Why AAX Built a Crypto Exchange with London Stock Exchange Technology

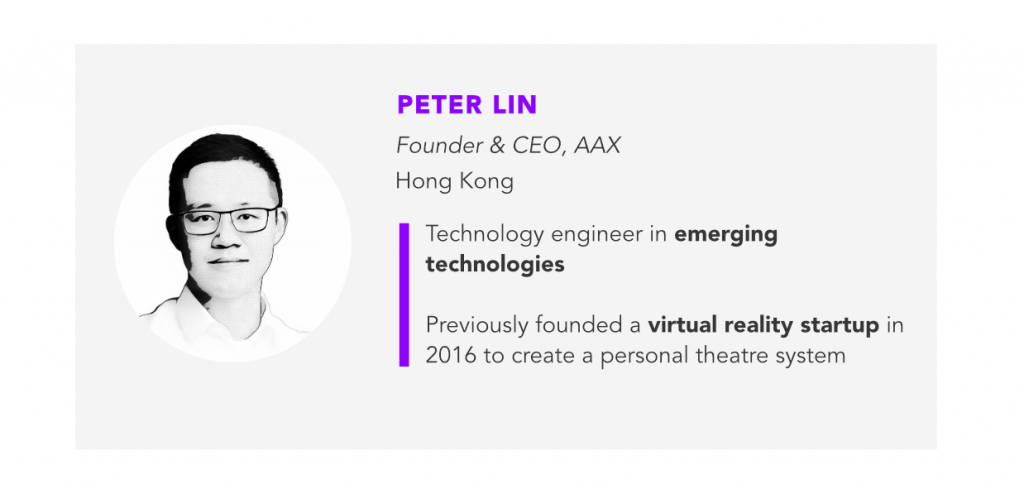

Forkast.News Editor-in-Chief Angie Lau sits down with Peter Lin, CEO of AAX at the Mobile World Congress in Shanghai for this episode of “In Conversation With” Lin is about to launch a new digital asset exchange using London Stock Exchange trade-matching technology to provide an institutional grade platform to attract investments from hedge funds and institutions beyond retail investors interested in cryptocurrency.

It is a crowded space.

And in a cryptocurrency trading environment challenged cybersecurity hacks hitting other exchanges and increasing concern among regulators on KYC and AML, how is AAX thinking about protecting the investor, navigating regulations, and accepting full liability if its customers get hacked? Will institutional investors be reassured by LSE-technology based exchange platform and jump into cryptocurrencies?

Lin shares with us his perspective on how crypto exchanges are evolving… and more broadly, how technology is starting to shape how the real world in the future.

Full Transcript

Welcome to “In Conversation With” on Forkast.News, Editor-in-Chief Angie Lau at the Mobile World Congress 19 here in Shanghai where tens of thousands, I think, Peter Lin of AAX, CEO, sitting right next to me, about 60,000 people here in attendance in Shanghai. So Peter and I are here for the Blockchain Summit. I have the pleasure of leading the Blockchain Summit, the first inaugural one for Mobile World Congress and I thought I’d snatch Peter from the stage before he heads to the panel to discuss the regulatory and the digital asset space here in Asia and what he’s doing at AAX. So thank you so much for joining us, Peter Lin, CEO of AAX.

This is a very crowded space. You are a digital asset exchange and the first in the world to be differentiated by what? 0:50

AAX is going to be the first digital asset exchange powered by London Stock Exchange. So, London Stock Exchange is, besides operating the London Stock Exchange market in the world, they are also being one of the top technology providers for the global financial markets, including Hong Kong Stock Exchange and Singapore Exchange. So it will be the same technology running on AAX that is running on those traditional, established, and proven financial markets.

How did that partnership come about? 1:32

In our teams, we have members who have previously worked with them closely, so when we started AAX in the beginning, we were looking to build a world class financial exchange for the market amounts that we believe is going to be a trivial or even a model of the existing amounts today. So we are looking at the top technology globally and this is where we start our first contact.

Well, I’ve had conversations with you before this. When Bitcoin was at its lowest level after dropping from near 20,000 levels and really the sentiment in the industry, the sentiment about crypto-currency was very, very low. And now, a couple of months later, here we are, we’re at the blockchain summit here at Mobile World Congress. People are clamoring to know more about it. Facebook just announced their Libra project. Tell me about the climate now as you head towards launching your digital asset exchange. 2:04

Actually, everyone is very excited. When we started in 2018 there was a down trend in the market, so at that time we joined the game and also we are looking at the long-term. At that time, we believe there was a bubble in the market and then the bubble burst. It’s a good timing for the companies like us to invest, to build good foundations of technology and operation-wise. So, now it seems we are going to launch the platform very soon, in Q4 of this year, and were actually very happy to see the price of Bitcoin climbing up again, and everyone is going to be super interested and excited of this technology.

