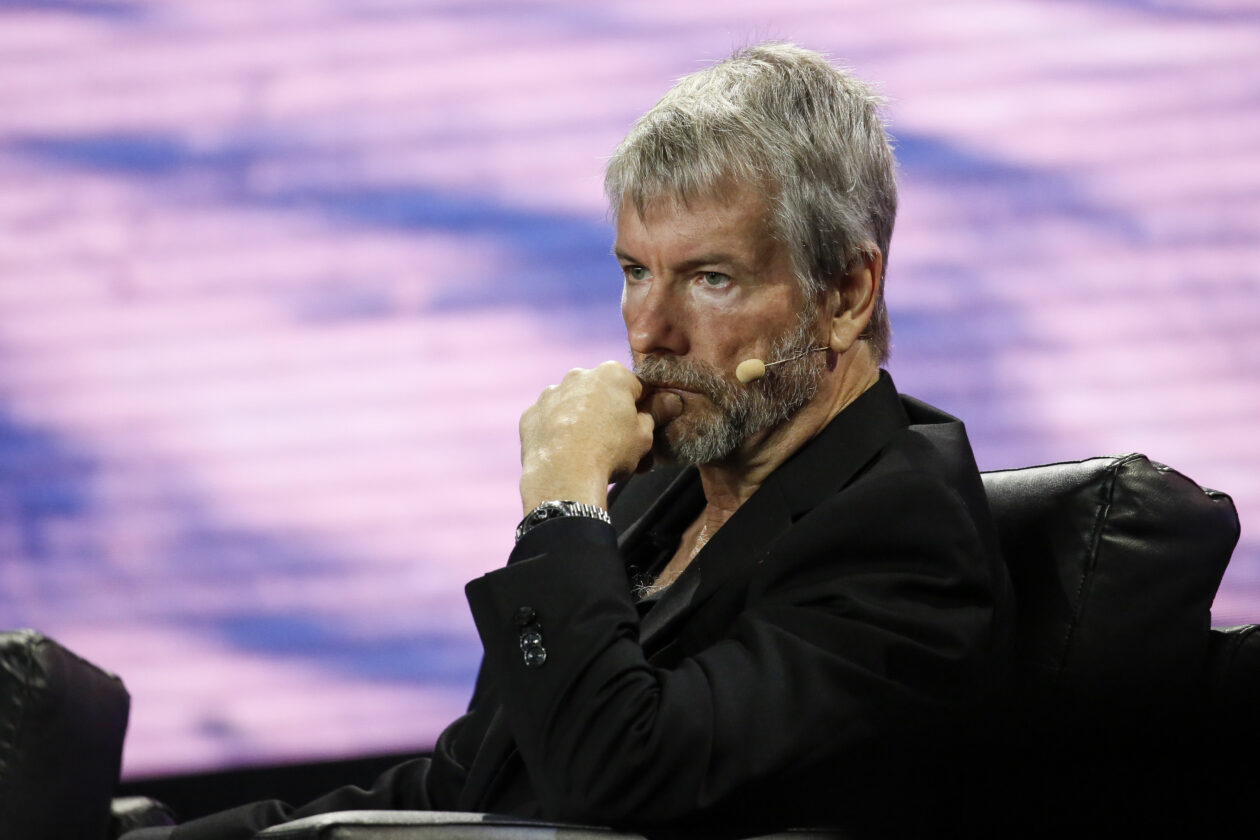

Washington, D.C., formally known as the District of Columbia (DC), is suing MicroStrategy Inc. founder and executive chairman Michael Saylor for tax fraud, alleging the Bitcoin evangelist failed to pay taxes for more than a decade that he has lived there.

In a series of statements on his verified Twitter handle, DC Attorney General Karl A. Racine Wednesday said his office is also suing MicroStrategy — which holds the most Bitcoin in its treasury of all public companies listed in the U.S. — for allegedly conspiring to help Saylor evade these taxes.

Forkast’s request for a comment to MicroStrategy sent via email outside of normal U.S. business hours was unanswered at the time of publication.

Saylor is accused of using an “elaborate scheme” to dodge paying taxes in DC between 2014 and 2022 by claiming to be a resident of Florida — a state that has no income taxes, according to a press release put out by the AG’s office.

For tax purposes, D.C. counts individuals who have homes in the District where they intend to remain or to return to after any absences, and individuals who maintain a residence in the District for at least 183 days during the year as residents.

Racine’s office believes Saylor resided in DC for at least 183 days of any given year and is therefore liable to pay taxes in the jurisdiction.

As a result, the AG’s office alleges Saylor neglected to pay more than US$25 million in taxes during this time, and that MicroStrategy assisted Saylor to do so by filing false statements with his Florida residence listed.

Racine is seeking to recover more than US$100 million from both parties to cover the shortfall in taxes and penalties that have accrued over the years.

“Although MicroStrategy is based in Virginia, Florida is where I live, vote and have reported for jury duty, and it is at the center of my personal and family life,” Saylor said in a statement released Wednesday. “I respectfully disagree with the position of the District of Columbia, and look forward to a fair resolution in the courts.”

Meanwhile, MicroStrategy has denied any involvement in the case, calling the issue “a personal tax matter involving Mr. Saylor.”

“The Company was not responsible for his day-to-day affairs and did not oversee his individual tax responsibilities,” MicroStrategy said in a statement. “Nor did the Company conspire with Mr. Saylor in the discharge of his personal tax responsibilities. The District of Columbia’s claims against the Company are false.”

Racine also said this is the first lawsuit brought under DC’s recently amended False Claims Act, which encourages whistleblowers to report residents who violate the district’s tax laws by misrepresenting their residence.

The case was first brought to the attention of the AG’s office by whistleblowers in April 2021, who originally sought to sue Saylor for tax fraud.

In April 2021, whistleblowers represented by Cadwalader, Wickersham & Taft, filed a lawsuit against Saylor alleging he had failed to pay taxes over a period of time. After independently reviewing the allegations the AG intervened and filed its own complaint against Saylor and MicroStrategy.

“D.C. residents and their employers are now on notice that attempts to evade the District’s income tax laws by falsely claiming that they reside in another jurisdiction will be investigated and, if substantiated, held accountable,” Racine said in a statement.

Saylor rose to prominence in the crypto community by being an outspoken proponent of Bitcoin and shifting a large part of MicroStrategy’s business strategy to Bitcoin acquisition, with the company now holding about 130,00 BTC valued at approximately US$2.6 billion at current prices.

He recently stepped down from his role as chief executive officer to become executive chairman and focus on Microstrategy’s Bitcoin strategy, and other advocacy initiatives.

The U.S. Securities and Exchange Commission (SEC) had previously accused Saylor of fraud along with two other MicroStrategy officials in 2000 for allegedly reporting profits when the company was actually losing money.

Saylor settled the civil charges without admitting or denying them and agreed to pay shareholders US$8.3 million along with a fine of US$350,000 to the SEC.