Indonesia’s central bank has released a whitepaper detailing plans for its central bank digital currency (CBDC), as the country looks to “advance digital transformation.”

See related article: Indonesia to launch crypto stock exchange at end-2022

Fast facts

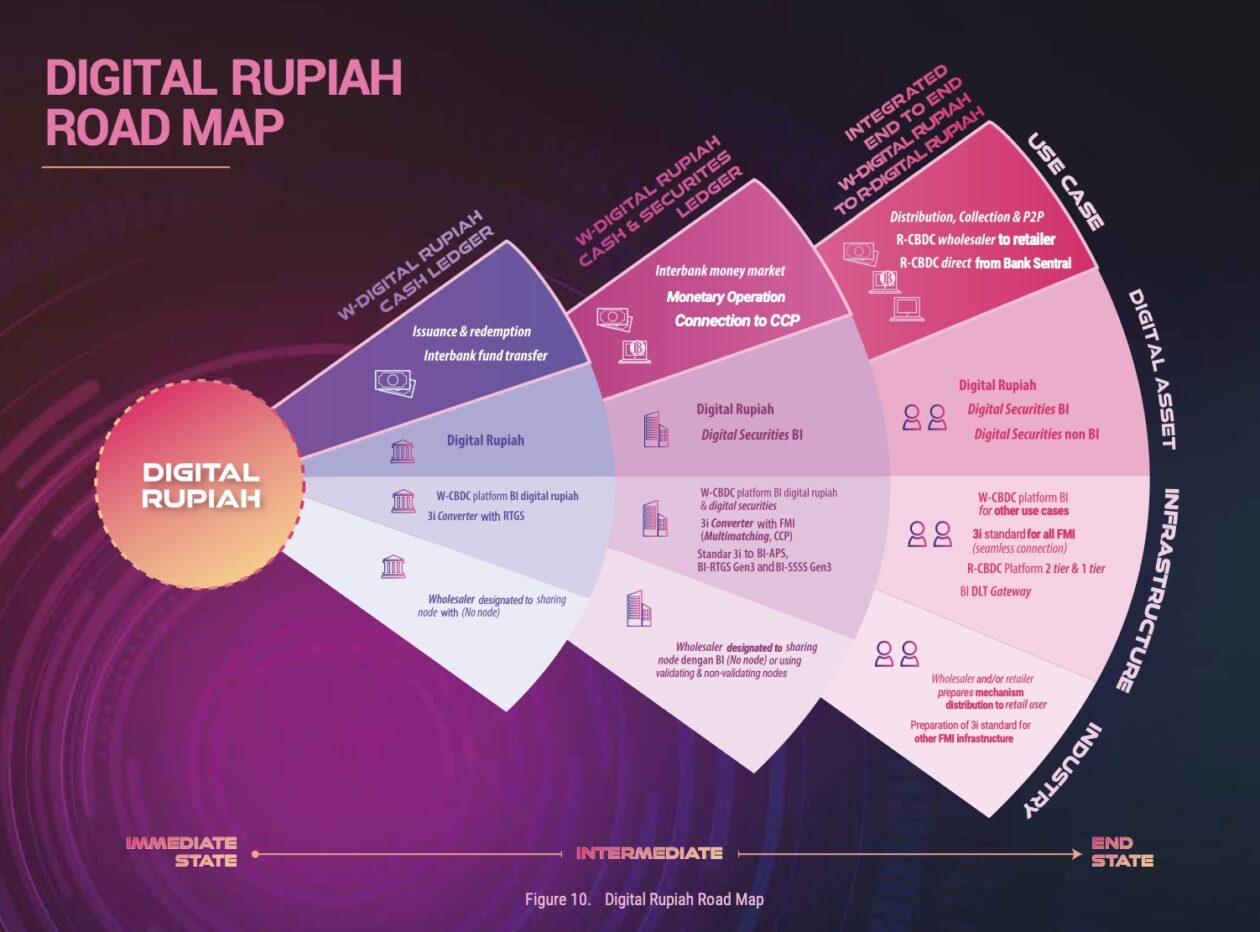

- Bank Indonesia, the central bank, said in the whitepaper released on Wednesday that Project Garuda, the national initiative to develop a digital rupiah, will be carried out in three stages, with the wholesale digital rupiah being examined first.

- The agency said it will then test the digital rupiah for retail use and “develop use cases for distribution and collection.”

- The central bank also said the synergy with the international central banking community and institutions is essential for it to design cross-border transactions.

- Bank Indonesia Governor Perry Warjiyo said in the whitepaper that the issuance of the CBDC is not an easy task, as central banks need to “prudently contemplate on CBDC design features by balancing the benefits with its associated risk.”

- A number of countries in Asia are developing their own CBDCs, with China’s e-CNY regarded as the most advanced among other leading economies testing the concept.

See related article: Indonesia’s crypto scene is booming. What are the risks?