The non-fungible token (NFT) space is growing faster than most had ever imagined. In a few short years, it has gone from hundreds of people trading PFPs and art for fun into a multi-billion dollar movement behind principles of digital ownership and decentralization.

While the Forkast 500 NFT Index may not directly reflect it, the NFT space is maturing tremendously. In fact, falling NFT prices and lower volume are probably some of the biggest indicators of non-fungible tokens’ growth. NFT collections that were once worth tens of thousands of dollars are now sometimes worth just hundreds, and that’s a good sign that traders are learning how to value NFTs properly.

The products themselves are maturing too. Whether building payment tokens and utility into existing ecosystems or hiring one-of-a-kind talent, the most ambitious projects are keeping their heads down and building during the bear market. Some of their bold moves today will be looked back on as moments that cemented a strong foundation for Web3.

In December, Yuga Labs onboarded Activision Blizzard’s COO Daniel Alegre to Web3 as their new CEO, and last week followed it up by hiring Epic Games’ CTO Mike Seavers as their own. Yuga Labs’ past few months of impressive hiring show us the large grown-up steps the NFT space is now taking on the path toward mass adoption.

On the tech front, Yuga Labs has done nothing but impress too. During a beta test of their Otherside metaverse game last year, over ten thousand players came together in a single instance that seemed to defy at least my own expectations of what current technology would allow. Their second beta test this year was just as impressive, showcasing over seven thousand concurrent players in a 90-minute adventure into the future of blockchain gaming. Though these feats didn’t require the blockchain, if you combine this type of tech with digital ownership through NFTs, Web3 will offer gamers a futuristic experience that gamers will never want to leave.

Financial tech has also been evolving, with Polygon and other layer-2 blockchains pushing the boundaries of what can be done in defi. Squeeths and strattles are just two new types of defi investments that, in many cases, are backed by NFT positions.

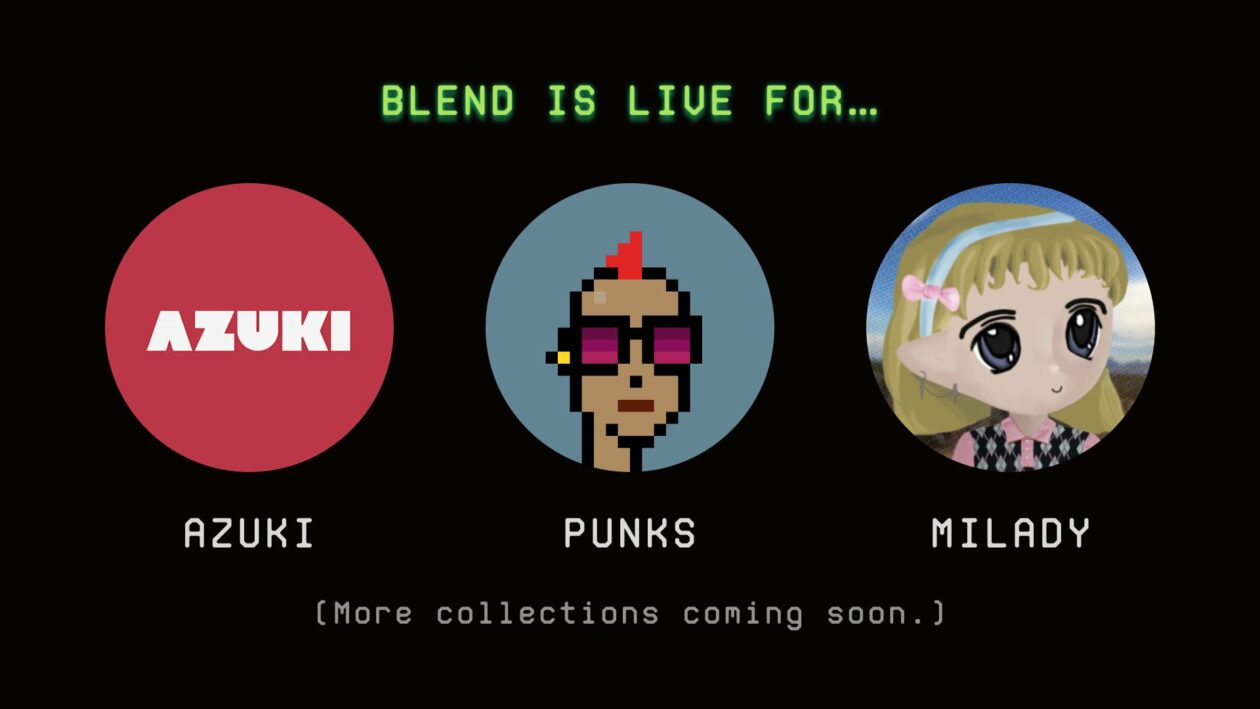

And now, Blur marketplace is crossing over into the world of finance with a new innovation called Blend, Blur’s spin on lending. Blend will let traders lend ETH, with borrowers putting up their NFT as collateral. They’re also offering a form of layaway where certain NFTs can be purchased for just a fraction of the cost, with a tacked-on daily interest fee. So if you see an NFT you want but can’t afford it, don’t sweat it, buy it. (What could possibly go wrong here?) Teasing aside, new tools and new ways to access liquidity are important for growing an ecosystem and will almost certainly make an impact on the NFT markets.

1/ Blur Lending, aka Blend, is NOW LIVE.

— Blur (@blur_io) May 1, 2023

If you have a Punk, you can now borrow up to 42 ETH within seconds.

If you want an Azuki, you can now buy one with just 2 ETH up front.

Points have been updated as well. Learn more 👇 pic.twitter.com/jRBwE8DYEo

Naysayers are beginning to change their tune about where NFTs are headed, and as easy as it would be to say, “I told you so”, it’s even easier to understand why they may have doubted NFTs’ significance. Today’s NFTs are markedly different than before, now more mature and supported by a growing cast of influencers and professionals that can speak on the tech with knowledge and conviction.

For now, we should enjoy watching the backbone of Web3 be built as it leads to a future where most businesses have at least some blockchain exposure. The time of true mass adoption is coming when the public may not even know they’re even using NFT tech, and that’s exactly the time you can say, “I told you so”.