Last month, the Bank of England published a discussion paper on CBDCs that delved into how this technology could present a number of opportunities for the way that the Bank of England “achieves its objectives of maintaining monetary and financial stability” and also asked for feedback and ideas from the public and industry parties.

The then-bank governor, Mark Carney, stated in the foreword that “We are in the middle of a revolution in payments.” He further elaborates that “the use of banknotes — the Bank’s most accessible form of money — is declining, and use of privately issued money continues to increase, with technological changes driving innovation.”

He also asks: “as the issuer of the safest and most trusted form of money in the economy, should the Bank provide the public with electronic money — or a Central Bank Digital Currency (CBDC) — as a complement to physical banknotes?”

Central banks control price stability, inflation and employment, and they walk the tightrope to ensure that the economy grows and jobs are created while keeping inflation in check. Former U.S. Federal Reserve Chairman William McChesney Martin described the Fed’s role as “to order the punch bowl removed just as the party is really warming up.”

In the past few years, there has been a global shift by central banks into digital currencies, with northward of 50 nations actively exploring the concept, some rolling out pilots, and China’s Central Bank, the People’s Bank of China recently filing 84 patents in relation to digital currencies. Indeed, a study by the Bank for International Settlements found that 80% of central banks are engaged in some form of CBDC work, with 10% expecting to issue their own within three years. This indicates that digital currencies are here to stay.

There is little doubt the unveiling of Facebook’s digital currency Libra and its ability to potentially engage two billion people (representing a quarter of the world’s population) has caused central banks and regulators to sit up and take notice. The BoE amongst others have taken a hardened stance on Libra, requiring it to meet its highest standards prior to launch in the UK, some have suggested that this was the reason behind the withdrawal of high-profile partners such as Paypal, Visa, and Mastercard from the Libra Association. Facebook and its remaining partners last week extended an the olive branch with a redesign to offer stablecoins tied to local fiat currencies.

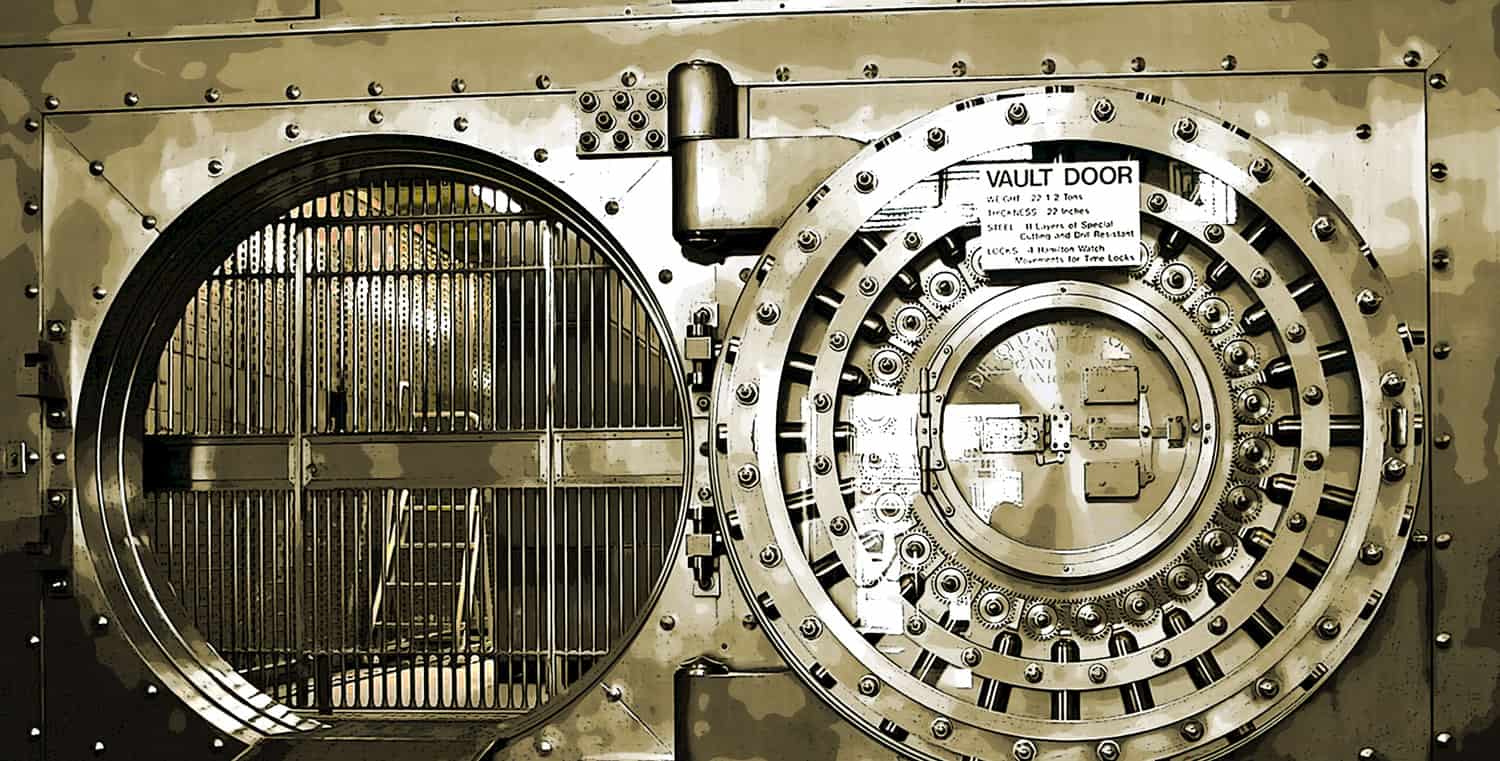

At present, central bank-issued money can only be held in the form of coins and notes. A CBDC would function as a new form of money issued by the central bank that would offer citizens and businesses a new mode of payment. This would differ from digital cash, i.e. what you use to pay when you shop online or use your debit card in a store, which just serves as an electronic representation of physical money.

It’s worth mentioning, that in reality, central banks have issued digital currency for decades, but only ever to a select group of financial institutions under the guise of the reserves in their role as the lender of last resort. They have never done so directly to retail customers.

In line with the change in spending behavior, research suggests that digital currencies have a positive impact on the economy through the simple fact that they are easier to spend. This would provide central banks with more efficient ways of implementing monetary policy. Mohammad R. Davoodalhosseini from the Bank of Canada believes that being able to accurately trace money flows on the blockchain and, as a result, being able to execute a more active monetary policy is perhaps one of the most significant selling points for a central bank digital currency. In addition, the ease of distribution and reduced cost of transactions would provide further efficiencies for central banks especially when transacting cross borders.

See related article: Why is China’s Central Bank Launching a Digital Currency? Chicago Booth Economist Explains the Impact