Listen to the podcast

Full Transcript

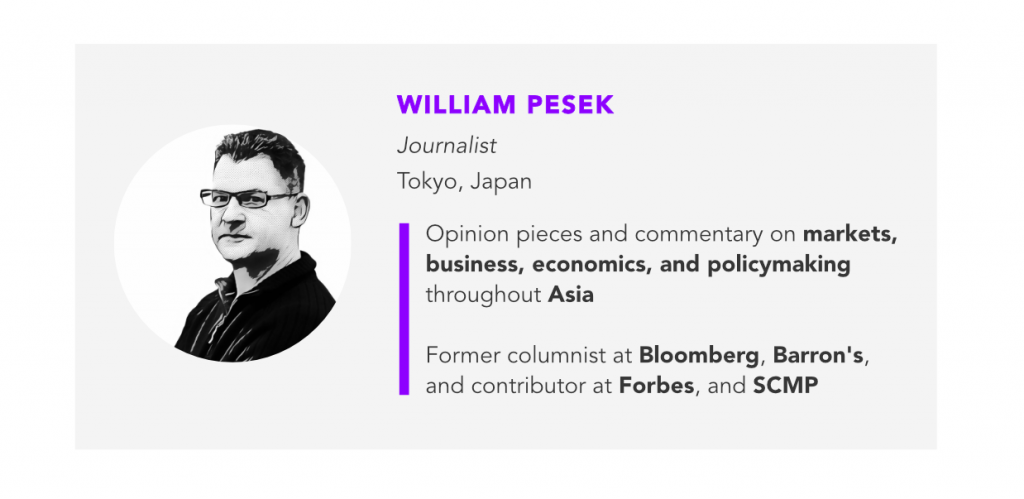

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the topics we cover right here on Forkast.News. I’m Editor-in-Chief Angie Lau and today we dive into what many are seeing emerging in blockchain, that Asia could soon be taking the lead from the West. That’s a question that we’re going to be covering today. That was the topic that our Forkast.News columnist Willie Pesek covered with three seemingly disparate yet connected developments in Asia. Thanks Willie for joining us.

Willie Pesek: Hi, Angie.

Angie Lau: All right. So South Korea, China, Japan — not necessarily moving in unison Willie, but certainly in the same direction when it comes to cryptocurrency and blockchain acceptance.

Willie Pesek: Right. And I think the most important thing is we’re seeing forward motion. We’re seeing that, to differing degrees, the governments of Korea, China, and Japan are actually making some bold gestures and moves in the right direction. And I think that we’re certainly weeks or even in some cases months away from knowing what to expect. But we have seen continued forward inertia, forward motion if you will, and given the chaotic state of the world… This most recent weekend’s G7 meeting and the fact that markets are tumbling and there in Hong Kong you have a lot going on just looking out your windows onto the streets. It is very comforting to think that regulators in Korea, China, and Japan are multitasking to an extent needed to move the market forward.

Angie Lau: Let’s start with South Korea here. It’s interesting. It’s got big appetite when it comes to cryptocurrency from its citizens. They’re highly engaged but government regulators kind of seem slightly schizophrenic when it comes to policy and it kind of makes the cost of doing business slightly high, especially if you don’t have regulatory stability or vision, but what’s changed or what is changing, perhaps?

Willie Pesek: Well schizophrenia certainly is the best word to use here. We are seeing in many cases, one step forward one or two steps back in Korea and it is very interesting to think from day to day where Seoul is in all of this, but what we’ve seen recently is that for the last year and a half Korea has been very very committed to market itself. I think that Korea realizes they want more startups. They want to make Seoul more of a financial hub. And I think they see the blockchain space as a natural addition to where their economy wants to go.

So what you’ve seen recently is Korea has set up, I guess what you would call a special enterprise zone for the blockchain space in the southern city of Busan- that’s the second biggest city in Korea. Very cool city, I really love it. It’s the home to the annual Busan Film Festival. So it’s a place with a bit of buzz and it’s also one of the cities in Korea that has bit more startup activity, more entrepreneurs than the rest of the country and you have seen Korea setting up what they’re calling a regulation-free zone.

And they’re trying to encourage entrepreneurs to do their worst. One of the problems we’re seeing though is that Korea still bans ICOs. And there is chatter at the government level to legalizing issuance at some point, but we are seeing Korea… I guess you can say they’re setting the stage but the production itself is being held up a bit by regulators.

Angie Lau: And when it comes to regulation of cryptocurrency and blockchain in China, it’s also a very murky story. I mean we’re doing a lot of deep analysis and reporting out of China, but that space is very specific. When the government decides to support blockchain, that’s very much a supported industry, but the cryptocurrency aspect of it… the ICOs are completely banned. How does that help blockchain? How does that help crypto talent in China?

Willie Pesek: And also Beijing is kind of down on mining these days as well. So all around, the government has reservations, but what you are seeing, and there’s schizophrenia in China too. The central bank, the People’s Bank of China, they claim to be within perhaps days or weeks away from issuing their own digital or cryptocurrency. China has been known as a very top-down economy. And the PBOC is realizing the extent to which issuing its own currency could help the central bank give more traction over the economy.

