In this issue

- Twitter: Hit the road, Jack

- Crypto crime: Checkmate

- Bilibili: Tokens and tolerance

From the Editor’s Desk

Dear Reader,

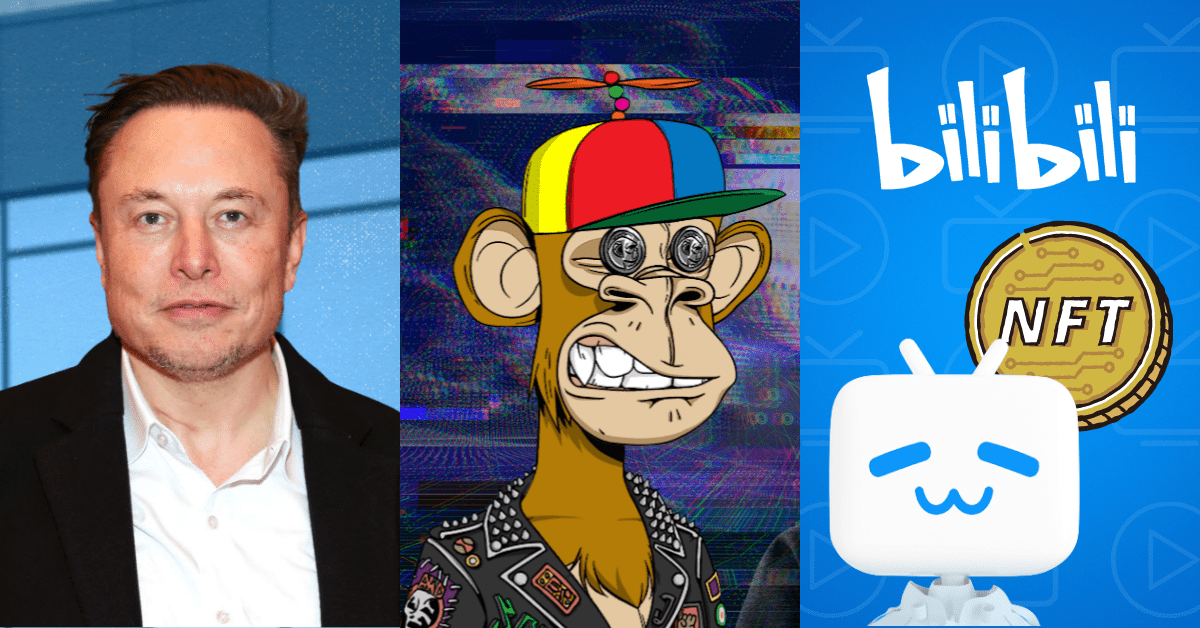

Tesla founder Elon Musk’s acquisition of Twitter ought not to have taken anyone by surprise this week — least of all those of us in the cryptocurrency community. But there may be some ill feeling in the air.

Musk’s dalliance with crypto has seen him in the Twitter spotlight since the crypto market began soaring to all-time highs early last year, and he has remained prolific in his commentary on Bitcoin and other tokens that are now, thanks in large measure to his influence, well known.

He has been sued multiple times by shareholders of his own companies and others — including Twitter — over potentially market-moving tweets, which have been described as “erratic,” among other things, and he has taken several breaks from posting on the network.

Yet Musk’s purchase of Twitter has now given him a bigger megaphone than ever.

In the political and social spheres, there is much speculation about what Musk’s libertarian-tinged freedom-of-speech claims about Twitter might mean for the platform under his stewardship.

What Musk’s latest acquisition means for the crypto space, however, is moot, although it is abundantly clear that his conduct has alienated many in the community, and he has been accused of treating crypto investors like playthings as the values of their portfolios have undergone wild swings amid the caprice of his Twitter messaging.

It’s not yet a year since a plucky group of developers minted a token named STOPELON, which aimed — rather improbably, as it turned out — to limit his sway over the market. The crypto community is nothing if not resourceful, and its members don’t like being told what to do.

And it’s worth remembering that Bluesky — an independent social media network started by Twitter whose decentralization might be expected to appeal to the crypto crowd — is not part of Musk’s acquisition.

Musk’s move into social media will undoubtedly give him an even higher profile, but, paradoxically, it may curb his outsized influence over the crypto space.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast

1. Ruling the roost

By the numbers: Twitter — over 5,000% increase in Google search volume.

Twitter’s board has accepted Tesla chief Elon Musk’s bid to buy the social media platform for US$44 billion, or US$54.20 a share, in cash.

- Twitter will become a privately held company once the transaction is finalized.

- Dogecoin was the biggest winner among cryptocurrencies following the news, rising more than 34% to reach US$0.1677, its highest price since earlier in April, when Musk became Twitter’s biggest shareholder.

- Dogecoin has retraced most of its Tuesday gains to trade at US$1420 at press time.

- Twitter’s board earlier had adopted a “poison pill,” diluting Musk’s stake in the business by allowing shareholders to buy shares at lower prices after he proposed a US$43 billion takeover.

- Musk has been a Dogecoin supporter since before the Gamestop trading frenzy in early 2021, and he has continued to promote the memecoin to his 86.1 million Twitter followers.

- His tweets have become known as “the Musk effect,” as memecoin traders leveraged market trends fueled by the world’s richest man to pump Dogecoin’s price.

- Twitter’s owner-to-be has vowed to crack down on bots and spam on the social network, which are widely believed to be associated with cryptocurrency scams and rug pulls.

- Twitter’s stock ended trade at US$49.68 in New York on Tuesday.

Forkast.Insights | What does it mean?

Elon Musk’s acquisition of Twitter may have tongues wagging over the prospects for Dogecoin, but insiders are more concerned over what will become of Twitter founder Jack Dorsey’s extensive efforts to bring Web 3.0 technology to the social media network.

