The Bitcoin mining difficulty level rose 3.27% on Tuesday morning in Asia, as some mining firms continue facing cash shortages due to lower Bitcoin prices and high energy costs.

See related article: U.S. considering bill to require crypto miners to report carbon emissions

Fast facts

- The mining difficulty reading came in at 35.36 trillion at block height 768,096 in Tuesday’s biweekly adjustment, following a 7.32% drop in the previous adjustment on Dec. 6, according to data from BTC.com.

- The latest Bitcoin mining difficulty reading was 45.7% higher than on Dec. 25 of last year, when the difficulting reading was 24.27 trillion.

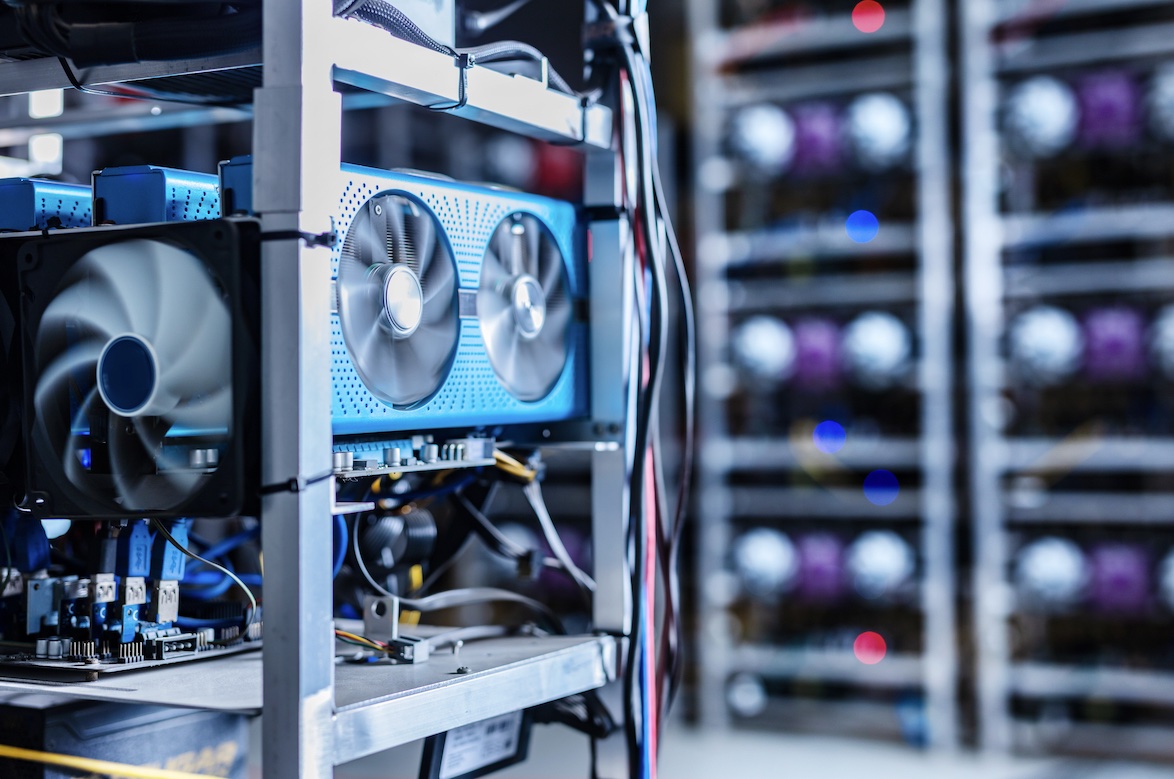

- Bitcoin mining difficulty, which determines how much computing power is required to verify blocks on the blockchain in exchange for Bitcoins rewards, changes roughly every two weeks.

- Bitcoin’s seven-day average hashrate, a measure of computational power used, was at around 245.1 exahashes per second on Monday, down from a seven-day average of 253 exahashes on Dec. 6, Blockchain.com data showed.

- Bitcoin’s price reached an all-time high of more than US$67,000 in November 2021, but has since fallen 75% to trade at around US$16,740 on Tuesday morning in Asia, according to data from CoinMarketCap.

- The profitability rate of Bitcoin mining stood at US$0.0558 per terahash per second in the past 24 hours, down from US$0.248 from a year ago, data from BitInfoCharts showed.

- A number of U.S.-based mining firms, including Core Scientific and Compute North, are mired in liquidity crunches. Another miner, Foundry Digital LLC, said last month that it plans to acquire two turnkey mining facilities from Compute North.

See related article: US raises red flag on crypto mining with concerns over carbon emissions