Total weekly global non-fungible token (NFT) sales dropped by 72% this week from the previous week, with the number of unique buyers surging 75%, after cryptocurrency exchange Coinbase introduced its own Layer 2 blockchain that came with free NFT airdrop.

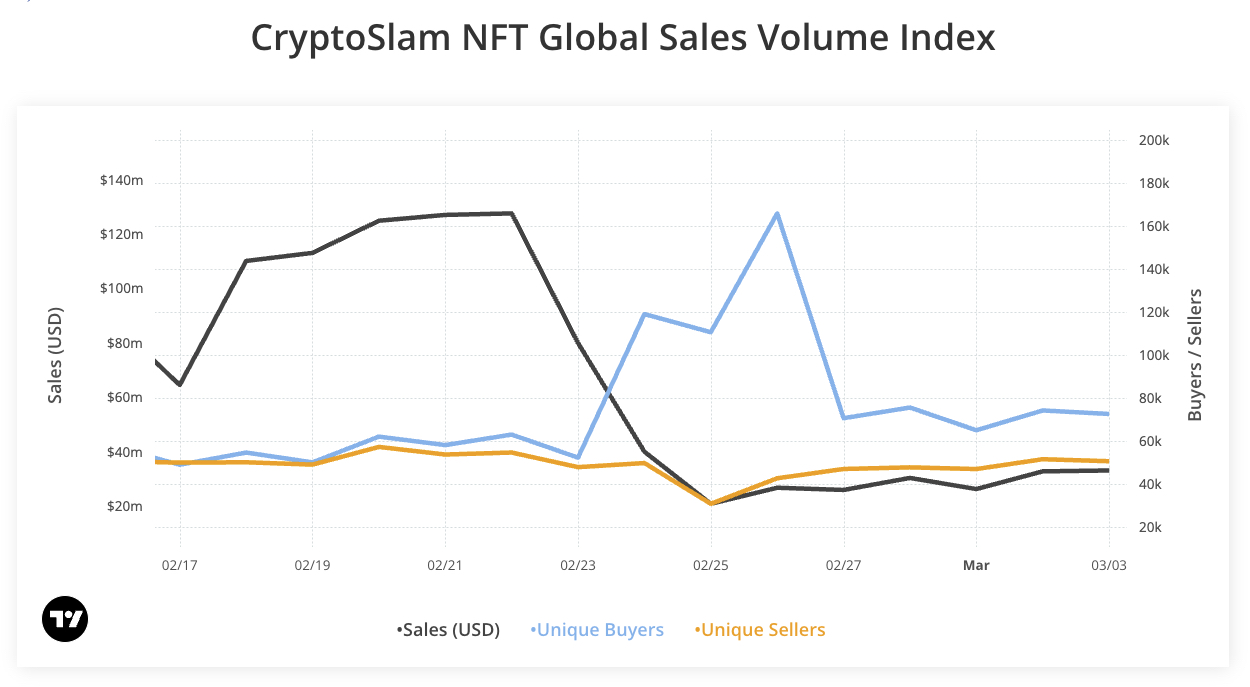

Total weekly NFT sales shrank to US$203 million in the seven days from Feb. 24 to March 2 from US$747 million in the previous week, according to data from NFT aggregation site CryptoSlam.

Notably, the number of unique buyers strengthened to an all-time high of 165,840 on Feb. 26, and the weekly total rose by 74.9% from the previous week. The total number of unique sellers, however, dropped by 12.7%.

“Surprisingly, new buyers are really all organic and have nothing to do with gamification of Blur like one might initially expect,” said Yehudah Petscher, NFT relations strategist of Cryptoslam.

Petscher said Coinbase’s new blockchain launch could largely contribute to the spike in unique buyers.

Coinbase last week launched Base, a new Layer 2 network, and airdropped free NFTs called “Base, Introduced.”

“The catch is that you can only collect 1 (NFT) per wallet,” Petscher said. “The action we’re seeing is either traders creating multiple wallets to claim the NFT, or it’s possible that we’re also having an influx of people that Coinbase is newly introducing to NFTs.”

Petscher added: “If we see NFT volume rise in the following few months we can start speculating that we actually had an influx of new NFT traders.”

Meanwhile, CryptoSlam last week detected at least US$577 million worth of wash traded NFTs related to the marketplace, Blur.io, since the platform started airdropping its native tokens on Feb. 14. This suggested that some Blur users were selling NFTs to themselves using different wallets to acquire Blur tokens and accrue points for airdrops.

Wash trades, illegal in U.S. securities markets, refer to an investor acting as both the buyer and seller of a financial instrument to generate misleading trading volume and potentially manipulate prices.

Petscher said on Thursday that, for the most part, “it seems now that traders have been tuning out the noise of wash trading.”

“Education always leads to smarter trading, so hopefully we’re beginning to see the beginning of smarter trading,” he added.