Chinese President Xi Jinping’s endorsement of blockchain technology has spurred speculation of whether China and the U.S. are in a blockchain arms race, but Digital Asset CEO Yuval Rooz plays down concerns.

“I don’t view President Xi’s comments about blockchain as the start of a technology arms race,” he said. “I view them as an opportunity for U.S.-headquartered companies like Digital Asset to collaborate with companies in China who are looking to use or invest in distributed ledger technology.”

See related article: President Xi Jinping Endorses Developing Blockchain Technology in China

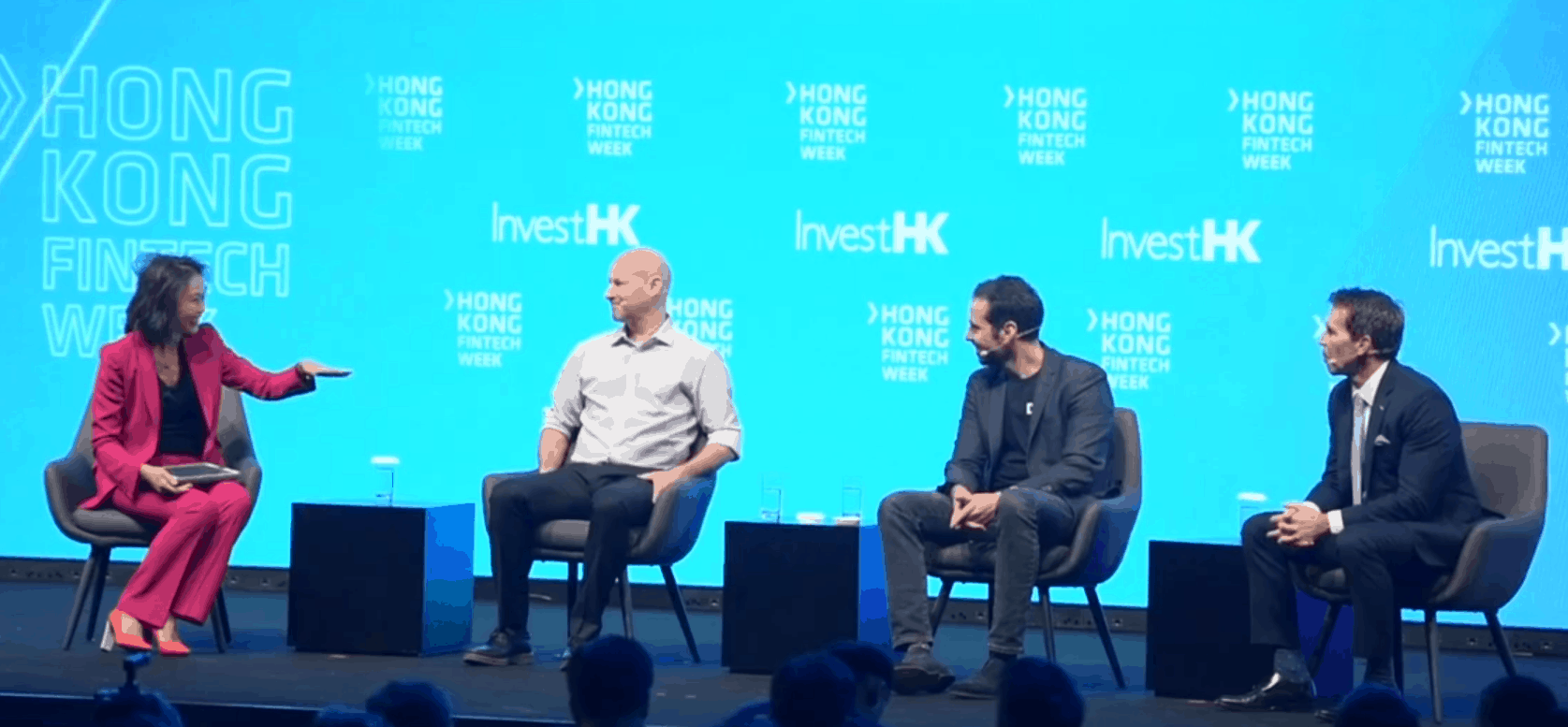

After speaking on a panel on how blockchain technology is changing the world of finance and enterprise at Hong Kong FinTech Week 2019, Rooz, along with R3 CEO David E. Rutter, answered questions from members of the audience.

Asked about obstacles to blockchain adoption in the current climate, Rooz explained how Digital Asset addressed such obstacles with Committed Settlement, an approach which allows blockchain adoption with less upfront investment and risk. Rutter, meanwhile, saw regulators as key players in “harnessing this new technology” as he discussed how the public sector could overcome deterrents to adoption.

In consideration of the Asia-based nature of the conference and Chinese President Xi Jinping’s comments on blockchain implementation in China, Rooz laid out his hopes for technological cooperation, not competition, between Chinese and U.S. blockchain companies, starting with Digital Asset’s own existing partnership with Shanghai-based Blockshine. Rooz and Rutter also elaborated on the blockchain applications they considered to be the most successful and impactful in their careers. The following is an excerpt of their answers:

What are some of the biggest hurdles each of you are facing in moving clients from the proof-of-concept phase and into building for production?

Yuval Rooz: “Blockchain mass adoption … still needs a lot of experimentation. The less costly and risky that experimentation is, the quicker it will become mainstream.”

Can you share what deploying on your platforms will be like? Is it ready to scale?

Rooz: “[Our platform, DAML, is] the only smart contract language that has been tested at the scale of a national equities market.”

Are the projects you are working on truly decentralized? Do they need to be?

Rooz: “Decentralization is a spectrum and not a goal in itself. Full decentralization, that is the ability to create a network that no one, or no group, can modify or censor is only desirable in some narrow use cases, such as censorship-resistant electronic cash.”

Are the projects you are working on truly decentralized? Do they need to be?

Rooz: “When you look at how assets that aren’t bearer instruments, such as traditional securities, have centralized entities issuing them, putting these assets on a decentralized network doesn’t magically make them censorship-resistant, but it does inherit all of the inefficiencies.”

What are the implications of regulatory capital requirements on securities custody and settlement as blockchain develops over the next five years?

Rooz: “Our guiding principle is that technology should support the existing legal frameworks governing business transactions and exchanges of value. Technology should not assume or attempt to change statutes and case law in order to support the value exchange it enables.”

Are we already in a so-called technology cold war? Given Xi’s comments on blockchain recently, how do you balance your strategy between breaking into China versus the U.S.?

Rooz: “I don’t view President Xi’s comments about blockchain as the start of a technology arms race! I view them as an opportunity for U.S.-headquartered companies like Digital Asset to collaborate with companies in China who are looking to use or invest in distributed ledger technology.”

What are the main obstacles to blockchain adoption by financial services firms, and do regulators need to do more to accelerate adoption of this technology?

David E. Rutter: “Any new technology which requires a firm – financial or otherwise – to rethink how it runs its business demands a considerable shift in mindset. Blockchain presents an amazing opportunity to solve non-differentiating, non-proprietary and redundancy [in] middle- and back-office processing, but these types of changes take time.

“Each and every day, we see the public sector’s level of engagement increase as they push to solve vexing issues – such as KYC, systemic fraud and more – by harnessing this new technology.”

Give one real application of blockchain that you think has been most successful in your career.

Rutter: “Trade finance in particular is a sector that is primed and ready for digital transformation – be it blockchain or otherwise – to make a difference.”