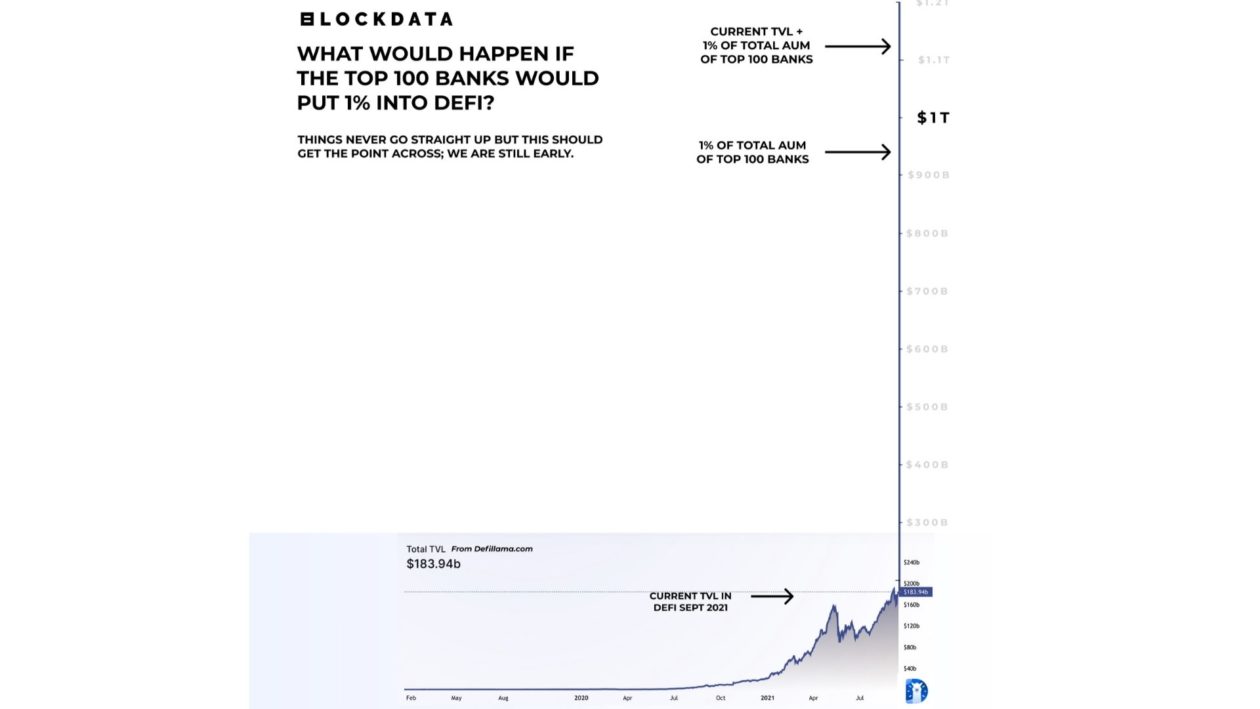

A trillion dollars could flood into decentralized finance (DeFi) if the world’s 100 biggest banks invested, even experimentally, into DeFi, according to blockchain research firm Blockdata.

DeFi — financial services that can be carried out on the blockchain without the need for intermediaries such as banks or brokers — has seen exponential growth over the past year. According to Chainalysis, a blockchain data analytics firm, DeFi adoption has been largely driven by bigger investors — large institutional transactions above US$10 million accounted for over 60% of DeFi transactions in Q2 2021, compared to under 50% for all cryptocurrency transactions.

Over US$178 billion is currently locked into DeFi protocols as of publishing time, according to DeFi Llama, and institutional investors are increasingly realizing that they cannot afford to ignore the potential returns DeFi can offer.

See related article: Why institutional investors cannot afford to ignore DeFi

Banks, too, are paying attention to DeFi. U.S. investment bank JPMorgan, which was initially averse to crypto, is bullish on the staking business, which currently generates US$9 billion in annual revenue and could be worth over US$20 billion when Ethereum 2.0 launches in 2022 and US$40 billion by 2025.

With 55 of the world’s top 100 banks, which hold US$94 trillion in assets, having invested in cryptocurrency, it would not be insurmountable to imagine that many of these banks and other institutions are now looking to put money into DeFi, according to Blockdata’s co-founder and general manager Jonathan Knegtel in an article published this week.

“If one or two major banks find a way to benefit from DeFi even with a small 1% injection, they will reveal a path that many, many more will want to follow so as to not be left behind,” said Knegtel, adding that 1% of US$94 trillion works out to US$0.94 trillion of new liquidity into the DeFi ecosystem — around half of the market value of cryptocurrencies and a drop in the ocean in terms of the traditional financial system.

“Whatever traditional finance has, there’s a parallel version in DeFi — credit lending, trading, derivatives, asset management, insurance and so on,” Mukaya Panich, chief venture and investment officer at SCB 10X, the venture arm of Thailand’s oldest bank, Siam Commercial Bank, told Forkast.News in a recent interview. “This could completely disintermediate the bank and financial institutions in the future. So we wanted to prepare the bank by investing and learning about DeFi and try to find partners and integrate DeFi with traditional finance.”

