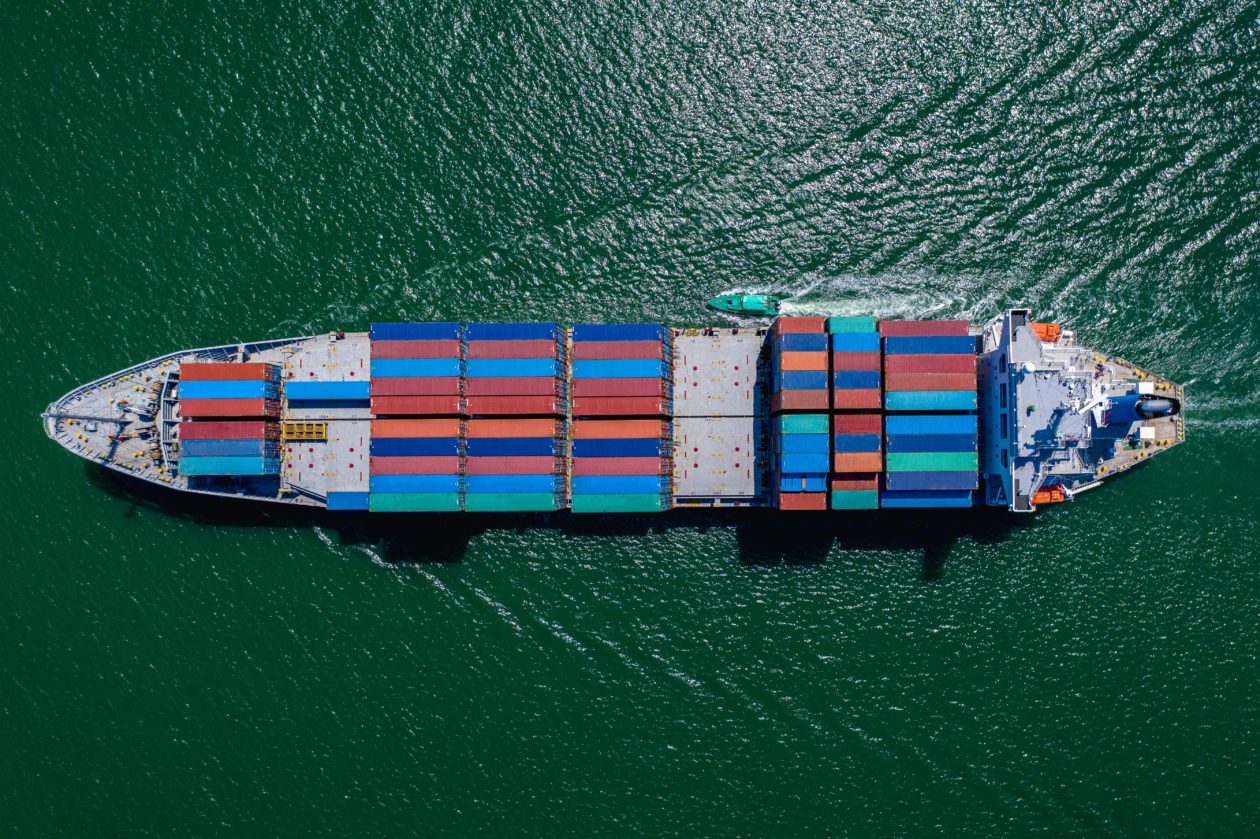

Amid the global energy crisis, nine companies from four countries — China, Japan, Australia and Saudi Arabia — announced they will jointly build a blockchain documentation platform to speed up customs clearance and cargo delivery to trade the commodities of energy, chemical products and metal.

Fast facts

- Platform participants includes Sinochem Energy, Mitsui.Co, Macquarie CGM, Saudi Aramco Energy Ventures, and five other Chinese firms in finance, blockchain, shipping and energy.

- The platform was announced at the China International Import Expo, the largest trade fair in China.

- China has been suffering from an iron ore price surge and oil shortage recently. In May, China’s iron ore price soared to a 14-year high as Australia-China relations eroded. Last month, large-scale power outages hit northeast China due to a coal shortage caused by an imports cut, floods and emission reductions, and it led to another crisis of diesel used to drive private generators.

- Now the whole world is amid a power shortage as the economy recovers from the epidemic. Natural gas prices have surged in Europe, India is running out of coal, and the U.S. may also be threatened by global energy scarcity as temperatures drop.

- China started using blockchain to boost cross-border trade, in both shipping and financing. In September, a Hong-Kong based nonprofit consortium whose members handle one-third of all the shipping containers globally, Global Shipping Business Network (GSBN), activated the global shipping blockchain platform. Then Bank of China, DBS, and HSBC announced a partnership on digitizing trade finance with GSBN. The platform is built in partnership with Oracle, Microsoft, AntChain, and Alibaba Cloud, aimed at reducing the paperwork and enhancing the information credibility in cargo shipping and cross-border trading.

- Shipping is a file-intensive industry, and a study shows that blockchain in lieu of paperwork can reduce 99% of carbon emissions in the filing process.