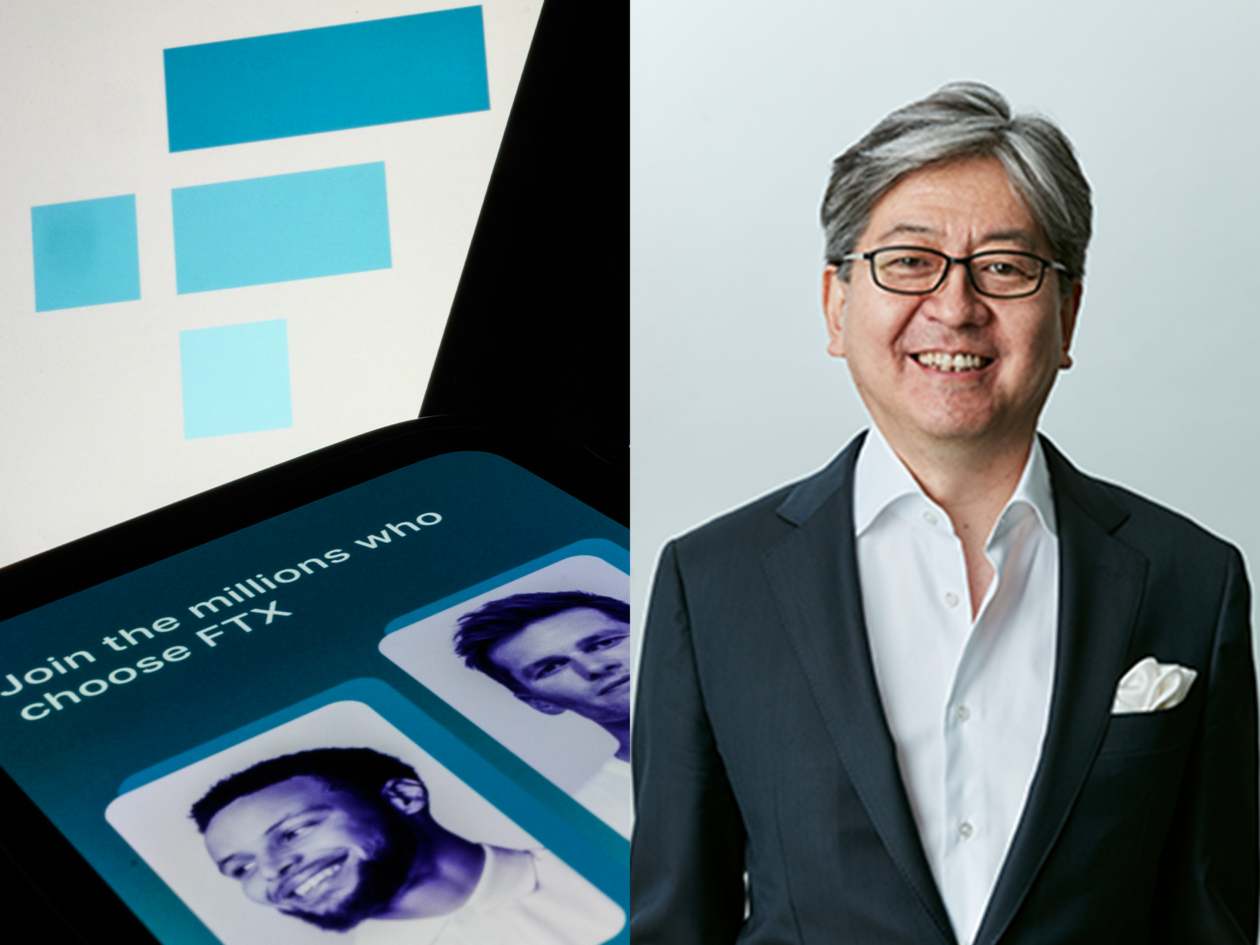

Tokyo-based online brokerage company Monex Group Inc. indicated it may join the bidding for the Japan subsidiary of Sam Bankman-Fried’s collapsed FTX cryptocurrency exchange, Bloomberg reported on Monday.

See related article: Bankrupt FTX exchange has recovered US$5 bln worth of ‘liquid’ assets, lawyers say

Fast facts

- “Generally speaking, we naturally are interested,” Monex Group’s chief executive officer (CEO) Oki Matsumoto told Bloomberg in response to a question about the upcoming sale of the Japan FTX unit.

- The CEO did not state that Monex will bid for FTX Japan, but said it will be a “very good thing” to reduce the number of crypto exchanges competing with Monex.

- Last Friday, the U.S. Bankruptcy Court in Delaware gave FTX permission to sell off assets to pay back creditors, which include FTX Japan Holdings, FTX Europe, stock trading platform Embed Financial Technologies, and crypto derivatives exchange LedgerX.

- According to the court filings, parties interested in acquiring FTX Japan need to submit a non-binding preliminary bid by Feb. 1. The final deadline for FTX Japan bidding is Mar. 15.

- Tokyo-listed Monex Group purchased local crypto exchange Coincheck Inc. in 2018, after the exchange suffered a US$500 million hack earlier in the year.

- FTX Japan announced last month that it is working to allow its users to withdraw assets in February through Liquid, the Japanese crypto exchange FTX acquired last year and turned into its subsidiary.

See related article: Alameda liquidators get liquidated while consolidating funds on DeFi lending platform Aave