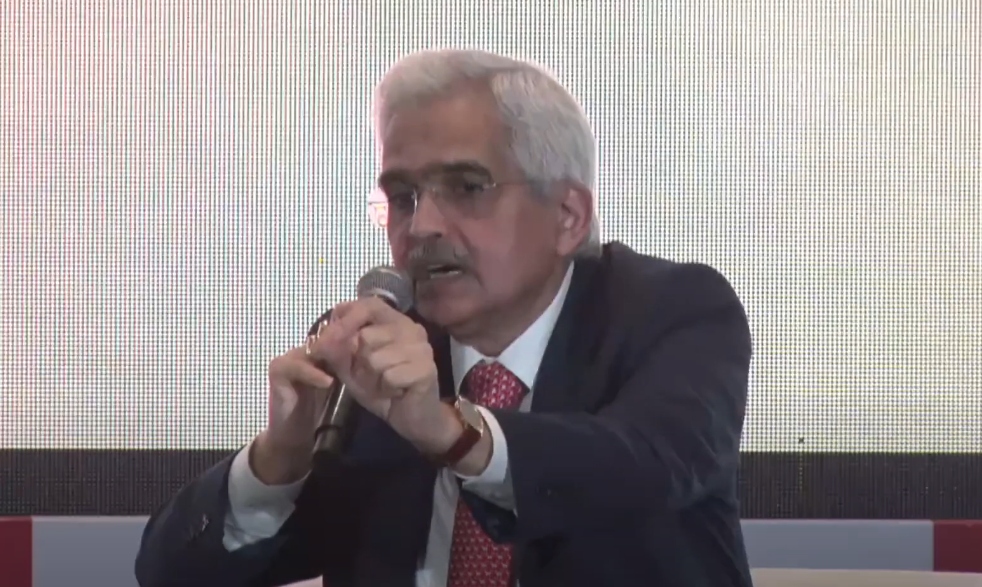

The next financial crisis will come from “private cryptocurrencies” if they are not banned, Reserve Bank of India (RBI) Governor Shaktikanta Das said at a banking and finance event on Wednesday.

Fast facts

- The head of the central bank said that simply regulating the crypto industry and allowing it to grow would not be sufficient to avoid a financial disaster.

- “Mark my words, the next financial crisis will come from private cryptocurrencies… they have no underlying value, and they have huge inherent risks for our macroeconomic and financial stability,” he said.

- In India, the term “private cryptocurrencies” is often used to distinguish cryptocurrencies that aren’t issued by the central bank, such as Bitcoin and Ether. The RBI launched a retail central bank digital currency (CBDC) pilot in December.

- “I am yet to hear any credible argument about what public good or what public purpose [private cryptocurrencies] serve,” Das said, adding such tokens are just used for speculation while defending the RBI’s plans to expand its CBDC project.

- India assumed the presidency of the G20 in December, to receive the authority to determine the agenda for global crypto regulatory discussions. India’s term will end on Nov. 30, 2023.

- India finance minister Nirmala Sitharaman said in November that crypto regulation should be an international priority and topic of discussion during India’s G20 presidency.