See related article: Why Thailand’s oldest bank is investing US$110 million in DeFi

What is institutional DeFi

Blockdata defines institutional DeFi as blockchain-based financial products that have been tailored to the requirements of institutions that have strict compliance needs.

The lack of regulatory clarity and concerns around compliance and security have been some oft-cited hurdles to greater institutional involvement in DeFi. Regulators, including the U.S. Securities and Exchange Commission, increasingly have DeFi in their sights.

Singapore’s DBS Bank, Southeast Asia’s largest lender, in a report on digital assets earlier this year, said: “DeFi, like any new technology application, is undergoing teething pains, including high cost of trading, volatility, and regulatory uncertainty. These are early days for what promises to be a source of a variety of financial intermediations. If DeFi can pass the test of speed, cost, and transparency, financial institutions would find it in their interest to join in, issuing tokens and acting as the bridge between centralized and decentralized finance. Regulators will have to evolve as well, needing to approve protocols and smart contract before they are widely used.”

Sam Lin, CEO Asia of Swiss-regulated SEBA Bank, recently told Forkast.News that as the DeFi industry matures, users have evolved from developers and crypto native early adopters to high-net-worth individuals, family offices and crypto hedge funds. Increasingly it is funds, trading firms and centralized yield platforms providing the bulk of the liquidity, Lin said.

DeFi infrastructure for institutions

Interest in DeFi for banks and other institutions has unleashed a wave of institutional DeFi service providers that are attempting to bridge the gap between DeFi and institutions’ regulatory and compliance needs. “Proper, regulated, institutional DeFi tooling is arriving, on schedule, with growing interest,” Knegtel wrote.

For example, Circle, the digital payments company that issues USDC, the world’s second-largest stablecoin, is rolling out a DeFi API for institutions to access leading DeFi protocols, starting with Compound Finance on the Ethereum blockchain. Aave Arc (formerly known as Aave Pro) enables institutions to access DeFi yields through private liquidity pools where participants have completed know-your-customer requirements.

Sidney Powell, CEO and co-founder of Maple Finance, a decentralized corporate debt marketplace built on the Ethereum blockchain, told Forkast.News in an email that he has seen a lot of interest from institutions in DeFi yield products. “They’re most attracted by capital preservation and risk mitigation because these are fixed income products. They think in risk-adjusted terms, so they’re looking for yields that are more attractive than what is available in traditional finance, but these yields can’t come at the expense of risk management and security. Hence, they care about the quality of the institutional counterparties on Maple.” According to Powell, Maple has had US$172 million of deposits since launching in May and over 80% of the deposits have been larger than US$1 million, which highlights the level of institutional adoption.

Institutional staking providers, custody support and KYC / KYT providers, with eyes on institutional usage, are also popping up making the transition from crypto to DeFi a lot more seamless, Knegtel added.

What’s next for institutional DeFi

“DeFi is the logical next step for investors into crypto,” Philip Gradwell, chief economist of Chainalysis, told Blockdata. “Bitcoin taught them that they could hold a crypto asset, DeFi is teaching them that they can use crypto assets in a wider range of financial activities.”

“But it really is still early days — there are only tens of thousands of entities involved with DeFi, an order of magnitude or two less than simply trading and investing the core assets. The most common institutional exposure to DeFi that I’ve heard of is gaining yield on stablecoins. This appears low risk and analogous to a money market fund but with better returns,” Gradwell said.

With the increasing interest in DeFi, infrastructure for functions such as compliance, trading and data analytics — financed by funding rounds, strategic investments and even acquisitions — is being developed to build and scale access for institutions to access crypto, Ethereum software company ConsenSys said in its DeFi ecosystem in Q2 2021 report.

As the players and products targeted towards institutions continue to grow, Blockdata expects the number of DeFi users to increase and more DeFi protocols creating permissioned versions that use whitelisted counterparties. A wider range of collateral used in DeFi protocols, such as non-fungible tokens (NFTs) or other digital assets could also be used. Traditional financial assets such as real estate, stocks, bonds could also make their way into DeFi protocols via asset tokenization, contributing to the movement of assets away from traditional financial services.

Institutional DeFi set for explosive growth

It may still be early days yet for DeFi but Knegtel predicts explosive growth in institutional DeFi given the fast-paced nature of the industry. “Regulations are quickly catching up and setting out their requirements, DeFi services are growing, maturing and becoming more attractive to institutions, and for the institutions, 1% of their AUM is a very small amount.”

“Institutions are in the phase of keen discovery when it comes to DeFi, but they are now waiting patiently in the wings as institutional service providers enter the market to appease regulatory scrutiny,” Knegtel added. “When, not if, these services pass muster, and institutions have their chance to test the waters, 1% of assets under management from the world’s top 100 banks entering DeFi may be an underestimation.”

See related article: Why some big investors are diving into DeFi but others are holding back