The pile-up of bad news in May has left the future of the metaverse looking decidedly bleak at a surface level. The meltdown of TerraUSD, volatility in cryptocurrencies and jitters in technology stocks are hardly encouraging. Bitcoin itself has been under pressure, losing about half its value from its 2021 peak. Even Meta, the parent of Facebook and one of the biggest names in metaverse developments, is pulling some plugs, announcing cutbacks at its Reality Labs division in May.

All this comes after a stunning hack at the end of March, when some US$600 million in token value was stolen from Axie Infinity players.

It is no wonder that companies and entrepreneurs may be questioning their convictions around the technology that will underpin Web 3.0.

These headwinds are strong, but they are temporary. Companies and individuals will continue building digital worlds, and their presence in them, because that’s where consumers want to be.

Long-term thinking

After the Terra/Luna meltdown, cryptocurrencies more broadly lost billions of dollars in value. That’s been a painful lesson for many, yet the impact is only likely to carry weight in shorter-term speculative trading.

The bigger picture revolves around the long term value of Bitcoin, decentralized finance in general, and the blockchain-gaming foundations of Web 3.0 and the metaverse.

The promise of integrated, interoperable and open economies online will continue to drive consumer interest and activity. And once a critical mass is reached, the branding and sales opportunities in the metaverse are only going to add to that momentum.

As a parallel, e-commerce was once such a niche market compared to physical retail that some industry analysts speculated it would always be a side show. Today, according to eMarketer, e-commerce already accounts for more than 20% of global retail sales. In three more years it could represent about a quarter of the total, surpassing US$7 trillion in value. There have been hurdles along the way, but pandemics and wars have only made online outlets and connections more critical. E-commerce itself has become a destination store, to use the formal retail-industry definition.

The metaverse is on a similar track. Major investment banks, such as Goldman Sachs, Morgan Stanley and Citigroup, are all predicting the metaverse will represent US$8 trillion to US$12 trillion in value over the next three to 10 years. Morgan Stanley has even issued a note saying the metaverse could be worth US$8 trillion in China alone.

Where is the value?

Blockchain games are a big part of it. According to DappRadar, a blockchain data and reporting firm, blockchain games attracted US$2.5 billion of investment in the first three months of 2022; the pace is on track to beat 2021 by 150% for a US$10 billion investment year.

Games and virtual worlds, like Sandbox, Decentraland and Axie Infinity are all attracting new unique users. According to DappRadar’s latest data, blockchain-based gaming is growing at a rate of 2,000% a year, with over 1.23 million wallets interacting daily with blockchain games in April, an all-time high. Even for Axie Infinity, where token prices took a hit, user metrics are up.

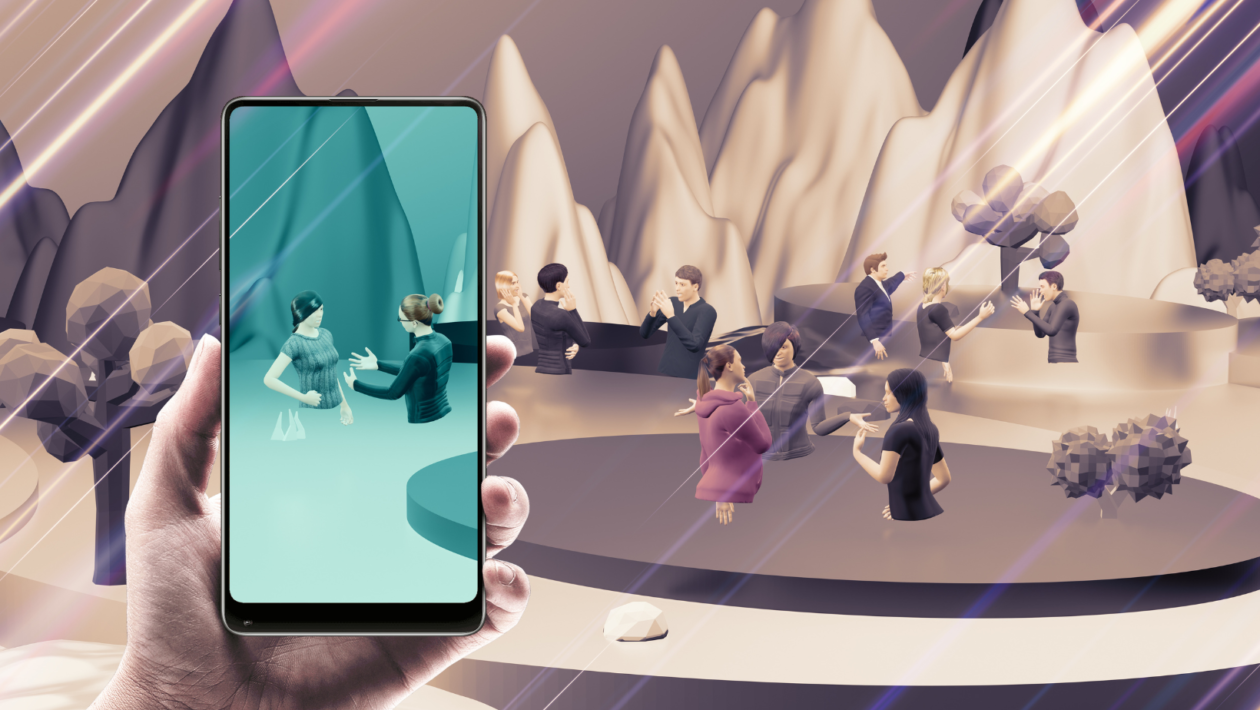

Blockchain games are so popular because people like the idea of the decentralized web. They get more control over their identity and their interactions in games and worlds that are both immersive and collaborative, often allowing users to build their own elements or contribute to their design. Add in an element of play time can also be earning time and the proposition for players becomes even more compelling.

Trading earned or created digital assets on a variety of open markets only adds to the fun and earning potential.

People like to gamble — on card games, lotteries or in the equity markets — and that risk/reward component exists for them too with blockchain games. An NFT (non-fungible token) of a specific game item or piece of virtual land could become hugely valuable. Or it might not, so there is a thrill factor there.

Social media platforms built billion-dollar businesses just on “likes.” So why wouldn’t an immersive, blockchain-based world that combines this social element with addictive gameplay, real-world earnings and even shopping be a success? It will.

No doubt, there’s still a high degree of hype versus reality when it comes to the metaverse or Web3. But this is where consumers want to be, and companies will be obliged to follow. And wars and pandemics that fracture international connections and hold back physical travel only make that more likely.

The metaverse is not a trend. It’s the destination.