid the noise created by this case, to refocus the industry’s attention on the benefits of asset tokenization. Going beyond IP rights, it becomes clear that blockchain technology is not here to undermine the value of brand assets; rather it will enable more opportunities for IP holders to leverage their IP to increase revenue for their creations. Once creators and brands alike see the value of NFTs in this light, the immense value and programmable nature of blockchain and Web3 become apparent.

There are several utilities to NFTs that can provide immense benefits to brands and consumers alike. The first of these is secondary sales, which is a huge area that luxury brands aren’t yet taking full advantage of. Enabling royalties on secondary sales — of not just digital but physical items — can be achieved by encoding NFTs redeemable for physical luxury goods. This ensures that brands receive a royalty every time a product is bought and sold again. Another useful utility of NFTs is their ability to prove authenticity, prevent counterfeiting and track provenance.

Future opportunities

Increased clarity coupled with the opportunity presented by Web3 and NFTs has meant that brands can now act with confidence in the wake of the Hermès trial. This opens up an already available revenue stream for brands, empowering them to grow profits through novel business models. While challenges have existed in the past for luxury brands in protecting their IP rights within the digital realm, NFTs and blockchain are serving as a solution to this, and the verdict of this landmark lawsuit could see a summer of phygital commerce upon us.

As well as bolstering profit-generating opportunities, NFTs have forged a new means for brands to engage with their communities and reward their loyal customers. For example, to use a sports analogy, a team could sell its match tickets as NFTs, encoded with additional benefits for those in possession. This could give supporters a discount on refreshments at the stadium or the ability to purchase limited-edition merchandise or highly sought-after tickets for a subsequent match. The possibilities are also endless when it comes to NFTs and customer loyalty programs. We have already seen this with major names, including Starbucks, which recently launched its Odyssey blockchain-based loyalty scheme. We should expect more brands to follow suit as they wise up to Web3’s opportunities.

It is only a matter of time before phygital commerce becomes ingrained within the everyday buy-and-sell market. With clear precedent on IP rights surrounding NFTs now in place, this will open the doors to those brands that were previously deterred from getting involved in this new commercial paradigm — particularly high-end brands that thrive off exclusivity and hallmark creative designs. New players are emerging into this new layer of commerce at a rapid pace, in a race to position themselves as leaders in the industry, and those that aren’t embracing it will sooner or later get left behind.