In the latest sign of crypto becoming increasingly mainstream, two of the industry’s major players — Coinbase and CoinShares — are going public.

Coinbase, the largest cryptocurrency exchange in the United States, has filed with the U.S. Securities and Exchange Commission to become a publicly listed company through a direct listing — which is less expensive than an initial public offering and avoids a lock-up period.

According to Coinbase’s new S-1 registration filed with the SEC, the company intends to list its Class A common stock on the Nasdaq Global Select Market under the ticker symbol “COIN.”

“A registration statement relating to these securities has been filed with the SEC but has not yet become effective,” according to a company announcement posted on The Coinbase Blog.

Separately, Jersey-based CoinShares — Europe’s largest digital assets investment firm — has announced the launch of its IPO of up to 3,364,403 shares on the Nasdaq First North Growth Market in Sweden, with the same ticker as Coinbase — “COIN.”

The offering by CoinShares, which closes tomorrow, will be conducted at a fixed price of SEK 44.90 (US$5.30) per share, according to the company’s prospectus. This translates to a total market value of US$336 million for the company prior to IPO. If fully subscribed, the IPO is expected to generate US$17 million in net funds. CoinShares reported US$4.56 billion in assets under management as of Feb. 19 this year.

The public listings by both companies come as cryptocurrencies rise in popularity as an alternative asset class in recent months, in particular with institutional investors. Last week, business intelligence company MicroStrategy announced that it had purchased an additional 19,452 bitcoin for US$1.026 billion in cash at an average price of US$52,765 per bitcoin, bringing the company’s holdings of bitcoin to 90,531, worth US$4.2 billion at publishing time.

See related article: Singapore’s DBS bank becomes first in Asia to offer crypto exchange

The cryptocurrency market is currently valued at over US$1 trillion, and with the price of bitcoin now over US$46,000 — more than double the US$20,000 peak in 2017 — going public may allow crypto companies’ early investors, including its executives, to cash out.

In the case of Coinbase, the biggest beneficiary of the company going public may be Marc Andreessen, co-founder of venture capital firm Andreessen Horowitz and Coinbase’s biggest Class A shareholder. Andreessen’s 5.5 million Class A shares are equivalent to 24.6% of the shares — more than Coinbase CEO Brian Armstrong, who owns fewer Class A shares but more Class B shares — which has more voting power. Coinbase’s direct listing is only for its Class A shares, which have been trading for US$300 on private markets — which would make Andreessen’s stake worth US$1.65 billion, according to a Decrypt report.

Aside from letting early investors and executives to cash out, companies also turn to public listings to raise more capital. CoinShares, for example, says it intends to use 30% of the proceeds from its IPO to strengthen its balance sheet to support its trading strategies, and 20% of the funds to expand its product offerings.

For investors, these listings would also allow them to get exposure to crypto by buying into companies rather than buying and holding cryptocurrency directly. It would primarily be a price appreciation play, as both Coinbase and CoinShares have indicated that they do not expect to pay any dividends in the foreseeable future.

Coinbase — by the numbers

Last year, Coinbase suggested that it would be doing an IPO underwritten by an investment bank. But in its most recent SEC filings, Coinbase said it would now go public through a direct listing, where no new shares are created and only existing, outstanding shares are sold directly to the public without an underwriter.

There is no fixed number of shares available for the sale, and it is unclear what the opening public price of the stock will be. Coinbase’s SEC public filing on Feb. 25 followed the submission of its draft registration statement in December.

Coinbase generated US$1.3 billion in revenue in 2020, more than double the US$533.7 million earned in 2019, according to its SEC filing. Net income was US$322.3 million in 2020, and the company saw a loss of US$30.4 million in 2019. Adjusted earnings before interest, taxes, depreciation and amortization was US$527.4 million in 2020, a significant increase from US$24.3 million in 2019. The company reports cash and cash equivalents of US$1.1 billion as of Dec. 31.

