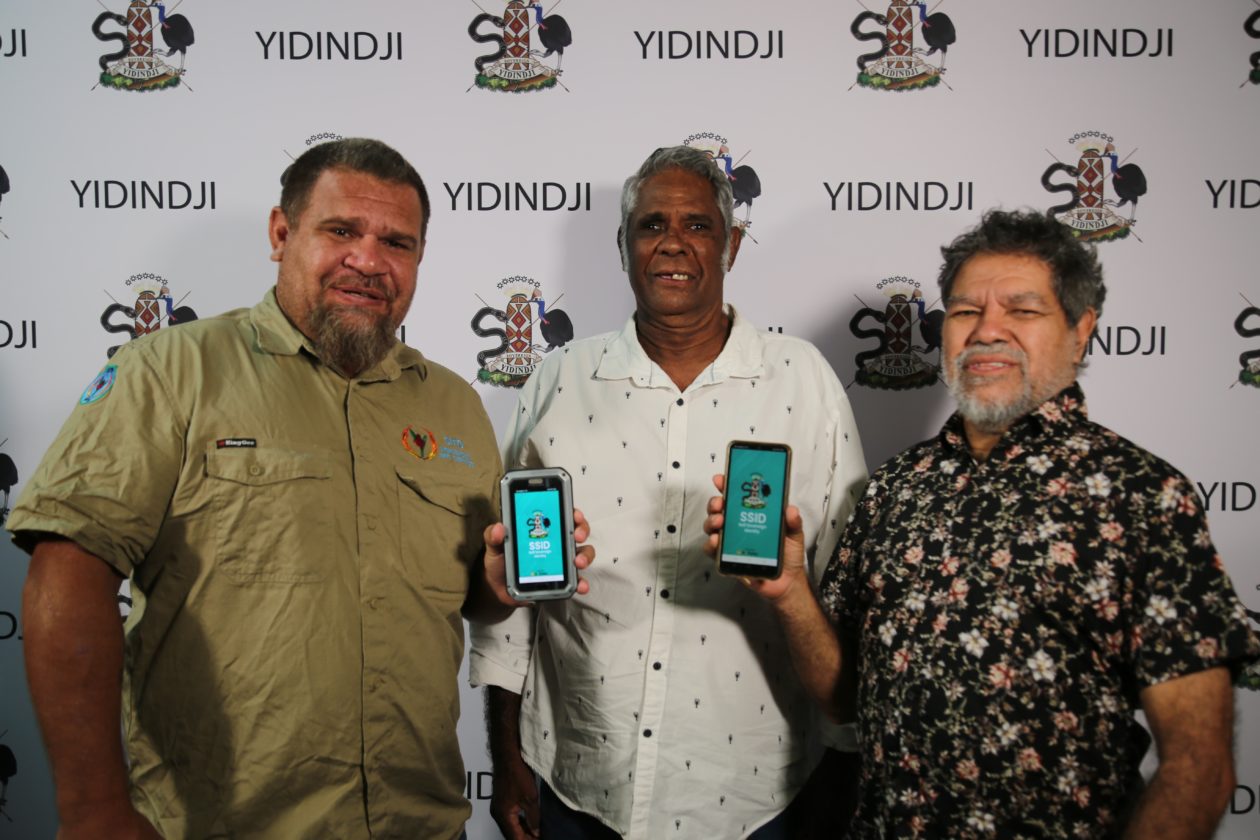

The first transaction on the first central bank digital currency (CBDC) in Australia took place on Tuesday in the Sovereign Yidindji Government (SYG) territory in the country’s northeast.

The SYG launched its CBDC in partnership with blockchain wallet network MetaMUI last week to further its mission to establish a treaty with the Commonwealth of Australia.

“This is a matter of survival for the Yidindji people and it really is a positive development,” minister for financial technology Murrumu of Walubara said in a statement shared with Forkast. “We can now confidently start to map out our priorities knowing that we will have the mechanism to procure and pay our way through our [CBDC].”

The Yidindji people have lived in the territory for at least 60,000 years and as with other Aboriginal communities across the continent have never ceded sovereignty nor formed a treaty with the Australian government.

Australia’s constitution does not recognize any Aboriginal countries, which Murrumu says makes the Yidindji lands foreign to the commonwealth until a treaty is reached. SYG was formed in 2014 when Murrumu renounced his citizenship to Australia and declared the territory sovereign under Yidindji tribal law.

“We’ve done that to help set the record straight and to help Australia with the treaty,” Murrumu said in an interview with Forkast, explaining the SYG is looking to officially share sovereignty with the commonwealth. “The sovereignties coexist; our sovereignty is still here and the Commonwealth of Australia’s sovereignty is still here, and we’re just trying to unite that.”

The SYG is in ongoing talks with Australia’s government — including meeting with the prime minister on a number of occasions — to discuss a formal treaty, though it is yet to reach a formal agreement.

Many Aboriginal communities across the continent share similar sentiments regarding their own sovereignty, but the SYG is the first to issue a CBDC and Murrumu says the territory is 15 to 20 years ahead of any other First Nations group in establishing a sovereign government.

“The benefits of central bank digital currencies are profound, and it is only a matter of time before they are implemented by countries around the world,” said Don Tapscott, executive chairman of the Blockchain Research Institute, in a statement shared with Forkast. “I am delighted to see this technology used to build a more sustainable future for the people of the Sovereign Yidindji Government in Australia.”

While it never printed any physical cash, the SYG central bank had already issued its own currency called the Sovereign Yidindji Dollar (SYD) which was displayed on its internationally recognized postage stamps. As a digital dollar, the SYD’s value equates to AU$1, but is backed by collateral assets like gold, silver and green and blue carbon — unlike its Australian fiat equivalent.

The roughly 100 Yidindji citizens are able to spend the CBDC through an Android app on any government service and a growing list of private businesses within the territory.

Citizens are also eligible for a digital identification that is accessible through the same wallet as the CBDC.

Article 4 of the United Nations Declaration on the Rights of Indigenous Peoples — of which Australia was a reluctant signatory — says that Indigenous peoples have a right to a means of financing their autonomous functions. Murrumu says that blockchain technology can help such communities exercise their right to self-determination in virtually limitless ways.

“Financial inclusion is a very big part of that,” he said, “and maybe the different tribal societies can use their sovereignty to not only empower themselves but the Commonwealth of Australia.”

The Yidindji CBDC operates on a private blockchain, where transactions can be verified to ensure the territory can protect against bad actors and adhere to anti-money laundering and counter-terrorism financing best practices.

Reserve Bank of Australia assistant governor Michele Bullock recently said the bank was looking to establish a wholesale CBDC of its own, and Murrumu believes the SYD could offer an appropriate model to base it off.

The RBA declined to comment for this story.