It certainly could help from a transactional standpoint for companies. It’s a very nifty way to reduce the dollar stranglehold over trade. It’s a way for China to make sure that there’s no money laundering going on, that there’s no tax evasion going on. However, this is very much a response to Facebook. I think that Libra has in many ways has catalyzed this activity in China. The PBOC for a while has been talking about issuing some kind of digital cryptocurrency, but it really is Libra that got China to step forward and say “we have to get on this.”

Angie Lau: They’re getting on it. They’re going to at some point launch what’s called a CBDC. Is that going to help blockchain talent domestically within the borders of China, you think?

Willie Pesek: Well, I mean that is a fair question. Is this an issue of the government overwhelming the private market to a degree that you’ll kill all innovation, that you’ll kill startup activity? That is yet to be seen.

One of the interesting things that China is looking at, the PBOC is looking at, is they’re looking at a two-tiered system. One where central banks would be able to issue whatever kind of currency they come out with and then the second tier for financial institutions. So there would be a private sector role, presumably, so that you can argue is somewhat of a step in the right direction. It’s better to see China from the top-down doing something than banning the market outright.

But that said, purists will look at what China is doing and say it’s coming from the wrong direction. This is coming from the top down. This should be coming from the bottom up with the government working with the private market, with blockchain entrepreneurs to see where the market is going.

Angie Lau: And then over there based in Tokyo, what are you seeing in terms of how the BOJ is regarding a central bank-backed currency all the way to regulators looking to create an environment in which blockchain projects and cryptocurrency teams really want to engage and bring their business to Japan.

Willie Pesek: The bank of Japan and regulators here are certainly busily working on regulations that would in some ways harmonize. Regulations for G7 economies or even G20 economies around the world and that’s good, in the sense that Japan in many ways has been more open to Bitcoin trading and to blockchain entrepreneurship in general than most developed nations. So it is good that Japan is moving forward. The question is the speed at which it’s moving forward and that’s what we’re having a hard time figuring out here because you know, when you listen to what the bank of Japan is saying, when you listen to what the Ministry of Finance is saying, there can be a bit of conflict. But what’s interesting… in the market turmoil you’ve seen in recent weeks, the way that the Chinese currency has fallen, it in some ways has enlivened Bitcoin trading to a very big degree.

What’s interesting is the way that the Chinese currency when it falls, is kind of negatively correlated to the price of Bitcoin. Bitcoin also is kind of correlated positively with gold prices. And so from that you can see you can actually see that when people talk about Bitcoin being a safe haven in some ways, we are seeing the development of that phenomenon. So maybe in terms of the market turmoil we’re seeing and the way that Bitcoin is responding maybe this is a suggestion that the market is gaining trust at a very, very uncertain time for the global financial system. So you can argue that at the margin, that’s a positive development.

Angie Lau: Well, we sit in a very interesting spot of the world where we can observe what’s happening here in Asia against the backdrop of our collective journalistic experience of being Western, kind of objective journalists as well. When you take a look at the East versus the West, what is the emerging story that you’re watching and observing?

Willie Pesek: Well there certainly is this divergence in favor of what’s happening in the East. I think the East is pressing ahead. I think in the West you see more stasis. I think part of it has to do with the fact that the Federal Reserve has been very, I guess you could say, uninvolved. The European Central Bank has been somewhat uninvolved. The bank of England has been a little more involved but we certainly see that Asia is a lot more open and welcoming to the blockchain phenomenon. And when the rules of the road are created, when the rules of the market are implemented and agreed upon, I think they’ll bear a very strong Asian accent as opposed to the Western accent.

Angie Lau: And finally against the backdrop of the US-China trade wars because of course, that is the pervasive conversation that really bleeds into everything here. Do you think will come a time where technology divides here along political lines?

Willie Pesek: Political lines how?

Angie Lau: That the US innovation will be very specific to US and siloed from China innovation and technology.

Willie Pesek: Okay, good question. You know what’s interesting is, have you heard President Trump mentioned the word Bitcoin at all other than a couple of tweets where he said, “I don’t believe in this and it sounds all very mysterious to me”?

I think that in some ways we’re waiting for the US election of 2020 see where the US stands in all this but it is a good question. I think in many ways you can see that what China is doing in the Bitcoin and the blockchain space, in general, is a microcosm of what China is doing globally. China in many ways is going its own way. China in many ways is going its own way in terms of currency management, in terms of not opening up its capital account as quickly as people had hoped and you know, there could be very much a bifurcated system from West to East. I guess my question in Asia: Will there be some harmonization between the large economies here, Japan, China, South Korea, or will you see another level of bifurcation here in Asia?

And that’s something that no one can really answer. I think it’s one of those questions where if someone gives you a very firm and clear answer, they really don’t know what they’re talking about. I’m not sure if officials at the PBOC or the Bank of Japan really know what they’re doing at this point of where they will end up being a year from now.

Angie Lau: Well and really, you know, the fear is: Innovation for the evolution of our civilization really comes from general public discourse. It comes from decentralization, you know, the internet didn’t grow to the scope that it grew because it was a closed system; it grew because it was open. So the fear is, as these conversations of trade wars and not just between US and China, I mean, Japan and South Korea and all the rest. Will innovation become a casualty of this discussion? You know what Willie, it sounds like your next piece for us on Forkast.News.

In the meantime, thanks for joining us on this one. And thank you everyone for joining us on this episode of Word on the Block. I’m Editor-in-Chief Angie Lau. Until the next time.