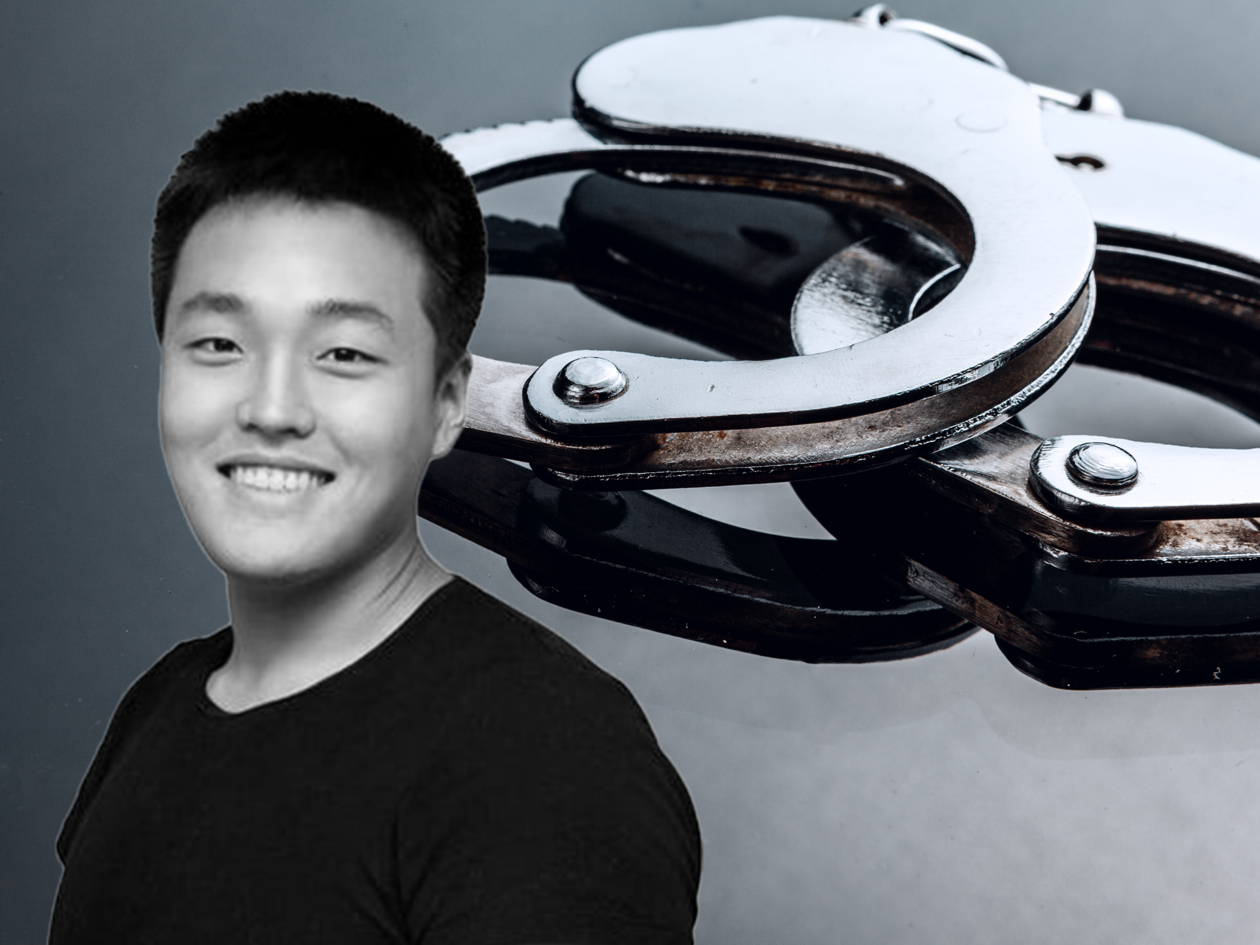

South Korea’s attempts to bring Terraform Labs Pte. Ltd. Chief Executive Officer Kwon Do-hyung to trial in the country face legal and operational hurdles, experts told Forkast.

An arrest warrant was issued earlier this week for the Terraform founder, known as Do Kwon, on charges of violating the country’s Capital Markets Act. The Seoul Southern District Prosecutors’ Office may also level charges of fraud with intent, a member of the team told Forkast.