When Facebook announced the Libra project, what was your impression? What do you think the impact will be? 3:28

We were actually expecting the big institutions or corporations, like Facebook, to join and we believed this day definitely would come. When we saw the news, we were very excited and we believe Facebook is definitely not going to be the last. Big names are going to join this game. There will definitely be more and more to come to invest and participate.

So that’s a very bullish outlook from the Blockchain community and the crypto community side. On the other end you have the regulators, some who are more embracing of this technology, but other lawmakers who are saying, “Let’s put a moratorium on the discussion.” They are very suspicious of it. How do you think the role of the regulator is going to affect how you, as a digital asset exchange, is going to be able to function, how Facebook is going to be able to function with its Libra project, and so many others in the community. 4:01

I believe for the cryptocurrency or blockchain industry to continue to grow, it’s very important to work with the regulators. It’s not going be like the previous existing ways of how things are regulated. It will be a new way, and the regulators, the startups, and the participants of blockchain need to work closely to discuss how to take benefit of this new technology, but also mitigate those errors or problems that occur because of this new, convenient technology.

How often are you talking with regulators? 5:10

So we are here for frequent discussions with a regulators globally. So Hong Kong and also regulators in Europe as well.

What are those conversations like for you? 5:24

First of all, there are countries having already released certain licenses for crypto exchanges, and even in Hong Kong, SFC has approved Type 1 license-holders to dealing security-backed tokens. So we are having frequent discussions regarding having our existing business license and also the future and potential business opportunities.

So it’s the regulators. Do these conversations… are they helped by the fact that you are partnering with London Stock Exchange and have that institutional grade foundation to be able to present to regulators that we have these type of institutional grade standards, that we’re applying? 5:58

Yeah, definitely… Because this is such a new industry, everyone is learning, including the regulators, so definitely they want to have the information and opinions from the established players like London Stock Exchange, hear about their voices and incorporate their suggestions into the way they want to have this market of the industry regulated.

KYC, ‘know your customer’, extremely important. AML, ‘anti-money laundering’, policies are in place. These have been the two things that regulators have universally pointed to as being a problem or an issue in the industry, especially for digital asset exchanges or cryptocurrency exchanges. How are you mitigating that? 6:44

So right now, we are taking KYC and AML very seriously. We built the exchange with this in mind from day one, and we are working with the service providers who have been providing KYC and AML services for other traditional financial markets, and we’re discussing very closely how to incorporate what they have and also bring the changes for these new types of asset classes so that we can have the customized solutions for AML and KYC for blockchain exchanges.

So that’s reassuring for the regulators. For the customer end, how am I going to engage with AAX? Why should I pick AAX over the 200 cryptocurrency exchanges that exist globally today? I just read about Binance getting hacked. I just read about BitfinX getting hacked. All of these fishing attempts, successful hacks of exchanges. How are you at AAX addressing those concerns? Why should I trust AAX over any of these exchanges? 7:44

Yeah, these are very good questions. Actually as a retail customer, yes, one should be very careful when it comes to the choice of exchanges… because this is like the asset, and in digital form, once an asset is stolen it is gone forever. It is very important to find an established and mature platform with a mature technology, security solutions, and also stability as well, which was also very important. So for us, we are working closely with London Stock Exchange to build an institutional great platform which can both serve in the big institutions like investment banks and also serve the individual retail customers like you and me.

Do you have to be an accredited investor to be able to participate on AAX? 9:01

No. There are no entry barriers, so anyone can participate.

So, I can participate along with institutional investors. So that means the liquidity pool is going to be quite high. 9:11

Yeah.

Who are some of the institutional investors that are interested in using AAX right now? 9:20

We have had several active discussions with institutions including hedge funds, crypto funds, and some trading individuals.

So they’re more comfortable with the LSE (London Stock Exchange) platform and so they come to the market with their liquidity pools, and so you’re really creating a healthier market by giving people access to the market. How are you going to protect them along with us against fishing, for example, cyber hacks, things like that? How are you thinking about cyber security? 9:41

We also built our platform from day one with security. It’s not something like we built a platform first and passed it to someone to make it secure. Security is something that you have to build into your architectural design and your implementations. And also from day one we have been working with Crow, which is one of the biggest security vendors to big institutions like banks and even some governments. So we had them working as closely to us when we did the architecture design of the platform and also after the platform is built we also invite external security vendors to come and do the testing and the penetration test trying to find loopholes.

