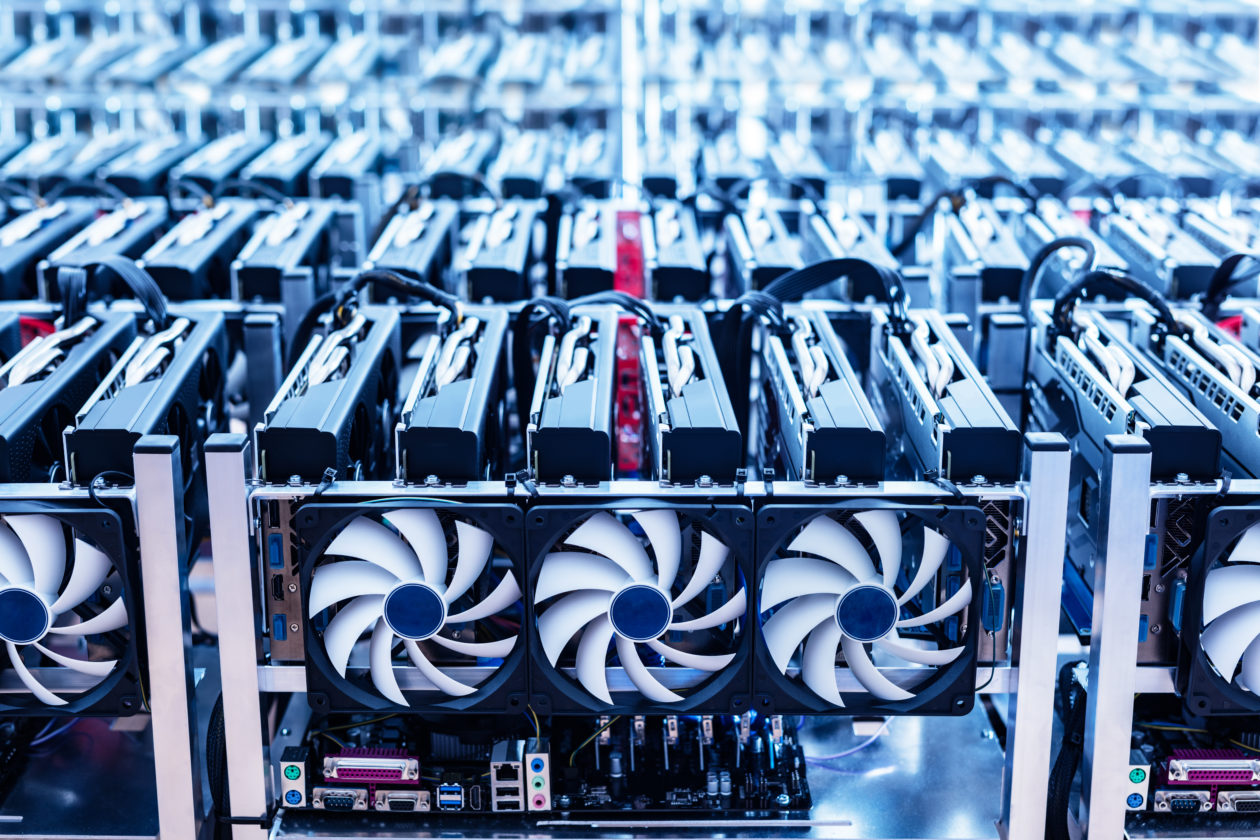

Chinese cryptocurrency mining rig maker Canaan Inc. has reported its strongest ever quarterly sales results, despite regulatory uncertainties surrounding crypto mining in some countries.

In the second quarter of this year, Nasdaq-listed Canaan reported 1.08 billion yuan (US$167.5 million) in total net revenues, up 507.3% year-on-year and up 168.6% from the first quarter of this year, according to the company’s second-quarter report.

The robust revenue growth was “mainly due to the substantial increase in total computing power sold,” the company said.

The increase in Bitcoin mining machines Canaan delivered saw its total computing power sold hit 5.9 terahashes per second last quarter, up 126.9% year-on-year and up 200% from the first quarter. The company said the significant increases were primarily thanks to the increasing number of machines sold driven by strong market demand.

The mining machine maker also saw an expanding profit. It booked a net income of 245 million yuan (US$37.9 million) in the second quarter, compared to a net loss of 16.8 million yuan in the same period of last year and a net income of 1.2 million yuan in the first quarter of this year.

Canaan’s strategy going forward is to increase its market share in the Bitcoin mining machine business, Nangeng Zhang, chairman and CEO of Canaan, said in a statement following the release of the latest quarterly earnings. He said that the company has also been making strides into the AI business, with the launch of its Kendryte K510 chip.

Canaan has been securing deals with clients and partners in North America since earlier this year. Its most recent deals include a sizable purchase order with Genesis Digital Assets, which ordered 20,000 Bitcoin mining machines with an option to buy up to 180,000 additional units.

Last month, Mawson Infrastructure Group, an Australian crypto mining company, said it had purchased an additional 17,352 ASIC Bitcoin mining machines from Canaan to bolster its mining operations on its home turf and in the United States. HIVE Blockchain Technologies, a Vancouver-headquartered crypto mining company, has also bought thousands of machines from Canaan.

In addition to making mining machines, Canaan in June said it had launched its own crypto mining business in Kazakhstan.

“Regarding our self-operated Bitcoin mining program, we plan to continue to deploy computing power to grasp the tremendous opportunities of Bitcoin mining,” Zhang said.

Canaan said the fiscal outlook remains healthy looking ahead. For the third quarter of this year, the company expects to increase by 10% to 30%.

Meanwhile, Canaan’s major rival Bitmain, another major Chinese crypto mining rig maker, is no slouch when it comes to securing new deals.

For example, New York-based Greenidge Generation Holdings Inc. said on Wednesday it is buying 10,000 Bitcoin mining machines from Bitmain for its upcoming facility in South Carolina, according to a company statement. The mining machines are scheduled to be delivered in the second and third quarters of next year.

Restrictions and bans on crypto mining continue to emerge in various countries. China, for example, has been cracking down on the sector, with the most recent bans are being imposed in Hebei and Gansu provinces, followed by similar clampdowns in Xinjiang, Inner Mongolia, Qinghai, Yunnan and Sichuan.

Iran has also been closing down unauthorized crypto mining operations, according to local media reports.