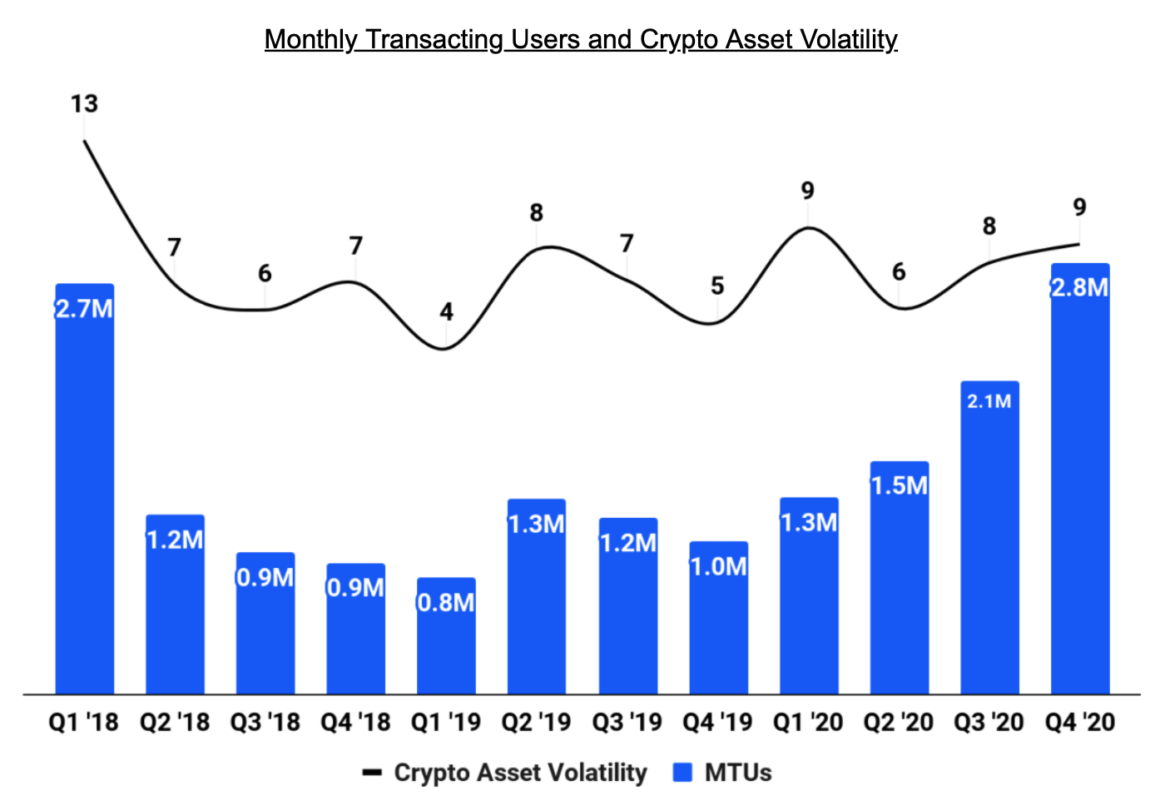

Coinbase users grew from 13,000 in 2012 to 43 million in 2020. There were 2.8 million monthly transacting users as of Dec. 31, 2020, an increase of about 180% from the year before. Coinbase currently serves customers in over 100 countries, with 76% of its revenue generated by customers in the U.S., followed by 24% from customers in Europe.

Coinbase’s clientele reflects the recent trend of institutional investors moving into the digital assets space. The company’s institutional customers grew over 67%, from about 4,200 in December 2019 to 7,000 in December 2020, with institutional assets held or managed on Coinbase’s platform increasing nearly six-fold, from US$6.5 billion to US$44.8 billion over the same period.

Since its 2012 launch, Coinbase has generated over US$3.4 billion in total revenue on US$456 billion worth of crypto transactions. Transaction revenue represented over 96% of net revenue in 2020.

The company’s total crypto assets held — about US$90 billion worth as of Dec. 31 — represent 11.1% of the total market capitalization of crypto assets.

While Coinbase has seen high variance in trading volume and net revenue between quarters given the volatile nature of the crypto assets markets, median quarterly trading volume has grown over the longer term, from US$17 billion to US$21 billion to US$38 billion in 2018, 2019 and 2020 respectively.

Investing in crypto entails “a high degree of risk”

Coinbase’s prospectus points out the many risk factors involved in investing in the crypto industry. Crypto is highly volatile and Coinbase’s revenue is highly dependent on trading, specifically the prices and volume of transactions. Furthermore, the majority of its revenue comes from transactions in bitcoin and ether, which account for over 56% of its trading volume. Bitcoin and ether represented 70% and 13% respectively of assets on platform as of Dec. 31, 2020.

Given bitcoin’s significant impact on Coinbase’s trading volume and revenue, Coinbase also listed “the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed bitcoin, or the transfer of Satoshi’s Bitcoins” as a risk factor, on the theory that such news regarding Nakamoto could affect bitcoin prices. Perhaps as a publicity stunt, Coinbase also listed Nakamoto as a recipient of its S-1 statement, in care of Nakamoto’s Bitcoin genesis block address.

.@coinbase put Satoshi on cc for their S-1 🤣$COIN pic.twitter.com/3lPk2X9498

— Michael Sonnenshein (@Sonnenshein) February 25, 2021

Regulatory uncertainty in crypto’s rapidly changing regulatory landscape is another risk factor.

In December, Coinbase announced that it was suspending the trading of XRP on its platform following the SEC’s lawsuit against Ripple Labs. U.S.-based cryptocurrency exchange Kraken also halted XRP trading for U.S. residents in January.

See related article: No Ripple-SEC lawsuit settlement in sight as XRP prices tumble

In the prospectus submitted together with its S-1 statement, Coinbase called out one of its main competitors: “We also compete with a number of companies that solely focus on the crypto market and have varying degrees of regulatory adherence, such as Binance.”

Binance’s co-founder and CEO Changpeng (CZ) Zhao does not appear to have taken offense and took to Twitter to congratulate Coinbase and its CEO Brian Armstrong on the announcement.

Thank you @cz_binance! A class act.

— Brian Armstrong (@brian_armstrong) February 25, 2021

Incredibly impressed with your speed of execution, and hustle. You’re an amazing CEO/founder.

Will other crypto firms follow in the footsteps of Coinbase and CoinShares?

San-Francisco-based Kraken, currently the third largest cryptocurrency exchange by market cap, is reportedly in talks to raise new funding that could more than double its valuation to above US$10 billion, according to Bloomberg. New-York based cryptocurrency exchange Gemini, is also considering going public.

In September 2020, Hong Kong-based Diginex (EQOS) became the first cryptocurrency exchange to be listed on Nasdaq following a merger with special purpose acquisition company (SPAC) 8i Enterprises Acquisition Corp.

“The @coinbase Direct Listing will either confirm direct listings as a reasonable on-ramp for companies or kill it all together by making retail the true bag holders,” tweeted Chamath Palihapitiya, “SPAC King” and founder and chief executive officer at venture fund firm Social Capital, a publicly traded SPAC.

“It is the very early days of this industry,” noted Coinbase’s CEO Brian Armstrong in the prospectus.

“You can expect volatility in our financials given the price cycles of the cryptocurrency industry,” he added. “We are looking for long-term investors who believe in our mission and will hold through price cycles”.