So I’m going be responsible for a lot of my own security, that’s for sure. Are there measures in place at AAX that also protect me at a level that maybe somebody else might not be able to? 10:59

So for example, we have these security mechanisms that we have enabled. You have to have your credentials in a registered device in order to access your bank account. And then we have these smart algorithms that, for example, if the account is logged in from a different location, then we have extra security mechanisms to verify that this operation is authenticated.

There’s also a thought right now in South Korea. There’s a new law, for example, and I don’t know what you think about it, that if there is a hacking event, that the exchange itself is responsible and liable for the loss. And so, do you think that that is a good measure for the market? Do you think that this is reasonable? Is this something that you would be comfortable with? 11:42

Yeah, so security is actually a never-ending game. There’s no absolute security. So it’s always like a catch-on game with the security teams and also the hackers. So besides those security mechanisms that we are building into the platform, we are also setting up like a security insurance fund. So in case there is a security breach, we will make sure that our customers are compensated.

Another thing about the exchanges is really the power that you have to provide a platform of liquidity for tokens. What are the mechanisms that you have in place to determine which tokens get listed on AAX and which don’t? I mean, what are the parameters and the protocols that you go through? 12:41

So always changes besides the technology part. Actually, our operation code of act is integrity because we want to create a fair, trustworthy, and transparent platform because we believe this is essential for the whole industry to continue to grow. When it comes to the token selections, we are actually having a process to make sure that the tokens listed in our platform are consistent with our philosophy and code of act, which is trust.

What if one gets on and it becomes a toxic token. Are there parameters or protocols in place in which you would remove it? Is this arbitrary? Is this emotionally-driven, which seems to be what happened to BSV over at Binance and others? 13:39

So internally this not like a decision being made by a single person. We have internal committees, which consist of key stakeholders of the exchanges, and we have a process to govern and manage all those decisions regarding the listings and delistings being made.

Ultimately, what is your ambition? What do you hope for the market itself? Why do you believe that there is a need for this type of exchange to exist for crypto currencies, period? 14:27

We have huge confidence in blockchain because we believe the market is going to be, as I said earlier, is going to be multiple times of what the size of the market is today. So, that’s why really our ambition is going to create an exchange that is not only for today’s demand, but actually for tomorrow’s demand. This is why we invest so much in the fundamentals, looking for the best technology and setting up best security and operation mechanisms. Our ambition is really to create a trustworthy platform which has security, performance, and integrity, so that everyone trusts our platform, and the investors and the other participants of the blockchain wouldn’t need to worry of those things. They can focus on new creative ideas. I believe a fair market is going to be very critical for the whole industry to continue to grow.

A fair market for crypto currencies, at the end of the day, we’re going to hold it in our hands. Peter, if I were to ask you to look into your crystal ball as a blockchain leader, as a blockchain participant, where do you think in 5 years we’re going to be using these crypto currencies and how will we be using it in real life? 15:44

Well, with the Libra project released by Facebook, I can say the changes are already happening. I believe, actually they would happen sooner than in 5 years time. People and the public majority would accept that the digital assets are just one of the asset types in their portfolios. I can anticipate new applications can be built on top of this blockchain layer, and then new business models and new business opportunities would be created. So, in the future, people wouldn’t have a second thought about whether blockchain is okay or not. We will just take it as granted, just like you get into a car with Uber. People don’t feel strange about it.

We’ve seen it happen right before our eyes in the past 5 to 10 years here in China. I mean, there is an entire financial ecosystem that exists that is all based on your cellphone, on WeChat, online, and it really is an incredible application of technology from AI to digital. Where is blockchain going to take all of us, you think? 16:53

So blockchain is a really fundamental element. It brings new concepts, new ways of how financials can be done, or how people can collaborate, or how they associate with each other. And on top of these foundations, people can be really imaginative and creative. One of the examples I can give is, for example, how the technology of mobile phone and GPS created a business model like Uber. We know that change is going to come, but knowing in which exact way is really difficult to predict.

Look, this is an entire industry. Mobile World Congress really gathers the world leaders in telecom and all the subsidiary industries. There are more than 1,000 top companies that are gathered in Shanghai today to talk about exactly what you said, blockchain innovative technology as it applies to the one thing that we all increasingly use, which is the handset. So I would be remiss if I didn’t ask you this last question. As you’re going to walk through the floors of Mobile World Congress, what are you hoping to see? What’s most interesting to you, you think, that’s going to come out of the Summit here and also the conference this year? 18:04

I will be very excited to see the conversations… How technologies like blockchain and 5G could be used to create things that people cannot even imagine. There could be very creative applications of the traditional things that are done today. All these things are going to be different tomorrow. This is the kind of conversations I want to engage, actively.

Well, thanks for having this conversation with us. And this is just the beginning, you and I both see it. 19:23

Yeah, yeah, I’m super excited. Thank you very much for the opportunity.

Peter, it is great to talk to you.