Under Dorsey, who has been described as a spiritual leader of Bitcoin, Twitter had teams dedicated to exploring blockchain technology. Funding had also been allocated to build a decentralized version of the social network, and the team had successfully let users tip one another in Bitcoin via the Lightning Network.

The future of these forays under Musk’s ownership seems unclear. The South African-born billionaire seems more interested in relaxing content guardrails and ridding Twitter of bots than he is in Web 3.0. Dorsey seems relatively unfazed by the takeover, writing recently that having companies control online content and user identity was a mistake for which he had been partly to blame. Musk broadly shares that view, and has railed against networks controlling what people can and can’t say — to the extent he has even floated the idea of building a rival to Twitter.

Although Dorsey may feel the social network is in safe hands from a philosophical perspective, time will tell whether its engineers will be able to continue their efforts to bring it better into line with the true ideals of Web 3.0.

2. Don’t trust, verify

By the numbers: BAYC Instagram hack — over 5,000% increase in Google search volume.

The blue and white check-mark badges used by social media networks such as Twitter, Facebook and Instagram are no longer just proof of verified accounts but are now targets in their own right for hackers and scammers.

- Bored Ape Yacht Club’s Instagram profile was hacked on Monday. The collection’s cofounder, Garga.eth, said four Bored Ape Yacht Club non-fungible tokens, six Mutant Ape Yacht Club NFTs and three Bored Ape Kennel Club NFTs were stolen.

- Bored Ape Yacht Club said the account’s two-factor authentication — a form of user verification widely used by social media platforms and e-mail accounts — had been enabled during the attack.

- Also on Monday, NFT scammers hacked the University of the Philippines’ official Twitter account, changing the name of the account to that of Japanese contemporary artist Takashi Murakami to promote airdrops of Murakami Flowers NFTs. The floor price for items in the collection is 6.63 ETH (US$19,061).

- This month, numerous verified Twitter accounts have been hacked by unknown parties to promote airdrops of NFTs in the Azuki collection, with India’s University Grant Commission, a statutory body operating under the country’s education ministry, falling victim to one of the attacks.

Forkast.Insights | What does it mean?

Social media profiles, like crypto wallets, are only as secure as the users who own them. And when those profiles are known to be associated with valuable assets, they become tempting targets for wrongdoing.

Although this Bored Ape Yacht Club hack has made headlines, it’s not the first attack on that NFT collection and others. Earlier this year, 17 users of NFT marketplace OpenSea lost a number of NFTs to a phishing attack.

An increase in hacks and thefts is taking place across the industry, with almost US$2 billion of digital assets stolen in the past year alone in attacks targeting both individuals and exchanges.

Among the most notable cases are those involving the Ronin network (worth around US$550 million on March 23, the date of the exploit), Poly Network (US$610 million) and Wormhole (US$326 million). What these demonstrate is that security is still not being taken sufficiently seriously by crypto companies.

Digital asset holders worried about the increase in crypto crime should be reminded that their perception of their investments’ upside potential should take into account the security gaps and risks involved.

3. Bilibili — bold or silly?

Popular Chinese video streaming platform Bilibili now allows non-fungible token (NFT) transfers, becoming the second major Chinese tech firm after Alibaba to offer such a feature.

- The video streamer is a popular platform among Generation Z in China, with its daily user base topping 72 million in March, according to business intelligence site China Internet Watch.

- Bilibili introduced a 30-day lock-in period for NFT transfers, the shortest among Chinese tech giants, although a transfer can be delayed if the platform determines that speculative activity is taking place.

- Other Chinese tech titans, such as Tencent, Baidu, JD.com and Xiaohongshu that operate NFT markets prohibit NFT transfers.

- Chinese state media outlets have issued warnings and hinted at future clampdowns on speculative activity in the NFT space, but an official ban on trading has yet to materialize.

- NFT trading in China is still generating profits for investors in secondary markets, some operated by tech giants Alibaba and Tencent.

Forkast.Insights | What does it mean?

Chinese tech giants are doubling down on NFTs, or “digital collectibles,” as they are known domestically — a semantic effort to distance them from the trading-intensive NFT sector outside China — with a huge emphasis on developing existing intellectual property. Bilibili, an internet hub known for anime, comics and gaming content, is joining a rush to cash in on the country’s ranks of loyal anime fans.

The first point of difference between Bilibili’s approach and that of other digital collectible platforms is the frequency with which it allows users to transfer ownership of their NFTs. Unlike Alibaba, whose strict rules require owners to wait 180 days to transfer an NFT, Bilibili requires only a 30-day wait before reselling. It has also avoided using the word “reselling” in its publicity materials, instead opting for the phrase “gifting for free,” to underscore its anti-speculation bona fides.

Nevertheless, Bilibili’s move to open up transfers opens the door for users to engage in speculative NFT trading, despite the lock-up period. Chinese NFTs continue to change hands at a brisk pace in secondary markets, and there are even groups on WeChat — a ubiquitous messaging app that, like all media in China, is subject to strict state supervision — with owners auctioning off their collectibles on a daily basis.

It’s likely only a matter of time before Chinese authorities move to rein in the mushrooming NFT trade. Government-owned media as well as industry lobbies set up by regulators have already warned of the risks associated with such trading when NFTs have the attributes of financial products.

Despite its enormous growth, China’s NFT sector is still in its infancy, and the regulatory gray zone that it’s currently operating in will likely not last much longer. If China’s increasingly hardened stance against crypto mining and trading can be a guide, industry leaders awaiting more regulatory clarity in the NFT space should not be surprised if the authorities go after the “bad players” among them.