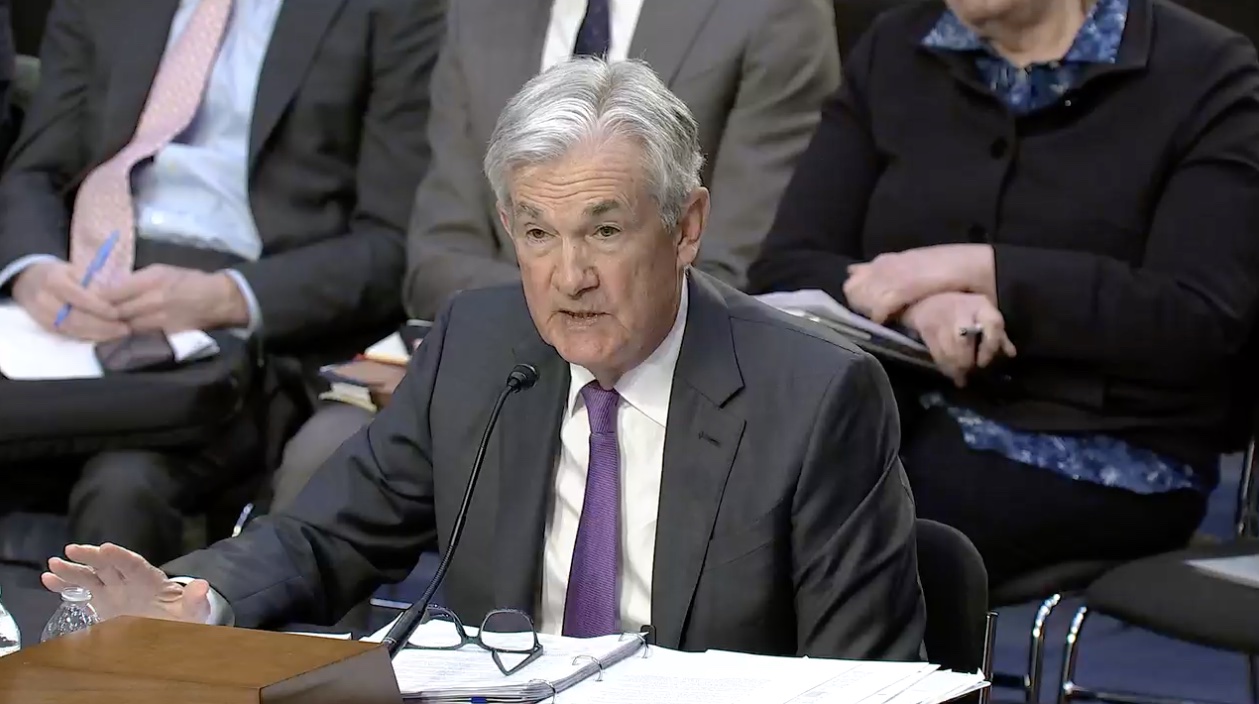

Stablecoins could have a place in the U.S. financial services sector if appropriate regulation is put in place, Federal Reserve Chairman Jerome Powell said on Tuesday at a hearing before Congress.

See related article: U.S. Congress, not the SEC, will set cryptocurrency regulations, says Blockchain Association

Fast facts

- “We don’t want to stifle innovation,” Powell said during his semiannual report to the Senate Banking Committee. “We don’t want regulation to stifle innovation in a way that just favors incumbents and that kind of thing.”

- “What we’ve been doing is making sure that regulated financial institutions that we supervise and regulate are careful (and) are taking great care in the ways that they engage with (the) whole crypto space and that they give us prior notice,” Powell added.

- Powell also reiterated the central bank’s “same activity, same regulation” principle. “People are going to assume when they deal with something that looks like a money market fund, that it has the same regulation as the money market fund or a bank deposit, and so stablecoins need some attention in that respect,” he said.

- In January, four senior officials in U.S. President Joe Biden’s administration called for Congress to step up efforts to regulate the cryptocurrency market.

- The Blockchain Association Chief Policy Officer Jake Chervinsky said last month that Congress will ultimately set the laws in the country to govern the crypto industry and not the Securities and Exchange Commission, which has filed lawsuits and regulatory actions against crypto companies.

See related article: Bitcoin dips, Ether little changed, with top 10 crypto mixed following U.S. equity slump