A nonpartisan global leadership organization, the Atlantic Council, released a six-month update of its central bank digital currency tracker Dec. 13. Among its key findings is that as the number of countries exploring their own fiat digital currency accelerates, the United States remains stuck in “research” mode and further losing ground.

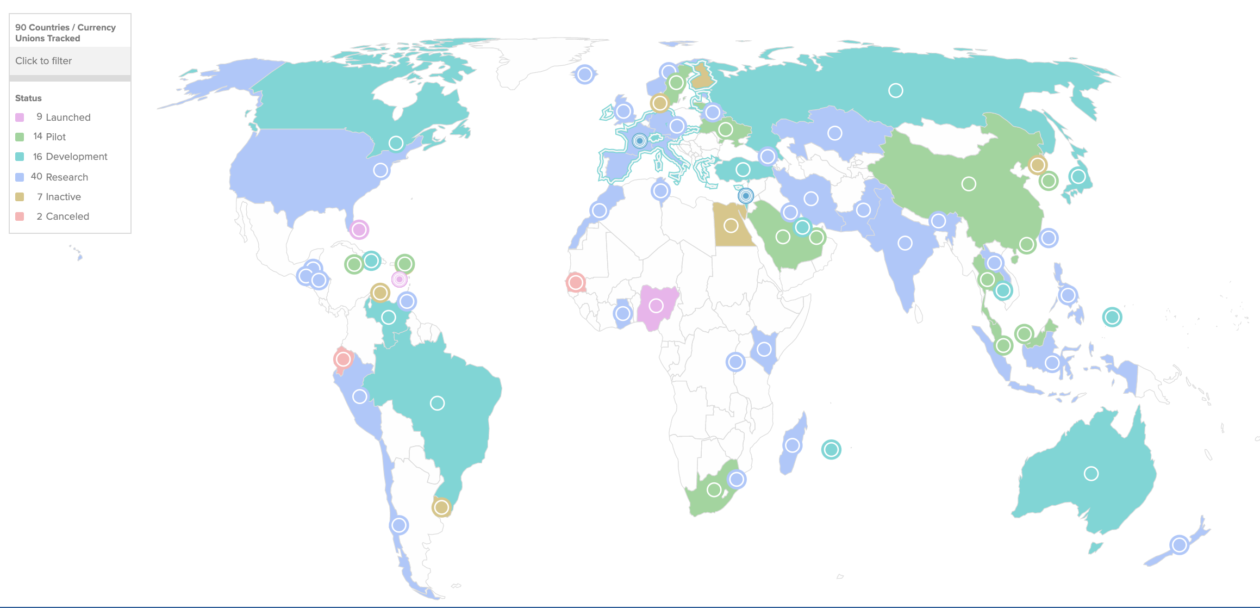

The council’s GeoEconomics Center, which examines the intersection of economics, finance and foreign policy, launched the interactive database in July 2021 and updates it quarterly. The tracker now follows 90 countries, up from 80 six months ago.

Among the signs of acceleration, the center found that 87 countries are exploring CBDC, compared to 35 in May 2020. Nine countries have fully launched CBDC, all in the Caribbean except for the most recent launch and the first in Africa, the e-Naira of Nigeria. Fourteen countries, including China and South Korea, are in the pilot phase and possibly preparing for a full launch.

The Federal Reserve’s perceived dawdling has far-reaching and serious global and domestic implications. “The way the dollar is set up and exchanged through messaging systems like SWIFT has been a coordinating force for the entire world and a standard setting for us,” said Josh Lipsky, director of the GeoEconomics Center and former senior advisor at the International Monetary Fund, in an interview with Forkast.News. “You have a lot of different systems developing, and it’s unclear whether they will be able to work with each other or not in the near future, and if and when the U.S. comes in, how their digital dollar will align with all these other CBDCs that are being built. So the basic takeaway is people are not focused enough on cross-border right now, and they should be.”

The People’s Bank of China is widely expected to launch the world’s first major CBDC — officially called the e-CNY or colloquially, the digital yuan — in February at the Beijing Winter Olympics. The e-CNY has been tested in 28 cities, as well as in cross-border applications with Hong Kong, Thailand, and the UAE. In June 2021, the PBOC announced that about 21 million personal digital yuan wallets had been opened, with a total transaction value of around $5.4 billion; the numbers are likely to be far larger today.

Of the countries with the four largest central banks — the Federal Reserve, the European Central Bank, the Bank of England and the Bank of Japan — the United States is the only one in the research phase, while the other three are considered to be in the development phase and actively working toward pilots.

Earlier this year at a virtual conference hosted by the Bank for International Settlements, Federal Reserve Chairman Jerome Powell said “Because we’re the world’s current principal reserve currency, we don’t need to rush this project and we don’t need to be first to market. A dollar CBDC would have potentially large implications here and around the world, and we’ll be sure to think carefully about all of that and engage very broadly with the public around the world, in particular here in the United States before we even approach a decision.” He went on to say, “We are sort of purveyors of stability,” meaning the Federal Reserve, due to the unique role of the dollar in international transactions, and “we do not want to destabilize that.”

The Fed is expected to release a policy paper on CBDC and a technical white paper on the Fed’s Project Hamilton, which may describe what a digital dollar would look like. The releases have been eagerly anticipated, especially as other countries have declared their progress in the last six months.

In May, J. Christopher Giancarlo, co-founder of the Digital Dollar Foundation and former chairman of the Commodity Futures Trading Commission, told Forkast.News, “The United States needs to be involved now if we have an expectation that our values will be built into future money. Now’s the time to get into the debate over the future of money and make sure those values, not just privacy, but values of free enterprise, of free speech, of democracy are built into the future of money.”

Now at the cusp of 2022, Lipsky gives the U.S. six months to a year to “get into the game seriously.” Progress, he said, would simply require a statement of intention. “It just means outlining the principles that would be important to the Federal Reserve and the Treasury if and when they had it. Every country is going to take note of that because they’re going to say, Well, if the U.S. does it, they’re going to build it like this. We better make sure we’re aligned with those standards.”

The alternative? “This is the thing that keeps me up at night when it comes to central bank digital currencies and really digital currencies more broadly,” he said.