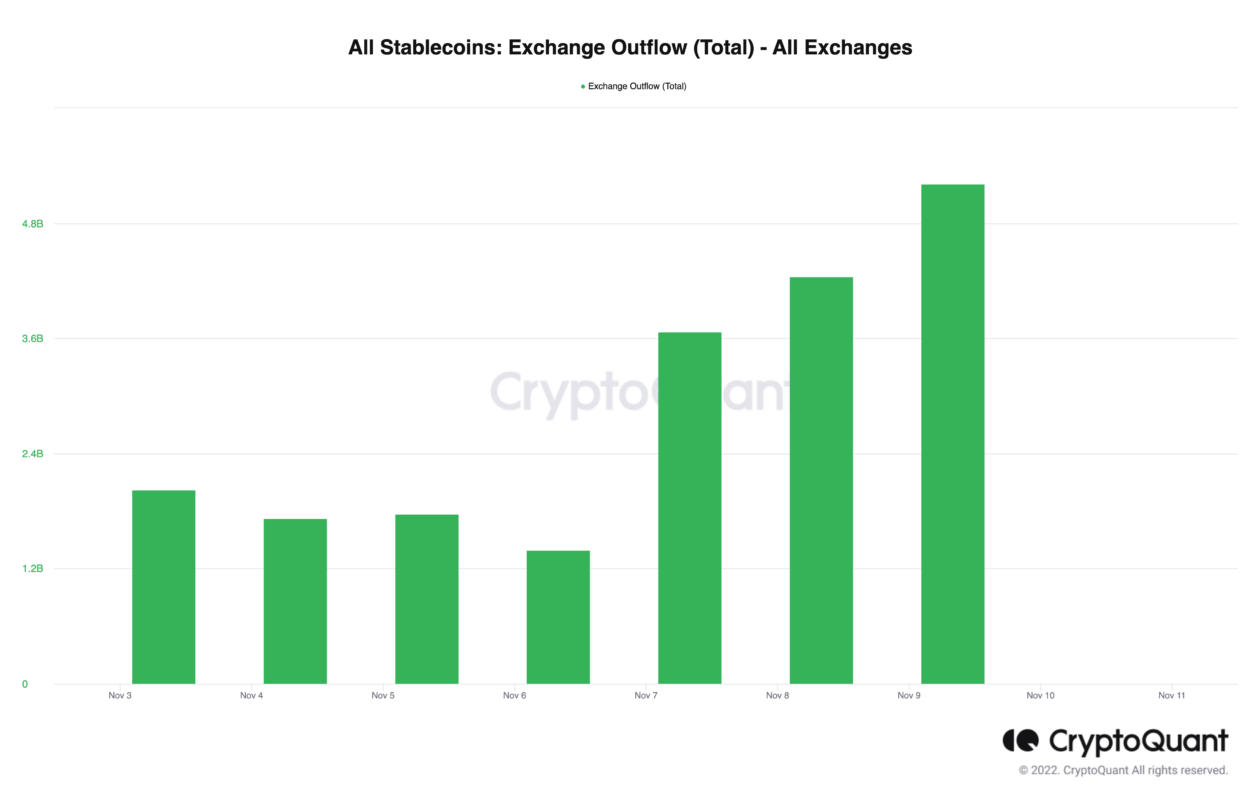

Cryptocurrency investors continued to withdraw assets from major exchanges on Wednesday, with stablecoin outflows recording the highest volume in nearly five months, as Binance backed out of acquiring its rival, FTX.

On Wednesday, over 5.2 billion stablecoins moved out of exchanges tracked by on-chain data provider CryptoQuant, the most since June 15. The number of transactions withdrawing stablecoins from exchanges surged to 57,917 from 7,016 a week ago, CryptoQuant data showed.

“Crypto investors are paranoid right now, and rightfully so,” Rachel Lin, cofounder and CEO of Singapore-based decentralized derivatives exchange SynFutures, told Forkast on Thursday. “It’s not surprising that assets are moving out of centralized exchanges following FTX’s shake-up and can be considered a knee-jerk reaction that shouldn’t come as a surprise.”

The spike in stablecoin outflows is widely believed to have been triggered by troubled crypto exchange FTX, which ran into a liquidity crisis on Tuesday where users were unable to pull out their assets from the platform.

Binance, the world’s largest crypto exchange said on Sunday it would dump its FTX Token (FTT) holdings after a CoinDesk report suggested solvency issues at FTX and sister trading firm Alameda Research.

On Tuesday, Binance offered to bail out FTX via acquisition, but abandoned rescue efforts a day later following due diligence.

The series of risk events triggered withdrawals at a number of major exchanges over the past few days.

In the past seven days, OKX saw the largest stablecoin outflows among exchanges at US$395.4 million, according to data from blockchain analytics platform Nansen.

FTX saw about US$303.3 million in seven-day stablecoin outflows as of 5:30 p.m. on Thursday in Hong Kong, followed by US$276.6 million at KuCoin, US$252.3 million at Curve.fi and US$170.1 million at Binance, Nansen data showed.

As investors scramble to secure their funds, they are putting more weight on risk controls and perceived solvency in lieu of trading fees and features to decide which service to park their funds in, Lin said.

“Some of these services that will benefit include decentralized exchanges like ours, which offer transparency and allow users to keep ownership and control over their crypto assets,” Lin said.