The member of the prosecuting team said Kwon’s possible arrest will not stop the ongoing investigation on fraud charges. Any arrest would have to involve the cooperation of Interpol as Kwon is believed to live in Singapore.

“We don’t know if it will be one offense or two, but we will not stop [the investigation],” Choi Sung-kook, a prosecutor at Seoul Southern District Prosecutors’ Office told Forkast.

“We don’t know if it will be one offense or two, but we will not stop [the investigation]”

– Choi Sung-kook, Seoul Southern District Prosecutors’ Office

The investigation started after the multi-billion dollar implosion of the Terra-LUNA cryptocurrency project in May. A group of investors who lost millions of dollars had filed a lawsuit against the developers of the project on a number of charges, including fraud.

A Terraform Labs spokesperson declined to comment on the charges facing Kwon, while Kwon himself has not responded to Forkast’s queries via text message.

When custody is nine-tenths of the law

South Korean prosecutors have also asked the Ministry of Foreign Affairs to cancel Kwon’s passport. It is not known whether he possesses passports issued by other countries.

In July, South Korean authorities raided 15 companies, including seven cryptocurrency exchanges, as part of their investigation into the Terra-LUNA debacle. No fraud charges have yet been filed.

See related article: Terra CEO Do Kwon faces ‘illegal alien’ status in Singapore as Seoul cancels passport

That may be difficult as under South Korean law, prosecutors will need to prove intent to commit fraud for charges to be accepted by the court, blockchain and crypto law attorney Koo Tae-on of Seoul-based Law Firm LIN told Forkast. In Koo’s opinion, prosecutors may have opted to arrest Kwon based on securities law as it would be relatively easier to prove.

In doing so, South Korean prosecutors would be adopting the playbook used by their counterparts in the U.S. Terraform Labs and Kwon had impeded a U.S. Securities and Exchange investigation for years by challenging an investigative subpoena for documents from the company and testimony from Kwon.

In the case of South Korean prosecutors, they would need to cross-examine Kwon and his associates along with getting access to internal emails, chats and communications of Terraform employees to prove any intention to commit fraud.

The probability of doing so would be higher if prosecutors can get custody of Kwon through the existing arrest warrant for securities violations.

Prosecutors are seeking to classify TerraClassicUSD (USTC) and Luna Classic (LUNC), then called UST and LUNA, as investment contract securities, prosecutor Choi told Forkast. Under that categorization, prosecutors would be able to allege violations of the Capital Markets Act.

However, local experts think it’s unlikely that prosecutors would eventually be able to persuade a court to penalize Kwon and Terraform Labs for capital markets violations.

“I think it’s a long shot,” Koo told Forkast on the possibility of a South Korean court actually recognizing Terraform’s cryptocurrencies as securities.

“I think it’s a long shot.”

-Koo Tae-on, Law Firm LIN

See related article: South Korea issues arrest warrant for Terraform Labs CEO Do Kwon

“The so-called investment contract on South Korea’s capital markets act is very different from that of the U.S. investment contract securities,” Koo said.

“It refers to a contractual right in which one investor invests money in a joint project with another individual, where the gains and losses come from the results of a business operated by that other individual,” he explained.

Prosecutors are seeking to classify the LUNC as a “joint project” or an investment partnership as price fluctuations of the token were not decentralized, as claimed by Terraform as the firm manipulated supply, Koo told Forkast.

“[Hence], I believe they saw Do Kwon, the decision maker, as the issuer of that investment contract security.”

Spanner in the works

The problem with the South Korean prosecutors’ logic is that a “joint project” classification would apply to every other cryptocurrency that is not decentralized, Koo told Forkast.

“The impact will not stop at Terra-LUNA and [such a view] will affect other cryptocurrencies,” Lee Jang-woo, blockchain business expert and adjunct professor at Seoul-based Hanyang University told Forkast. “So I think it’s difficult for the court to actually make that judgment.”

“If they designate LUNC an investment contract security, the exchanges that listed LUNC would be in trouble too,” Lee said.

That list would also theoretically extend to crypto services firms that made use of LUNC as they would now be considered as businesses that dealt with securities without a license, Lee added.

Some 280,000 South Koreans were affected by the collapse of the Terra-LUNA project, with several publicly known cases of people taking their own lives after losing their life savings.

“It’s a whole other story if there weren’t any victims involved,” Lee said. “Fundamentally there were victims, and someone has to be held responsible and punished.”